With summer heat waves spreading across China and many tourist destinations relaxing COVID policies, locals are escaping to tropical islands like Hainan or the white beaches of Xiamen. What better places to parade your new luxury swimwear?

According to China Baogao, the market size of swimming products in the country was $4.6 billion (31 billion RMB) in 2019 and is estimated to reach about $6 billion (40 billion RMB) in 2022, indicating significant room for growth.

Luxury names like Fendi, Louis Vuitton, and Dior, of course, are all pushing their resort collections. (Xiaohongshu user @Ttlee, who recently managed to travel to Hainan, was spotted by Jing Daily sporting a Fendi monogrammed one-piece suit.) However, high end houses are facing fierce competition from niche domestic players (and savvy contemporary Korean lines, too) who often have the edge over their global rivals.

To capitalize on the lucrative swimwear sector, there are a number of strategies maisons can employ if they are ready to dip their toes in this booming market.

Localizing product fit and design#

Body-flattering designs that reflect culture and tradition are essential. This has been seen in the growth of adjacent areas, for example, underwear and athleisure. Neiwai and Maia Active both tailor their fit to Asian sizes and are disrupting their segments. The same rule applies to swimming costumes.

“Fashionistas and young consumers are willing to spend money on luxury swimwear with unique designs that flatter their figure,” Amber Wu, account director at the digital marketing agency Emerging Communications stated. She pointed to both Chinese and Korean brands (like Jinxueer, Barrel, and 5pening) which tend to understand locals better when it comes to product design.

In general, shoppers tend to err on the side of being more conservative than provocative. “Beach and bikinis are not part of the mainstream culture. Tummy control swimsuits or bikinis with padding are preferred choices because mainland consumers tend to like looking sexy without being too revealing,” Wu added.

One-pieces fare better#

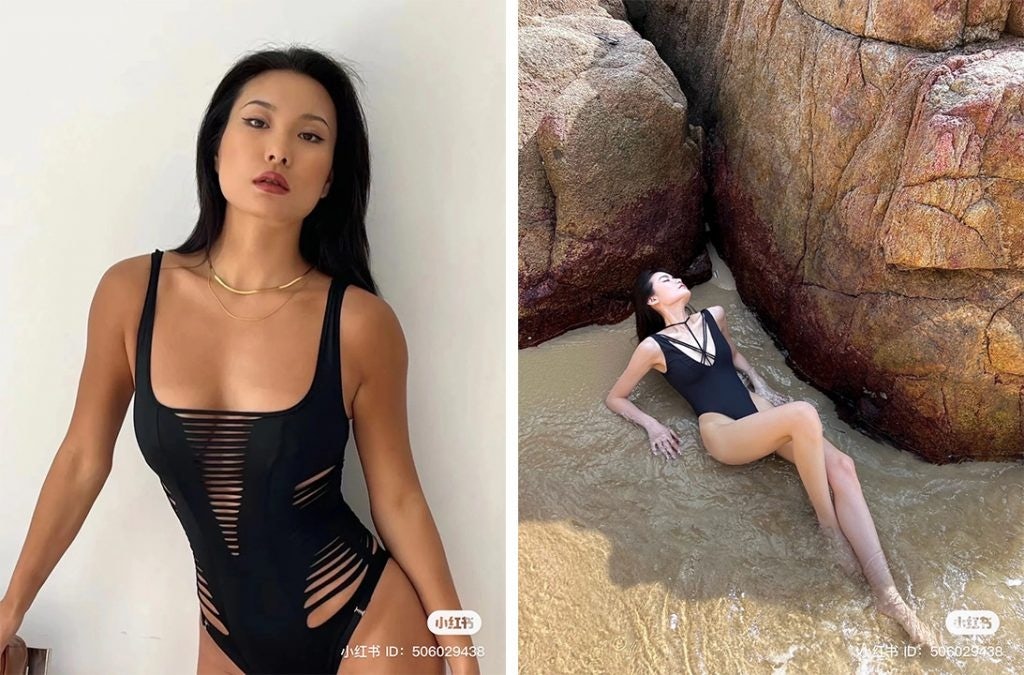

Whether its indigenous establishment Jinxueer (which offers French chic style one-piece swimsuits) or K-label Barrel (which infuses athletic aesthetics into its designs), these makes have one thing in common: all-in-one suits. And when Michael Kors invited numerous KOLs to Hainan last October, what were they wearing? MK one-piece swimsuits, naturally. See, again, the preference of being slightly more covered up, rather than slightly more exposed.

Indeed, Xuehua News has reported that, unlike in the rest of the world, one-piece swimsuits are the best-sellers here. “Even young girls rarely ask for bikinis” was the verdict of a long-time retailer from Jinan in Shandong province. Luxury groups should not only adapt their designs but also their visuals accordingly. H&M learned this early, creating two shoots for its 2013 campaign with Beyoncé: one showed her in a bikini and the other in a one-piece. The latter’s cover appeared on a billboard in Changchun city, while the two-piece ad was shown in Times Square.

Xiaohongshu is your friend#

Planning the consumer journey is crucial if you want to win over citizens looking to lifestyle app Xiaohongshu for style inspiration. And there are a lot of them: on the platform, the hashtag #swimwearrecommendations has reached 430,000 UGC instances. It's important to know and be present on their journey.

For swimwear, one viable option is actively collaborating with the platform’s KOLs to reach end consumers. According to Wu, British lingerie firm Agent Provocateur has done well to understand the nuances of this sector. While its main underwear line is provocative, its one-piece swim category is faring better. Why? Monthly product seeding with Xiaohongshu’s influencers. With young buyers in particular relying heavily on the social app, such a strategy can maximize brand exposure.

Collaborations and endorsements#

Other channels to increase visibility and product awareness include popular dramas and reality shows. Louis Vuitton’s bikini top, which appeared on the K-TV series "Singles’s Inferno," is currently a hit product in the niche market. The swimming pool scene in season one of the C-reality show “Viva La Romance,” where female celebrities showcased their swimwear, went viral on social media. Impressed shoppers soon started looking for similar styles online.

Partnering with C-brands to create a capsule collection could facilitate luxury’s foray into the multibillion-dollar space. Currently homegrown designers are taking advantage of this opportunity: such as luxury outfit Xu Zhi, which has partnered with its compatriot Neiwai, a lingerie concern, to co-design a Spring 2020 swimwear capsule.

Finally, if they can master all of the above, lesser-known emerging names have a real opportunity here as well. A look at reviews on Xiaohongshu reveals how users are in fact showing a greater preference for these. The hashtag #nicheswimwear has accumulated over 10,000 UGC instances, compared to the 700 UGC of #luxuryswimwear. The handmade Italian company La Reveche, known for adorning swimsuits with petal-like designs, is gaining significant popularity among netizens. And Canadian label Visual Mood’s printed one-piece swimwear is also becoming a favorite.

The right product — seeding at the right timing — and on the right platform. This is what’s crucial for visibility. But to drive actual sales, businesses have to do their due diligence by gathering consumer insights and design products that fit the culture.