Update published May 19, 2020:#

With France ending its strict lockdown on May 11, pent-up consumers were finally free to shop once again. But for Paris’ many luxury stores and boutiques, like Louis Vuitton to Gucci near Champs-Élysées, the only consumers lined up with space apart were locals, who tend to spend far less than well-heeled Chinese shoppers, the Wall Street Journal reported last Saturday.

Chinese tourists typically do most of their luxury shopping outside of China, but with current travel bans in countries like France due to the ongoing COVID-19 crisis, this lucrative segment will have to stay put for a while longer, which is less than great news for Europe’s luxury markets. In 2019, Chinese shoppers contributed 29% of the luxury spending in Europe, 10% in the US, and 60% in Asia (excluding China and Japan), according to consulting firm Bernstein. In other parts of Europe, luxury shops in Austria and most parts of Italy are also reopening with a list of restrictions, and, like France, with far less Chinese tourist euros.

Update published April 30, 2020:#

A number of Chinese designer brands are joining a one-off fashion auction in France to raise funds for the nonprofit #ProtegeTonSoignant, which sources and distributes medical supplies for French health workers during the COVID-19 pandemic. The organizer, La Mode S’Engage, has so far confirmed the participation of more than 100 established brands as of the time of publishing, including French luxury brands Louis Vuitton, Chanel, Dior, Prada, Lanvin, as well as three Chinese designer brands DAWEI, SEAN SUEN, and Anaïs Jourden. La Mode S’Engage’s online auction is goes live Friday, May 1, at noon in France and finishes on Monday, May 4, at 11.59 pm local time. As one of the hardest-hit European countries by COVID-19, France now has more than 128,442 infected cases and over 24,000 deaths, according to the French government.

Update published April 13, 2020:#

Among all the countries affected with COVID-19, China was hit first and also the first to rebound. But now, with new cases mounting across the mainland — mainly stemming from overseas travelers and asymptomatic cases — its infection case number has been climbing once again, from 83,607 today compared to 81,740 a week ago.

Although these new cases — around 200 each day — seems small, it has caused concerns as to whether a second wave might be hitting China and with it the retail industry, which is on a long road to full recovery. As China decreases inbound flights to control imported cases, pulmonologist Dr. Zhong Nanshan, the Chinese government’s senior medical adviser famed for combating the SARS epidemic in 2003, also debunked the concern for asymptomatic cases in a recent interview. “Asymptomatic cases will not cause an outbreak because of China’s stringent surveillance system,” he said.

Dr. Zhong is confident for a reason: Chinese citizens are equipped with a Personal Health Code app on their phones. This enables the central Chinese government to track their health condition and serves as a ticket of entry when they enter a public space like a shopping mall. The country’s National Health Commission started adding asymptomatic cases to its national confirmed case count on April 1st.

Update published April 3, 2020:#

Sergio Rossi, one of the industry’s most respected shoe designers, died this past Thursday at 84 after being hospitalized in Italy with COVID-19, according to WWD.

Having learned the trade from his father, Rossi founded his eponymous brand in 1968, which is now headed by Riccardo Sciutto. “Today everyone at Sergio Rossi joins me in remembering our dear Sergio, the inspiring founder of our dream,” Sciutto said through the brand’s social media. “His vision and approach will remain our guide in the growth of the brand and the business.”

The luxury shoe brand has started targeting China’s millennials in recent years, as Jing Daily previously reported. Back in 2018, the brand inked a deal with K11 Art Mall’s owner Adrian Cheng’s brand management firm, Luxba Group, in a bid to relaunch in China. Sergio Rossi opened stores in Beijing, Shanghai, Hong Kong, and Chengdu after the partnership embarked, according to its official WeChat.

Update published March 24, 2020:#

COVID-19 has created an emergency medical supply shortage in many countries. But after periods of halted production, luxury houses are now starting to dedicate their factories to the production of essential medical goods in the fight against the deadly virus.

French luxury group LVMH was one of the first to announce that it would be making hand sanitizer in its fragrance and makeup factories, which normally churn out products for brands like Guerlain, Christian Dior, and Givenchy. Meanwhile, rival luxury group Kering ordered 3 million medical masks for French hospitals in need. Kering group brands, such as Balenciaga and Yves Saint Laurent, are even using their French studios to help produce the masks.

On March 18, Prada started producing 80,000 pairs of medical overalls and 110,000 masks for healthcare professionals following a request from the Tuscany Region. The production plan provides daily deliveries until April 6. With their supply chain and logistics departments being severely impacted, luxury brands have seen their sales take a big hit, and they’ve suspended orders or shut down stores in many countries around the world. But thanks to a recent recovery from the virus, many deliveries and orders have opened up again in China — a silver lining for many international businesses.

Update published March 20, 2020:#

As the rebound of China’s luxury market slowly begins, it’s the rest of the world that is now dealing with COVID-19’s extensive impact. In China, however, as social distancing measures continue to loosen up, more and more luxury stores are reopening their doors. The normalizing of offline businesses, growing in-store footprints, and consumer’s budding optimistic sentiment, are solid indicators of the awakening of China’s retail sector.

Meanwhile, international travel restrictions and cancelled flights still exist worldwide, the ongoing halted outbound tourism, however, as well as China’s import tariff, which was lowered this year make the recovery of domestic luxury consumption more promising.

Elsewhere, homegrown creatives in the fashion industry are adapting to the new normal and resuming their businesses. Chinese designers, both China-based and abroad, have been able to resume production either in-house or in reopened local factories to catch up on back orders from stockists and to prepare for the upcoming fall collections. Local showrooms such as Tube Showroom and DFO Showroom are connecting with buyers through live-streaming or online order platforms, with physical showrooms expected to be set up at the end of March or April, as WWD reported.

Update published March 19, 2020:#

The prestigious “Made in Italy” label is the latest victim of the global COVID-19 pandemic, as many Western luxury brands’ — from Chanel to Hermès to Gucci — are shutting down factories in France, Switzerland, and Italy for the next several weeks.

“Chanel took the decision, in accordance with the latest government instructions, to close the entirety of its production sites in France, Italy, and Switzerland [watchmaking], as well as its haute couture, ready-to-wear, métiers d’art and jewelry,” the company said, noting that some distribution sites are still active and maintained by minimal staff.

Moreover, it’s been reported that Hermès has already closed down 42 production bases until March 30th, and Gucci has closed six factories in Italy’s Tuscany region and all of its stores in Italy. LVMH also stated that they are doing their best to stay in production, with one of its perfume factories now producing hand sanitizer since earlier this week.

As the COVID-19 virus continues to disrupt the luxury industry in unprecedented ways, orders from China for Gucci, Prada, and Salvatore Ferragamo products have significantly declined, a couple of suppliers told Reuters recently. Given this, will this massive production halt in Italy stop brands from being able to sell to a now-recovering-China market to help offset their losses? We’ll keep a close watch on how the situation develops.

Update published March 17, 2020:#

As global stock markets tumble due to the worsening COVID-19 global pandemic, major luxury companies' stock prices have slashed as much as 48% of their market value compared to their highest point last year. LVMH and Kering, which are both listed on Euronext Paris, were at €297.6 and €377.2 as the market closed yesterday — down 32% and 37% compared with their respective peak prices of €439.05 and €605.1 in January. Moreover, Richemont (SIX Swiss Exchange), Burberry (London Stock Exchange) and Prada’s (The Stock Exchange of Hong Kong Limited) stock prices have all shed over 40% compared to their peak prices in the last 12 months.

The tide has turned this week, as confirmed cases of COVID-19 outside of China have surpassed new ones within China. Moreover, now that China is on the road to recovery, growing concerns over luxury companies’ store closures and supply chains across the globe are becoming a reality. And as the next round of earnings calls are approaching for LVMH and Kering in April, all eyes will be on whether luxury CEOs have a global solution at hand.

Update published March 12, 2020:#

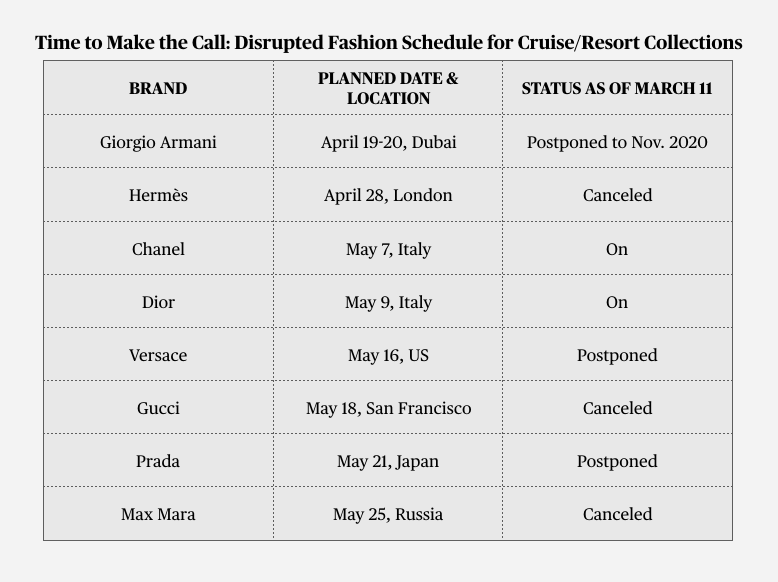

As the COVID-19 pandemic unravels in 125 countries, more and more luxury brands are expected to cancel or postpone the next milestone on their calendars: their resort/cruise collection shows. Such a move so close to the shows themselves will certainly not help a brand’s bottom line, but it indicates the extent of precaution brands are willing to take during the ongoing crisis.

Most recently, Max Mara joined the string of brands that either postponed or canceled their resort/cruise shows, and halted its 2021 resort wear show in Russia’s St. Petersburg, according to WWD. This has put Chanel and Dior* under the spotlight, as their resort/cruise shows are still expected to go on in locked-down Italy. When is it time to make the call? And if the show needs to be postponed, until when? Given the pandemic’s lasting effects, brands might have already started thinking about their takeaways from dealing with China’s lockdown during the past fashion weeks, and turn to livestreaming as the last resort.

*Dior has decided to postpone its cruise show indefinitely as of March 16, WWD reported.

Update published March 9, 2020:#

The COVID-19 virus is non-discriminatory regarding territories, as Jing Daily sees in terms of infected cases and market reactions. By market close on Monday, all three major indexes in the US were all falling beyond 7%, while the Dow had its worst single-day drop since 2008, according to the WSJ. Meanwhile, China’s Hang Seng Index sunk 1,106 points, or 4.23%, to 25,040. And the Stoxx Europe 600 shed over 7% to 339.

Thanks to a stringent quarantine policy from the central government, China seems to have the virus under control, with 42% of almost 140,000 reportedly infected cases being cured. However, the battle for the other 108 infected countries has just begun, as Italy recently announced to lock down the entire country, and many US companies like Amazon and Facebook encouraging staff to work from home. As the Chinese society and businesses limp back to normality after over a month-long lockdown, can Western luxury brands translate what has worked in China — from cloud shows to livestreaming — to prepare for a “worst-case scenario,” as investor Ray Dalio said, while the COVID-19 epidemic takes over the world?

Update published March 5, 2020:#

Dolce & Gabbana is cooperating with the Italian private college Humanitas University to support a study into immune system responses to the deadly COVID-19 virus. The research objective is to lay a foundation for developing diagnostic and appropriate treatment.

The donation will support a study coordinated by Professor Alberto Mantovani, the Scientific Director of Humanitas and Emeritus Professor of Humanitas University, along with Prof. Cecilia Garlanda of Humanitas University and Professors Elisa Vicenzi and Massimo Clementi from the San Raffaele Vita-Salute University. This is notable because Professor Vicenzi and Clementi were “the first in Italy to isolate the pathogen responsible for SARS.”

This project is not the first collaboration between the Italian fashion house and Humanitas University. In fact, Dolce & Gabbana awards yearly grants for students of the MedTec School program in Medicine through Humanitas University and Politecnico di Milano, another Italian university.

“We felt we had to do something to fight this devastating virus, which started in China but is threatening all mankind,” said Domenico Dolce and Stefano Gabbana in a statement. “In these cases, it is important to make the right choice. This is why we thought Humanitas University would be the ideal partner, whose excellence and humanity make it a special entity, with which we have already cooperated on a scholarship project.”

Update published March 4, 2020:#

As the COVID-19 crisis continues, luxury brands are looking for digital solutions, including e-commerce and "see now, buy now" live-streaming, to offset revenue loss caused by the virus. Last week, for example, Prada joined Tmall, Alibaba's business to consumer channel. This week, the Belgium brand Delvaux launched on JD.com, it’s first e-commerce channel in China. And the prestigious French label Lanvin, which is under the Chinese group Fosun, also joined forces with the high-end e-commerce platform Secoo, live-streaming their Fall/Winter 2020 runway show with a popular "see now, buy now" function. As Chinese consumer spending sentiment is still slowly recovering, to what extent this will help brands with their sales is unknown, but it's certainly a strategic move for many brands.

Update published February 24, 2020:#

As of Monday, with over 200 confirmed Covid-19 cases and five dead, Italy has stepped up measures to contain the virus by placing a dozen towns in northern Italy, including the regions of Lombardy and Veneto — home to Milan and Venice — on lockdown. This had a profound effect on Milan Fashion Week. In order to ease health concerns of attendees and stop the possible spread of the virus, a few brands, including Giorgio Armani and Laura Biagiotti, decided to livestream their runway shows. How this will affect Paris Fashion Week, which starts today, is still unknown.

Update published February 18, 2020:#

Chanel announced today that it will postpone showing a replica of its Paris - 31 rue Cambon 2019/20 Métiers d'art collection in May in Beijing due to the Covid-19 crisis. The collection, which debuted in Paris in December, was inspired by the studio of founder Coco Chanel. The decision to prioritize “the health and well-being of its teams and clients,” however, was in line with the brand’s recent $1.4 million (10 million RMB) donation to support China and its citizens, as reported by BoF. While the restage strategy has been regarded as a fundamental initiative to engage Chinese consumers, this isn’t the first time the brand has had to reschedule an event in China due to unexpected challenges. Last year, they had to cancel their Hong Kong cruise show because of ongoing protests. Similar postponements have hit other luxury brands, including Prada, which recently put on hold its upcoming Prada Resort show in Japan for May 21. New dates for both events are yet available.

Update published February 12, 2020:#

Burberry, the British heritage label, recently issued an urgent warning about the material effects of the coronavirus on the luxury market, and updated its own outlook for fiscal year 2020 as well. The announcement scrapped their positive sales forecast to a low single digit percentage increase envisioned in the brand’s third quarter trading update released last month. Moreover, they did not discuss any updates on either their previously scheduled Shanghai runway show in April or their first social retail store in partnership with Tencent. Along with their warning, however, Burberry only touched upon the “mitigating actions” they are taking to compensate for losses due to the coronavirus, but did not discuss further details.

Update published January 24, 2020:#

As concerns about the coronavirus escalate, many Chinese tech companies are joining in to help. For example, Tmall, JD.com, and others have blocked vendors from jacking up prices on facial masks and other health and cleaning supplies. Also, in responding to the Wuhan city lockdown announced recently, cross-border e-commerce BorderX Lab has prepared plans to deliver supplies to Chinese consumers threatened by the coronavirus. And to minimize customers’ costs, several airlines, as well as China’s state railway company and online travel agencies, are offering refunds for trips related to Wuhan.

The timing of the outbreak during Chinese New Year, a time when Chinese travelers on the mainland and overseas make their way back home, marking the “world’s largest human migration,” only added to the spread of the virus. A total of seven cases have been confirmed outside of China, including Thailand, Japan, South Korea, and the US, updated by financial media Caixin. On Thursday, January 23, WHO clarified that the virus is not yet a global emergency. However, it's likely to continue impacting not only travel and duty-free industries, which typically expect an increase in sales during the holiday, but also luxury retailers overseas who should brace themselves for potential hits.

Update published January 23, 2020:#

Since Tuesday, when Jing Daily reported on the decline of Western luxury groups’ stock prices due to the coronavirus, prices have continued to spiral downward as the virus continues to spread in mainland China and beyond its shores. LVMH and Kering’s stock prices, which shed 25.2 euros and 36.8 euros respectively as of the close of the European stock market today, reached a 30-day low. The question is: how low will they go?

The Chinese public’s growing concern that any official action by the Chinese government, which states as of Wednesday, January 22, that there are 571 reported cases of the coronavirus and 17 deaths, has been affected by delays and censorship on the local level.

Meanwhile, the government has put an unprecedented quarantine on Wuhan, the epicenter of the coronavirus, with all public transportation, including airports and trains, that keeps the massive city of 11 million people running to a halt. And now, with four more nearby cities announcing similar measures, the concern is how to stop the global spread of the coronavirus and what lingering damage it may cause.

Original article published January 21, 2020:#

The Jing Take reports on a piece of the leading news and presents our editorial team’s analysis of the key implications for the luxury industry. In the recurring column, we analyze everything from product drops and mergers to heated debate sprouting on Chinese social media.

What happened

China’s new strain of the coronavirus, which has already spread to at least three other countries and could spread further during the Chinese New Year holiday travel rush, has sent European luxury stocks tumbling, including the likes of LVMH, Kering, Richemont, and Burberry. Official reports say that coronavirus, a respiratory virus that causes pneumonia-like symptoms and that can be passed in between humans, has already killed four people and infected nearly 291 in China, according to state media China Daily on Tuesday. But the actual outbreak might prove worse.

An estimate by scientists from University of Hong Kong said today that nearly 1,700 people in Wuhan, China — where the virus outbreak started — may have also been infected. As China’s 40-day Spring Festival travel season just kicked off, health experts are also discouraging people to travel to Wuhan, though major cities like Beijing and Shanghai already have confirmed cases. Given the increasing concern of a global outbreak, stocks of European luxury brands that rely heavily on the Chinese market have slumped as a result. Compared to last Friday, LVMH and Burberry’s stock fell 3%, while Kering lost over 4%, and Richemont’s declined almost 5.5%.

The Jing Take

Luxury veterans might still remember how the SARS outbreak in China left the industry in despair in the early 2000s, leading to billions in losses and cost the Chinese GDP growth by nearly 1%. At the moment, however, it’s difficult to predict how much economic damage a potential coronavirus outbreak will be for China, as well as the global economy. For Western luxury brands, there is not much they can do at this point other than paying close attention to how their consumers are reacting and pray that the Chinese government has potential epidemic under control, as it claimed this Monday. Time will tell.