This post originally appeared on McKinsey & Company.

The coronavirus outbreak is first and foremost a human tragedy, affecting hundreds of thousands of people. It is also having a growing impact on the global economy. This article is intended to provide business leaders with a perspective on the evolving situation and implications for their companies. The outbreak is moving quickly, and some of the perspectives in this article may fall rapidly out of date. This article reflects our perspective as of March 9, 2020. We will update it regularly as the outbreak evolves.

The coronavirus crisis is a story with an unclear ending. What is clear is that the human impact is already tragic, and that companies have an imperative to act immediately to protect their employees, address business challenges and risks, and help to mitigate the outbreak in whatever ways they can.

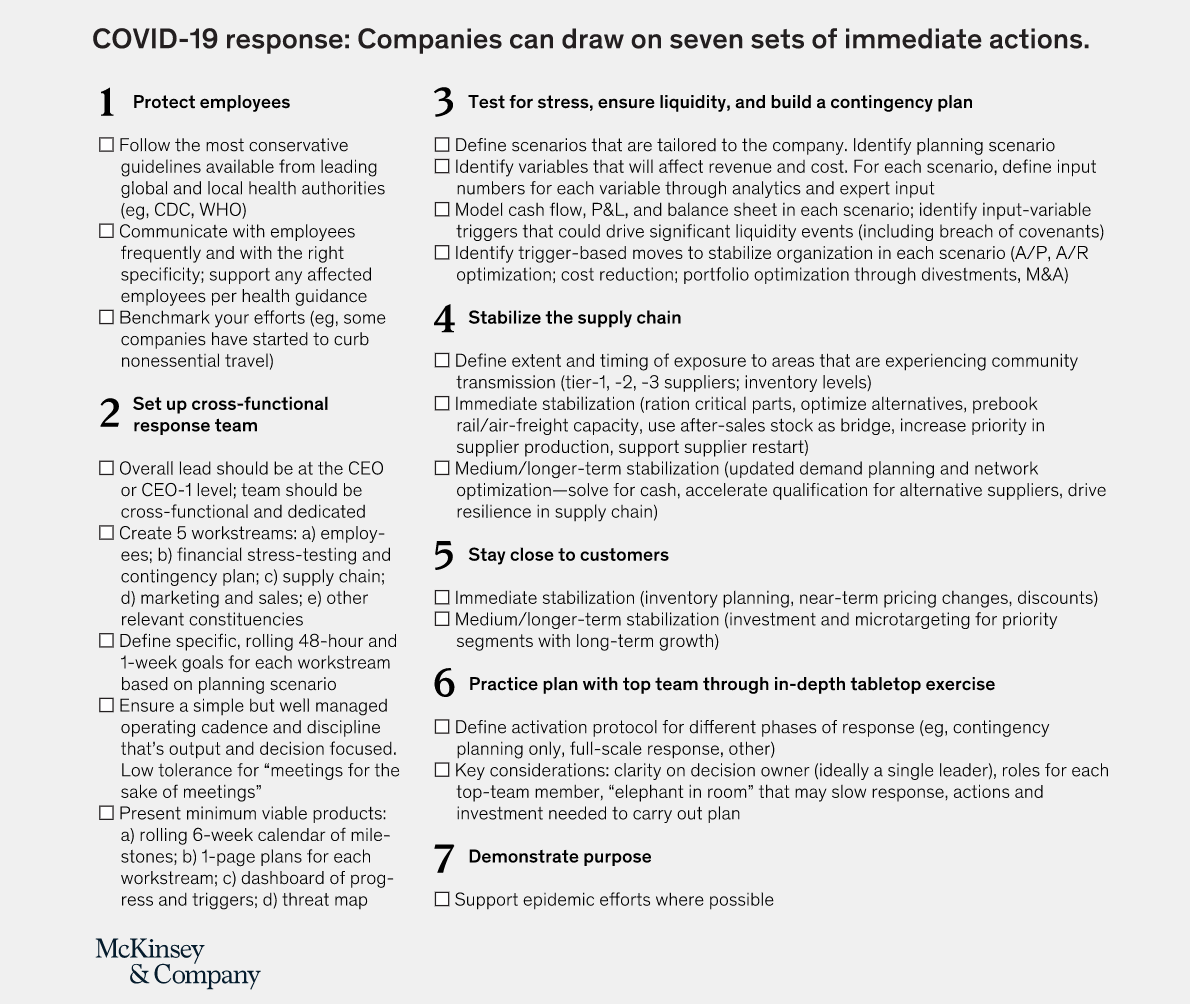

In our experience, seven actions can help businesses of all kinds. We outline them here as an aid to leaders as they think through crisis management for their companies. These are only guidelines; they are by no means exhaustive or detailed enough to substitute for a thorough analysis of a company’s particular situation.

Protect your employees.#

The COVID-19 crisis has been emotionally challenging for many people, changing day-to-day life in unprecedented ways. For companies, business, as usual, is not an option. They can start by drawing up and executing a plan to support employees that is consistent with the most conservative guidelines that might apply and has trigger points for policy changes. Some companies are actively benchmarking their efforts against others to determine the right policies and levels of support for their people. Some of the more interesting models we have seen involve providing clear, simple language to local managers on how to deal with COVID-19 (consistent with WHO, CDC, and other health-agency guidelines) while providing autonomy to them so they feel empowered to deal with any quickly evolving situation. This autonomy is combined with establishing two-way communications that provide a safe space for employees to express if they are feeling unsafe for any reason, as well as monitoring adherence to updated policies.

Set up a cross-functional COVID-19 response team.#

Companies should nominate a direct report of the CEO to lead the effort and should appoint members from every function and discipline to assist. Further, in most cases, team members will need to step out of their day-to-day roles and dedicate most of their time to virus response. A few workstreams will be common for most companies: a) employees’ health, welfare, and ability to perform their roles; b) financial stress-testing and development of a contingency plan; c) supply-chain monitoring, rapid response, and long-term resiliency (see below for more); d) marketing and sales responses to demand shocks; and e) coordination and communication with relevant constituencies. These subteams should define specific goals for the next 48 hours, adjusted continually, as well as weekly goals, all based on the company’s agreed-on planning scenario. The response team should install a simple operating cadence and discipline that focuses on output and decisions, and does not tolerate meetings that achieve neither.

Ensure that liquidity is sufficient to weather the storm.#

Businesses need to define scenarios tailored to the company’s context. For the critical variables that will affect revenue and cost, they can define input numbers through analytics and expert input. Companies should model their financials (cash flow, P&L, balance sheet) in each scenario and identify triggers that might significantly impair liquidity. For each such trigger, companies should define moves to stabilize the organization in each scenario (optimizing accounts payable and receivable; cost reduction; divestments and M&A).

Stabilize the supply chain.#

Companies need to define the extent and likely duration of their supply-chain exposure to areas that are experiencing community transmission, including tier-1, -2, and -3 suppliers, and inventory levels. Most companies are primarily focused on immediate stabilization, given that most Chinese plants are currently in restart mode. They also need to consider rationing critical parts, prebooking rail/air-freight capacity, using after-sales stock as a bridge until production restarts, gaining higher priority from their suppliers, and, of course, supporting supplier restarts. Companies should start planning how to manage supply for products that may, as supply comes back online, see unusual spikes in demand due to hoarding. In some cases, medium or longer-term stabilization may be warranted, which calls for updates to demand planning, further network optimization, and searching for and accelerating the qualification of new suppliers. Some of this may be advisable anyway, absent the current crisis, to ensure resilience in their supply chain—an ongoing challenge that the COVID-19 situation has clearly highlighted.

Stay close to your customers.#

Companies that navigate disruptions better often succeed because they invest in their core customer segments and anticipate their behaviors. In China, for example, while consumer demand is down, it has not disappeared—people have dramatically shifted toward online shopping for all types of goods, including food and product delivery. Companies should invest in online as part of their push for omnichannel distribution; this includes ensuring the quality of goods sold online. Customers’ changing preferences are not likely to go back to pre-outbreak norms.

Practice the plan.#

Many top teams do not invest time in understanding what it takes to plan for disruptions until they are in one. This is where roundtables or simulations are invaluable. Companies can use tabletop simulations to define and verify their activation protocols for different phases of response (contingency planning only, full-scale response, other). Simulations should clarify decision owners, ensure that roles for each top-team member are clear, call out the “elephants in the room” that may slow down the response, and ensure that, in the event, the actions needed to carry out the plan are fully understood and the required investment readily available.

Demonstrate purpose.#

Businesses are only as strong as the communities of which they are apart. Companies need to figure out how to support response efforts—for example, by providing money, equipment, or expertise. For example, a few companies have shifted production to create medical masks and clothing.

The checklist of the below Exhibit can help companies make sure they are doing everything necessary.

The next phases of the outbreak are profoundly uncertain. In our view, the prevalent narrative, focused on pandemic, to which both markets and policy makers have gravitated as they respond to the virus, is possible but underweights the possibility of a more optimistic outcome. Our perspective is based on our analysis of past emergencies and on our industry expertise. It is only one view, however. Others could review the same facts and emerge with a different view. Our scenarios should be considered only as three among many possibilities. This perspective is current as of March 9, 2020. We will update it regularly as the outbreak evolves.