After closing 10 franchise stores in China last year, Sergio Rossi is preparing to relaunch in China. The 83-year-old brand Italian shoemaker recently partnered with Hong Kong billionaire entrepreneur Adrian Cheng, and has its eye on Chinese millennials.

Cheng’s brand management and distribution house, Luxba Group, manages Chinese operations for brands including Moschino and Red Valentino. About the new partnership, Cheng said, “Sergio Rossi represents a certain ideal that Chinese Millennials and Gen Z aspire to — heritage, craftsmanship, and design subtlety.”

While Cheng sounds confident, Sergio Rossi faces an uncertain future in China. Despite its high-quality products and previous efforts, Sergio Rossi is still little known to local consumers compared to rival brands such as Roger Vivier.

In 2015, Sergio Rossi was sold by French luxury group Kering to Italian private equity firm Investindustrial. After the acquisition, the brand invited fashion brand Hogan’s former CEO Riccardo Sciutto to join, launched the SR1 shoe collection in tribute to Sergio Rossi's classic designs, and refurbished stores in China and Hong Kong.

Now, having closed 10 stores in China, Sciutto emphasized that Sergio Rossi will again focus on expanding their network in China, with particular emphasis on catering to Chinese millennials.

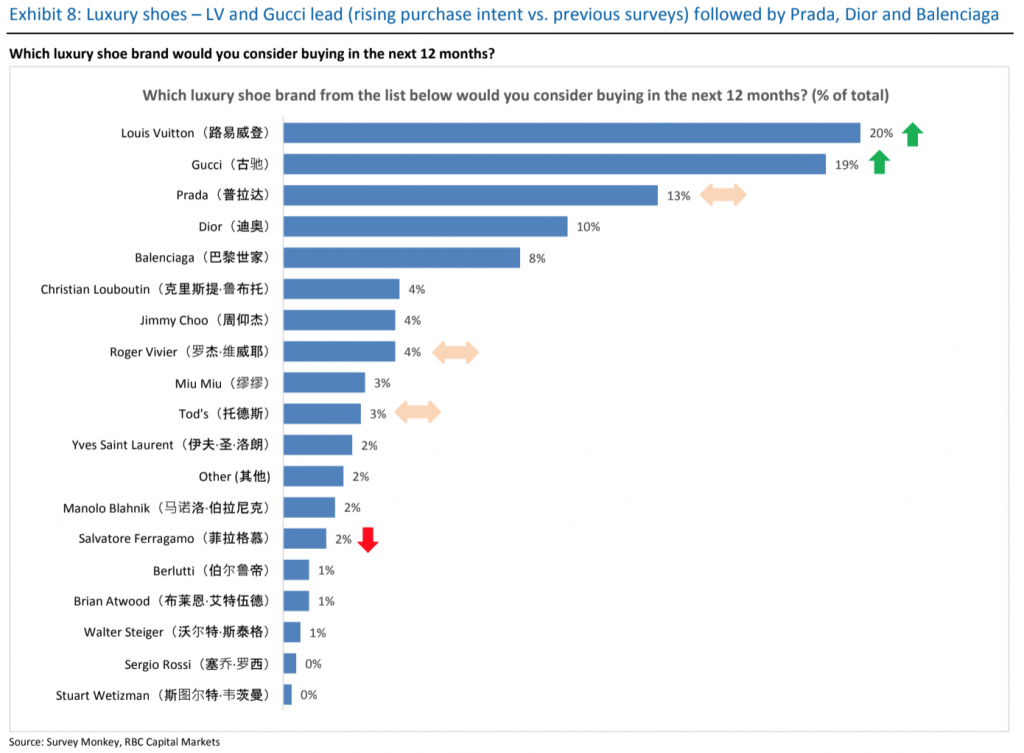

In a recent report about Chinese consumers’ preferred luxury brands in 2018, the outlook for specialty shoe brands is worrisome. The respondents (over half of which were millennials) are more interested in full product line brands such as Louis Vuitton and Gucci than shoe brands like Christian Louboutin and Jimmy Choo.

Going against the trend, Sciutto previously said the brand is closing down its menswear division to focus on the SR1 shoe collection. That calls into question how much market share Sergio Rossi can own in this already crowded market.

Analysts have pointed to a bottleneck in the industry. Luxury shoemakers rely too much on classic styles and the speed of product innovation is too slow, causing consumers to lose interest and turn to luxury bags.

Cheng may see Sergio Rossi as a test of his ability to ignite the interest of Chinese millennials through his 'cultural ecosystem'. Cheng’s investment fund C Venture has laid the foundation for this ecosystem with investments and partnerships in fashion, art, media, and e-commerce. Additionally, Cheng is the vice chairman and creative director of Nowness in China, and the executive vice chairman and general manager of property giant New World Development Co.

“We chose a partner with the resources, experience and a vision in line with ours to help us go further,” said Sciutto. “The Luxba Group, with Adrian’s network, makes for such a partnership.”