This post originally appeared on Azoya, our content partner.

Whilst the global pandemic severely constrained international travel, it is shifting the demand for imported products from overseas back to China domestic. With China's consumer market gradually recovering from the pandemic, we noticed some changes happening in customers' purchasing habits. In this article, we took a look at China's imported retail market and consumption trend under COVID-19 and how merchants can prepare for 2021.

The Epidemic Accelerates Shift to Online Retail#

Since March 2020, the outbreak of Covid 19 in China, we noticed a steady increase in e-commerce penetration. As of June 2020, Chinese online shopping consumers have reached 749 million, increased by more than 100 million over the past year. According to the Chinese Ministry of Commerce, the turnover of online retail grew 9.7% YoY to 8 trillion RMB (US$1.19 trillion) in the first three quarters.

The restriction of outbound travel also boosted the development of cross-border e-commerce in China. The latest data[1] from the Chinese Ministry of Commerce showed that cross-border e-commerce retail in China witnessed a growth of 17% YoY in the first three quarters of this year.

A large number of international brands are flooding into China’s e-commerce market. Alibaba’s data revealed that as of October 2020, the number of new overseas brands entering Tmall Global increased by 250% YoY[2], including top brands such as Too faced, Valquer, Spring Sheep, Tatcha, and Charles Farris, etc. Up to now, more than 26,000 international brands from 84 countries and regions around the world have entered the Global Tmall, covering over 5,300 categories.

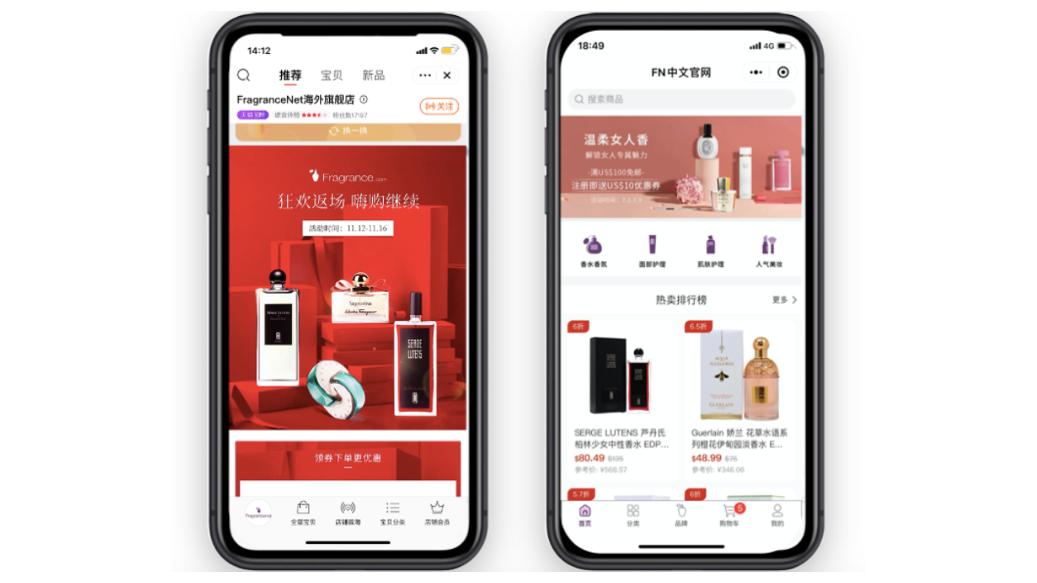

FragranceNet.com, New York’s independent retailer has launched its official flagship store on Tmall Global in June, bringing more than 7,000 products covering fragrances, skincare, haircare, candles and makeups. Top brands in their inventory include Burberry, BOSS, Gucci and Versace.

It’s just the beginning; as China continues to open up imports by developing the digital economy, more and more overseas brands will enter China by capitalizing on cross-border e-commerce.

Post-00s and 50s generation are rapidly growing in imported consumption#

According to Tmall Global, post-90s customers' spending on healthcare and beauty product have grown by 51% and 85% respectively since the coronavirus outbreak. While the post-90s generation still accounted for the major part of sale volume in imported consumption, it's noticeable for the growth of post-00s and post-50s.

Known as the "new elderly," the post-50s generation is gradually unleashing their strong purchasing power to online shopping. Since the epidemic began, the number of post-50s online shoppers has increased by 28%, driving a 39% growth in online imported sales volume. Paying more attention to health and product quality, they have an increasing demand for imported healthcare products like Coenzyme Q10 and glucose.

Another noticeable increasing group is the post-00s consumers aged between 10-20. The number of post-00s consumers rose by 62% and the amount of consumption increased by 66% during the pandemic. As the digital natives, the post-00s have their unique consumer cultures such as evening and idol economies. This also gives birth to the increasing demand such as first-aid skincare products, healthcare items and the products endorsed by their idols.

As the post-50s and post-00s become more active, merchants should adjust their product strategies to meet their demand for high-quality and diversified goods. Also adopt some new marketing approaches such as influencer marketing and celebrity endorsements.

Changed shopping habits gave rise to emerging categories#

We saw some new retail scenarios after the pandemic outbreak, which upended the shopping behaviors of consumers and redefined the imported consumption landscape.

Household, personal care, and cooking categories

Driven by prolonged stay-at-home policies, Chinese consumers have spent more time on cooking and housework, which led to the boost of imported household, personal care, and cooking products.

This year, Tmall Global has brought over 30 new overseas oral care brands in China. From March to August, the transaction of smart oral products increased by 253% YoY on Tmall Global. The sale of cooking and household items grew 74% from January to March and 42% from April to August. Household fragrances such as scented candles also witnessed historical growth of sales, with a record showing 75% of sales increase from January to June compared to the same period of last year. This was likely stimulated by the stay-at-home policy and improving living conditions.

Healthcare, pet, and professional beauty products

As customers pay more attention to health and quality of life under COVID-19, consumption-related categories such as healthcare and beauty products were more popular this year.

In the Singles Day campaign this year, the sale of imported healthcare products increased by five times YoY on JD.com in the first 30 minutes on November 1. According to CCTV-2, a Chinese finance channel operated by China Central Television, the scale of the healthcare market is expected to exceed 330 billion RMB ($50 billion) in 2021.

The pet care industry is also benefited from the Covid situation. According to Tmall Global data[3], compared with traditional pet food, the popularity of imported raw meat has risen sharply by over 100% from January to July. This emerging category now accounts for over 80% of the pet market. It also showed that international pet supply sales increased by more than 90% in the same period. Growth of pet snacks and pet healthcare products are 300% and 120% respectively, while pet shampoo had a skyrocketing increase by 1100%.

Another trend is the booming demand for professional beauty products. More than 40 new European and American professional beauty brands have come onto Tmall Global in the past year. Turnover of imported facial masks increased by over 500% in six months, and the growth of beauty devices is up to 210%. In September, Tmall Global has aligned with Erno Laszlo, Medspa, Repacell, Dermalogica, and other international beauty brands to establish a global alliance, to develop exclusive products for Chinese consumers.

Alcoholic beverages and travel size items

As the Chinese are not able to travel outside of mainland China, we saw a massive demand for alcoholic beverages transferred from outbound tourism shopping to domestic online purchases. From January to July 2020, sale of imported alcoholic beverage in Tmall Global jumped 220% over the same period of last year, of which top sales were Japanese sake with a 470% increase, liqueur, up 430%, brandy increased by 220%, and whiskey with a relatively “moderate” growth rate of 110%. Half of the consumers are young people between the ages of 18-29, who are also the mainstream shoppers of imported merchandise.

We also notice a rising demand for travel-sized products as domestic travels rebounded strongly after the national lockdown was released. There are over 637 million domestic travelers estimated during the Mid-autumn Festival and the National Holiday, recovering to 79% of last year's travelers. It generates an increase of travel-sized products such as small-sized daily necessities and snack food. For example, during Labor Day in May, the sale of imported sunscreen increased by 337% on Tmall Global.

Key Takeaways#

As global epidemics seem to last for an extended period, e-commerce will become more important to merchants in the upcoming year. For new brands that are looking to penetrate to China, cross-border e-commerce via leading e-commerce platforms in China is an emerging business model. Brands should also be aware of localizing strategies to meet consumer demands in the post-Covid19 situation.

Besides the post-90s generation, post-50s and post-00s are also emerging customers for international brands. We recommend brands to review their current China strategies to cater to these customers for sustained growth in China.