Key Takeaways:#

Brands have continued to tap C-pop power by appointing more Chinese idols as ambassadors.

While China’s fandom culture can create tremendous business value for luxury brands, it could also lead to erratic fan behavior that hampers brand PR agendas.

To navigate China’s unpredictable C-pop fan economy, brands must practice due diligence, understand C-pop’s peculiar idol-fan dynamic, and remain agile with their crisis PR.

C-pop has undoubtedly been a driving force behind luxury’s explosive growth in young China over the past two years, and brands have continued to mine this industry for the idol ambassadors with massive influences over millennials and Gen Zers. Recent appointments include Wang Yibo for Chanel and pop stars Fan Chengcheng and Ouyang Nana for Givenchy. But despite luxury and fashion’s growing infatuation with C-pop ambassadors, China’s increasingly hysterical fandom culture and the government’s repeated criticism over C-pop-related social scandals have become potential risks that could hamper brand PR agendas.

The rise of C-pop stars in luxury campaigns comes as a result of young China’s surging purchasing power. A decade ago, the prestige of representing the world’s most coveted fashion houses was reserved for Western, Oscar-winning megastars that brands thought of as “aspirational” for their audiences. But the industry’s shift towards Gen Z and China has rewritten those rules, forcing brands to favor a star’s social media influence and commercial potential over traditional cultural measurements.

So far, C-pop celebrities have demonstrated huge success in helping brands regain media buzz and spike their sales, especially those who had lagged in market hype.

In October of 2016, British luxury brand Burberry appointed the Chinese rapper Kris Wu as its global brand ambassador, making him the group’s first non-British spokesperson. By the first quarter of 2017, Burberry’s financial report showed a 13-percent year-on-year increase, with APAC leading that growth at a rate of 16 percent. Kris Wu’s image also gave Burberry's Chinese social media presence a big boost. Since announcing the appointment, it saw Chinese user views of the brand's WeChat marketing content more than triple.

Another remarkable example has been Prada’s appointment of idol Cai Xukun in 2019. The day after Kun’s official announcement, the topic quickly rose to 730 million views on Weibo, with Prada’s campaign video featuring Kun having played over 76 million times. Weeks after, Kun’s fans created a hashtag community that had posted more than 50,000 Prada shopping receipts, while a Prada keychain with Kun’s name went out of stock worldwide. “Fans don’t know about Prada through us; they know Prada through Kun,” said the house’s director Miuccia Prada over an interview with Chinese media GQ Lab.

In part, the C-pop craze has exploded due to intensified nationalism among younger Chinese generations. Instead of seeing yet another Hollywood face on a luxury billboard, they feel proud and connected to a brand when seeing a Chinese idol in this prime position. Aside from the nationalist factor, China’s peculiar fandom culture has also contributed to a high level of engagement, making C-pop idols particularly commercially viable for brands.

By C-pop’s community standard, fans see bolstering the idol’s commercial portfolio and sales KPI as a concrete way to support their hero. Therefore, they take ownership of whatever products the idol sponsors.

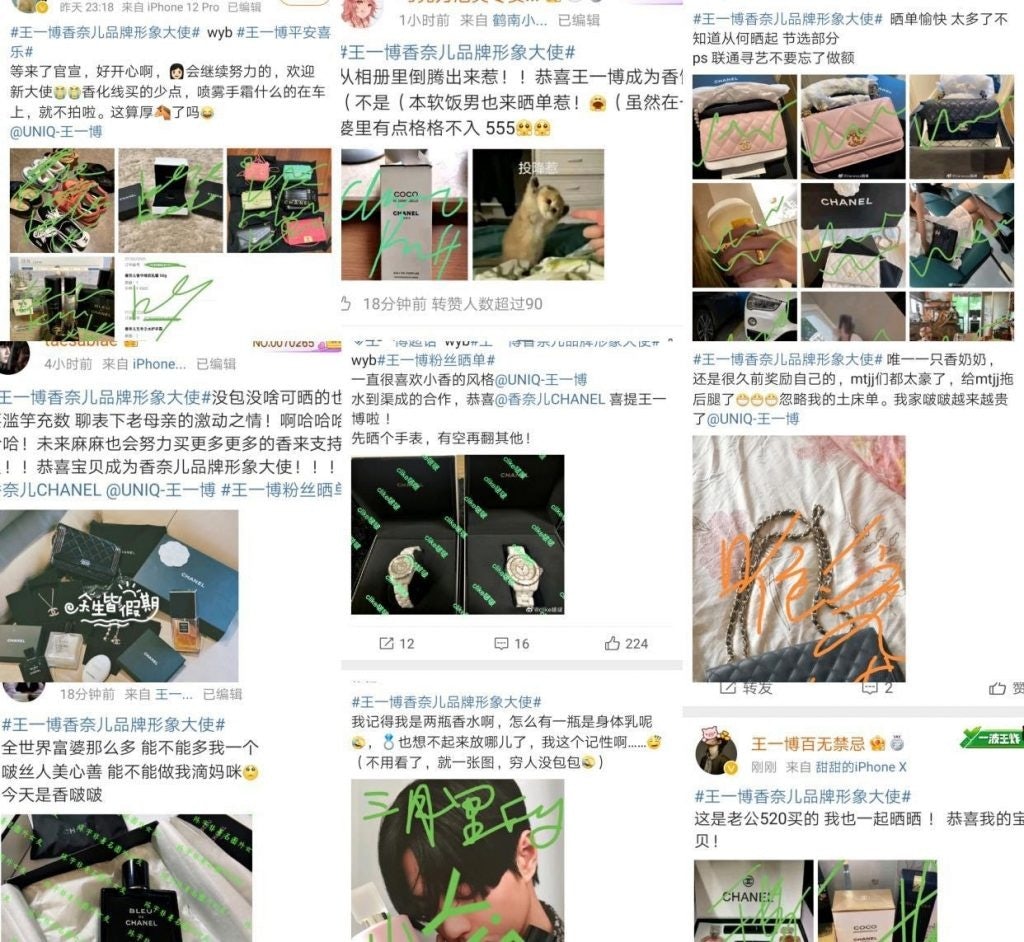

This direct show of loyalty via purchases by C-pop fans has led to astonishing business records. For example, “Produce Camp 2021,” a Chinese talent show airing this February, raised an average of 6.13 million per contestant from its audience, which was eager to help its favorite idols win. And earlier in June, the Weibo hashtag community #王一博粉丝晒单# (Wang Yibo’s fans receipt center) — featuring fans displaying proof of purchase on everything the idol promotes, ranging from Chanel watches to Kentucky Fried Chicken takeout — surpassed two million posts.

However, C-pop fans’ shopping devotion is not a free pass for brands to go all-in on recruiting more idol ambassadors. That is because increased erratic incidents by C-pop fans could end up harming these brands.

The most famous of these incidents was when actor Xiao Zhan lost his ambassador contracts with brands like Estée Lauder, Piaget, and Cartier because his fans raged a cyberwar against a website that allegedly “defamed” his image.

In May 2021, the talent show “Youth with You, Season 3” led to gallons of milk being poured into a river after fans purchased a milk product from a show-sponsoring brand just to get a QR code so they could vote for their favorite idol. Incentivized by competitions with other fans, people bought the bottles by the thousands but simply poured the milk out. People’s Daily, the government’s official mouthpiece, condemned the show for encouraging wasteful behavior. Two days later, “Youth with You” had ended its recording and streaming of the show.

Within a local context of slowing income growth and soaring living costs, celebrities who post their extravagant lifestyles are now becoming a target for media censorship. For example, Su Mang, the ex-editor-in-chief of Bazaar China, faced a significant social media backlash after saying a 650 yuan (100) budget is not enough for breakfast on a cooking show. Likewise, Zheng Shuang, a controversial Chinese actress who lost her Prada ambassadorship due to a surrogacy scandal, drew social resentment after disclosing that she earned as much as 2.1 million a day.

To tame this outbreak of fandom scandals, the Chinese government launched a media crackdown initiative called “Qinlang” in May, aiming to remove all celebrity content that potentially promotes bad values to the country’s youth, such as reckless spending and drug use.

For brands, using C-pop celebrities for image or sales boosts has become an increasingly risky venture. To be smarter about their partnerships, brands must keep these three things in mind:

1. Do your due intelligence on the idol. Idols are the key to reaching Gen-Z consumers, but brands need to know who to choose. Precisely because of the emotional and financial value that young Chinese fans pour into their idols, they can be intensely disappointed and resentful towards idols if they get caught committing immoral or illegal deeds. As a consequence, they will boycott the brands the idol represented.

2. Reward the idol to reward the fans. Since China’s fandom culture ties fans’ identity to their idols’ commercial success, watching an idol get status promotions or privileged seats from a prestigious brand rewards them most of all. Brands have to show concrete rewards like these for the idol to maintain their high engagement and sales performances with fans.

3. Be prepared for potential pitfalls and PR crises. Knowing that no human is perfect, all celebrities could experience a fall from grace, making fans boycott their brands. With how fast things can escalate in China’s social media, brands would be better off taking a firm stance immediately after a scandal rather than waiting for the perfect answer.