Consumers in China are watching coronavirus numbers closely as they wait patiently for a tipping point to arrive with the warm weather. The outbreak has had a heavy impact on the retail market because the majority of Chinese citizens remain under quarantine. Shopping malls either postponed or shortened their operating times, and landlords have slashed retail rents as the virus spread across China and beyond.

Galleries Lafayette Beijing already halted operations on February 4th, and the Hang Lung Property group’s Plaza 66 announced a half-rent reduction for tenants in mainland locations for three weeks, beginning on January 25. Harbour City shopping center, a benchmark for luxury sales in Hong Kong, lowered its February rents by half.

A journalist from the Chinese newspaper China Times visited many popular business districts after the virus hit — including Wang Fujing, Joy City, and SKP in Beijing — and exposed the dire nature of the country’s retail scene. For example, SKP, which saw daily sales reach $157 million (1 billion yuan) 3 months ago, now hardly has any foot traffic. The mall has adjusted operating times to open from 11:00 to 18:00, and while “the in-store traffic is less than the same time last year, we still saw customers coming in,” says one sales associate from Cartier. “We had quite a few clients shopping in-store for Valentine’s Day.” One shopper coming out of the LV store says she felt safe, as there’s less of a crowd, “There’s also temperature screening equipment by the entrance, and sales associates were taking extensive safety measures,” she says. SKP adopted a commission model with its tenants, so the virus situation has affected both the mall and its stores.

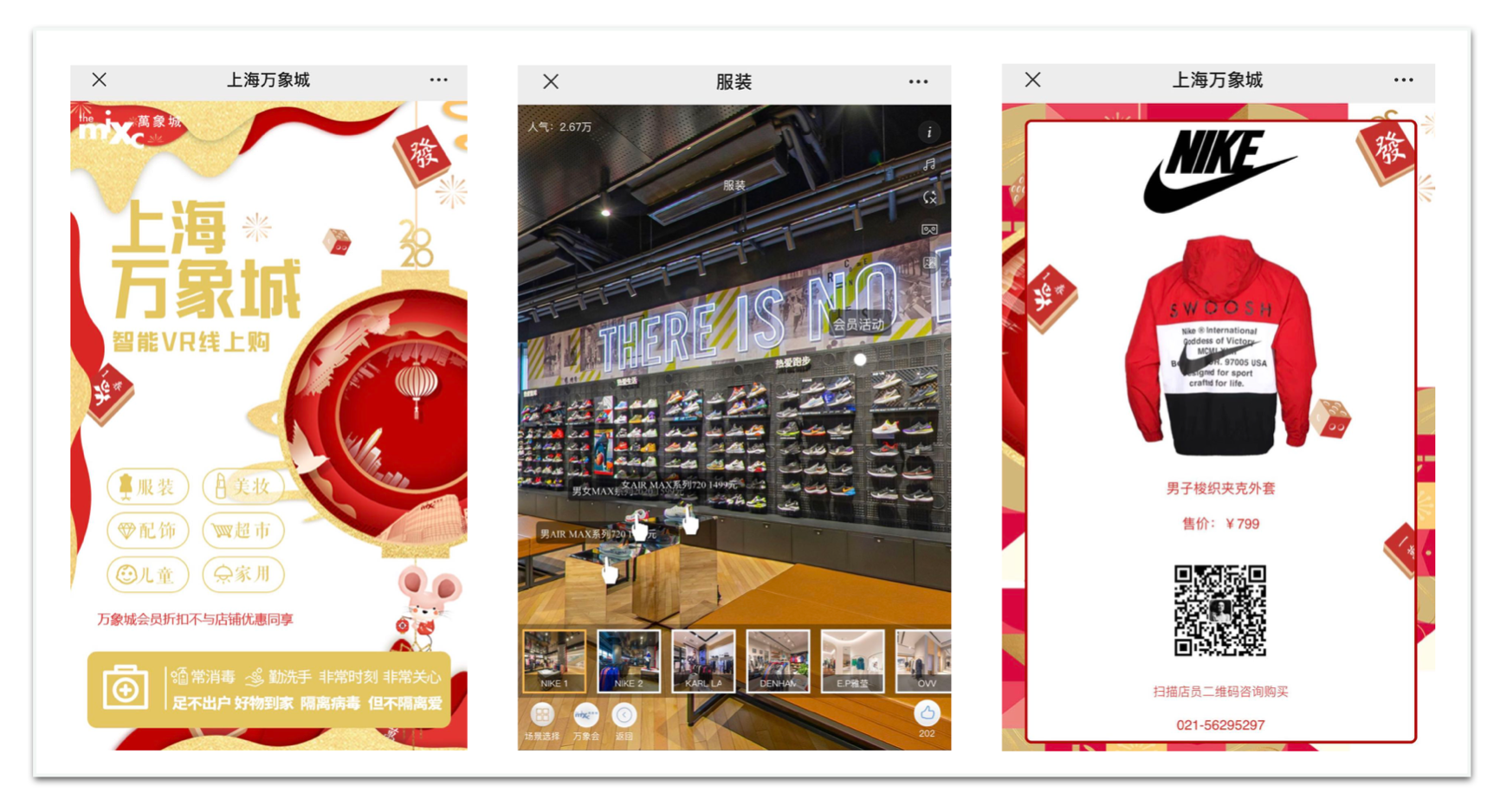

While consumers are stuck at home, many have turned their attention to the virtual world as a way to take a break from the constant stream of virus news. Virtual shopping has even become a full-blown trend. Consumers are learning to fulfill their shopping urges by taking virtual tours online. For example, the Mixc in Shanghai launched a VR channel that allows consumers to browse many of the mall’s offerings, from fashion staples like Nike, Puma, and Fila, to beauty brands and retailers such as Lancome, Cle de Peau Beaute, and Sephora. This trend, however, is less practical, as both customer service and items are limited.

Comparatively, luxury shopping malls are conservative about taking the shopping experience virtual, leaning more toward creative campaigns to help generate attention. For example, both SKP Beijing and Chengdu IFS launched Valentine’s Day campaigns. IFS invited heartthrob celebrity Heize to promote its latest holiday offerings, while SKP Beijing came up with an online quiz to help consumers curate special Valentine’s Day items.

In an interview with Jing Daily, IFS Chengdu stated that the development of omnichannel is a long-term goal. So far, its CRM system has accumulated 300,000 VIP consumers, who can revive convenient delivery service after the virus subsides. “The virus situation is an emergency, and a testament to brands’ operational capabilities,” the company says. IFS Chengdu hopes to build a lifestyle through its artistic and experiential space. In the past, it hosted events like Chengdu Parcours Art Festival and launched WeChat mall with the support of over 30 luxury brands that offered unique collaborations and limited collections. IFS is currently one of the most influential luxury malls in China’s midwest region, with over 600 luxury fashion brands.

“All this will be temporary once the virus situation softens and consumer confidence and purchasing desire is restored,” adds Chengdu IFS, “Our tenants are all looking forward to the future.” The mall’s parent company, Wharf Holdings, injected roughly $1.4 million (10 million yuan) into the “Wharf Emergency Relief Fund” to help combat the virus.

Meanwhile, many shopping malls are using this moment to revamp and introduce new technologies to help them prepare for their omnichannel futures. Xuan Zheng, the founder of Chatail, a smart retail technology provider, suggested several solutions in development that could convert offline brand traffic to online.

One is to build an Instagram-like social shopping feed where sales associates can post their latest items and consumers can leave comments or click to shop. Another is a livestreaming WeChat Mini Program (created in collaboration with Tencent Cloud) that lets consumers video chat with sales associates who broadcast products in the store. Consumers can screenshot items and purchase them anytime during the livestream session. This is beneficial because the large WeChat ecosystem offers brands exclusivity and flexibility that third-party sellers cannot.

The key here is to power a parallel online community that revolves around human – sales associates. Brands can then use different functions — livestream, group sale bundles, or virtual scores, for example — to increase consumer stickiness. And with a smart back-end system, they can view the sales numbers of each associate, consumer demographics, or other useful data points to help them make intelligent decisions. “We are currently overwhelmed with requests from retailers. In a time of crisis like this, they are more willing to try new technologies to survive,” Xuan states.

Whether conservative luxury players will become early adopters of these technologies has yet to be determined. The challenge lies in whether online information will keep in line with branding guidelines, and if malls can direct enough customer traffic to those online platforms. Regardless, the coronavirus has forced traditional retailers to at least start considering innovative sales tech.