This post originally appeared on Walkthechat Blog, our content partner site.

Newrank, one of the largest social data analytics company in China, recently released a report regarding online content. Let’s dig into some of its central insights.

Spending on WeChat Official Account Key Opinion Leaders#

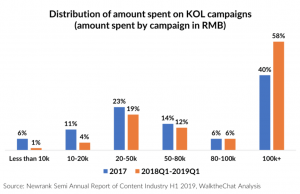

One of the main trends pointed out by the Newrank report is the increasing amounts of large WeChat KOL campaigns.

Between 2017 and 2018, the amount spent on WeChat KOL campaigns of more than 100k RMB jumped from 40% to 58% of the total KOL investment.

This trend reflects the fact that larger influencers tend to yield a better return on investment for brands. It also reflects the fact that as the WeChat KOL market is maturing, the view traffic is also consolidating into fewer larger accounts.

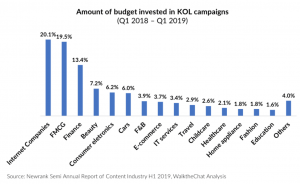

The top KOLs are most likely overpriced, but at least brands can see a real return. When it comes to which companies are investing the most in influencers, large Internet companies and FMCG brands are leading the way. This is mostly because these groups tend to have deeper pockets and can invest in more significant campaigns.

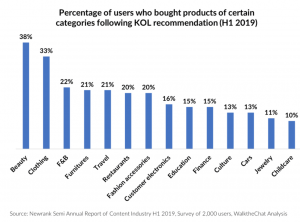

Actually, beauty products and clothing are the top categories of product that sell the best with KOL recommendations. Cosmetics and fashion companies tend to be smaller in scale than FMCG companies, but they are seeing higher returns from KOL campaigns.

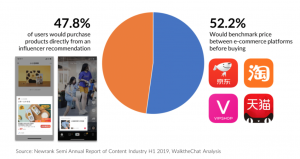

Influencer campaigns can be incredibly efficient. Among people who purchase a product following a KOL campaign, 48% of them buy directly from the links provided by the influencer. The other half will head to e-commerce platforms to benchmark prices before buying. This means nearly half of the consumers are willing to purchase a product merely based on reading one article, without doing research or comparing price in other channels. That’s why KOL marketing is maybe the most effective way to promote a new brand.

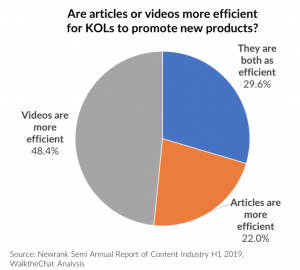

When it comes to promotion format, videos are twice are likely to convert than articles. With the rise of live streaming and short video platforms, it is a strong hint for brands to diversify their content format.

Online advertising#

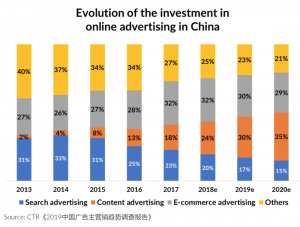

Online advertising has also seen significant transformations over recent years. One of the most significant changes has been the shift from search advertising to display advertising.

Brands are now much more likely to put money into WeChat Moment advertising or Douyin advertising than on Baidu search. This trend is simply linked to higher returns from social ads. Search engine platforms are also losing traffic to social media platforms.

Search advertising is expected to plummet from 31% to 15% of online advertising in China between 2013 to 2020, while display ads will have grown from 2% to 35%

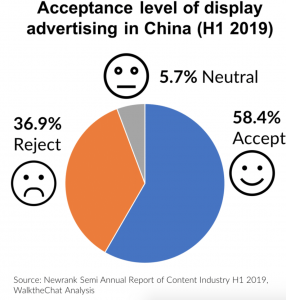

Brands are more likely to invest in online ads as the Chinese population is overall very accepting of them. 58.4% of Chinese Internet users have a positive outlook on online advertising.

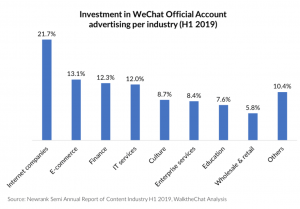

The primary industry in terms of WeChat ads investment is Internet companies (as you might have guessed given the significant amount of JD.com or Pinduoduo advertising on your WeChat feed).

WeChat Official Accounts#

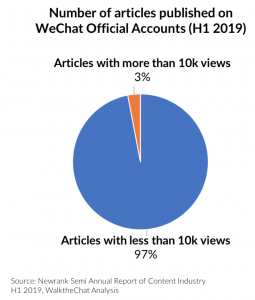

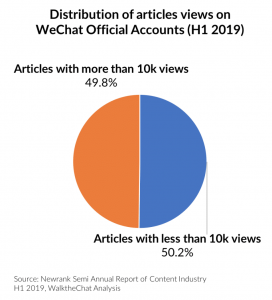

One of the main insights from the Newrank report is the extreme concentration of views into a small number of accounts and articles.

Articles with more than 10k views make up for only 3% of articles but account for around half of the views on WeChat.

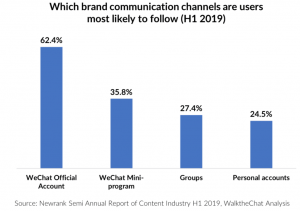

WeChat Official Accounts remain the main channel through which users want to hear from brands.

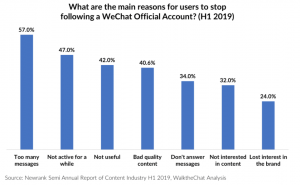

The overwhelming reason for which users unfollow WeChat accounts has to do with the content published. Either the amount is too frequent, not frequent enough, or quality is too low.

Publishing the right content at the right time takes careful calibration to keep users engaged.

Live-streaming#

The last category of content covered by the Newrank report is Live Streaming.

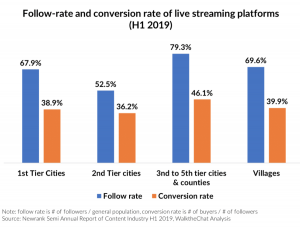

Overall, users from smaller cities are much more likely to follow live streaming. They are also much more likely to make a purchase after watching a live stream.

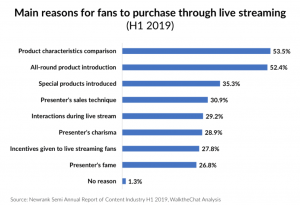

The best marketing method for sales conversion is product characteristics comparison. By demonstrating the product’s top characteristic comparing to the competitor’s, viewers will more likely to make an impulse purchase.

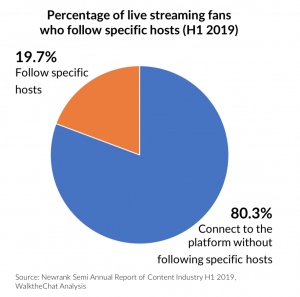

Users are not very faithful to one specific presenter. More than 80% of users mention they are happy to see different live streamers and are more likely to follow a platform than a person.

Conclusion#

The Newrank report highlights some significant trends. Influencer marketing is getting increasingly important, with a focus on larger influencers, video, and live streaming.

The report also highlights the differences between China and the West, with a clear drop in interest in search engine marketing.