Key Takeaways:#

China’s perception of male beauty has changed over the last few years due to the rise of Little Fresh Meat idols and shifting gender roles.

Certain products, such as BB cream, have become the focus of new brands when launching.

Compared to established brands, it may still take time for young brands to earn consumer trust over quality.

In early December, a recording of an Omegle video (where strangers play Chatroulette) in English of a little boy praising a man in full makeup unexpectedly took off on Weibo. The hashtag #LittleBoyFirstSeeMenWearingMakeup (#小男孩第一次见到男生化妆#) was trending. And to show additional support, the majority of netizens agreed that China should be more inclusive.

The comments mirror China’s changing public view on male grooming. Thanks to the rise of well-preened Little Fresh Meat idols and shifting gender roles, young Chinese consumers have become more open about expressing themselves, which has manifested in an increased acceptance of skincare and makeup use.

Where consumer trends go, brands and investments will follow. Global brands have made notable steps in shifting China’s male beauty standard ever since Boy de Chanel — a milestone in male beauty — was first released in 2018. No less than ten new Chinese male beauty brands emerged in 2020, Reuters reported.

Macroeconomic reports show growing optimism as well. According to Euromonitor, from 2016-2019, the Chinese male beauty market increased at an average annual rate of 13.5 percent, far higher than the global average of 5.8 percent. Ahead of this year’s Double 11 Shopping Festival, Cainiao (Alibaba’s logistics arm) prepared 3,000-percent more male beauty products than the previous year.

Jing Daily takes a closer look at the current social perceptions of male beauty, the various product categories, and whether C-beauty can thrive in a booming market.

K-Pop influence & LGBT+ acceptance opens a window to male cosmetics#

China and the West have clear distinctions on social perceptions of male beauty, which affects market expansion. In China, male beauty has been redefined over the past few years, thanks to the rise of Little Fresh Meat idols (小鲜肉) and young male consumer spending power. And in this rapidly shifting landscape, entrepreneurs with a global outlook are quick to seize this opportunity.

“When it comes to men’s beauty, Asia is by far leading the way,” said Shane Carnell-Xu, the co-founder of a UK-based maker of BB cream and concealers called Shakeup Cosmetics, which became available in China on Tmall Global last July. Having moved to the UK from Beijing in his teens, Carnell-Xu said that he and his twin brother (the other co-founder of the company) wanted to create products for themselves after struggling to find concealers and foundations suited to their skin types and tones.

“In China, more and more young men are taking better and closer care of their looks and personal wellbeing as a whole,” Carnell-Xu noted. “And, crucially, societies are accepting this trend with a generally positive attitude, seeing it as a good trait in men.” The brand’s success reflects this change, as its Tmall store reached 1.58 million yuan in sales after the first hour of this year's Singles' Day shopping festival.

Similarly, Belinda Chen, who founded JACB in early 2020 after overseeing the watch category of JD.com’s fashion division for three years, has witnessed a rise in male Gen-Z consumers in China. “In the process [of working at JD.com], I've come to observe that Gen-Z customers have become a dominant group among all e-commerce consumers,” she said. “Also, a lot of gen-Z males have become increasingly discerning in how they look, so there's strong demand in the male grooming sector across different e-commerce platforms.”

Born during the COVID-19 pandemic, JACB now offers six skincare and makeup products on the site of Chen’s former employer for 70-150 yuan. It closed an angel round of investment in late 2020, led by Bertelsmann Asia Investments and China Creations Ventures.

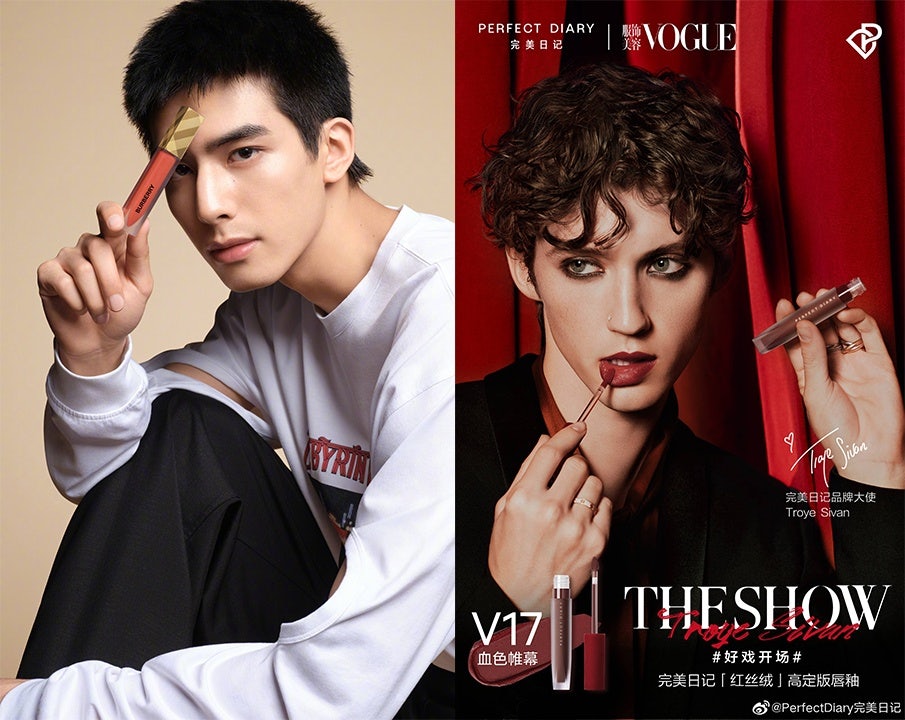

Yet, it is international brands that these companies can thank for the growth of the male beauty products sector. Beauty brands that traditionally own female lines have learned to pick male idols for their consumers in China. After the British luxury brand Burberry selected actor Song Weilong as its brand beauty ambassador, Song’s 10.8 million Weibo followers drove over eight million engagements on the social platform in just a few days. In October, C-beauty poster child Perfect Diary tapped the Australian singer-songwriter Troye Sivan — who also starred in a short brand film wearing colorful eye shadows — to be its ambassador. These high-profile choices helped move the needle of male beauty in the eyes of the public.

From product categories to brand preferences, Chinese male beauty is still being defined#

Despite China’s growing acceptance of male beauty, entrepreneurs may still need to be careful when choosing products or marketing messages. In an active post, titled What do you think of men wearing makeup, on the Chinese Q&A site Zhihu with over 500 thousand comments, many stated that the highest standard for men’s makeup is to be “invisible.” Interestingly, the DTC brand Shakeup Cosmetics directly addressed those commenters' needs by stating on the post that when wearing their best-selling BB cream that “no one can tell that you are wearing makeup.”

Since founding the company in 2018, the co-founder of Shake-up Cosmetics, Shane said he had his eye on the China market's large customer base. He even incorporated data from Tmall for the new product’s development pipeline. He and his co-founder decided on BB cream and lipstick, the brand’s two current best-sellers, after seeing how these products grew by 249 percent and 278 percent at the Double 11 shopping festival on Tmall in 2018.

Those already-popular product categories can also be a springboard to develop customer loyalty. “When we dove into our product strategy, we looked at the sectors that have been growing very quickly and where existing products cannot meet the demand,” said JACB’s Chen, who also added that it’s still important for brands to eventually create a full product assortment.

According to Shane, the price boundaries in the male beauty market have already become clear. There are three tiers: the mass sector of representative C-beauty brands priced below 100 yuan, the high-end sector that includes products by Boy de Chanel and Tom Ford for aspirational consumers, and mid-tier brands like Estée Lauder’s Lab Series. The latter is few and far between, said Shane, leaving less competition for his brand.

But the right product category may not be enough for more affluent consumers, many of whom still prefer established brands. Adam Wang, a 27-year-old Wuhan native, said he would still choose established brands over new ones due to quality concerns. “I won’t try C-beauty or new brands because their quality isn’t guaranteed,” he said in a WeChat interview. He has used foundations from Boy de Chanel, the Korean brand IOPE Men, and skincare products from Estée Lauder’s Lab Series in the last two years.

Much like the female beauty sector in China, established companies still hold a large market share. In skincare, top-three companies L’Oréal, Beiersdorf, and Rohto make up more than 60 percent of male facial skincare market value, according to a report by the global market research firm Mintel. But, the same report mentioned that a great number of small DTC brands “help drive product experimentation among men,” thanks to their accessible price points and rich product options.

In 2020, even with COVID-19, competition in China's male beauty arena increased, which is encouraging, as it helps expand the market. For young brands like JACB, the next step is to expand their product portfolios. “We really need to bring more new products to the market that we currently don’t have,” Chen said. “In 2021, we have some fun initiatives for customers in the pipeline.”