This post originally appeared on Quartzy, our content partner.

American fashion label Michael Kors once called Alibaba “our most dangerous and damaging adversary.” The comment, made in 2016, was in response to the spread of counterfeits on Taobao, the Chinese e-commerce giant’s online marketplace.

The company struck a different tone about Alibaba earlier this year: John Idol, CEO of Michael Kors, called Alibaba’s Tmall Luxury Pavilion “the perfect venue for us to communicate Michael Kors’ brand vision.” Luxury Pavilion is a dedicated site Alibaba created for high-end brands on Tmall, its general retailing platform. Chinese shoppers are engaging more with luxury online, Idol noted when he announced in July that Michael Kors would open a digital flagship on Tmall.

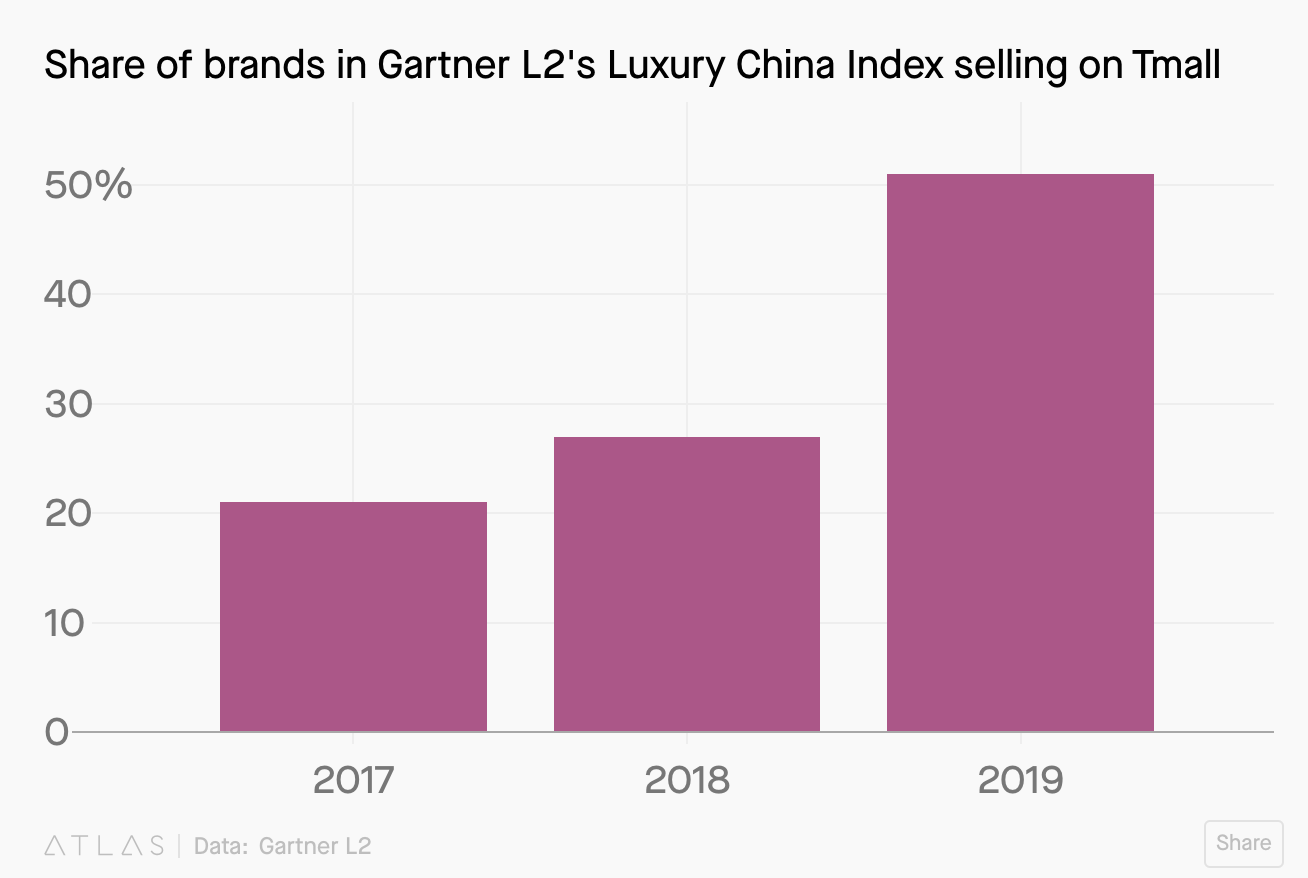

The turnabout illustrates how the fashion industry, which once eyed Alibaba with suspicion, is now flocking to it in order to reach China’s luxury-hungry shoppers. Business-intelligence firm Gartner L2 noted in a recent report that 51% of 45 top global fashion brands it tracks in an index now have official flagships on Tmall. It’s a big uptick from previous years. Luxury brands that now sell on Tmall include Valentino, Versace, Isabel Marant, Coach, Bottega Veneta, Givenchy, and Burberry.

At the end of September, online fashion retailer Net-a-Porter and its men’s site , Mr. Porter, opened a shop on Tmall too. They’re offering more than 130 luxury and designer labels as part of a major deal that their owner, Swiss luxury group Richemont, signed with Alibaba last year.

The main appeal for the brands, of course, is sales. Chinese nationals are the world’s leading buyers of luxury goods, and while only about 10% of luxury sales in China currently happen online, that share is growing quickly. Tmall, which wants to own as much of that growing share as possible, offers some advantages to brands, even as many operate their own e-commerce sites too.

“One of the main factors is that it offers brands exposure to a massive audience at a time when it’s becoming increasingly challenging for brands to drive traffic to their China sites or WeChat accounts,” explains Liz Flora, editor of Asia Pacific research at Gartner L2, in an email. (WeChat is China’s highly popular messaging app.) Gartner L2 has also found that China’s top search engine, Baidu, is seeing its traffic decline, meaning it’s driving less traffic to brand sites. “Meanwhile,” Flora adds, “Weibo [a microblogging platform] and WeChat are pay-to-play; brands must invest heavily in advertising and celebrity promotions to gain visibility and engagement on these platforms.”

Luxury’s mega-brands, such as Louis Vuitton and Gucci, haven’t come around to Tmall just yet. According to Flora, they have the name recognition in China and resources to run successful e-commerce sites of their own. But for independent brands and so-called affordable-luxury labels such as Coach and Michael Kors, the reach Tmall provides is particularly beneficial.

And Alibaba says luxury shopping on the platform is on the rise. Last October, in the most recent figures it has released, it noted that total luxury sales on Tmall grew 46% in the 12 months ending in June 2018, while the number of luxury shoppers grew 36% in the same period.