When Luo Yihan, 21, began her first year at an art school in Los Angeles, it was around the same time that she had her first taste for luxury, purchasing handbags from Michael Kors, Coach, and Kate Spade. But over the next couple of years, she lost interest in these brands.

Now back in Beijing, as the ongoing COVID-19 pandemic forced her school to close, she shared her newly found love — a 360 handbag from a niche Lebanese brand called Vanina that’s made with large pearls and gold beads — over WeChat. “I feel special when I use it. I like that it doesn’t have any big luxury logos, and that I can catch people’s attention with it just by being unique.”

Legions of young Chinese consumers share the same sentiment as Luo, and they show it by posting on Little Red Book, a social platform targeting millennials and Gen-Zers. The hashtag #niche (小众) was used over one million times, while #accessibleluxury (轻奢) was posted less than one third of that. Despite most niche brands being less than ten years old, they are the “future of growth” in the luxury world in the next decade, according to Sonja Prokopec, Professor at ESSEC's Department of Marketing in Singapore.

Accessible luxury brands were on tilt long before COVID-19, with stagnant financial growth and criticism of frequent discounting and dependency on outlets. In the most recent quarter during the pandemic, they have been hit harder when compared to luxury brands. While LVMH’s Fashion & Leather Goods category reported a decline of 9% in revenue, and Hermès reported a 6.5% drop, accessible luxury brands Coach and Kate Spade dropped 20% and 11%, respectively. The two brands' owner, Tapestry, has not responded to requests for comment.

Most accessible luxury brands have less exposure in China compared to European luxury brands, which means that accessible luxury will benefit less from a China in recovery, said Erwan Rambourg, Global Co-Head of Consumer & Retail Research at HSBC. “Two years ago, we’ve seen the beginning of repatriation of growth within mainland China. Obviously, COVID-19 is an accelerator of growth, because the vast majority of Chinese citizens are basically stuck at home and buying at home.”

Under a shifting landscape when accessible luxury faces both external and internal threats, how are Chinese young consumers redefining this category, and do new entrants — niche brands — fit into this lucrative category and do they pose a real danger to the multi-billion dollar accessible luxury market?

Redefining “Accessible Luxury”#

While the notion of accessible luxury is constantly evolving, accessible luxury brands were conceived to give the middle class consumers a taste of luxury — but with an affordable price. Today, however, this segment appears to be losing some cachet among Chinese consumers, as more are seeking out contemporary brands, dubbed as “niche brands” by young Chinese consumers that share similar price points (around 500 per item). For example, upon launching on JD.com this April, the Bulgarian leather goods brand By Far and the French sneaker brand Veja have sold out many products in under a week.

Just like Luo, Vicky Li (@宇宙大鹅), a millennial influencer on Little Red Book, believes the popularity of niche brands to people of her generation is that they offer something different. “I think in recent years, Chinese people’s sense of style has been elevated, and they are happier when others think they have both personality and good taste.” A finance worker in Beijing’s central business district during the day, she often recommends and even predicts the next viral niche brands for her 22,800 followers, of which over 70% are millennials and Gen-Zers from first-tier cities.

While comparing handbag designs from accessible luxury and niche brands, the latter are usually designed in irregular shapes and constructed with unusual materials that make them look more like rule breakers, just like many young Chinese consumers themselves.

The Tab bag from the UK-based handbag brand Yuzefi, for example, features a color blocked design and an oversized top handle that bridges the front and back of the bag, instead of the sides. According to Naza Youzefi, the brand’s founder and designer from Iran, the bags’ unique design is the key to win its Chinese customers, who are mostly between 18 to 34 and from first-tier cities. “Our customers are more fashion-forward for newness rather than following a classic luxury aesthetic,” she said.

The unwavering preference from Chinese young consumers made China a strategic market for many niche brands. “China has been our biggest market since the brand’s early days, and Chinese customers in and out of mainland China account for the majority of our wholesale and retail trade,” Youzefi said. The brand, founded in 2015, is planning to launch a WeChat store this summer to up its exposure in the Chinese market.

Classic luxury aesthetic at an affordable price used to be an accessible luxury brands’ advantage. But lately, it has become a shortcoming among many young consumers, who are drifting away from the herd mentality that dominated an older generation of Chinese luxury shoppers. In a world where Michael Kors’ Accordion bag, Kate Spade’s Harmony tote bag, and even Louis Vuitton’s classic models became ubiquitous on China’s high streets, it could be a bit awkward to clash bags with someone else, according to Guangzhou-based Little Red Book influencer Carrie Day (@Carrie). “Though with niche bands, they usually have good quality and design, people will think they are expensive, but they don’t know what the price is; they are more enigmatic.”

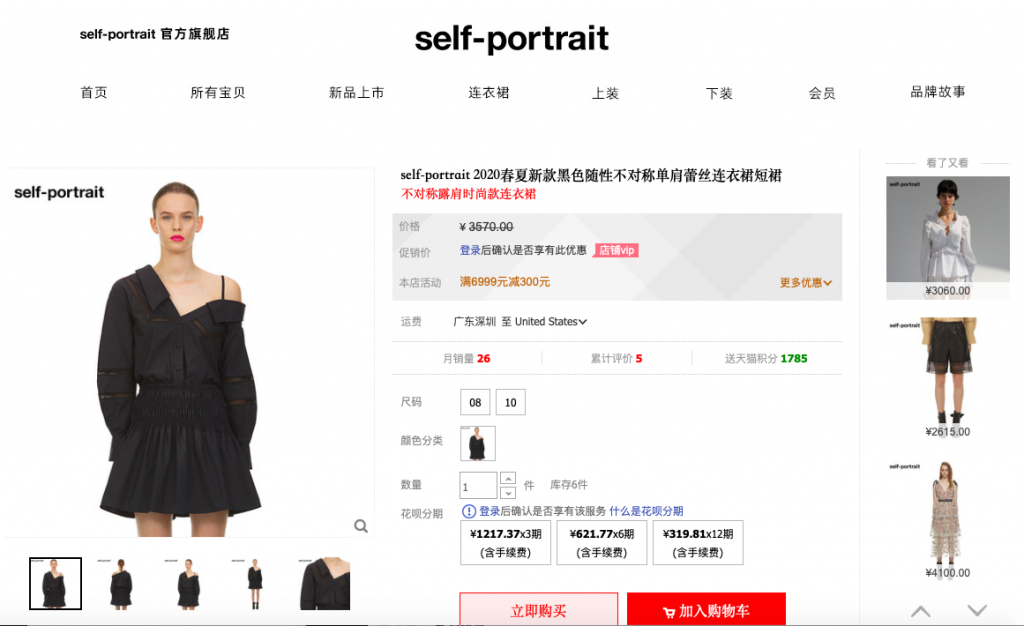

Self-Portrait, a contemporary British fashion house known for its signature laced dresses and floral prints, is taking a stride in mainland China since coupling up with Shenzhen-based partner Ellassay. Han Chong, the UK-based Malaysian founder and designer, said he was surprised to see the traffic from young Chinese consumers — mostly tourists and overseas students — in his London flagship store carrying over to Chinese social media. And he realized that it was “the right time to open stores and e-commerce in China,” he said.

This March, with the help of its local partner, the seven-year-old brand launched an official Tmall store and has two new store openings lined up in Beijing. With the official e-commerce presence and new offline locations in addition to concessions, sales from China is expected to account for around one third of total revenue in the next five years, Chong said.

Although Chong defines his brand as “accessible luxury”, and it has been widely recognized in the industry, for many Little Red Book users who post their Self-Portrait dresses, it’s still “niche”. Perhaps the word itself is a selling point.

Noticing the market potential, China’s e-commerce giants have been adding niche brands onto their digital shelves. “Chinese consumers are always looking for great new brands to add to their collections,” a spokesperson from Tmall said, adding that the platform is working with Net-A-Porter, where many Chinese consumers first saw these niche brands, to bring them to the local market.

David vs. Goliath#

New York-based handbag brand Apede Mod saw a huge spike in the brand’s mentions on Chinese social media last year, as it launched new items during fashion weeks. But quite unexpectedly, the social volume carried through the COVID-19 lockdown and brought an exponential growth to the online orders, which resulted in a bittersweet situation for co-founder Claudia Lin. “I’d get hundreds of emails asking when we would restock,” Lin said. “Because we’re restricted in production capacity, consumers might have to wait as long as three to four months, which leaves space for counterfeits. This is definitely something we are working on.”

Balancing the demand and supply is an issue for many niche brands, like Apede Mod and Yuzefi, which first became viral because of key opinion leaders (KOLs) or key opinion consumers (KOCs) on social media. While the brands embraced the free marketing, it also means that they don’t know how much product to prepare for. Naza Youzefi expressed the same challenge, saying that while the demand, driven by KOLs without the brand’s involvement was welcomed because it saved their marketing and public relations dollars, she found it hard to keep the products in stock.

Compared with these niche brands’ organic growth, accessible luxury realized that they need to try harder by spending more marketing dollars on new celebrity endorsements and holiday campaigns to win a young audience. In recent years, many of these brands have turned to China’s “fresh meat” idols for assistance. After Coach appointed actor Xu Weizhou as its China ambassador in 2018, and Michael Kors handpicked actor Wu Lei last July, Furla announced 22-year-old actor Neo Hou’s mainland China ambassadorship in May.

“Furla is taking positive actions to attract Chinese young consumers,” Furla's CEO Alberto Camerlengo said. As the Italian brand relaunched its iconic Metropolis collection this May, it also used the new Chinese Valentine’s Day, May 20, as an opportunity to introduce the new "sweet" ambassador, and “to expand the social influence during Chinese young generation,” Camerlengo noted.

Established brands can easily win on marketing, as they largely don’t care about spending on an idol. But outside of marketing, niche brands still have a long way to catch up with them in terms of the market size in China, which reached nearly 80 billion in 2018, according to a recent Boston Consulting Group and Tencent report. At over five million dollars annual revenue worldwide, Yuzefi’s last publicly reported sales is a fraction of those of accessible luxury brands.

It may look like a David vs. Goliath battle, but do niche brands want to fight the good fight? Niche brands seem to think they are targeting different audiences than accessible luxury brands. “China is so big, you always have your own audience and then your customer, nowadays, everybody is buying different things,” said Chong, Self-Portrait’s founder.

Market watchers think that the bigger threat for accessible luxury comes from within. “I don't think brands like Coach or Michael Kors lose sleep over new entrances of brands generating five million in sales,” Rambourg, the HSBC researcher said. “I think they do lose sleep in terms of how we are going to reopen and how are we going to be successful and grow when more than half of our profits are likely coming from outlets.”

Although niche brands may not be seen as the competitors of the same weight class yet, there is a thing or two that accessible luxury brands could learn from them. For one thing, none of the founder-designers Jing Daily talked to worry about competition. As the global pandemic forces change in the market, the ones who pick the winner will be the consumers. Apede Mod’s co-founder Lin sums it up best: “Ultimately, what makes consumers tick is whether something is worth the money and its design.”