Even though the ongoing Covid-19 crisis has temporarily put a hold on the business of luxury in the Greater China region, executives from various Western luxury brands have expressed positive sentiment and strong confidence in restoring growth momentum in the near future. As the outbreak reaches a global tipping point, rebuilding connections with consumers shouldn’t be a question of when, but how.

The global communication consultancy group, Ruder Finn, together with the market research group, CGS (Consumer Search Group), published their latest China Luxury Forecast 2020 report on the luxury market for this year, giving a much-needed overview to those who are ready to carry on their China strategy with a long-term view.

The annual report was conducted with 2,100 respondents; the split between mainland and Hong Kong shoppers is about seven to three, with an average household income of $192,898 (1,358,040 RMB) in mainland China and $127,996 (997,360 HKD) in Hong Kong. The report was conducted in December 2019, which was before the outbreak of the Covid-19 crisis, so brands should keep in mind the changes brought forth by the global pandemic.

Given this, the report answered some other key questions, such as: Where should brands focus more to offset their cost? How has Hong Kong consumers’ confidence been impacted so far? And what are the subtle differences between Hong Kong and mainland China shoppers?

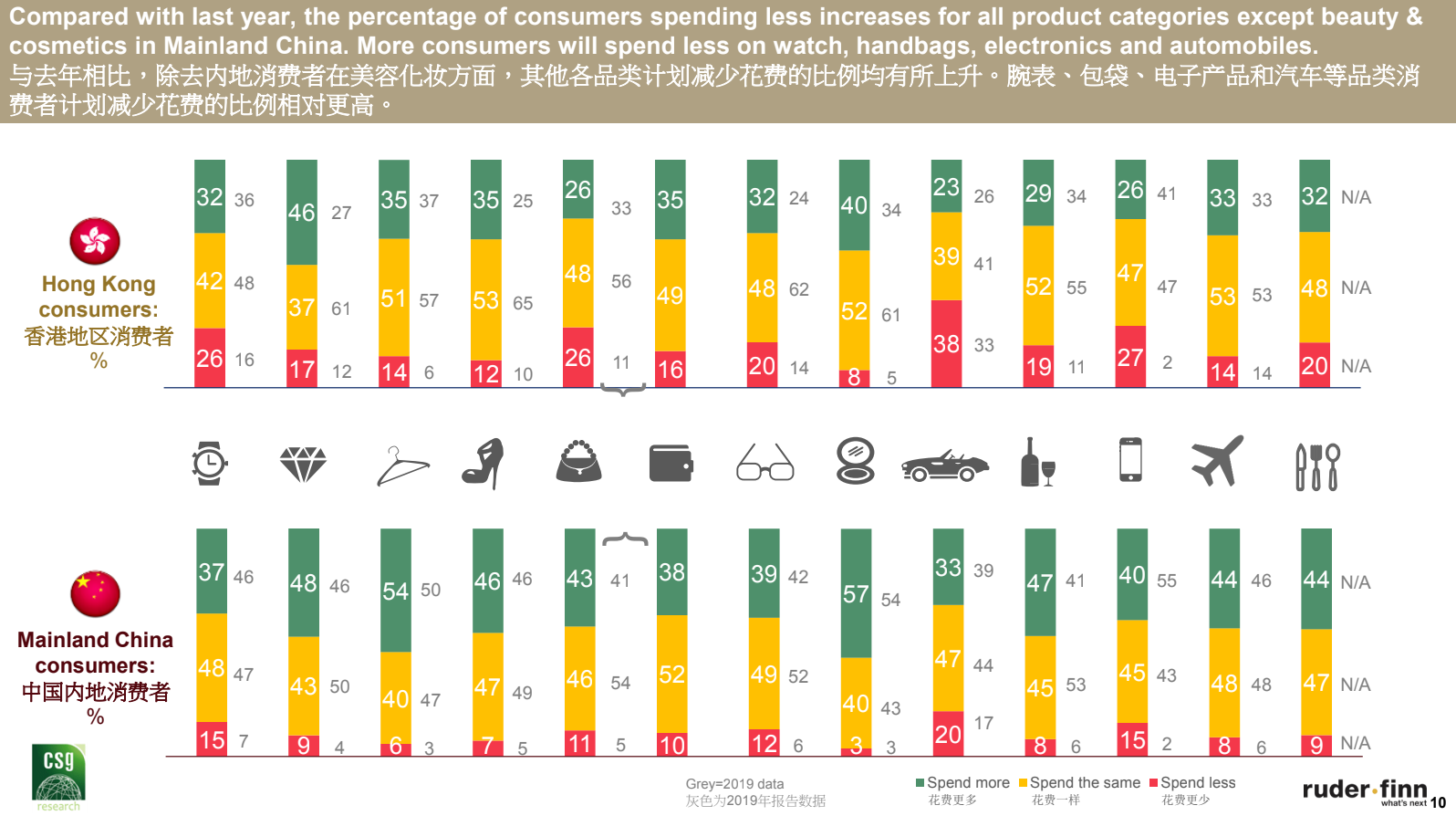

The most alarming finding, however, was that in the next 12 months, spending desirability is likely to be damped. “This is the first time in the past decade that we witness Chinese respondents’ confidence weakens,” said Gao Ming, the Senior Vice President and Managing Director of Luxury Practice Greater China at Ruder Finn Group, on the online press conference held on February 25 in Shanghai.

It’s a reasonable finding. Against the backdrop of China’s economic slowdown, ongoing trade war, and regional challenges, the appetite for luxury items among consumers in both Hong Kong and China has turned less optimistic. And again, this predication was before the Covid-19 crisis.

However, a separate survey (with smaller sample size) sent during the crisis indicated a silver lining: the impact of the virus will be much less on the mainlander than Hong Kong shoppers. Moreover, their consumption confidence didn’t differ much from the original report taking before the virus — 42 percent said they didn’t think the virus would influence their luxury consumption.

Where should brands focus next to offset their loss?#

To combat depressed spending sentiment, brands should focus on spending power in the 3rd tier and lower cities, which showed the highest spending over the past year. And that KOLs and celebrities still hold much influence on this demographic’s shopping decisions. Plus, brands should also continue to focus on Gen-Z (between the age of 21 and 25), who generally purchased their first luxury item no later than when they were 20 years old.

For the first time since the launch of the report in 2009, “improving the quality of life” ranked No.1 for mainland shoppers when it comes to reasons for purchasing a luxury item, demonstrating consumers’ increasing sophisticated altitude toward luxury, from flaunting wealth to achieving more discreet goals.

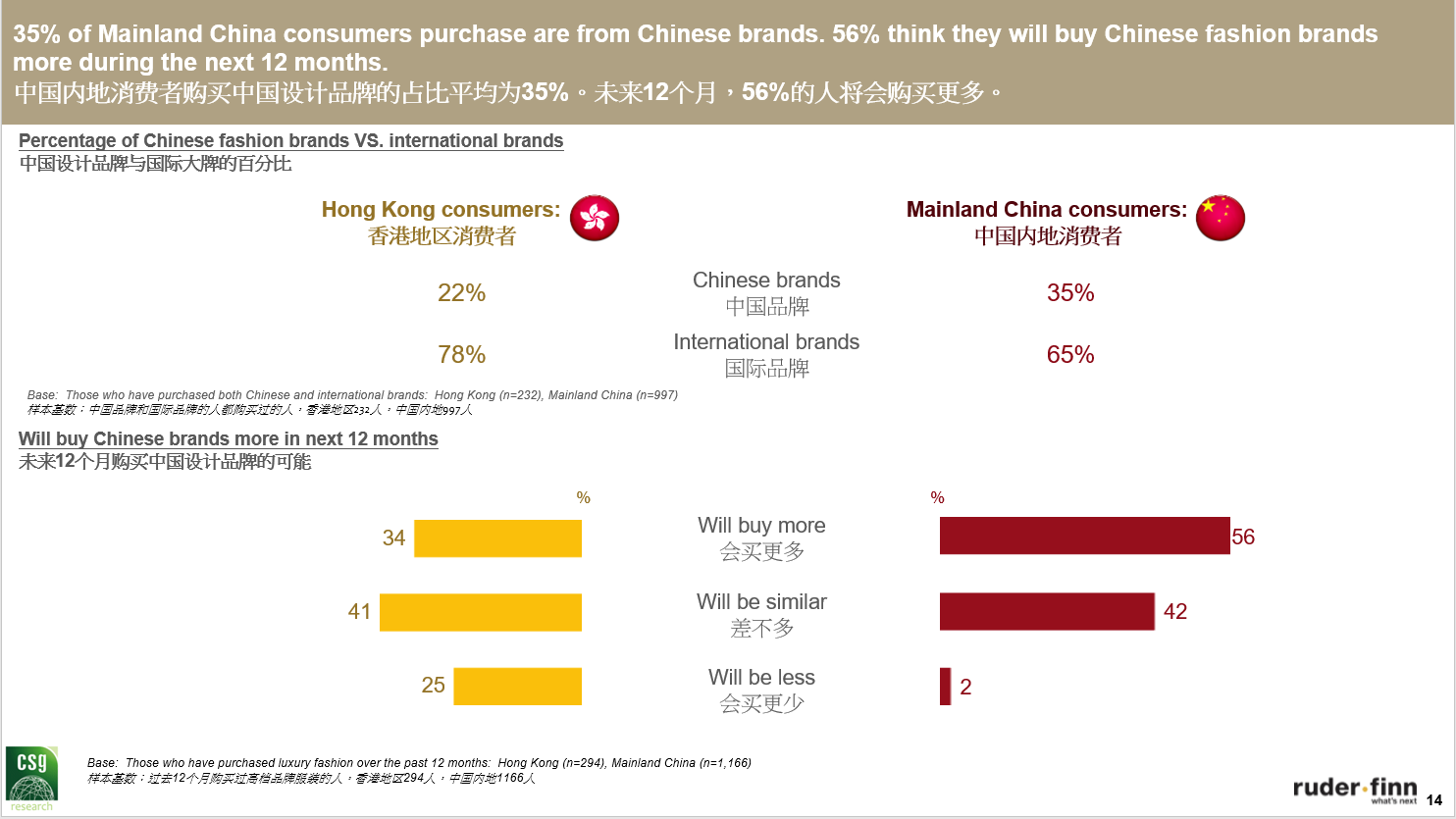

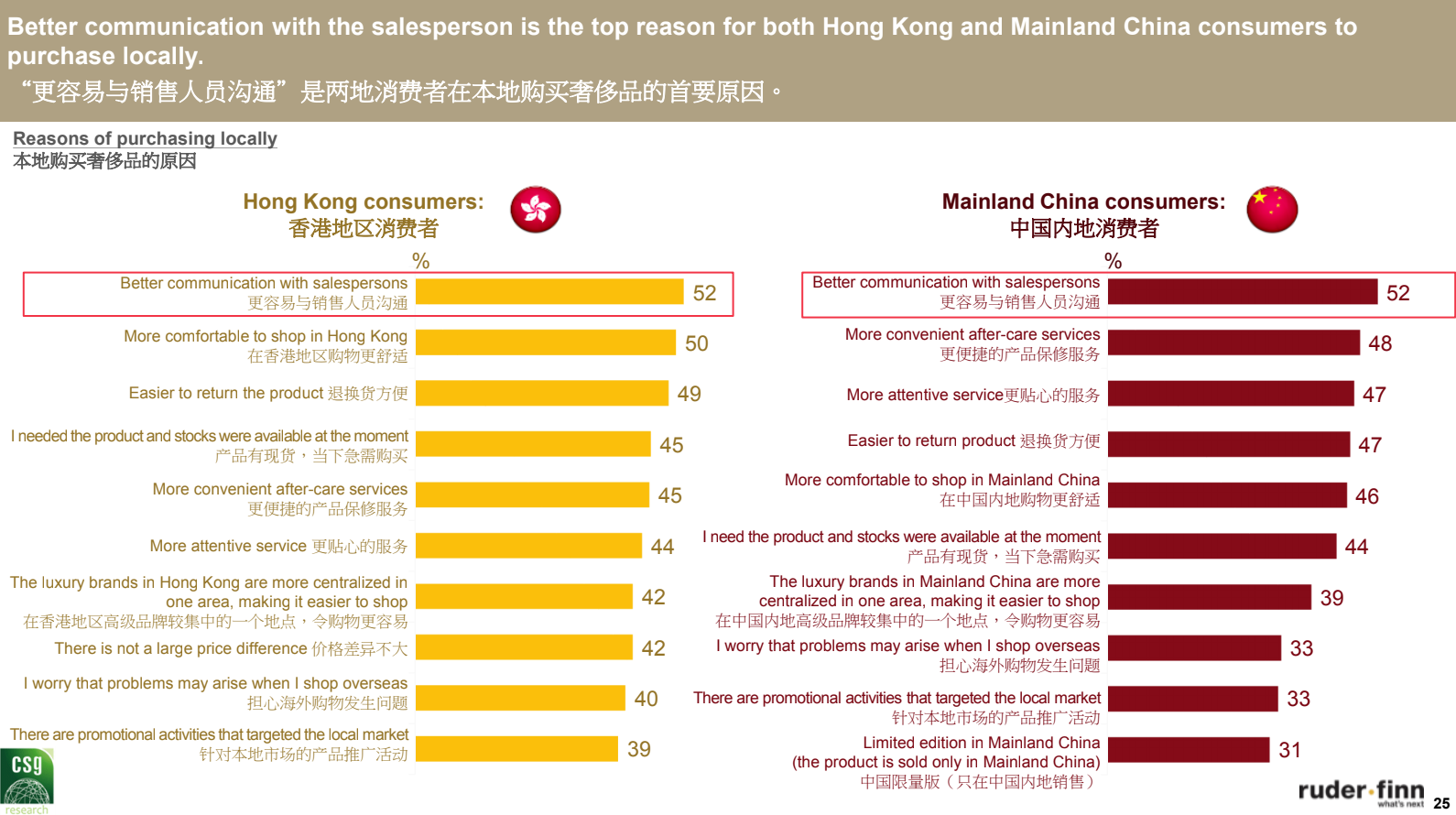

Not surprisingly, for mainlanders, Japan wins over Hong Kong as a preferred travel destination. And shopping domestically has become an irreversible trend, with 64 percent of mainland respondents purchasing luxury goods locally during the past 12 months. “Looking ahead, new opportunities for boosting local consumption are expected to emerge in terms of offering products tailored to Chinese culture and aesthetics, as well as more customized member services,” said Simon Tye, Executive Director of CSG Hong Kong.

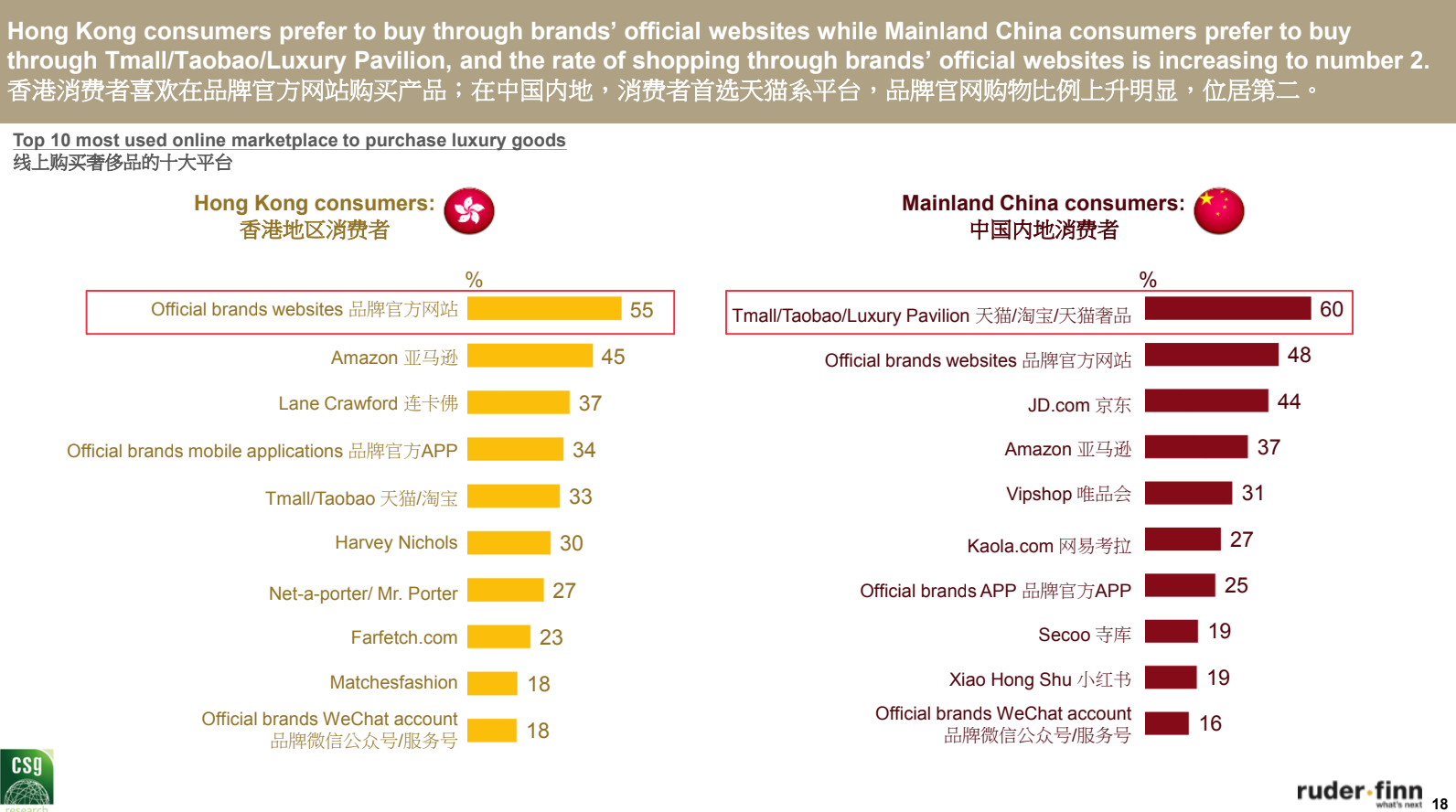

Going forward, digital efforts will only become more important, especially given that the Covid-19 crisis has already forced many brands to go omnichannel. Additionally, the report breaks down respondents’ online and offline behavior by region. Compare to Hong Kong respondents, mainlanders are more comfortable with purchasing online, especially on e-commerce platforms held by Alibaba, namely Tmall and Taobao, given the exhaustive content on there, while both increasingly choose to place online orders via brand’s official website due to trust issues.

All in all, brands should continue to find new points of growth, even though the overall consumer spending sentiment is not strong, but growth momentum will continue in 2020, especially in the mainland.

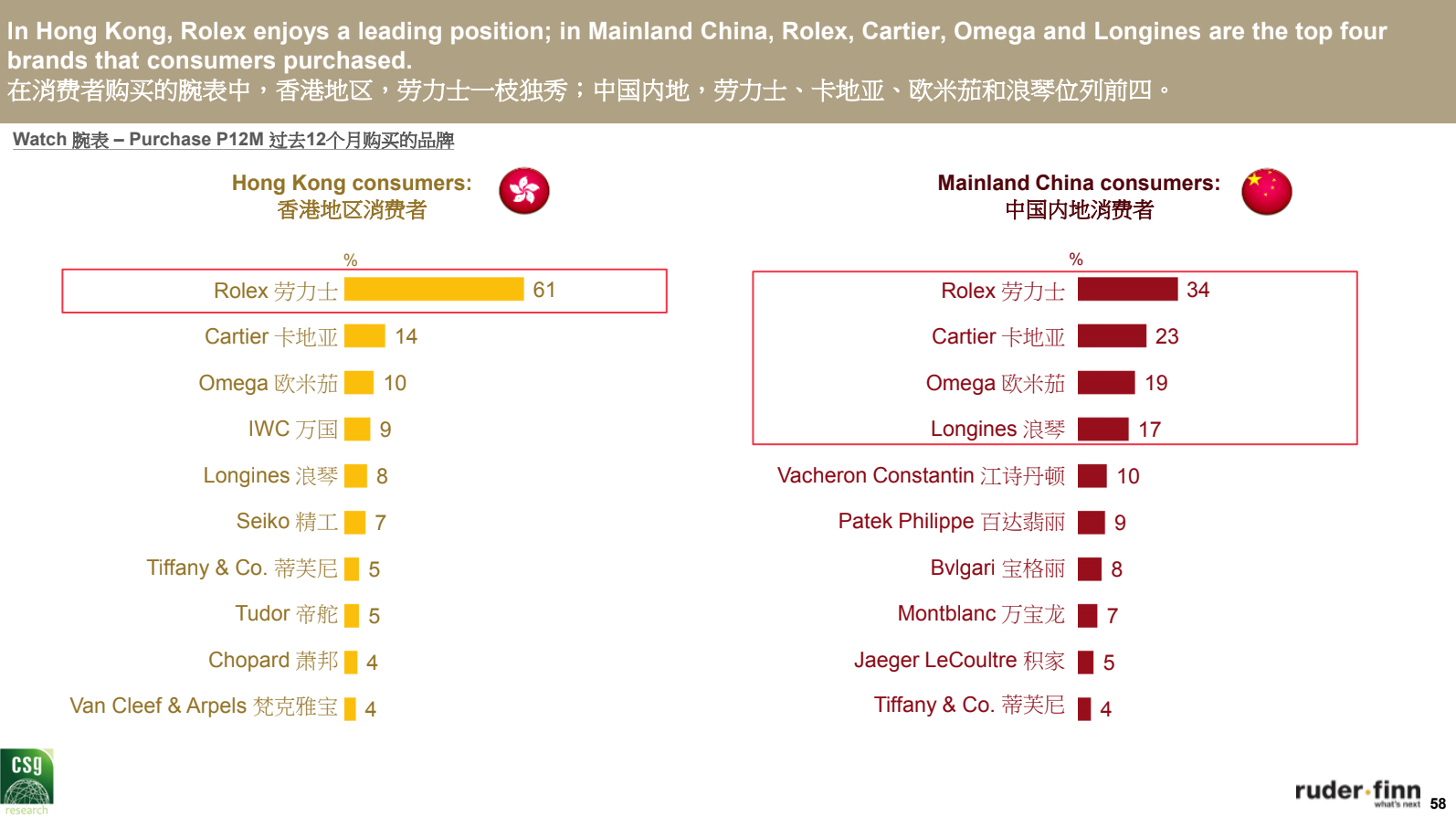

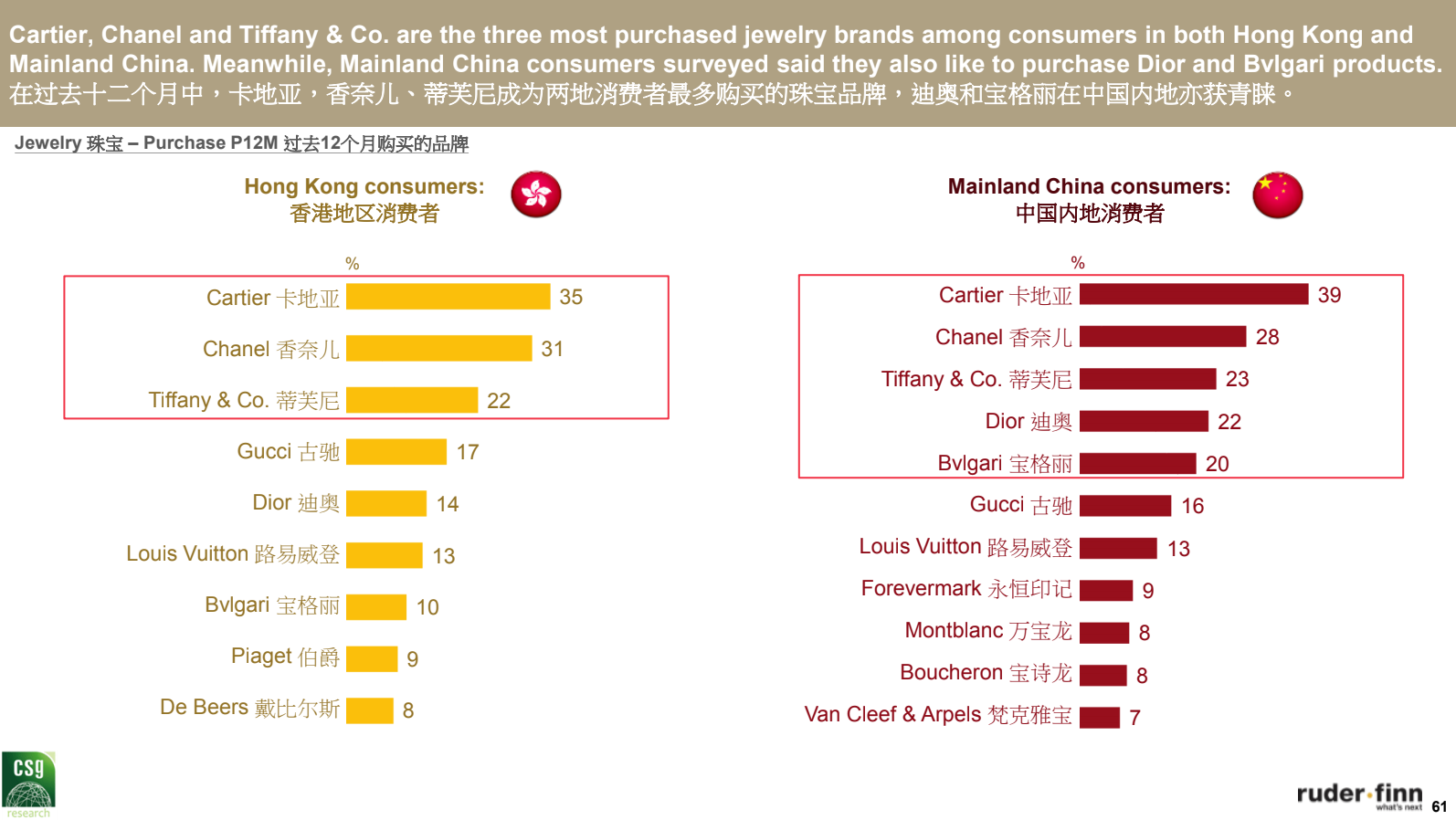

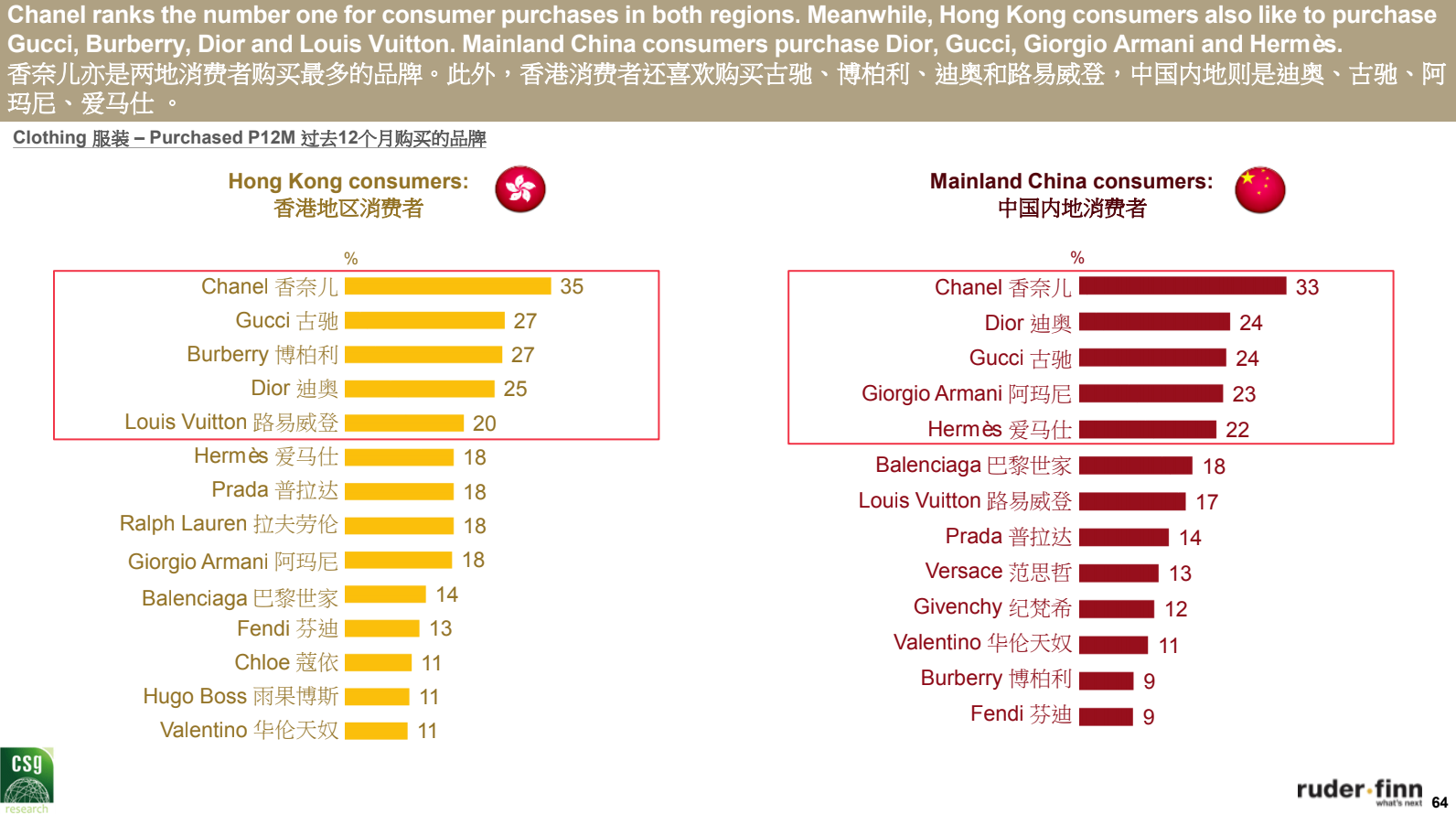

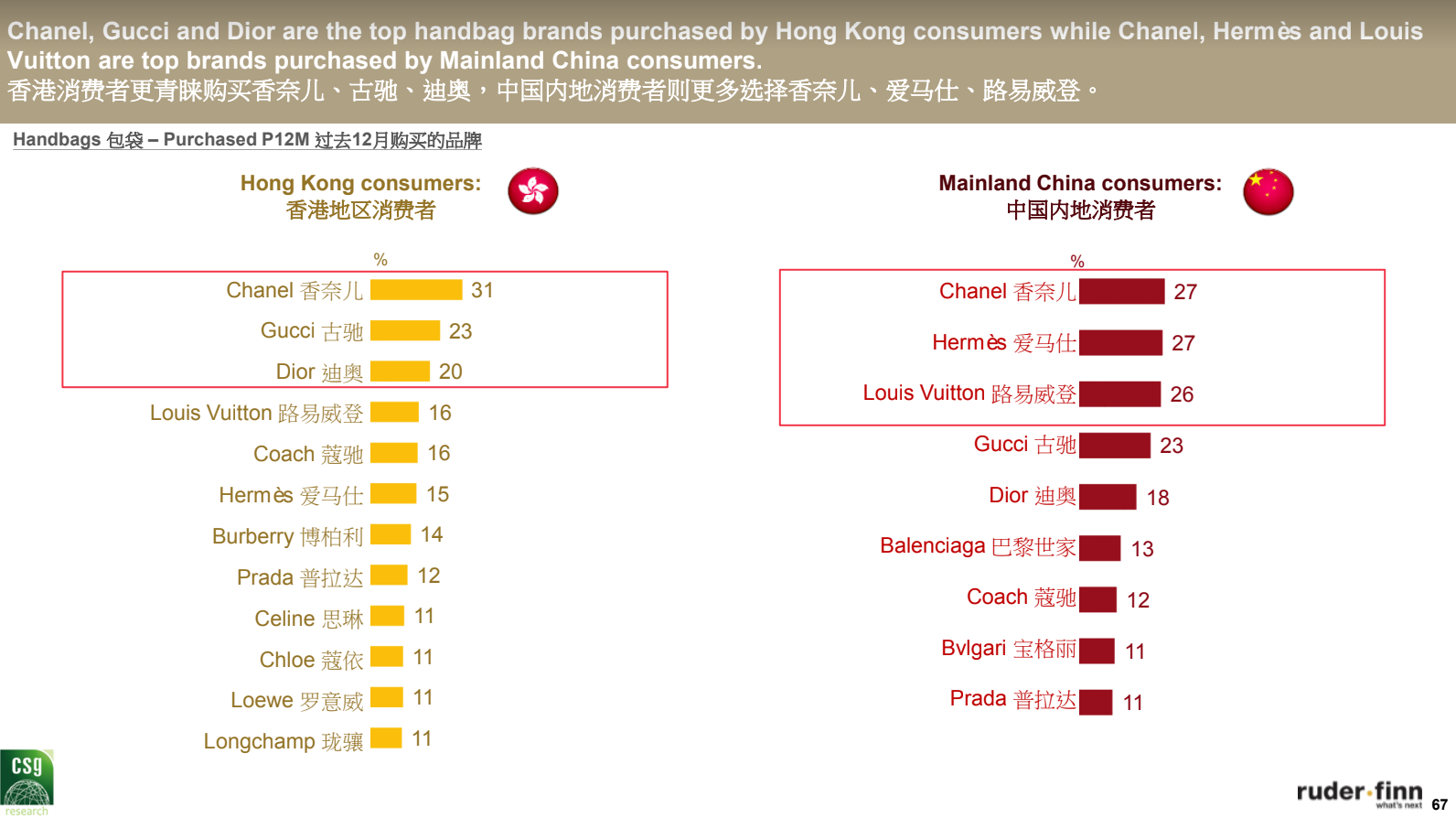

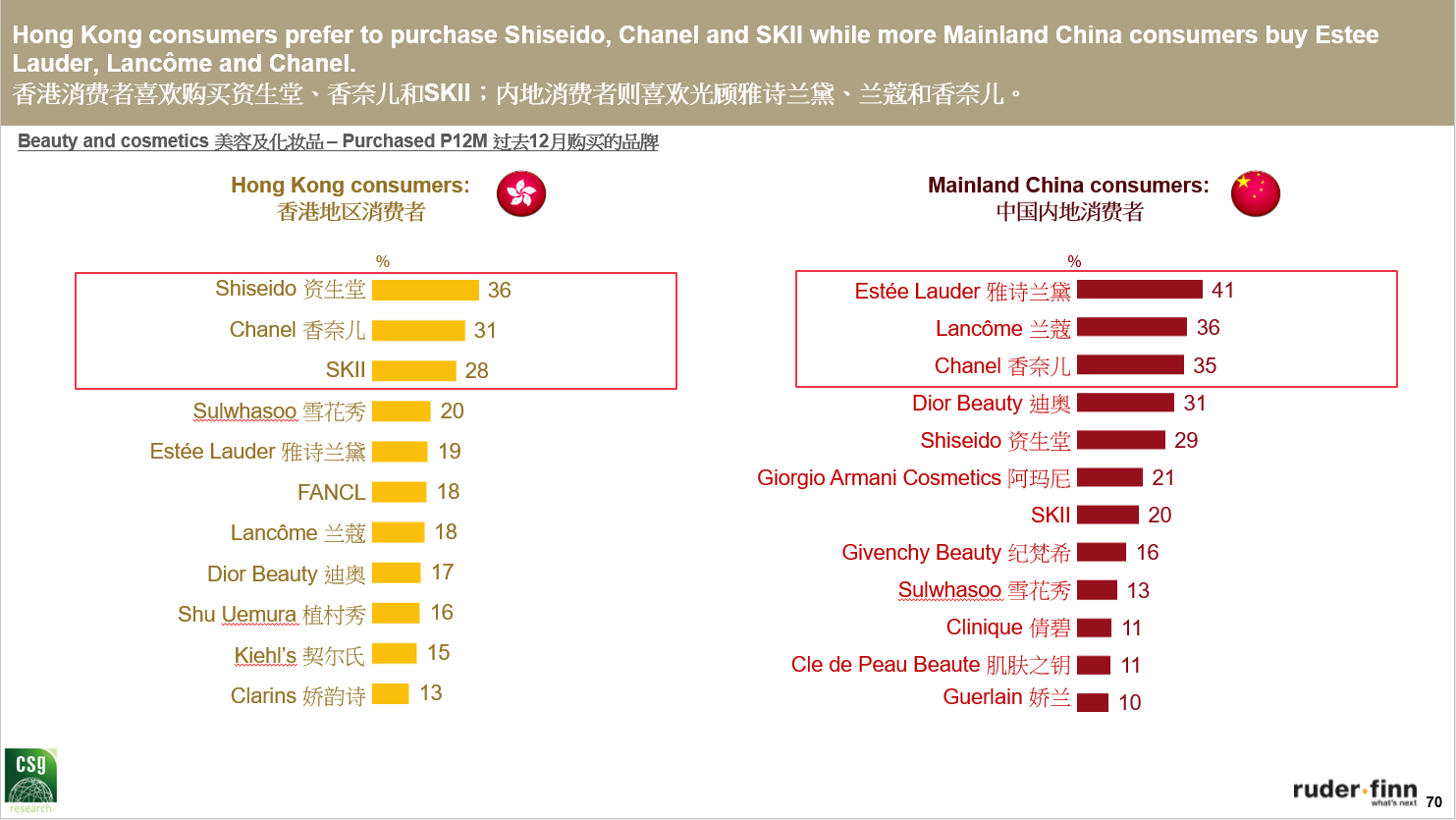

Below are lists of top brands purchased by respondents in the past twelve months in 2019 by category.

Watch#

Jewelry#

Clothing#

Handbags#

Beauty and Cosmetics#

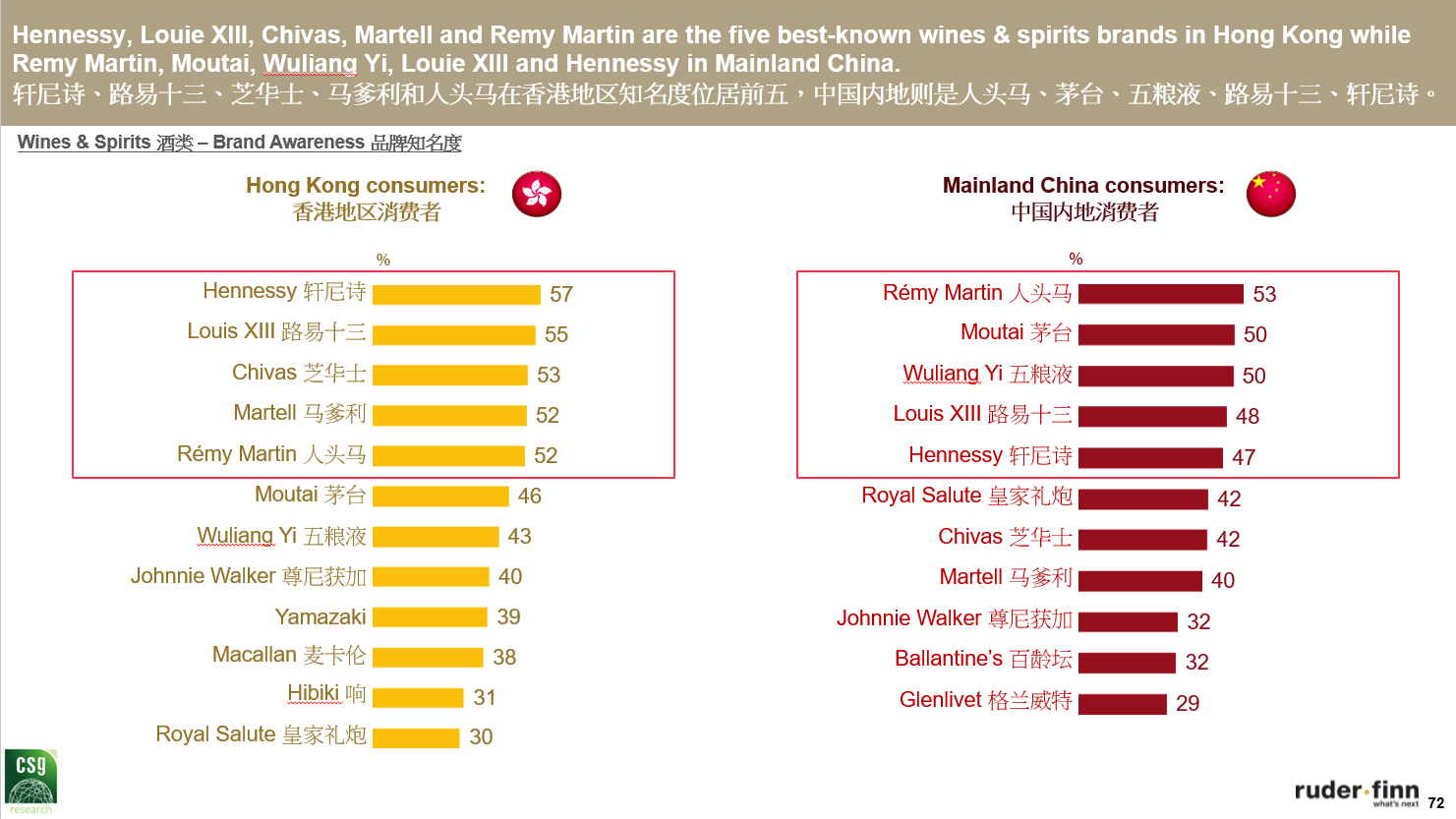

Wines & Spirits (by brand awareness)#