When Cassandra Huang married Paul Chen in Suzhou at a chic Western-style outdoor wedding in August last year, whisky was the drink of choice. The pair, both in their late 20s, asked wedding guests to bring foreign alcoholic drinks. Most of them showed up with a bottle of whisky, like Tomintoul, Aultmore, Tomatin and Talisker.

“That whisky was the main drink was fantastic for us because it added to our wedding's joyful mood; people sipped it over conversations. Plus, whisky glasses filled with ice are ideal for posing for pictures, especially on a hot summer's day,” says Huang.

Despite only making up about 1 percent of China’s spirits market, whisky’s popularity in China is booming. China imported 460 million worth of the spirit in 2021, an annual increase of 91.7 percent, reports Chinese economic news media Yicai. And Euromonitor projects that whisky market revenue in China will surpass 2.25 billion in 2025, up from 635 million in 2019.

Jing Daily examines why young Chinese consumers are turning to whisky and how brands can overcome hurdles like the dominance of baijiu, a colorless Chinese liquor, to win market share.

Diversity of whisky#

About 47 percent of China’s whisky consumers are Gen Zers, 40 percent of whom are willing to spend upwards of 145 (1,000 RMB) on a bottle, according to a 2021 report from China’s Billion Bottle whisky information platform. China’s whisky drinkers also tend to be well-educated and reside in big cities: 69 percent of them have at least a bachelor’s degree and 54 percent live in first-tier and new first-tier cities.

Young Chinese consumers favor whisky because its diverse range of types and flavors and product origins fit with their pursuit of individuality. The drink also represents European culture and history, attracting the interest of cultural consumers who are keen to learn about a product’s cultural significance. Moreover, whisky is becoming a standard feature of big gatherings attended by the young.

During China’s COVID-19 lockdowns, millennials and Gen Z increased their spending on foreign spirits as part of consumption to self-please.

“Local consumers are more adventurous and willing to experiment with new products and brands,” says Atul Chhaparwal, Managing Director at Diageo Greater China, which purveys whisky brands such as Johnnie Walker, Talisker, and Mortlach in the country. “During the pandemic, we saw increased in-home consumption that led to growth in our e-commerce channels.”

Indeed, in the first half of 2022, Diageo reported 20 percent year-over-year whisky sales growth in the Asia Pacific market, including a 9 percent sales increase in the Greater China region.

“We are confident about double-digit accretive growth in China for our international spirits business, which is primarily made up of premium Scotch whisky,” he says.

A ‘baijiu’-saturated market#

Global whisky brands have recognized China’s market potential. For example, in December 2022, The Macallan opened its first duty-free boutique store in China at the Haikou International Duty Free Shopping Complex in Hainan. The store is The Macallan’s largest travel retail boutique in the world.

But these brands face a struggle scaling up their market share.

Whisky makes up a tiny fraction of China’s alcohol market. By contrast, baijiu accounted for 69.5 percent of the alcohol market in 2021, a study from market research firm Askci found.

Additionally, China’s whisky consumers are predominantly male — 88 percent of China’s Gen-Z whisky consumers are men, the Billion Bottle report found.

Moreover, many Chinese consumers lack knowledge about the spirit, and would need to be educated on whisky for the drink to go mainstream.

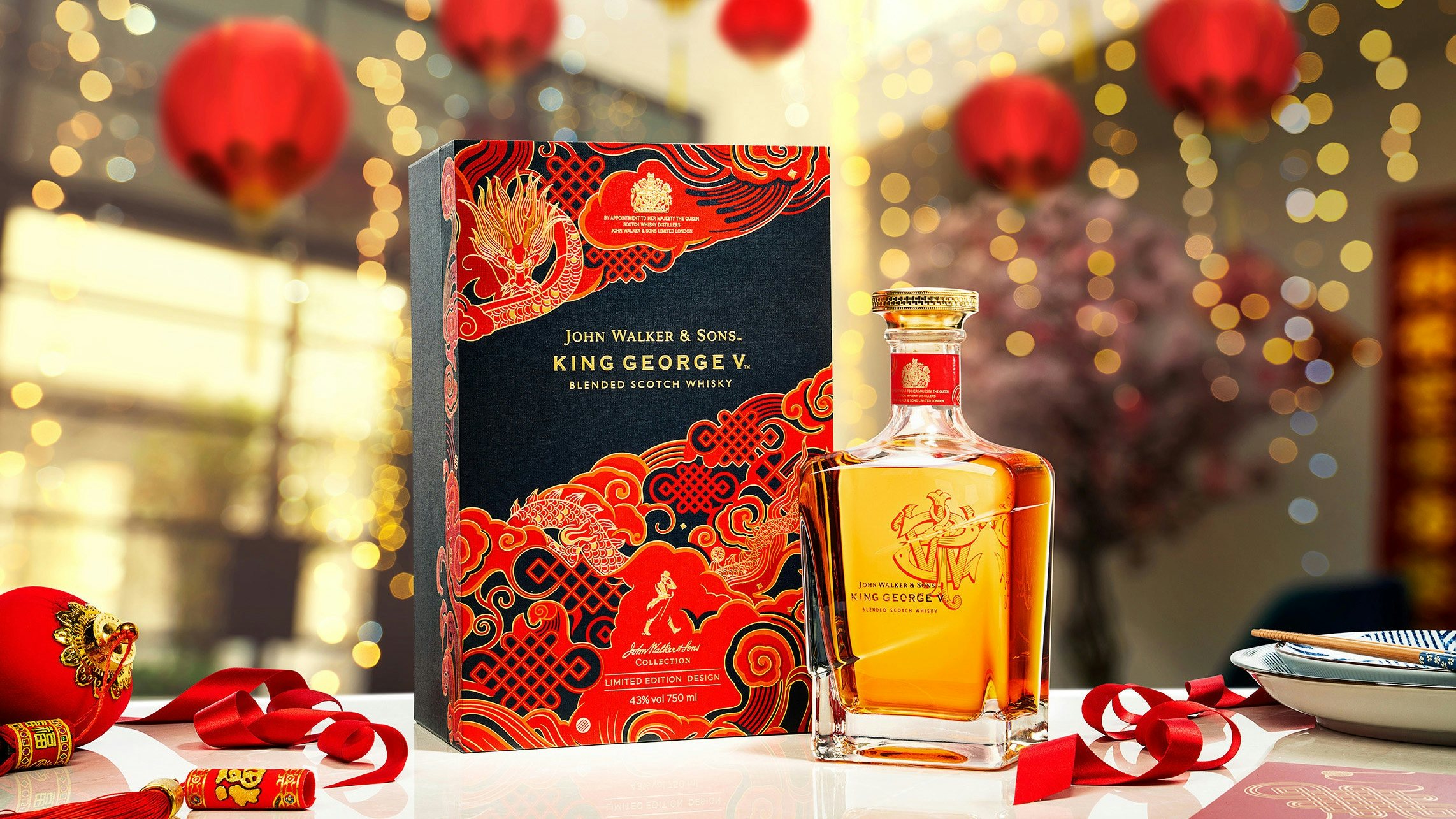

Recognizing these challenges, some whisky brands have sought to tie their products more closely to Chinese culture and attract more female consumers. A case in point is Bowmore, which has every year since 2019 launched a limited edition bottle exclusively in China featuring beasts from Chinese mythology, such as the phoenix and white tiger.

For 2023’s Lunar New Year, Johnnie Walker Blue Label cooperated with Chinese Gen Z favorite, female fashion designer Angel Chen to release a limited-edition bottle design that commemorated the Year of the Rabbit while echoing the brand’s motto, “Keep Walking.” And in 2022, Scotch whisky brand Loch Lomond partnered with Shen Hongfei, the chief consultant for China’s renowned culinary documentary series A Bite of China, to design banquets paired with whiskies.

More localization#

Taking localization further, one strategy is to set up whisky distilleries in China.

Although Chinese consumers are attracted by whisky’s European heritage, an “in China for China” approach would go a long way toward making the spirit a mainstream option in the world’s largest and fastest growing alcohol market.

In August 2021, Pernod Ricard’s whisky distillery in Emeishan, Sichuan Province, the first whisky distillery in China to be owned by an international group, went into production.

Meanwhile, in November 2021, Diageo announced plans for a 75 million whisky distillery in Eryuan, Yunnan Province. “The distillery will allow Diageo to further leverage the market’s rising interest in premium whisky and to bring China into the center of the global whisky conversation,” says Chhaparwal.

Notably, Chinese alcohol brands are also joining the race. For example, renowned Chinese beer brand Tsingtao stated in early 2020 that it would include whisky in its operational portfolio. This should give international whisky brands all the more reason to tailor their products to Chinese consumers.

Other measures brands can deploy in China include launching brand membership schemes that offer loyal customers exclusive experiences, such as tours of whisky distilleries.

Modern lifestyles#

Premium whisky brands have plenty of reasons to be confident of their future prospects in the Chinese market.

Although baijiu will remain the dominant spirit, it faces enormous challenges connecting with China’s young consumers. In 2021, the average age of baijiu drinkers was 45, and millennials only accounted for 20 percent of baijiu consumers, data from Tencent Marketing Insight found.

Not only is baijiu often stronger than whisky, it’s also commonly associated with formal banquets attended by middle-aged men.

This was one reason why Huang and Chen asked their guests to bring foreign drinks. In contrast to traditional Chinese weddings, which are usually large affairs, Huang and Chen’s intimate nuptials were attended by the couple’s friends and schoolmates from when they studied together at Tufts University in Boston.

“We wanted the occasion to be modern, and lighthearted, so we didn’t suggest baijiu because it’s more suitable for cumbersome, traditional ceremonies,” says Huang. That’s a lesson for brands.

Whisky brands in China should prioritize establishing tighter connections with their younger consumers in order to challenge baijiu’s dominant market share in China’s spirit market in the long term. Also, raising Chinese consumers’ awareness of whisky and its culture is vital as it would enable them to distinguish premium products.

Regardless of which steps whisky brands take, constant innovation and being able to combine European traditions with Chinese culture will be key to their future success in China.