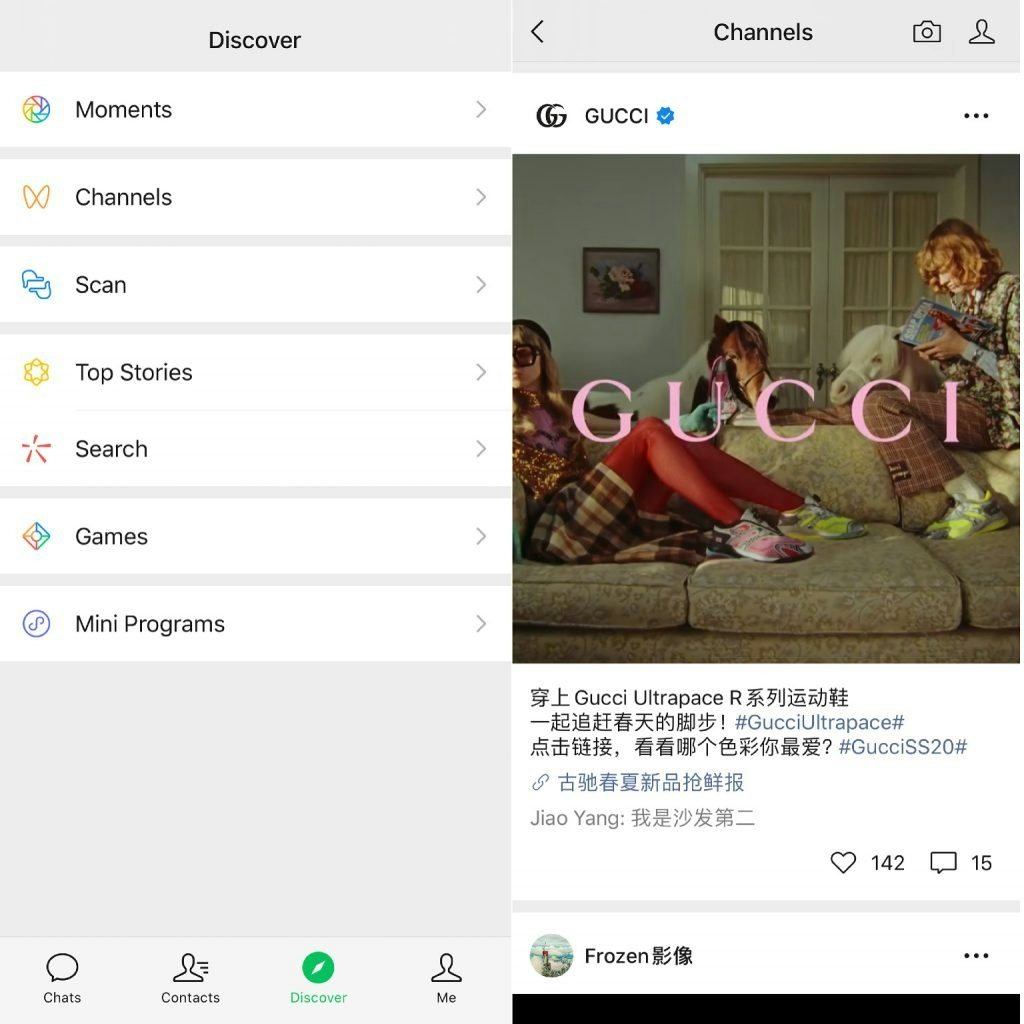

Chinese netizens may have noticed a new feature in their WeChat “Discover” tab called “Channels.” With WeChat Channels, users can explore media accounts, videos from celebrities and bloggers, and all from users that are not in their contacts.

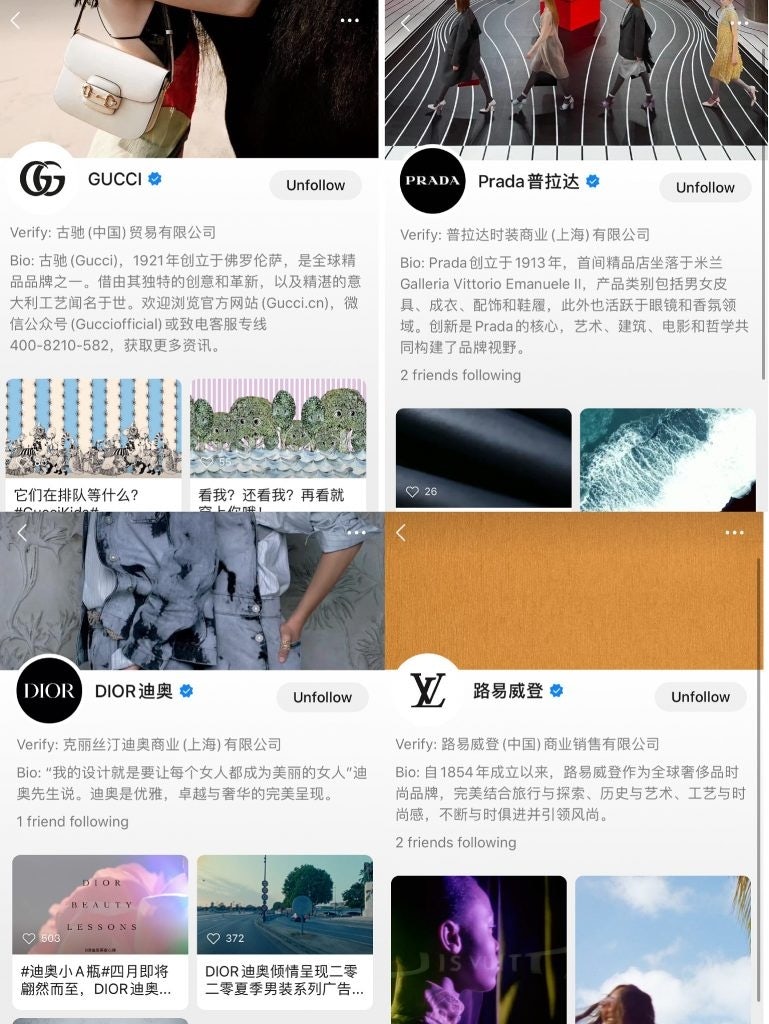

According to Tencent, the news-feed-like feature is still in beta testing, meaning it’s only open to users in certain Chinese cities who can prove to be influential and creative, such as KOLs, celebrities, and brands. Multiple brands under LVMH have launched onto WeChat's short-video feature, including LV, Dior, and Gucci. Prada also joined, and according to the Prada Group, Miu Miu's Channels launch will be happening in late April. Many KOLs, including Chinese lipstick king Li Jiaqi, also launched their own personal accounts.

This new feature is only the latest in WeChat's various experiments with short videos in recent years. For a digital platform like WeChat, the opportunity of the burgeoning short video market is too good to miss. According to Statista, the German online portal for statistics, the short video industry valuation was RMB 100.65 billion in 2019, with a growth rate of 744.7%. It is expected that the short video industry will increase to RMB 211 billion by 2021.

As more and more luxury brands look for new ways to reach consumers in China, what are the pros and cons of WeChat Channels for luxury marketing?

The Main Function — Share Instead of Create#

The short video space in China is currently dominated by the tech platforms Douyin and Kuaishou. The former managed to capture the hearts of people that live in first- and second-tier cities and later harvested audiences living mostly in suburban areas. Moreover, high-net-worth individuals (HNWIs) in China usually flock around big cities like Beijing and Shanghai and are frequent buyers of luxury products. For this reason, when it comes to luxury brands marketing platforms, Douyin attracted more attention from luxury brands than Kuaishou.

Aside from the lucrative Chinese HNWIs segment, females are also a main target for luxury brands, and Little Red Book has become the platform of choice to reach this group. According to the social media agency WalktheChat, Little Red Book is “the number 1 ranking cross-border e-commerce app in China.” Moreover, Little Red Book launched its livestreaming feature at the start of this year, with Louis Vuitton promoting the brand’s latest summer collection via a livestream.

Compared with Douyin and Little Red Book, WeChat Channels is not as multi-faceted with its video editing functions. Mainly, it has been used as an official platform for brands to release their official ads. For the current beta version of Channels, it only supports a few basic editing tools: adding stickers from WeChat collections, adding background music or captions, and trimming the videos. With Little Red Book, it provides a more user-friendly environment for video creation: users can add filters, stitch the footage together, and adjust the lighting and sound of the videos. With Douyin and Little Red Book, users can participate in the hit topic discussion by tagging the topic. They can also tag other users directly in the video, which is not currently available with Channels at this point.

What functions WeChat Channels lack, whether by design or not, appear to make this new feature more of a sharing platform than a space for original content creation and discussion. Interestingly enough, it was the opposite from how the founder of WeChat envisioned the feature. Earlier this year, WeChat founder Allen Zhang said his one big regret was how WeChat lacks a creative vehicle that everyone can participate in. However, it could still serve as a secondary market for precooked videos. After reviewing the videos posted by the first batch of users, usually established KOLs and celebrities, most have been transferred from other platforms.

The Main Selling Point — How it Marries with Other WeChat Functions#

WeChat is known for its digital marketing matrix powered by cutting edge technology. Including big data and artificial intelligence, these technologies help WeChat track down a marketer’s target audience and direct advertisements to specific groups. According to an official report released by WeChat, over 90% of luxury brands have established a WeChat Mini Program by the end of 2019. Given this, it’s become a platform for online selling, brand service, and VIP customer management. Luxury brands invested 80% more performance-based advertising on WeChat in 2019, with the target to increase the number of their followers and then redirect the online traffic to their official website or e-commerce platform.

Channels makes up for WeChat’s blind spot — being a text-based social media platform. However, along with WeChat Moments, each perform the same function of attracting users' attention. They then redirect the traffic to the brand’s Mini Program or Official Account, which has detailed product information. With online payment support from WeChat Pay, consumers can finish the transactions without exiting the application. That is the key selling point of Channels. It performed best with other affiliate features of WeChat. That is also what is going to differentiate the product from Douyin and Little Red Book, neither which has the equivalent technology support nor a massive user base like WeChat.

The Success of WeChat Channels Remains Unknown#

In December 2018, Time Capsule was launched by WeChat as the platform’s answer to Instagram “Stories,” which allowed users to post instant videos of 15 seconds or less on a user homepage for a 24-hour period. However, Chinese users never really adapted to this new feature like people in the West did with Instagram Stories. “It might be one of the worst features on the platform,” said Elijah Whaley, the Chief Marketing Officer of the influencer marketing agency, PARKLU.

In June 2019, WeChat and Weishi, a Chinese Vine-like app, launched the 30-second Moments function. In August, WeChat teamed up with Kuaishou to launch Kanyikan (“have a look”) feed, which was stocked with recommended content from each user’s contact list. However, many luxury brands didn’t see the value of it as a marketing tool for various reasons. This time, however, with WeChat Channels, feature brands are now given a chance to talk directly to the consumer.

Of course, it remains to be seen whether WeChat can successfully take on short video platforms such as Douyin and Kuaishou. As the first luxury brand to launch Channels account, Louis Vuitton told Jing Daily that they are still monitoring the benefits of this new feature. And other luxury brands are doing the same. Channels has already attracted a good deal of buzz and online discussions. The whole short-video industry is waiting to see how this new player is going to impact the industry?