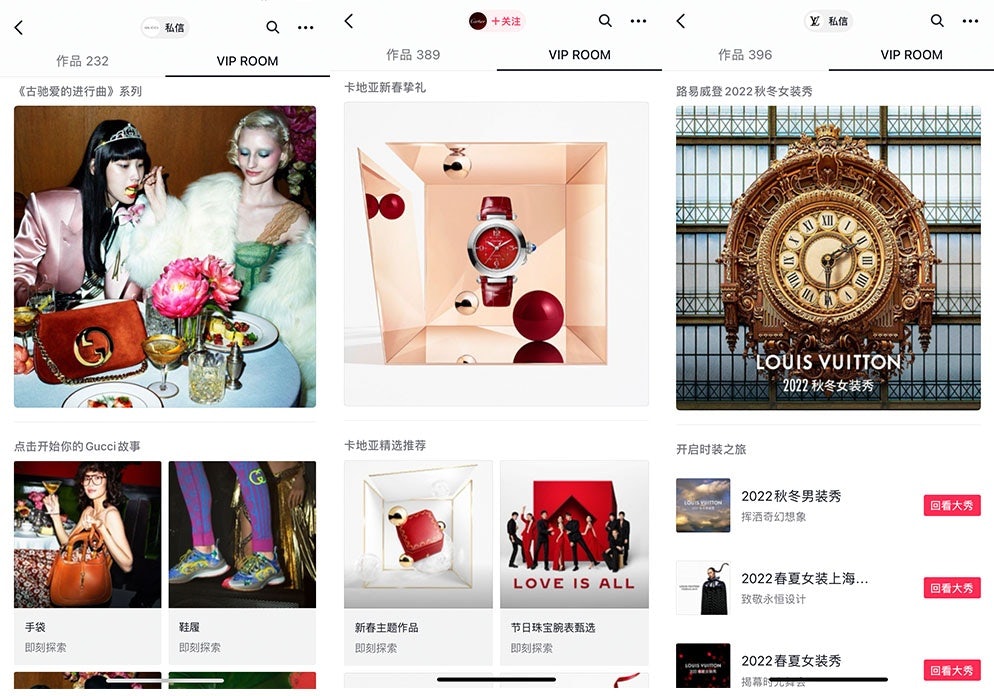

The entry of new players has reshuffled China’s competitive e-commerce landscape. Bytedance’s short-video platform Douyin, which boasts 600 million daily active users, is one of these rising stars. Despite launching its e-marketplace as recently as June 2020, the mainland’s TikTok has already consolidated its position in the industry: it now ranks among the top five e-commerce apps with the largest market shares.

But the short-video platform is relatively small in terms of reputation compared to the two top players, Alibaba’s Taobao and JD.com, which account for 70 percent of the total online transactions. What’s so exciting about Douyin is how it offers a new consumer journey that is transforming the e-tail game altogether.

“The social commerce app drives sales through an ‘interest e-commerce' model, where users are attracted by the content and product seeding created by the KOLs of the platform, and then they make the purchase there,” said Franklin Chu, US Managing Director of Azoya. As such, the app closes the loop from interest to final transactions. With traditional online marketplaces, shoppers only search for the products they would like to buy; the interest is generated elsewhere (perhaps on Douyin).

Bytedance is now showing greater ambition in the e-commerce space. In March, Douyin announced the launch of Douyin Global Choice, a cross-border e-marketplace, posing a direct threat to Alibaba’s Tmall Global. More recently, the short-video app began testing a new homepage layout, which replaced the former “Friends'' button in the navigation bar with the “Mall” function. Such a move signals the direction of travel: towards a greater emphasis on the marketplace.

Luxury names such as Louis Vuitton, Gucci, and Dior are all on Douyin, and it has the potential to gain many more. Given China’s ongoing lockdown, it could well be the right time for maisons to leverage the app’s e-commerce features to reach consumers kept at home.

Below, Jing Daily presents an analysis of exactly what Douyin offers to help luxury brands decide what is right for them.

Douyin Livestream#

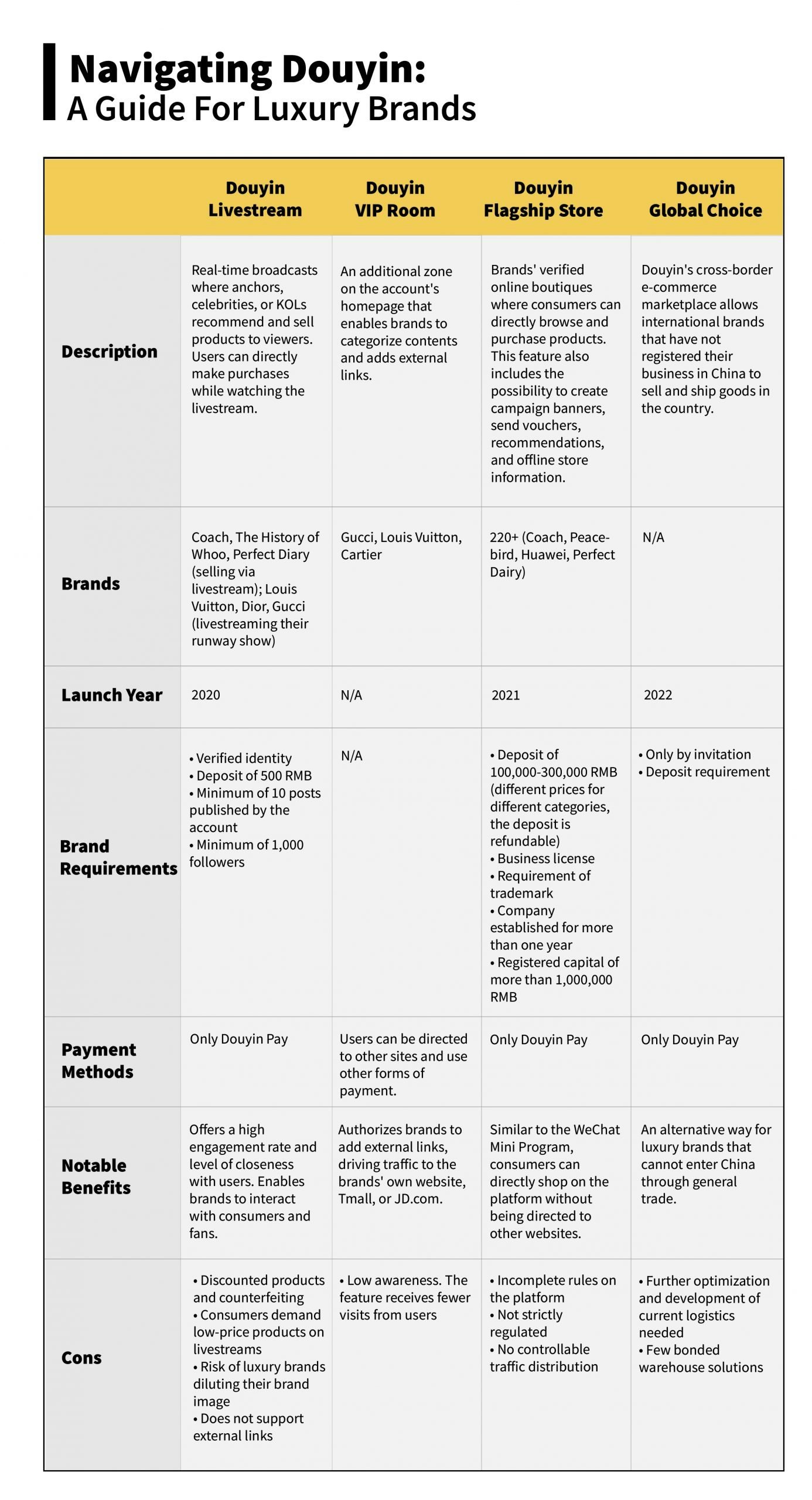

Launched in December 2017, Douyin Livestream is one of the platform’s most popular features. Widely enjoyed by young consumers, the app’s live broadcast has a low entry barrier: users with a verified identity, over 1,000 followers, and who have published at least 10 posts are able to sell products through livestreaming by paying a $75 (500 RMB) deposit fee.

However, since October 2020 the service no longer supports external product links (such as Taobao or JD.com) which were once facilitated on the platform. As Douyin seeks to affirm its own marketplace, the move means brands have to make items available on the app itself.

Although only a few luxury maisons have leveraged the tool, those bold enough to do so have achieved remarkable success. Take Coach, for example, which hosts many livestream events each month. In one of these, featuring actress Qi Wei, it only took six hours for its collaboration capsule with streetwear label BAPE to sell out. Similarly, Korean premium skincare company The History of Whoo reached $45.5 million (300 million RMB) in 10 hours thanks to a promotion from a top KOL.

Live broadcasts are a great opportunity to reach and entertain locked-down consumers. Jack Porteous, client services director at the cross-border e-commerce group Samarkand Global, explained: “A livestream can be an incredibly personal as well as a commercial forum. A creator has an audience wanting to understand why this brand and this product will enhance their life.” In this way, it offers firms the chance to develop close, lasting relationships with shoppers. Yet, as with all livestreaming in China, Porteous warns of the challenge of picking the right collaborators and “not compromising” on pricing or values for a quick sale.

Douyin VIP Room#

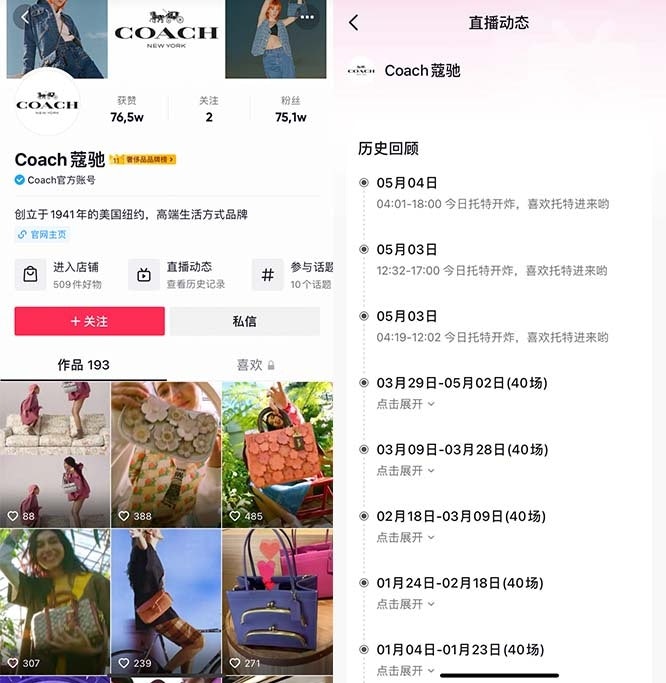

The Douyin VIP Room is an additional zone on the accounts’ homepage, where brands can categorize their content and include external links. In this area, luxury labels are authorized to direct their short-video traffic elsewhere — to their official website or Tmall flagship store — so consumers can make purchases via familiar methods.

With many high-end brands still reluctant to join Douyin’s sales channels, Chu, the US managing director at Azoya, believes that this function can help.“Douyin VIP Room provides a great gateway for heritage houses to convert traffic generated on the platform to sales, driving them to their own flagship store,” Chu commented.

Louis Vuitton has realized this. It leveraged the Douyin VIP Room to create an archive for its runway livestreams. Gucci and Cartier, meanwhile, have taken a step further: the former embedded its official mainland website links in the VIP Room, enabling customers to browse its products; the latter uses the space to direct traffic to its Tmall flagship store.

Chu advises businesses to develop their VIP Room section by making it specific to their purpose. “It’s an extra feature for luxury houses to flexibly engage customers, including runway shows, links to flagship stores, official websites, new collections, limited-edition items, etc.” That said, the space doesn’t have great visibility. To fully take advantage of it, brands need to actively drive virtual footfall: for instance, by announcing exclusive news and capsule releases.

Douyin Flagship Store#

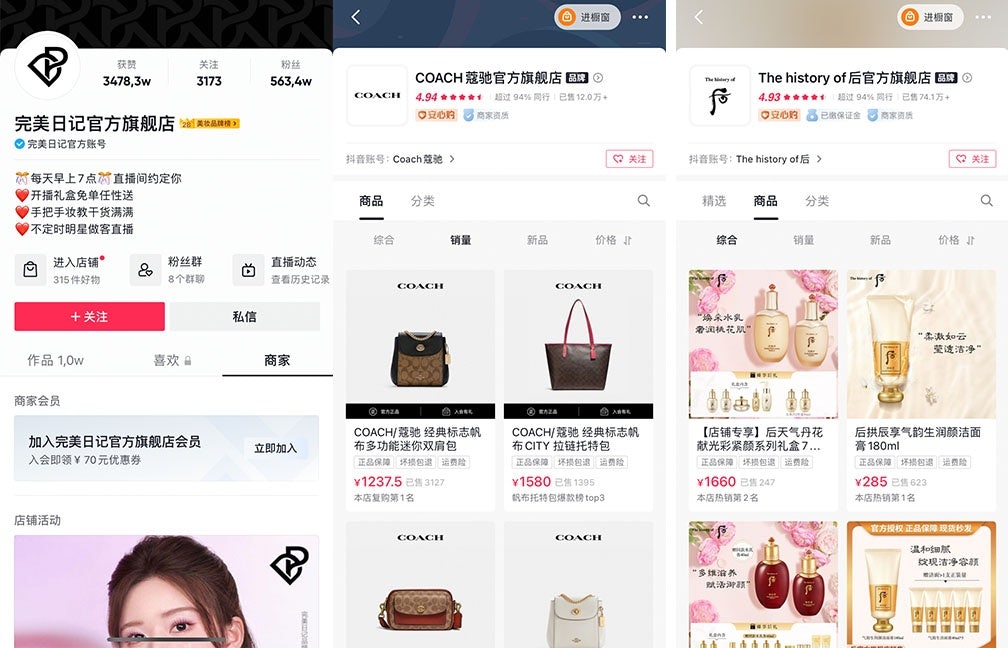

Douyin Flagship Store represents another attempt to close the loop of social commerce. Introduced in March 2021, the feature includes campaign banners, brand recommendations, vouchers, product recommendations, and offline information. Consumers can make purchases directly on the platform through the verified retailer without leaving the site. At least 220 labels have joined the Douyin Flagship Store since its launch: Coach, Huawei, and Perfect Diary, to name but a few.

Strict requirements guarantee the authenticity of products and flagship stores. Only companies established for more than one year, and with registered capital of more than $152,000 (1,000,000 RMB) can qualify. They must submit business licenses and trademarks — not to mention a refundable deposit fee of $15,200-45,000 (100,000-300,000 RMB). Such stipulations indicate that the service is targeting mature enterprises over niche brands wishing to test the waters.

However, to attract more high-end labels to join the platform, Douyin needs to upscale its offerings. Anaïs Bournonville, head of the luxury division at Gentlemen Marketing Agency, revealed, “the average basket purchased on Douyin is very low, around $30, and mainly concerns cosmetics products. Chinese buyers on the app are more interested in viral and low-priced products, as they want to make fast decisions. For a more complete and luxurious experience they prefer Tmall and JD.com”

Jing Daily noted that Prada has opened a Douyin Flagship Store but hasn’t made its products available on the online boutique yet. This shows that while high-end houses are tempted by Douyin’s 600 million active users, they are still worried about the risk of diluting their image.

Douyin Global Choice#

Douyin Global Choice is one of the most recent of Bytedance’s experiments in ways of taking on Alibaba. Similar to Tmall Global, the new service is also a cross-border marketplace that permits brands without local business licenses to sell goods in (and ship to) China.

Still in its testing phase, the feature is by invitation only and details are vague. The regulations of the service are yet unclear, but deposit fees are expected. It will take time and liquidity for Douyin to build Alibaba-like supply chain capabilities, procurement centers, and bonded warehouses.

In the future, though, it could be a gateway for niche outfits to make their first attempts at the mainland market. Porteous confirmed that “it’s a great starting place for beauty labels because it bypasses the more complex import registration requirements.” He also added that other categories which are traditionally strong in cross-border sales are fashion accessories.

As it develops, this is one for luxury to keep an eye on.

New horizons for luxury leveraging Douyin#

China’s zero-COVID policy is weighing on the financial performance of luxury conglomerates. Recently, during the release of their first-quarter results, Prada revealed it shut down over 50 percent of its local stores in the past fifteen days, Kering missed its Q1 estimates, and LVMH warned about the short-term impact of the country’s Covid outbreak.

Yet, according to Yaok Research Institute, the Chinese luxury goods market will continue to grow by 15-19 percent in 2022 despite the current omicron struggles. Online sales will contribute to more than half of this increase and are forecasted to exceed $34.6 billion (220 billion RMB). The data seems to point to online being a safe harbor in a challenging year. In light of this, having a presence on different and newer platforms, such as Douyin, may help brands garner further traffic and sales.

As Jing Daily previously reported, the short-video app is launching its own community: Pheagee. This involves both virtual fashion and idols, as well as links to the group’s e-commerce platform. The ultra-competitive nature of the e-market makes this a compelling prospect. Indeed, many such as Bournonville believe that virtual idols are the next frontier for luxury, especially as Bytedance pushes further into the field of extended reality. The tech giant has been busy: acquiring Chinese VR startup Pico in August 2021 and investing in virtual characters A-Soul and Li Weike more recently.

Hyper-futuristic tactics such as these shouldn’t be surprising. Of course, closing the loop between interest and final sale means an increasing number of consumers will complete their purchase directly on platforms such as Xioahongshu and Douyin. This will be a prime battleground in the future of luxury. But perhaps as important is Porteous’ insight that, with the profile of luxury consumers in China skewing much younger than other global markets, “being active on Douyin is a question of staying relevant today.”