The power brand collaboration has in today’s fashion industry is unmatched as a business strategy. Emerging designers have landed in the mainstream because of them, and they have provided historical luxury houses with fresh relevance, allowed Western brands to authentically connect to local markets like China, as well as connected some of the most inaccessible high-end names to valuable subcultures.

However, a divergence is occurring in luxury. The majority of businesses are frequently deploying co-branded drops, charmed by the associated marketing exposure and revenue. Whereas, some brands are avoiding the hype train, opting for solo launches, or hardly ever releasing collabs, if at all.

Hype-avoidant or consummate classic?#

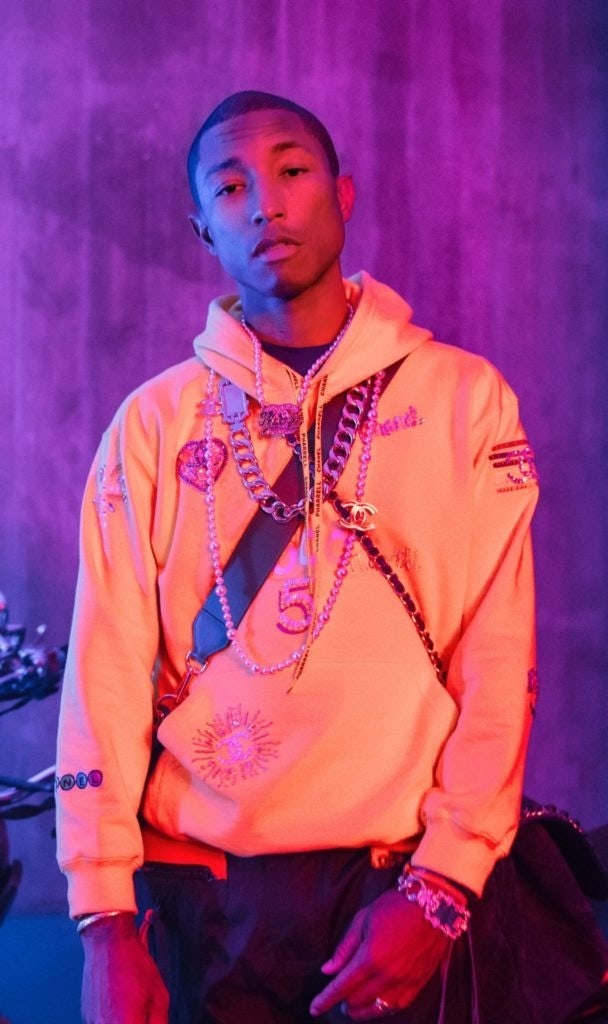

Among the aforementioned “hype-avoidant” brands, fashion houses Hermès and Chanel seldom release co-branded product lines, whereas competitors like Louis Vuitton, Gucci, Dior, and Celine frequently resort to the tactic. Opting to stay off the bandwagon, the only collaborative releases from Chanel have been a Pharrell Williams collection back in 2019, and the Formula 1 T-shirt collection of 2023, whereas all other tie-ups have taken the form of ambassador partnerships, such as with Timothée Chalamet or Blackpink’s Jennie.

The benefits of collaboration have clearly not won over Chanel, yet, though there seems to be an appetite for co-created products.

The Chanel x Pharrell Williams sneakers are listing on StockX at a 256 percent price premium, and the Chanel Formula 1 T-shirts took over the internet earlier this year.

Luxury British car manufacturer Bentley is another name that — unlike its collab-forward rivals Mercedes Benz, Rolls Royce, and BMW — hardly ever does collaborations. It is, very slowly, warming up to the scene, having worked with Bomber Ski on some skis on three occasions, and also collaborated on a project with Macallan Whisky in September 2022.

Similarly contradicting the common ideology that collabs are king for luxury right now, at the 2023 Walpole Luxury Summit, Dunhill’s Chief Brand Officer William Oliver was quick to debunk rumors that a skate brand collaboration would be on the horizon for the British luxury goods brand.

High-end names like Tiffany, Louis Vuitton, Burberry, and Comme des Garçons have all dropped Supreme collaborations, but Oliver says it’s not for Dunhill.

“For us, it is really about the makers, craftspeople, those who have a sense of excellence in what they do,” he says. “Ultimately, that is not about aligning with hyped brands in order to use them as a vehicle. Our client probably doesn’t want that.”

Street collabs: A strategy to reach Gen Z#

Dunhill might be against it, but skate brands are hot collaborators in fashion today, from Gucci x Palace to Dries Van Noten x Stüssy. The strategy of high fashion borrowing reach from subcultural names with cult followings has contributed to the rise of high-low crossovers in luxury.

Collaborating with skate brand Palace enabled Gucci to connect with young consumers, building on its brand reputation in a way that also benefits its existing athleisure offering. Perhaps, as names like Chanel and Dunhill are not focused on these categories, connecting to streetwear fans is not a priority.

However, Gen Z is a focus for all, and collaborations with skate brands is one vehicle for heritage names to earn relevance in 2023.

The wide reach of high street#

Just as joining forces with subculture brands invites luxury houses into that space, the rise of highstreet collaborations gives fashion an opportunity to provide more accessible pieces, along with connecting to wider, mainstream consumer bases.

It’s harder to find luxury brands that have not released high-street collections than it is to find ones that have — Hamp;M has launched two designer collabs on average per year since its Karl Lagerfeld collection back in 2004, most recently working with Mugler on a viral capsule.

Leader of the luxury wrap-dress Diane Von Furstenberg (DVF) is one label that has collaborated with Hamp;M, in 2021, and in 2023 it dropped an unexpected line of sneakers with comfort-first American footwear brand Skechers.

In support of that high-low collection, Co-Chairman of DVF, Talita Von Furstenberg told Jing Daily, “Collaborations allow a way to venture into new product categories, especially for us as we only do women’s apparel. I think it’s a way to get awareness; a way to get more customers. I think it’s all in all just an amazing opportunity to grow.”

Luxury brands such as Dunhill are opting against pursuing growth this way because they do not deem it necessary. Furthermore, the dilution of premium luxury that high-street or lower-end brand crossovers potentially create is seen as not worth the consumer-base expansion.

When Jing Daily asked why collab-trailblazer Lee Jeans releases so many co-created products in partnership with the likes of Be@rbrick (2023), The Hundreds and Engineered Garments, Joe Broyles, VP of global collaborations put it down to reaching new audiences, as well as building awareness in local markets.

“A successful collaboration is one that has generated media attention and brought new awareness and consumers to Lee, and has expanded our footprint,” says Broyles.

It could be argued that heritage names do not need to generate wider awareness because they are already household names. Yet, another appeal of collaboration, according to Broyles, is how existing house codes can be reimagined.

“While each collaboration is unique, each builds upon iconic Lee pieces. By leveraging these originals, we’re able to continue reframing the brand in a fresh way while being grounded in our heritage. The blend of a nod to heritage but fresh designs helps us to continue to evolve,” says Broyles.

Ultimately, collaborations provide the impetus for design evolution and newness. Therefore, the luxury brands choosing to eschew this approach are showing more confidence in their heritage than in the attention-grabbing logo collisions and co-branded product design.

In 2023, going it alone has become a luxury, as not many brands would survive without the benefits of collaborations.

The pros outweigh the cons. In fact, the best collabs do the opposite of dilution, accentuating existing characteristics of a brand that might not have been recognised previously.

The leading appeal of all collaborations has to be how they have become an instant vehicle for established brands to reach younger consumer demographics, whether that is Fendi collaborating with Heytea on a playful China-based activation, or Gucci’s viral Palace tie-up.

In an era of shortening attention spans, oversaturated news feeds, and expanding subcultures, brands need to join forces to build conversations. Some have chosen to rely on frequent co-branded collections, but perhaps the biggest flex of all is stating out of the fray.

For more analysis on the latest collaborations, sign up for the Collabs and Drops newsletter here.