What happened

According to a Luxury Consumer Insight Report released on November 14 by lifestyle platform Xiaohongshu, Chinese Gen Z luxury spending is being heavily steered by the company. Over 2,500 users in the mainland were surveyed, with 76 percent situated in tier-two cities or above, and 74 percent holding a bachelor degree or more. Of the Gen Zers who were questioned, just over 75 percent of them were introduced to at least one luxury product on Xiaohongshu over the past year that they ended up buying.

Furthermore, the report states that 62 percent of surveyed users are introduced to luxury before the age of 22, proving how social media is fueling a younger luxury spender.

The Jing Take

In 2022, the power of social media is no shocking revelation, yet what’s most noteworthy is the extent at which China’s young people are utilizing Xiaohongshu as a pre-purchase tool. Not only are posts directly spurring spending, the report also states that approximately 70 percent of users feel inspired to learn more about new luxury brands or products after encountering them one to three times on the platform.

As the place where many youths are being introduced to brands, Xiaohongshu should be viewed as an arena of opportunity for both established and emerging names. Whether that’s a case of incorporating the fruitful nature of recommendation purchasing, key-opinion-leaders (KOLs), or ensuring your brand or product appears when users type into the search bar before shopping.

The statistics suggest that luxury names need to zero in on where the youngest spenders in China are being introduced to products. Those born between 1997 and 2010, also known as Gen Z, are predicted to make up 60 percent of global luxury spending. In China, that demographic already encompasses an estimated 15 percent of all luxury purchases (data sourced from Jing Daily's The Secrets to Selling Hard Luxury To China’s Gen Z).

In short, those looking to meet increasing sales targets cannot ignore the latest data from the “Chinese Instagram.” Social media is a proven results-generator, and the figures illustrate that. In China, Gen Z are digital natives being heavily influenced by what they are exposed to on their feeds, so brands need to be intelligent in constructing their public perception and social media activity.

For luxury, the main takeaways from Xiaohongshu’s report are how young Chinese luxury consumers really are, their solid trust in recommendations, and how important it is to have products visually presented on social media.

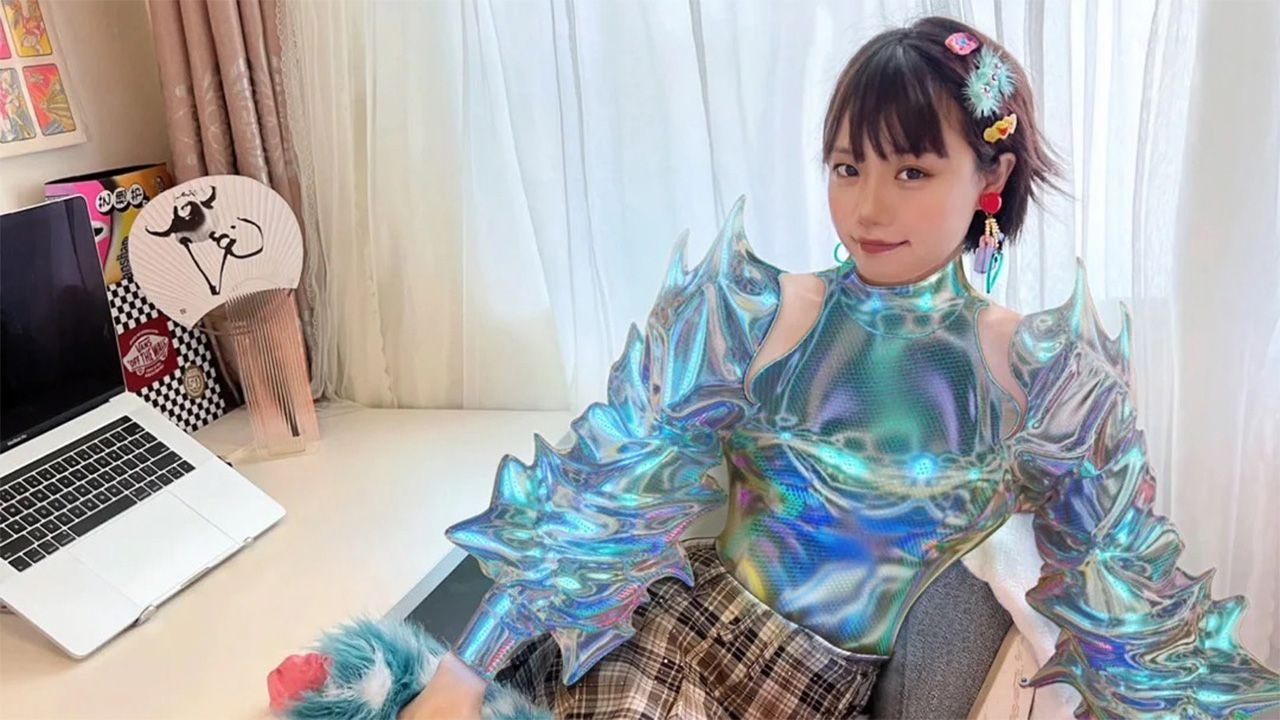

On a wider scale, the data provided by Xiahongshu also helps prove that viral “novelty” designs clearly are more than just clickbait marketing exposure. After all, Chinese young people are actually buying products that they see on their feed — for context, this week, Balenciaga’s novelty Lays bag sold out in China at the pre-order stage, before even going on sale, according to a staff member at Balenciaga's Plaza 66 store in Shanghai. On Weibo, the viral hashtag of "Balenciaga's New handbags are identical to Lay's chips and cost over 10,000 RMB each" gained 1.3 million views. Shoppers aren’t just marveling at these viral products, they’re buying them.

If a Gen Zer's social media feed is where most of their purchases start, then that’s where companies need to pivot their attention. Whether it’s via KOLs or competitions, online marketing budgets have never been more crucial in China. Perhaps, we’re about to enter an era of even more amplified meme fashion, as a result. We’ll grab the popcorn.

The Jing Take reports on a piece of the leading news and presents our editorial team’s analysis of the key implications for the luxury industry. In the recurring column, we analyze everything from product drops and mergers to heated debate sprouting on Chinese social media.