Vipshop, the Chinese e-commerce site, has managed to increase its user growth at a time when the vast majority of e-commerce sites are struggling to reach new users. One reason: it’s WeChat mini-program.

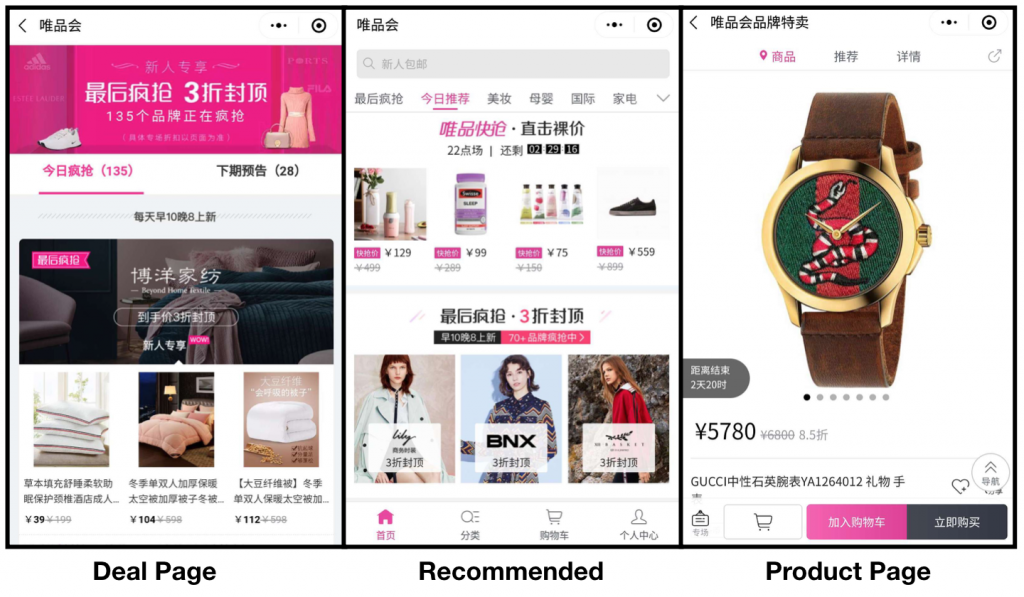

According to their latest earnings release, Vipshop’s users on its WeChat mini-program has grown an impressive 38.3 percent year-over-year. There are a couple of factors behind this. To begin with, Vipshop’s mini-program is a fully functional e-commerce site, meaning it offers the user the same amount of information and content that could be found on a standard e-commerce website—from fashion and beauty to housewares and child products to even accessible luxury products. And it covers them with as much depth.

Another factor has to do with the intrinsic nature of a WeChat mini-program. Beyond the simple fact that you don’t have to download an extra app, the majority of WeChat users live and breath it 24/7, which makes it super convenient for Vipshop customers to check (and recheck) for deals that can go live at any second. And to take advantage of this sense of urgency, the mini-program was designed with a countdown bar on top of each product indicating how much time remains, as well as how many people have already placed orders, reinforcing the message to buy, buy, buy.

But what makes selling on WeChat so profitable is its potent social sharing feature, which more and more companies have adapted their business models around, creating a sort of Facebook/Groupon mash-up. And Vipshop too. In June 2018, they launched a new B2C selling mini-program, Yun Pincang (云品仓), which invites an individual customer to become an "advocator" of a product. The customer, or "advocator,” is encouraged to share it with as many people as possible. If anyone buys it, the "advocator” gets a commission. And so it goes. The larger the outreach, the more the “advocator” can save on the product. While this marketing approach has been rapidly growing, and in some cases, adding to a companies profitability, the legitimacy of WeChat social selling is often challenged and is often criticized as a type of pyramid scheme.

Then there is Tencent's 2017 investment in Vipshop, which has helped it get a priority pass from Tencent. For example, on the “wallet” page on WeChat, Vipshop is listed as one of the shopping mini-programs, along with other competitors like Pinduoduo and Mo Gujie (蘑菇街). Additionally, Vipshop has also reported seeing a higher percentage of male and younger visitors on the mini-program than on its website, which is another indication that its user base is indeed expanding.

Yet, like other e-commerce sites, Vipshop’s revenue hasn’t reflected its user growth. We recently reported that in Q4 2018, although the company’s growth rate of active users was impressive, Vipshop yielded lower-than-expected revenue. So it still remains to be seen whether Vipshop can turn its increased user growth into increased revenue via WeChat. And how that might happen.