Key Takeaways:#

- According to Euromonitor International, in 2019, millennials and Generation Z accounted for around 60 percent of the population in China’s urban areas — a number that is projected to reach 65 percent by 2025.

- China’s KOL trend is still booming, and it has become most relevant for luxury fashion and beauty markets of all consumer trends in the report.

- Over 76 percent of Chinese consumers increased their consumption of locally branded products in the last year, and 90 percent of them have a positive perception of local brands.

As China’s economy continues to rebound in the third quarter, all eyes have turned to consumer spending — a crucial pillar for the nation’s recovery. But where and how are those consumers spending?

The global market research provider Euromonitor International recently published the consumer-driven report How China's Urban Millennials and Gen Z Live and Spend about the social groups that “represent one of the most critical forces shaping the outlook for the Chinese consumer market.” The research was conducted by end of last year, the company said, while having incorporated COVID-19 impact into the content.

In 2019, millennials and Generation Z (those born between 1980 and 2009, according to Euromonitor International) accounted for around 60 percent of the population in China’s urban areas — a number that is projected to reach 65 percent by 2025. With the help of one of the report’s authors, Jing Daily selected three out of the research company’s eight trends affecting fashion and beauty markets.

1. KOLs and KOCs are as important as ever#

In the realm of digital convenience, key opinion leaders and key opinion consumers continue to play an important role in the marketing of luxury fashion and beauty products, said Kelly Tang, the senior analyst at Euromonitor International. In fact, she added that the KOL trend is the most relevant to luxury fashion and beauty markets of all trends in the report.

“Chinese consumers very much rely on user reviews and recommendations when purchasing luxury [goods], and social apps like Little Red Book or Weibo and short-video apps like TikTok all enable influencers to connect seamlessly with consumers to promote products,” she said. Tang also added that Dior and Louis Vuitton’s venture into short-video and live-streaming territory speaks of the trend’s rising importance.

2. As local brands gain in popularity, luxury will show a deeper grasp of Chinese culture#

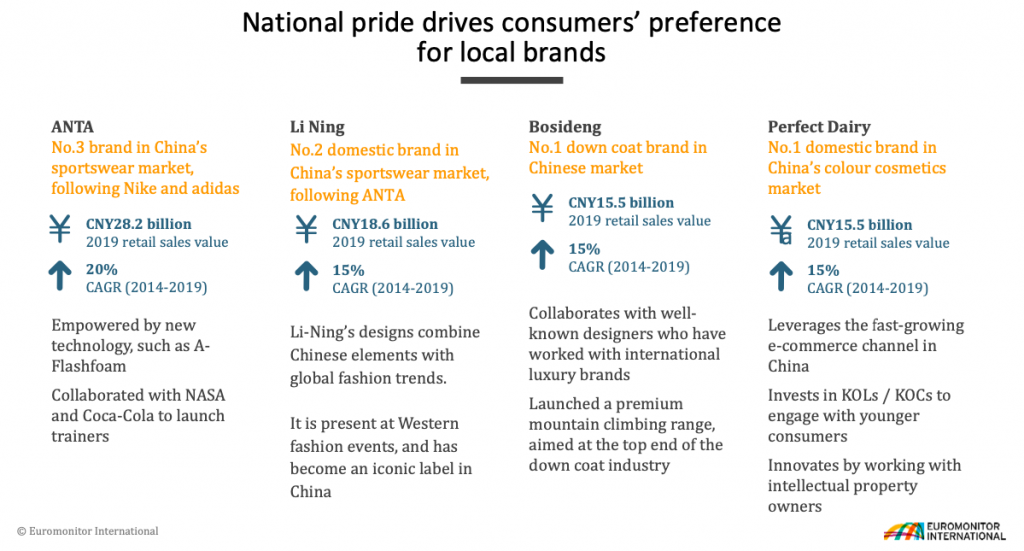

Over 76 percent of Chinese consumers increased their consumption of locally branded products in the last year, and 90 percent of them have a positive perception of local brands, said the report, which establishes that the country’s national pride movement has a growing momentum.

This trend has also been boosted by targeted initiatives on e-commerce-platforms such as Tmall. In May 2018, e-tailer Tmall collaborated with 50 local brands on “China Cool Action,” which generated a significant response on social media and helped boost brand sales.

“Chinese consumers are showing an increasing preference for local brands that demonstrate strong capabilities in leveraging new technology and adopting fashionable styles,” Tang said. “As a result, it is no longer enough for luxury brands to simply use traditional Chinese elements in their product designs. Instead, they are expected to incorporate those elements more wisely into products and brand communication in China.”

3. Consumer expenditure is growing in both high-tier cities and small towns#

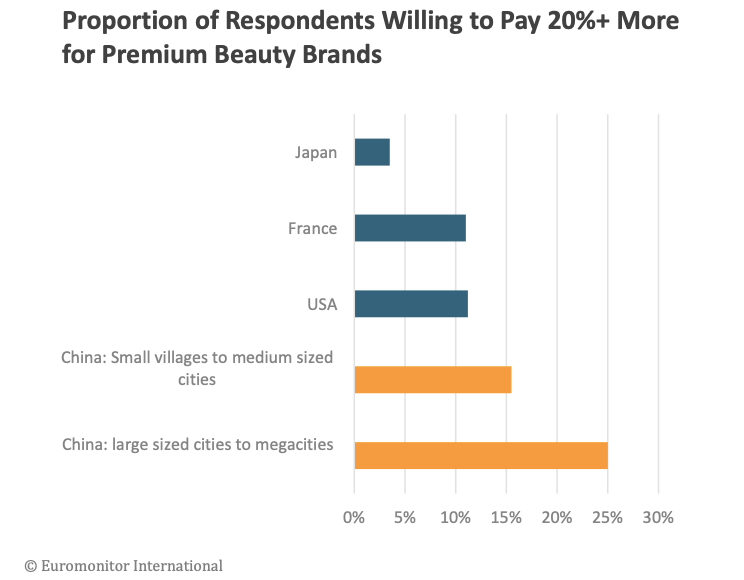

When it comes to shopping growth, China’s high-tier cities have far exceeded those in developed countries such as Japan, France, and the US. This is partly due to a consumer willingness in those cities to pay a significant premium for quality goods, says the report. In a chart comparing different countries, China’s small villages, medium-sized cities, large cities, and megacities show that between 15 and 25 percent of respondents were willing to pay over 20 percent more for premium beauty brands.

Consumers in China’s higher-tier cities are willing to pay extra for more sophisticated products, while people in lower-tier cities are also seeking more premium items. That has led to the rapid growth of brands that highlight quality and affordability, such as Jingxi, JD.com’s group-buying app targeting small-city shoppers.