Despite its popularity in Europe, perfume is only beginning to catch on with Chinese consumers.

Despite a difficult start caused by a lack of familiarity, China’s fragrance industry has finally taken off as young people become more concerned with their own well-being.

Before the 80s, few people wore perfume in China, but this began to change in the 90s with the growth of tourism and duty-free zones. This allowed Chinese consumers to have a first contact with perfume. Since then, the sector has continued to grow. Although it is still not up to what one could expect from such a big country, fragrances are increasingly becoming an integral part of the Chinese grooming routine.

According to data collected by Euromonitor, this sector is still relatively small, benefitting from average growth rates. In fact, the firm reports a year-on-year (YoY) growth rate of only 9 percent in 2012 compared to 12 percent in 2011. These average figures probably reflect a slowdown in economic growth during this period. While the Chinese population represents 20 percent of the world population, it contributes to only 1 percent of sales of perfumes. The market is there, but lacks the proper stimulus.

Not used to wearing perfumes#

Perfumes met little success because they are not products that Chinese consumers have the habit of wearing. Indeed, for a fragrance to be successful, there must be an emotional attachment as well as an already built-in fragrance culture like, for example, the one in France.

During China’s imperial period, people did not wear perfumes in the same style in which they were worn in the West. Later, during the Cultural Revolution, cosmetics were branded as illegal, which naturally included fragrance. Therefore, Chinese people never really had the opportunity to be familiar with this type of commodity. In order to grow, first and foremost, brands need to educate consumers on the product—this has been accomplished before with goods such as French red wine. Once this is in place, there is no doubt that Chinese consumers will catch up very quickly, thus allowing the market potential to unravel.

Many perfume brands in a market dominated by international brands#

The fragrance market in China is dominated by international brands. The first was Christian Dior, which was already established long ago in China. This brand was later joined by Chanel and Elizabeth Arden.

In 2011, Chanel alone gathered 12 percent of the market share, followed by Christian Dior with 8 percent, and Calvin Klein, Hugo Boss, and finally L'Oréal China. These world-renowned companies have done a lot of work to make themselves known to the general Chinese public through very costly advertising campaigns on television and in fashion magazines. In 2011, Chanel, Dior, and Lancôme were elected Chinese consumers’ favorite brands.

A slight rise of local brands#

Yet, there has been a rise of local brands with luxury perfume brands such as those that make chen xiang (沉香), known in English as agarwood, which is very much sought by wealthy Chinese not for its smell but for the prestige brought by having such an evanescent perfume.

Chen xiang is one of China's most sought-after and expensive fragrances.

Lack of interest in fragrances from the rest of the luxury cosmetics sector#

According to Chinese consumers, what matters is not so much the smell of perfume but the reputation of its brand prestige that it will bring. With only 1 percent of the population with this type of product, the potential is great—especially when we know that countries like France or the United States have market penetration rates around 60 percent. Will there one day be a similar penetration rate in China? A total of 600 to 700 million potential consumers seems distant, yet the perception of fragrance is rapidly undergoing a transformation.

The perception of perfumes in Chinese#

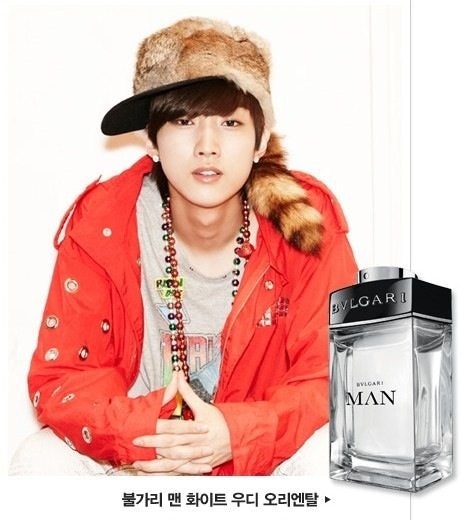

Knowing that the Chinese do not like strong odors, brands must have a scent that is light and unobtrusive to have any chance of success in China. They also must know that the word “scent” evokes femininity above all, which places an additional barrier to the sale of perfumes for men. However, the success of promotions by some Korean and Japanese celebrities forced Chinese consumers to review their positions on this point, and they are beginning to differentiate Chinese traditions to create their own styles.

With the market still not aware of perfume, there is much work to do over the long term—it is not clear if real benefits can be achieved in the short term.

Bulgari has enlisted Korean celebrities such as singer-songwriter, composer, and actor Jung Jin Young (정진영) to promote perfume to men.

How to attract customers in the perfumes in China?#

As we have just seen, the perfume market is still under-exploited. To enjoy it, you have to use the right media to reach the right target.

Knowing that there are about 600 million netizens in China—half of which are regularly shopping online—it makes sense to use a means of communication that allows brands to reach consumers across China in order to tap into long-term potential in both first-tier and lower-tier cities.

A luxury perfume marketing strategy in China should have the following two objectives:#

- Educate potential customers today to reach a certain profitability of the brand and an initial opening vis-à-vis the perfume.

- Reaching the younger generation to leave a lasting impact that will increase the penetration of your brand on the Chinese market.

What is the right way to launch a digital campaign in China to influence the fragrance market? Create a need and inform through educational campaigns on all types of digital media for maximum exposure of your brand.

As mentioned above, to promote your perfume brand in China, you must first and foremost a campaign focusing on consumer education. That is to say, set up a campaign that will highlight the following:

• How to use a perfume

• The consumer experience for the perfume in question

• The exploration of the senses with priority to smell

It is on this last key point that a brand can teach the Chinese customers how to distinguish its own scents as models and benchmarks in order to sustainably anchor its scents in the minds of Chinese consumers looking for new experiences in the perfumery sector.

A good brand website to show how to properly use a fragrance#

With the explosion of e-commerce in China, you must first have a brand website that includes your offers with prices and discounts on the first page visible at the first glance. Similarly high-resolution content is required in the case of fragrances to match the needs of medium luxury that it characterizes.

It has to be a website that is focused on user experience and education at the same time. Teaching how to wear and use a perfume is an important part of the process, since a consumer using too much or too little of the fragrance will not have the experience you want him to have—and therefore fail to properly deliver your creation at its best. For this experience to be visible, you need good visibility on the Chinese internet. This means a good ranking on Baidu, the Chinese search engine giant representing 70 percent of market share among Chinese search engines.

IWOM (word of mouth online)#

Since perfumes are all about appearances, brands should also manage their online reputations by paying attention to word of mouth online (also called Internet Word of Mouth).

Chinese social networks and KOLs#

On Chinese networks such as Weibo and WeChat, it is also possible to involve key opinion leaders (KOLs). This will give you the benefit of their reputation and followers’ attention to increase the reputation of your brand. This can be very beneficial, especially when the KOL has millions of followers that will quickly all know your brand. For instance, Yao Chen, the “queen of Weibo,” has about 50 million followers. Imagine the impact that the use of a KOL like her could have in term of brand awareness!

Conclusion#

As you can see, the perfume market has great potential in China, but brands need to know what the right tools are to market it. However, with the coming of Web 2.0 and the high internet penetration rate in China, it has become easier to reach customers the most likely to buy perfumes. With the rise of the middle class and the democratization of the smartphone, a variety of strategies can be implemented.

Olivier Verot is the founder of Gentlemen Marketing Agency, and specializes in digital marketing solutions for the Chinese market. Find more information about the author on Google Plus or LinkedIn.