The China footwear market has long reigned supreme worldwide, with the country manufacturing and exporting over 60 percent of the global market share.

The women’s slice of that market is not only huge, it’s booming. The annual compound growth rate of China's women's shoe market over the past five years has been a robust 8.7 percent. In 2016 the market reached 224.7 billion RMB (about 33.8 billion) and could exceed 260 billion RMB(about 39.1 billion) this year.

All of this has led luxury brands to target Chinese consumers with hard-to-resist, high-end shoes, celebrity endorsements, Chinese social media campaigns and culturally specific product launches. Here from Jing Daily are seven women’s luxury footwear brands that are winning market share with Chinese consumers and how some are doing it.

Bally#

Despite being one of the first international luxury brands to enter China back in the mid-1980s, Bally still attracts young Chinese consumers, in part due to a marketing strategy that’s paired the company with a group of auspicious Chinese influencers. In June 2017, Bally announced that Chinese actress Tang Yan (aka Tiffany Tang) would become the brand’s first Asia-Pacific spokesperson. Along with Yan, actresses Yang Mi, Guan Xiaotong, and Liu Shishi also favor the brand's leather slippers.

After Chinese textile giant Shandong Ruyi bought a controlling stake in Bally International AG, the 167-year-old Swiss luxury brand started taking in most of its revenue from Asia, with the China market alone accounting for half the firm’s revenues. Bally’s CEO Frédéric de Narp expects Ruyi’s investment to help accelerate the Swiss brand’s growth in key segments and territories, according to a February South China Morning Post report.

Christian Louboutin#

This French luxury shoe designer, whose signature red-soled shoes have become iconic, can also count many Chinese celebrities among his fans. Crossover Chinese actress Zhang Ziyi (章子怡), who is widely known and loved by the brand’s loyal consumers in China, wears Christian Louboutin heels to nearly every event. In October 2017, Ziyi wore her Christian Louboutin Aketata pumps to the wedding of two South Korean celebrities, Song Hye-kyo and Song Joong-ki.

And according to Women’s Wear Daily, Louboutin himself attended the China Fashion Gala in May 2018 as the first fashion advisor to the event. While there, the gala board honored his brand for making a sustainable impact on Chinese fashion along with other respected luxury brands such as Shanghai Tang and Tiffany & Co.

Gucci#

Ever since bamboo entered the lexicon of Gucci products via the Gucci Bamboo Bag in 1947, the Italian luxury brand has periodically returned to this iconic symbol of Chinese culture for new concepts. Aside from that groundbreaking handbag, Gucci also released a Bamboo fragrance in 2015 and bamboo heels in 2017.

In Gucci’s June 2018 presentation, the brand emphasized that their China website was “fully adapted to local specificities, showing very positive results since the soft launch in June 2017.” The luxury house has launched a WeChat platform and now selling via WeChat and Alipay. Since then, Gucci.cn has reported purchases in over 300 cities.

Jimmy Choo#

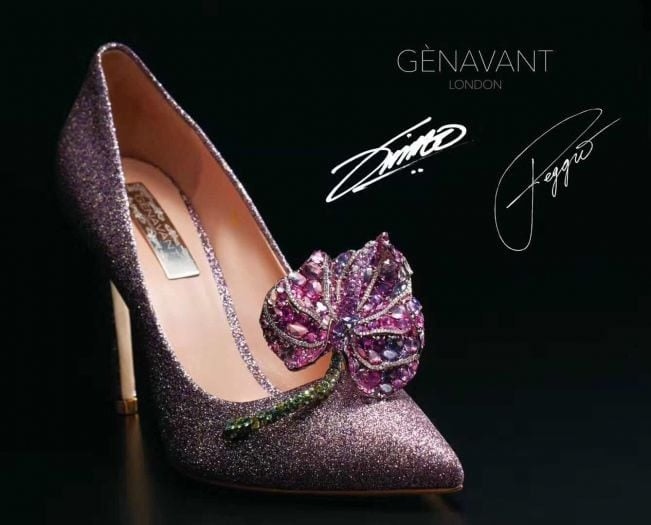

This British fashion house, which was favored by the late Diana, Princess of Wales, has primarily been known for its shoes ever since launching in 1996. But in February 2018, the designer Jimmy Choo added fine jewelry to his repertoire by working on a bejeweled stiletto with the jeweler Gènavant for a one-day exhibition at the Cambridge International Art Gallery in Cambridge, London. Popular Taiwanese actor Ming Dao (明道) was also at the event.

Through 2017, China was technically the second-largest consumer market for the Jimmy Choo brand after the U.S. However, it’s been estimated that around 15 percent of Jimmy Choo’s revenue comes from Chinese consumer purchases internationally, thanks to a large amount of international tourism from that country. The brand’s parent company MKHL also stated in a 2018 report that, “Our Greater China business acquired on May 31, 2016, contributed incremental revenues of approximately 42.0 million to non-comparable store sales for fiscal 2018.”

Louis Vuitton#

This world-renowned French luxury house is still one of the Chinese consumers’ favored brands for footwear. The brand’s recent partnerships with Chinese celebrities Fang Bingbing and Lu Han have given LV klout within the country’s fashion industry. Though traditionally known for their leather goods, the brand recently launched its new Archlight sneakers at its Spring/ Summer 2018 Paris Fashion Show, to considerable success. The Archlight became yet another example of high-end fashion blended with street style to yield impressive sales. Chinese actress Fan Bingbing and Tang Yan were spotted styling the sneakers in March, prompting a large and positive response from fans of the brand on Weibo.

According to LVMH’s 2017 annual report, Asia-Pacific remained the region for most brand revenue at 28 percent, with fashion and leather goods responsible for the highest percentage of sales.

Salvatore Ferragamo S.p.A#

Another Italian luxury goods brand best known for its shoes and leather goods, Salvatore Ferragamo has also pinpointed the Asia-Pacific area as its top market in terms of revenue, according to the brand’s 2018 report—an increase of 1.2 percent over the previous year. During late 2017, the chairman of the family business Ferruccio Ferragamo and his siblings spoke at length about Hong Kong’s importance as a market for the brand. Ferragamo viewed revamping their Hong Kong flagship store as a vote of confidence in both the city and in the China luxury market as a whole, according to a South China Morning Post report.

It didn’t hurt that the brand also collaborated with supermodel Ju Xiao Wen to attract more young Chinese consumers to its Spring/Summer 2018 Milan Fashion Show in September of 2017. Ju was dressed to impress in her new Ferragamo pink ankle-strap velvet pumps.

TOD’s#

As reported by Insider Retail in May, first-quarter global sales fell overall for the Italian fashion house Tod’s Group but Greater China bucked that trend with a 4.4 percent rise. That period netted a reported value of 48.7 million Euros (around 57 million USD) while showing positive results in Mainland China, Hong Kong, and Macao, according to Tod’s May press release.

Another Italian company known for its leather shoes and products, TOD’s has become popular for its Gommino leather loafer, a go-to product for many female consumers in China. In August 2017, Tod’s announced a collaboration with the Chinese actress Liu Shishi (刘诗诗) to make her their new brand ambassador. Liu filmed advertisements for Tod’s Fall/Winter 2017 collection.