Only a handful of luxury and fashion lines announced their earnings results in September, but those that did fared relatively well. Despite an array of challenges — from unfavorable foreign exchange rates to overstocked inventory due to shipping delays — Ferragamo, Tod’s, and Nike all managed to beat estimates. However, this was largely thanks to consumers in Europe and North America; China, the only major economy still enforcing strict COVID-19 measures, remains a sore spot for sales.

Ferragamo#

The newly rebranded Ferragamo started September off strong by topping market forecasts. Group revenue in the first half of fiscal 2022 climbed 20 percent to €630 million (619 million or 4.4 billion RMB) while net profit surged 85 percent to €62 million (61 million or 434 million RMB) compared to the same period last year. Unsurprisingly, net sales in the Asia Pacific region, which made up one-third of total sales, fell by 1.5 percent due to the ongoing lockdowns.

With disruptions beginning at the end of March, China was the one area that slumped. But the house maintained some activities: for the Lunar New Year, Ferragamo invited local artists Sun Yuan and Peng Yu to create unique prints for a special capsule, strengthening its relationship with the creative community. In April, it partnered with mega KOL Li Jiaqi and Tencent Huiju Luxury to promote its Spring 2022 collection and later participated in JD.com’s 618, which boosted sales by 150 percent during the 18-day shopping festival.

According to CEO Marco Gobbetti, who joined the luxury firm in January, Ferragamo will accelerate investment in the second half of the year to “build strength in platforms and regions,” driven by a “transformational deal” with Farfetch. This, combined with a revamp under its new creative director Maximilian Davis, could help bring the brand closer to its goal of doubling 2021 revenues by 2026.

Tod’s Group#

The parent company of Tod’s, Roger Vivier, and Hogan also reported solid first-half results. The Italian luxury group returned to profitability and reported a 17.4 percent increase in revenues to €465.7 million (458 million or 3.2 billion RMB), surpassing pre-pandemic levels. This was despite the fact that sales in Greater China tumbled 13 percent: “In China, in the first half, 88 percent of stores were opened, but the ones that were closed were the biggest and the ones that had the most impact,” explained CEO Emilio Macellari.

This impacted more than just brick-and-mortar foot traffic; online shrank to single digits as the “complete closure of the warehouse and logistics in Shanghai made it impossible to deliver,” Macellari added. However, the portfolio of labels maintained a steady stream of marketing activities in H1, especially with celebrities and KOLs: Hogan appointed Chinese actor Gong Jun as brand ambassador and Tod’s collaborated with brand ambassador Xiao Zhan on a capsule collection.

Despite beating analyst expectations, Tod’s recovered slower than luxury outfits like Richemont and LVMH. And now, with plans to delist the business after 22 years on the Italian stock exchange, there are more concerns about its future than just tough competition.

Nike#

In the quarter ended August 31, Nike’s revenue increased 4 percent to 12.7 billion (90 billion RMB) compared to the year prior, led by double-digit growth in North America and Europe. Although revenue sank 13 percent on a currency-neutral basis in China, the sneaker giant pointed out this decline was better than anticipated. In fact, it noted two wins in the market: liquidating more units than planned and higher full-price realization.

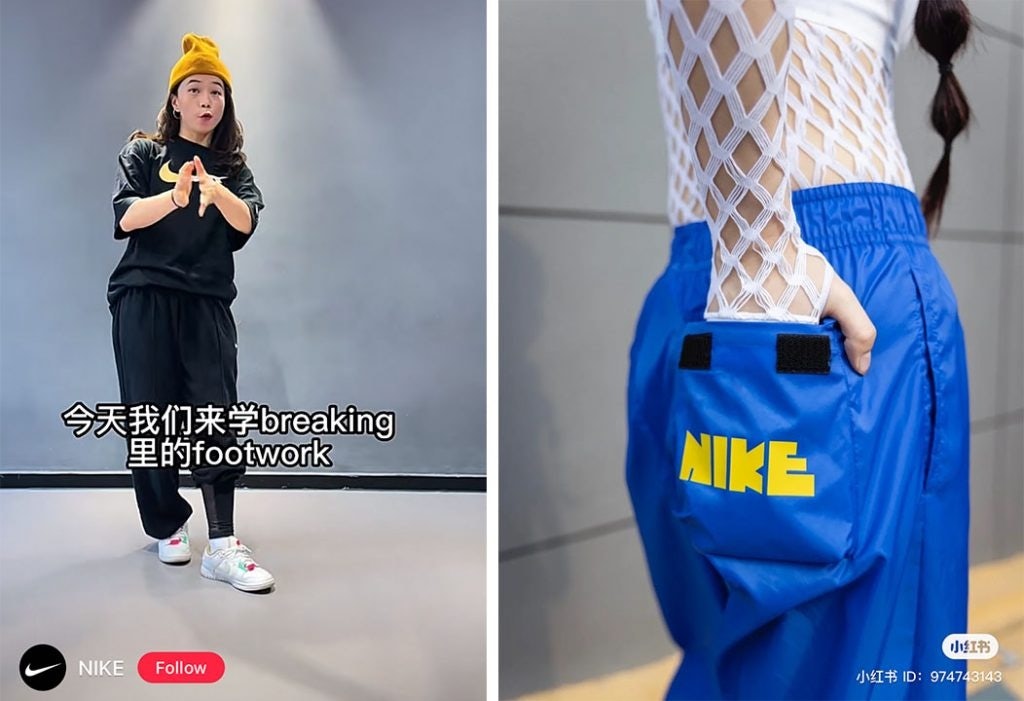

Though still cautious about the near term, the Swoosh is confident that its unique value proposition will fuel long-term growth in the mainland. “We continue to deepen connections with Chinese consumers in locally relevant ways, from elevating the street dance community with hyperlocal product and storytelling to igniting youth basketball culture through the lens of the Chinese high school basketball league,” CFO Matt Friend said in the earnings call. Driven by this “hyperlocalization,” Gen Z demand grew more than 25 percent versus the year prior on digital platforms and the newly launched Nike app became the top brand shopping app in the country, Friend observed.

Coming off this solid first quarter, the sportswear maker expects currency-neutral revenue growth of low double digits in the next period. As CEO John Donahoe stated, “what is clear is that the Chinese consumer is ready to come back into the market, and what they're looking for is innovation, quality, and storytelling” — promising signs for Nike and the industry at large.