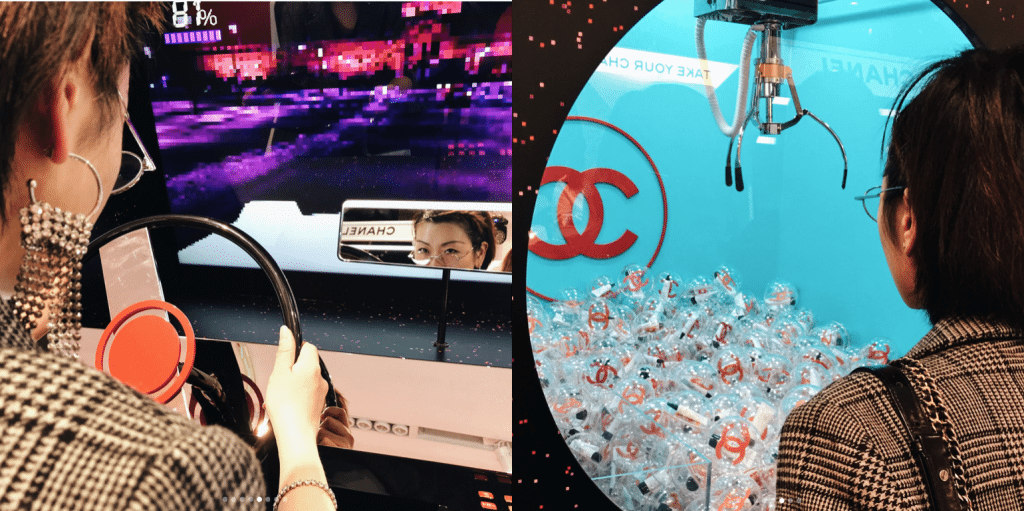

With racing games and a claw machine, it looks more like an arcade than a boutique. But the Coco Game Center housed in trendy Shanghai mall K11 from April 14 to 23 is actually a pop-up shop created by French luxury house Chanel. The racing game, for instance, has a double C logo steering wheel, and the prizes captured by the claw machine are Chanel cosmetics samples.

Chanel’s first game-themed pop-up took place in Tokyo in March this year, and excitement about it spilled over to Chinese fans on social media. When Chanel announced it was bringing the pop-up to China, reservations were booked out a week before it arrived.

The concept of pop-up stores was popularized by Japanese fashion label Comme des Garçons. Its founder, Rei Kawakubo, opened the label's first pop-up store in Berlin in 2004. Since then, the fashion label has been making its mark around the world through pop-up stores.

The compound annual growth rate of pop-up retailing has been over 100 percent since 2015. By 2020, over 3,000 pop-up stores will have launched in China.

Beyond Traditional Retail#

Pop-up stores’ spike in popularity can be attributed in part to the shifting tides of real estate. Traditional retail space is becoming more and more expensive but can feel outdated, making pop-up stores a more exciting alternative.

They allow luxury brands to unleash their creativity, building a branded world that consumers can fully inhabit. Impressive details stimulate fans to record their experiences and post them on social media. Done well, pop-up stores provide authentic social media exposure that money can't buy.

Last year, Chanel launched its Chanel Café, inviting fans to taste branded dessert and coffee after first trying out some of their products. Around the same time, YSL invited fans to a yacht party, providing them with free makeovers. At both events, brands offered exclusive products for consumers to purchase.

Combining exclusive products and limited durations, pop-up stores are a textbook example of hunger marketing, which is particularly effective in China. Queues often generate excitement, rather than a sense of inconvenience.

Digital Pop-ups Are Now a Thing#

Pop-ups are no longer limited to brands entering shopping malls. E-commerce sites are also hosting pop-ups both online and offline.

Luxury E-commerce platform Secoo opened a pop-up store with lingerie brand La Perla last year in Beijing's popular Sanlitun shopping district. Similarly, MyMM, a content-driven e-commerce platform, launched a ‘Trend hunter’ themed pop-up store in Shanghai, allowing visitors to touch the merchandise listed on the site. MyMM said the pop-up store benefits lesser-known brands on the platform, giving them a chance to test consumer response before investing in a physical store.

“About one and a half years ago, more and more e-commerce sites started to think about opening an offline pop-up shop. It has reached a near-explosive state this year,” Vincent Tan, the founder of a pop-up agency POPEX told Chinese media Netease Tech.

He argued that it’s become harder for e-commerce platforms to acquire new users online, and shopping malls have been struggling to attract foot traffic. Pop-ups are seen as a solution to both problems, leading online and offline retailers to increasingly working together.

Another recent development is e-commerce sites hosting virtual pop-ups on their platforms. Luxury brands concerned about cheapening their brand by selling online can experiment with e-commerce platforms by first trying a limited collaboration. On April 10 this year, for instance, luxury watchmaker Audemars Piguet announced its first online pop-up boutique in partnership with JD.com, which marks the 143-year-old Swiss manufacturer's first foray into e-commerce. That gives them the opportunity to evaluate sales performance and consumer feedback before committing to a deeper, more ongoing relationship.

What's the Future of Pop-ups?#

While pop-up shops can be a useful testing ground for some brands, for others they may already be too cost-prohibitive.

Pop-up stores are meant to make young consumers excited, but as they become more commonplace, it's getting harder to generate that engagement. Simultaneously, the cost of launching a successful pop-up has gone up as more PR and marketing staff are needed, and hiring a space is becoming more expensive.

For smaller brands, hosting a pop-up doesn’t necessarily help them survive and thrive. Guo Wanyi, a manager of a Chinese brand called Debrand said, “It’s not like a physical store where you can count on sales. Often times the purpose of opening a pop-up is not to generate sales, so you can’t necessarily get back the cost.”

For luxury brands, while pop-ups can help reach younger consumers, hosting too many can eat away at their uniqueness. Like online marketing, not ever retail pop-up retail store can go viral.