China’s e-commerce market is frequently seen as a battle for luxury consumer loyalty between two giants: Alibaba and JD.com. But in a country with a population of online shoppers that exceeds 460 million, smaller players have been emerging onto the scene to reach an increasingly targeted group of high-end consumer. These valuable consumers favor an exclusive, curated, and trendy shopping experience—like going into a Barneys versus an entire Westfield shopping mall.

One such newcomer that has rapidly expanded its presence in the scene is backed by Hong Kong’s The Wharf (Holdings), Lane Crawford Joyce Group's brand management company Walton Brown, and digital technology company eCargo. Called MyMM, the cross-border retail app features an array of about 1,200 premium to upscale fashion, beauty, and lifestyle brands and retailers, ranging from Lane Crawford and Revolve to Jimmy Choo and La Perla.

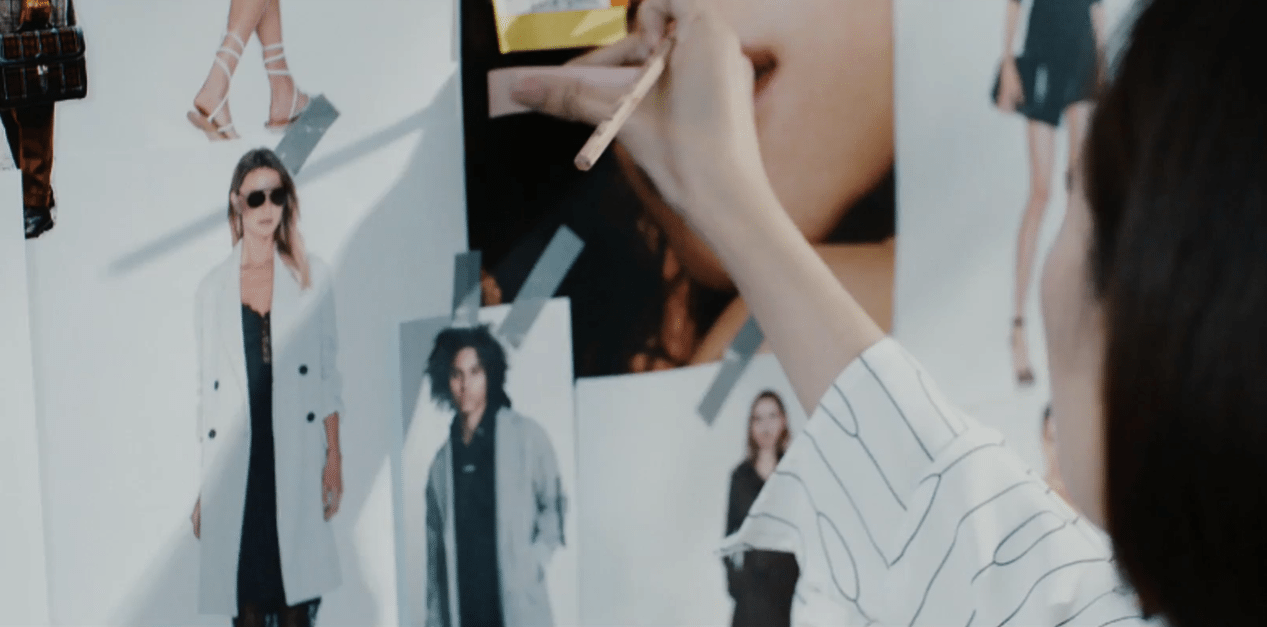

The app stands out in that it puts a heavy emphasis on building a community of sophisticated fashion enthusiasts that can convert into social media influencers, and in turn, fuel sales. MyMM lets users, which range from WeChat-famous fashion influencers like Becky Li to Taiwanese actress Ouyang Nana upload original content and share their favorite products or styles—all within a semi-open platform that still allows for integration with Weibo and WeChat.

In a market where social media platforms like WeChat are driving marketing choices, and where KOLs mean everything, the opportunity for influencers to interact with consumers in a more direct, intimate mobile shopping setting is something that, according to MyMM, is attractive to brands aiming to target middle class Chinese customers in a highly segmented market. The app also positions itself as having a unique appeal for luxury brands compared to other smaller, local competitors, some of which are discount-driven and fueled by grey market demand.

Jing Daily asked MyMM President John Steere to share his perspective on MyMM’s marketing approach, why it’s important for brands to become familiar with shoppers in lower-tier cities, and why social video is so important in retail right now.

Can you elaborate on the gap you see in the current luxury e-commerce market and how you are making your platform stand out among other local players?#

First of all, there’s very little differentiation between most of the e-commerce platforms, be it for luxury or mass affordable brands. Pricing, delivery, and brand assortment is not a differentiator in my opinion. That being said, there are some fundamental customer-focused issues that should be addressed, which we are working on.

Authenticity is something that is not consistent among many e-commerce platforms. Transparency, real and authentic products are something we take very seriously. By working directly with brands and authorized retailers we are able to ensure we offer authentic products.

The big players in the e-commerce industry are growing rapidly in the mass market. However, as the customer base becomes more diverse and more aware, there are, thus, more opportunities to reach sophisticated and niche audiences with the right market segmentation and offering. We are creating a community for users who desire to share experiences and create a beautiful life together. Our social-commerce features encourage users to interact with brands, merchants and influencers, thereby creating a richer experience that is beyond just buying or shopping online.

How do you reach the right consumer as a startup e-commerce platform?#

It’s crucial for us to deliver the right message to the right customer. Customers have many concerns when it comes to e-commerce, especially in the highly competitive market with a large variety of platforms. We focus our efforts on educating consumers about our group heritage, about product resources and relevant lifestyle content, which provides them a sense of trust when they experience and shop on MyMM. With so many ways to reach the audience, we carefully evaluate each channel and digital asset (e.g. KOLs, press, social media, offline events, video) to ensure we are targeting the right audience with the right messaging strategy at the right time, during a customer’s journey.

From your experience, how important is it to engage the consumer from multiple marketing channels via an e-commerce app?#

Engaging with the consumers is a crucial part of the e-commerce experience, which is why we are creating a community that offers more than the standard e-commerce features – it is a place for people to communicate, share ideas and inspire each other.

MyMM engages with consumers through different channels: media collaborations, offline activities in different cities, in-app special offers, responsive customer service, social media, web/landing pages, etc. Omnichannel marketing is an overused and often mismanaged concept, but it can be constructive, when applied properly, with a clear path to purchase/conversion principles and deep data analysis.

How important is it for brands to start focusing on lower tier city consumers? In your experience, how do luxury brands have to adjust their marketing strategy to reach these consumers?#

Our customers live all over China. We definitely value customers in second, third and fourth tier cities, and do our best to reach them. We have had offline events in Suzhou, Changsha, and Nanjing to reach our audience, and the results have been very positive.

Customers in second-tier cities have significant discretionary income and are generally more engaged in fashion-related activities. I think luxury brands need to see this change in the current market, and apply more efforts in lower-tier cities to build their brands and reach these key customers through online/offline promotions and events.

Many of the major e-commerce players are turning to KOLs and editorials/events to help market their offerings to consumers – what mistakes or gaps have you seen in the market in terms of brands (or platforms) getting their message out to luxury customers and how would you do it differently?#

I don’t want to give away all of our secrets but I think most of us know that we are moving quickly to a world where content is watched more often than it is read. So the use of video is essential, be it with KOL’s or your own content creation.

When it comes to working with KOLs, bigger is not always better. It’s important for brands to accurately assess the KOLs’ followers, and the way they communicate with their followers, to make sure the KOLs can help deliver the brand message authentically. Sometimes smaller scale micro-KOLs can generate a healthier engagement with brands if there’s a relevant fit and message. It is also important to maintain a consistent brand message through all of your digital assets.

What is the advantage of having a community of influencers and users within a semi-open e-commerce platform as opposed to brands working with KOLs strictly through social media channels like WeChat and Weibo?#

MyMM also works with KOLs through social media channels, but the in-app channel creates a more intimate and exclusive format of communication. Our semi-open platform guarantees a more VIP-type experience as opposed to open social platforms.

We believe everyone has the potential to be KOLs or content creators and the “influence” starts within their own personal network, which is why we are constantly expanding our KOL pool and inviting more people to join MyMM as curators and content creators.