Key Takeaways:#

Such is the demand for imported fragrances in China that Tmall Global and Cainiao Network co-launched its first “perfume route” — a dedicated daily flight to transport fragrances between Europe and China. The route was scheduled specifically to meet consumers’ growing interest in artisanal and niche scents.

Most notably, Gen Z preferences are shaping the trend and gender-nonspecific scents, with more personality, are particularly appealing. Consumers in their 20s are more likely to experiment with alternative formats, such as mini-size and solid perfumes.

Domestic competitors will also see growth in the coming years. Local company Scent Library has been particularly innovative at leveraging the nostalgia associated with scent. White Rabbit, based on a popular childhood Chinese candy, is a great example.

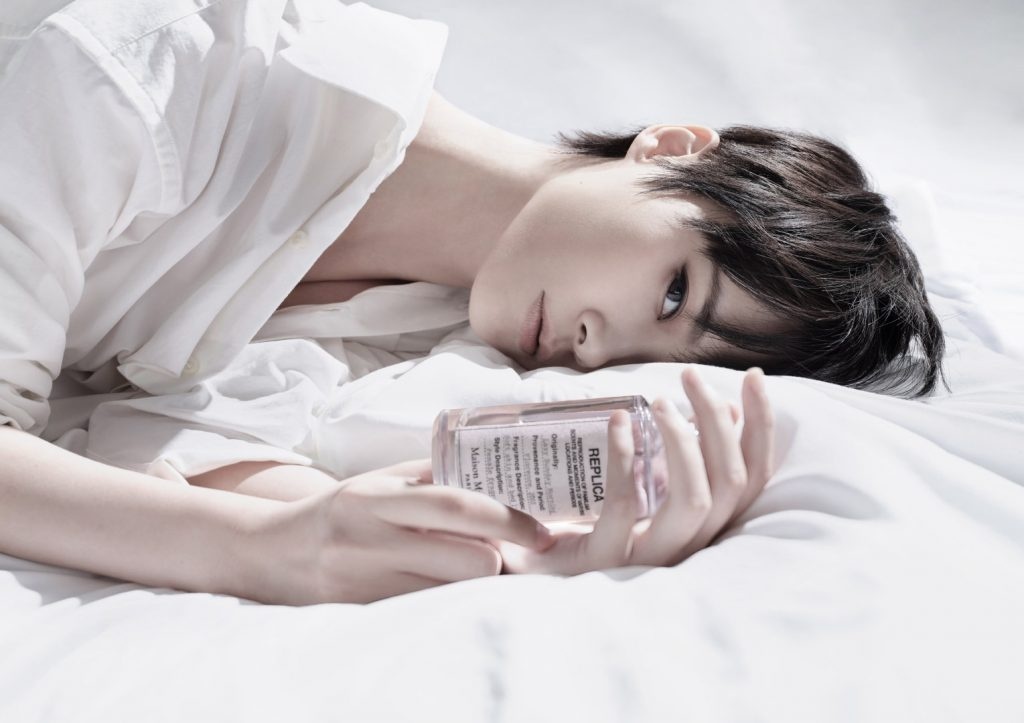

Scents have a powerful effect on the brain. A smell has the uncanny ability to transport you to a particular time and place, conjuring up memories that are forever associated with that aroma. Replica (founded in 2012) trades perfectly on this ability, bottling experiences in quirky apothecary-style bottles under imaginative titles like Beach Walk and At The Barbers.

In China, consumers are still opening up to olfactory joys. As such, growth in China is slow but steady: According to Minter, the sector was growing at a three-percent rate from 2014 - 2019, with the market reaching value sales of 995,000 (6,404 million RMB) in 2019.

Foreign brands dominate in China, and the big beauty companies you’d expect to see are all leaders in the arena: LVMH, Chanel, Coty, L’Oréal, and Estée Lauder. Yet, Mintel predicted that those brands should face big challenges after the pandemic once consumers seek more personalized and intimate scents.

Overall, imported niche names are performing well in China, too. Euromonitor has predicted that the niche and high-end perfume markets, dominated by imported brands, would grow by 18 percent. Data from Alibaba Group’s cross-border e-commerce platform, Tmall Global, also supports this prediction: In the past half-year, the platform’s imported perfumes have increased by 70 percent year-on-year, and, among them, niche brands have the highest growth rate with three-digit growth year-on-year.

In fact, Tmall Global and the logistics unit Cainiao Network co-launched its first “perfume route” — a dedicated daily flight to transport fragrances between Europe and China. The route was scheduled specifically to meet Chinese consumers’ growing interest in artisanal and niche scents. Products can't always be easily accessed due to cross-border logistical challenges (suppliers are often refused by air carriers, as their liquids may contain flammable substances, such as alcohol.)

Smaller brands have found it hard to meet the minimum volume requirements to ship by sea freight — usually the most common shipping option - but now, citizens can receive imported bottles directly from Europe in as little as three-days time.

Here, Jing Daily looks at other market factors that are accelerating the growth of niche perfume brands in China.

Gen-Z trends define perfume preferences#

In China, the term “niche” not only refers to limited sales but also connotes that a company or product's appeal is confined to a particular consumer demographic. Mintel reported that women between the ages of 30 and 39 are the core users of traditional fragrances, whereas consumers in their 20s are more likely to experiment with alternative formats, such as mini-sizes and solids.

According to industry experts like Allie Rooke, who is a beauty consultant and the founder of Clean Beauty Asia, post-90s generations are also driving the demand for niche names, and Gen-Z trends are shaping new perfume preferences. “Younger consumers are actually using them, as opposed to gifting them,” Rooke said, “which is a new trend in itself.”

Furthermore, they are using it as a way to express their identities, and gender-nonspecific scents are particularly appealing. “L'artisan Parfumeur's best-selling fragrance is Passage de L'enfer which is an oriental woody [scent] — this sums up the trends of gender-neutral and a strong move away from sweet florals that had been popular in the past,” Rooke explained.

Maison Margiela’s Replica (which is considered niche despite being licensed by L’Oreal) is also trending among Gen-Z demographics. Rook continued, saying, “Replica is an interesting fragrance to have done so well, but it works. Again, consumers are looking for gender-neutral and products that don’t have such a feminine style. They are choosing fragrances that are not very strong and not sweet… Ones with more personality.”

According to a young Gen-Z consumer who spoke to Jing Daily, it’s the ephemeral nature of fragrance that’s attracting Gen Zers. One user commented: “It’s something you can’t show, and only those close to you can smell it, so somehow the brand doesn’t matter. Perfume is like music or reading — the more niche it is, the more you show off how good your taste is.”

William Lau, CEO of omnichannel retailer Bonnie & Clyde, confirmed that Gen Zers want uniqueness: “Shoppers from post-95 and even post-00s don’t want to smell like their mothers,” which describes the original daily perfume wearer in China. Instead, they are looking for something different, he added, “even leapfrogging the traditional names like Dior or Chanel. Even Jo Malone is considered traditional by them,” he remarked.

Heritage is valued. But, so are brands with a clear vision. Lau listed Juliette Has a Gun, Byredo, and Diptyque as brands that are all trending due to distinctive positions and bold engagements (Byredo’s Rose of No Man’s Land and It’s Not A Perfume by Juliette Has a Gun ranked number four and seven respectively on Tmall’s 2020 Young People’s Favorite Imported Niche Perfume List).

Lau continued: “Juliette Has a Gun is growing rapidly, even though it was only founded in 2006 and lacks that heritage angle. It worked by creating a persona for the brand that is captivating the consumer… People want to talk to Juliette as a person. It’s emotional. It’s not simply a perfume; it’s an attitude.”

Online presents opportunities for perfume growth#

Online platforms like Tmall and JD.com are key outlets for fragrances. Already, in 2021, Hermès Fragrance opened, and Gucci Beauty officially launched, featuring fragrances. Another big name, Cartier, added the category by offering names like Panthère and Carat.

Popular niche brands to drop on Tmall Global during the pandemic were Replica and L'Artisan Parfumeur — two brands that were backed up by social media, which is vital to their amplifications. Outlets like Little Red Book are growing in appeal too, and the niche name Le Labo is relatively new to the market but already has 10,000 mentions on RED.

Perfume KOLs and bloggers, who recommend and amplify imported names, are on the rise too. Weibo’s top bloggers and sites include names like Sunillusion, Miss Wenshu (文殊), Initialscent, and The Perfume World of CC (CC的香水世界).

Tmall’s new flight could well be a game-changer for smaller niche brands, as well, so they can increase market penetration and follow the trajectory of a brand like Penhaligon’s. The brand opened a Tmall Global Official Store in October 2019, and by August 2020, it was atop the Young People’s Favorite Imported Niche Perfume List (not bad for the Queen’s favorite perfumer).

In China Beauty & Care 2021, ChemLinked reported that Penhaligon’s sales at Tmall’s Double 11 reached 1.24 million, ranking it ninth in the Top 10. This proves the resilience of the category.

Offline and experiential stores continue to hold value#

Perhaps given its olfactory nature, brands continued to open doors in China during the pandemic. Byredo managed to open three stores between May and July in 2020. ChemLinked stated that two niche names under the Estée Lauder Group, KILIAN and Editions de Parfums Frédéric Malle, opened their first stores in China last year, too. Compared to traditional offline stores, updated offline brand stores focus more on experience and services, which suits the branding of niche names.

Multibrand stores in China have been increasing, too, with some focusing on niche brands specifically. Rooke said retailers like Bonnie & Clyde and Harmay are offering Gen-Z shoppers more opportunities for an experience. The Colourist has also been gaining fans as a retail destination. “They can take photos, show off, and generally spend a lot of dwell time,” she noted.

Niche brands offer Bonnie & Clyde omnichannel possibilities to be more daring and bold, Lau said. “How we create content [for these brands] is drastically different. We reach out to multiple communities like the LGBTQ+ as well as the perfume ones.” These include experiential events for fragrance launches that include bartenders creating cocktails based on breaking down the top notes or pastry chefs devising recipes based on smells.

Future predictions and how local competitors fare up#

Given the infancy of the sector, there is scope for clean brands to rise in popularity given consumer interest in purer ingredients, botanicals, and impact consumption in China. Rooke was optimistic though: “Natural fragrances don't have much awareness thus far, and the trend is being impacted by logistics. Hopefully, with the changes in animal testing, there will be even more growth here too.”

Domestic competitors will also see growth in the coming years. Mintel reminded that growing localism gives domestic names a unique advantage to leverage Chinese heritage to connect with consumers, especially since smells are so emotional and the fragrance industry has lagged.

Domestic niche perfume brands have a 3 percent share in brand searches in the sector, ChemLinked reported. Names like Boitown, Fozoon, and Scent Library came out on top. Scent Library has been particularly innovative at leveraging the psychology and nostalgia aspect of smell; it has developed specific smells that evoke traditional flavors from the past to cater to local tastes, such as White Rabbit, based on a popular childhood Chinese sweet.

Whether it is recalling collective childhood memories or selling aspirational messages which speak more directly to consumers, as the fragrance sector grows, it will see the growth of local brands that resonate better with Chinese lifestyles.

Therefore, while imported niche brands are currently dominating, it might not last. “The majority of the brands doing well now are part of big groups, they have a lot of resources behind them, and are benefitting from the investment going into them. They are fueling the category, but like with any beauty category, if you go in and no one knows you, it is an uphill battle,” Rooke added.

In the future, luxury fragrance names could well call on a Chinese "nose" for its notes.