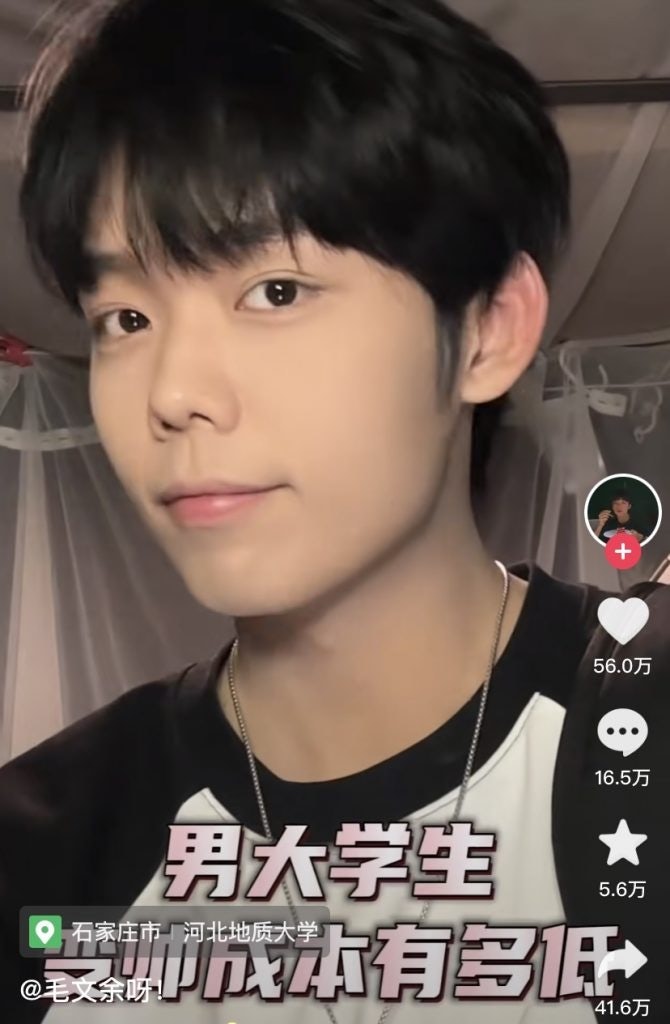

The male makeup tutorial has gone viral on short-video platform Douyin.

In the videos, men usually in their 20s, like Mao Wenyu (@毛文余呀!), often appear with no makeup and start hydrating their skin with moisturizer, before employing concealer and foundation, followed by oil-control loose powder, eyebrow penciling, and a slick of lip balm. Lastly, after grooming their hair and changing outfits, they turn out looking drastically different.

Mao’s video, titled ‘How affordable is it for today’s college students to become handsome?’ (男大学生变帅成本有多低) attracted over 500,000 likes. And some of the products featured in Mao’s videos, such as Dermafirm’s sun defense makeup base, have sold tens of thousands of units.

Douyin’s social selling business model is seamlessly closing the loop from consumer interest to transaction. The app is maturing as a sales channel, approaching the scale of China’s e-commerce giants Tmall and Taobao.

Feigua data shows that in the first half of 2023, the gross merchandise value (GMV) of men’s makeup sold via Douyin surged 365 percent year on year – Tmall and Taobao combined achieved 6.7 percent growth in the same period.

“Our Douyin sales have grown at an impressive pace, quickly becoming a contender to overtake our Tmall sales,” says Shane Carnell-Xu, founder of British male beauty label Shakeup, which beat L’Oréal by one place to take fifth place on Douyin’s H1 2023 top 10 best-selling mens cosmetics list.

Here, Jing Daily explores Douyin’s male beauty consumers demographics and psychographics and investigates how brands can engineer success on the platform.

C-labels outperform global brands#

Chinese male beauty brands are quickly expanding on the short video app.

Domestic labels like Refresh (珂岸), Bufflab, and Lilbetter claimed seven spots on Douyin’s top 10 best-selling mens’ skin care list, whereas international brands Shakeup, L’Oréal, and Mentholatum took three places.

Male consumers’ skin care behaviors are still at the entry level of basic daily care routines, Lin Lin Jacobs, CEO of China International Beauty Expo, tells Jing Daily.

Both international and local products’ qualities and SKUs are similar in this category.

“Marketing, packaging, and pricing are Chinese men’s top considerations. Demand for daily care is increasing among younger generations of Chinese men,” says Lin.

Domestic brands’ affordable price points and aggressive marketing strategies are the perfect fit for male first-time buyers of beauty products, who are inspired by male bloggers’ videos and decide to try skincare, starting with a small budget.

“Local players have a competitive pricing advantage since their products are developed, manufactured, and marketed within China. This localized approach leads to lower costs for raw materials and logistics. Furthermore, selling products within the country ensures a more stable supply chain and efficient distribution, reducing expenses related to time and labor,” says Franklin Chu, US managing director of Azoya, an agency that helps brands get established on China’s e-commerce platforms.

There’s an even split of males and females on Douyin, and around 67.1 percent of users have a monthly income of 700 (5,000 RMB), so price is the primary influencing factor in their decision-making process.

Male skincare buyers’ profiles#

Last year, 70 percent of men’s beauty purchases were made by women, according to a 2022 report from Xiaohongshu. But male buyers have caught up, now accounting for half of male cosmetics purchasers on Douyin.

“The consumers in the initial stages of skincare discovery tend to favor basic products, such as shavers, sunscreens, and creams. On the other hand, customers in tier-one cities show a greater interest in specialized and advanced skincare items, such as eye concentrates, facial concentrates, and skin toners,” says Azoya’s Chu.

“We observed that young Gen Z consumers who want to look good and feel confident in the office or school are also the biggest consumer base,” Chu adds.

On Douyin, topics such as ‘Boys’ plain makeup’ (男生伪素颜), a natural type of makeup that doesn’t reveal cosmetics have been applied, has over 20 million views. Nude-tone foundations and concealers are most in-demand, beating out bright and colorful cosmetics.

The average age of the male makeup user is between 18 and 30. This group accounts for 65 percent of total male makeup buyers, more than half of whom are located in third or lower-tier cities, where incomes are lower than in top-tier cities.

Hence, the average price of a male beauty product on Douyin is 9.7 (69.2 RMB), significantly lower than on other platforms like Tmall and JD.com.

“The development stage of male beauty in China today is like South Korea’s five to eight years ago. People will gradually shift to premium brands,” says Chu.

Effective marketing strategies#

Because male skincare and cosmetics categories are yet to go mainstream, male beauty brands are prioritizing market expansion by reaching and educating a wider audience.

Cooperating with KOLs has proven to be a quick and effective strategy for businesses that want to scale up brand awareness. These influencers are crucial for spreading knowledge about beauty routines.

“Makeup or skincare tutorials, videos of before and after that immediately show results, and content focused on problems and solutions comprise the typical content matrix for building a male makeup and skincare brand on Douyin,” says Chu, who adds that male creators are vital as male buyers more easily identify with them than female creators.

Resonance is also key. Local brands boast a more sophisticated understanding of Chinese culture and are more down-to-earth, both of which play pivotal roles in the storytelling process and make it easier for these brands to resonate with consumers.

“For instance, Chinese male beauty brand Make Sense (理然) collaborated with reputable livestream anchor Luo Yonghao for product endorsement. Within the first two hours of his livestream, Luo had received an impressive 10 million views,” says Chu.

But for high-end male skincare brands, those that cement their reputation and brand authority will provide consumers with a reason to trust them and buy their products.

“Douyin’s Staff category (职人) allows professionals, including hairdressers, beauticians, and fitness and wellness instructors, to distribute their recommendations for products and services. Premium products will have a chance to shine in their professional and insightful content,” says Lin.

Though Tmall and Taobao remain the primary channels for most businesses, Douyin Beauty is catching up. Therefore, a presence on all the platforms is often preferable.

“For us, it’s all about the multichannel approach, in a post-Covid world where the market is much more fragmented and consumers much more careful with their spending,” says Shakeup’s Carnell-Xu, who relies on local agencies’ expertise to operate its online business in China.