In The Review, we round up breaking news discussed in our daily newsletter, The Daily Brief. This week, we discussed:

- Chinese demand for high-end SUVs as an expression of the desire for comfort and security,

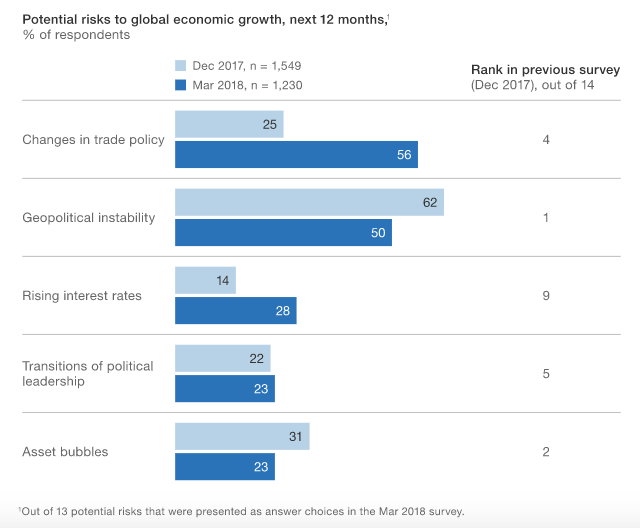

- A McKinsey survey that sees nativist trade policies as a major risk to economic growth,

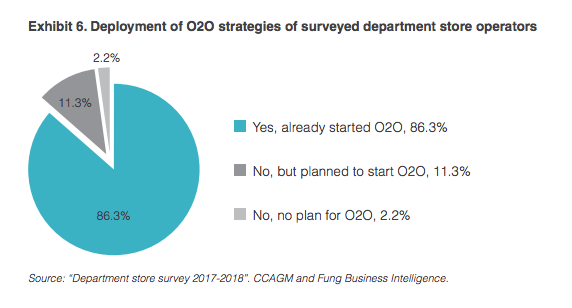

- Chinese retailers' mad rush to establish online-to-offline offerings,

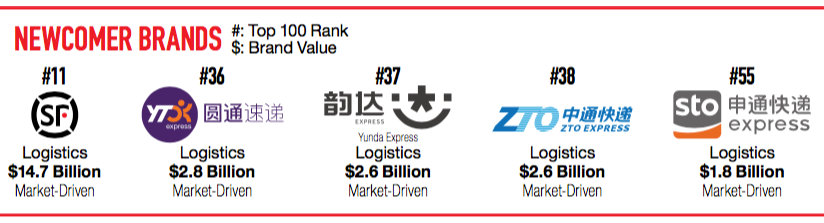

- Delivery companies' rise among 'unicorns' as e-commerce triumphs in China, and

- the growing popularity of luxury funeral services as incomes and real estate prices rise.

Monday, April 2#

Audi has launched an astonishing ten new SUVs targeting the China market, seven of which will be built locally. SUVs already make up more than 40 percent of Audi's sales in China, testament to consumers' preference for a sense of safety and comfort over performance. Audi also aims to introduce 20 rechargeable vehicles by 2025 to meet China's New Energy Vehicle (NEV) mandate, which forces automakers to boost their alternative fuel offerings to 10 percent of the car market by 2019 and 12 percent by 2020.

Click here to read our related story on the challenges facing Tesla in China.

Tuesday, April 3#

Geopolitical instability, changes in trade policy, and rising interest rates are the greatest risks to global economic growth according to a new global survey by McKinsey. Changes in trade policy saw by far the biggest increase in riskiness, unsurprising after new tariffs announced by the United States and China in recent days. China placed tariffs on 128 U.S. products, including various nuts, pork, steel pipes, and sparkling wine totally $3 billion.

Click here to read our story on the emerging preference for sparkling wine in China.

Wednesday, April 4#

In a market where e-commerce startups make up the greatest portion of unicorns, Chinese department stores have been quick to find ways of connecting their retail stores to online shoppers. Only 2.2 percent aren't working on online-to-offline offerings, according to a new report from Fung Business Intelligence.

Click here to read just how drastically future retailers will blur online and offline shopping.

Thursday, April 5#

The top five newcomers to the new Brandz top 100 rankings list for China are all delivery companies, proving China is not sick of e-commerce just yet. Hedging their bets, Alibaba and Tencent are both pouring resources into helping offline retailers reach consumers.

Click here to read how high end shopping malls are trying to compete with e-commerce platforms.

Friday, April 6#

China celebrated Tomb Sweeping Festival yesterday, a time to honor the dead. The cost of burial plots in China is going up along with incomes and real estate prices. Stocks in Fu Shou Yuan International Group Ltd., which runs graveyards from Shanghai to Chongqing, have leapt more than 60 percent in the past year, according to Bloomberg. They sell high end packages that cost up to 500,000 RMB ($80,000).

Click here to read how luxury brands are appropriated in burnt offerings for Chinese ancestors.