Editor’s note#

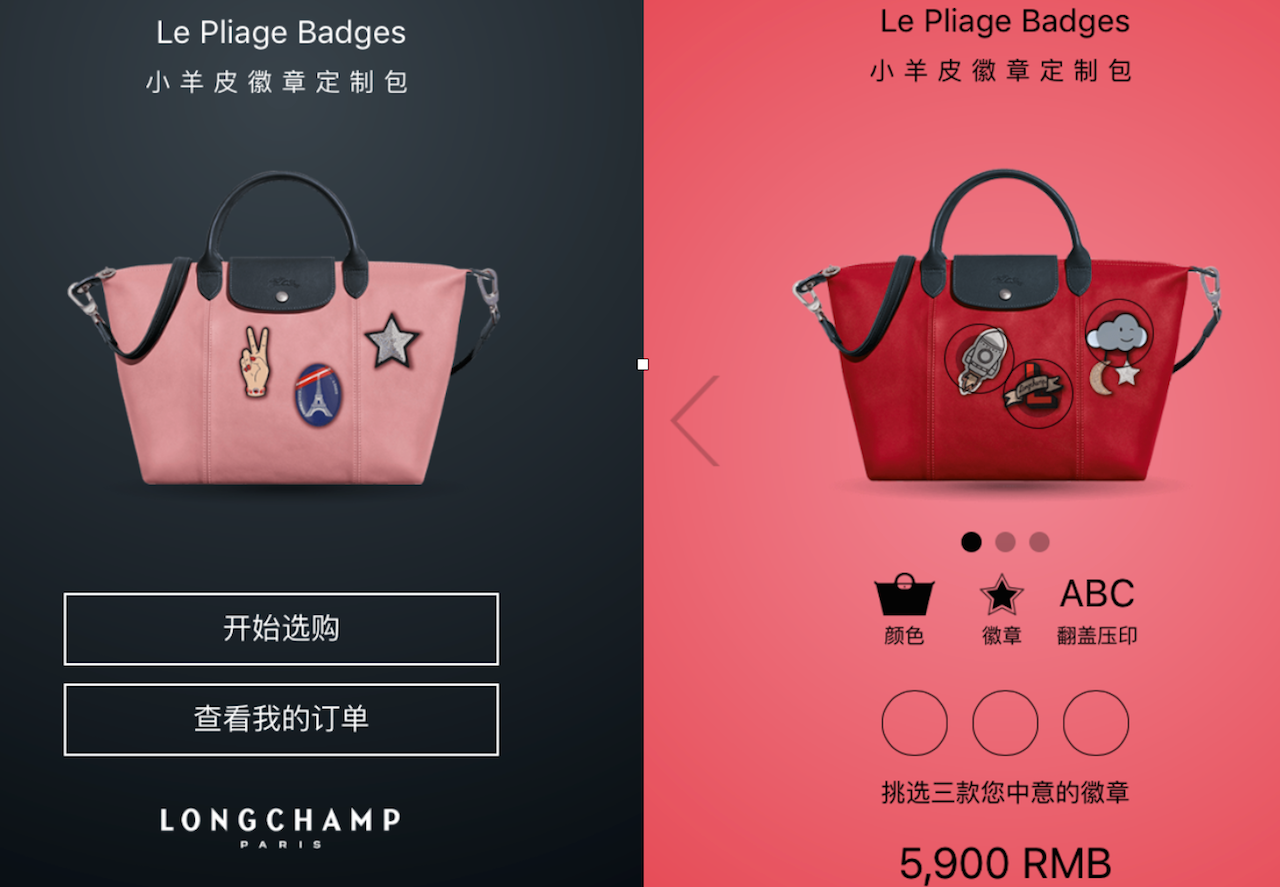

: Luxury brands such as Longchamps, Dior, and Michael Kors have been quick to establish their own WeChat mini-programs, including boutique stores, as the Tencent app continues to swallow more and more of Chinese consumers' attention. There already around 600,000 mini-programs, with over a million more in development. Struggling to compete, other tech companies are teaming up. This story was first published on Jing Travel.

Just starting to evaluate the possibility of launching a WeChat mini-program to stay on top of the latest Chinese marketing trends? There’s already a new player in town that hopes to substitute WeChat mini-programs, and it’s backed by all of China’s largest smartphone manufacturers, as well as the Chinese government’s Ministry of Industry and Information Technology. Much like WeChat’s mini-programs, the new standard is an “instant” app alternative to traditional apps from marketplaces like Apple’s App Store and Google’s Play Store — and a direct competitor to WeChat’s offering.

For China marketers, the introduction of yet another essentially China-exclusive digital marketing channel may seem frustrating. It’s already challenging enough to stay on top of WeChat and its many marketing offerings, China-compliant websites, not to mention up-and-coming social media trends like live-streaming, while also retaining a presence across more traditional marketing channels like Weibo and Baidu.

However, with a new standard also comes a new opportunity to gain early adopter advantage. It’s difficult (or expensive) to make noise on Weibo and WeChat, with both platforms crowded with brands and influencers all trying to engage an increasingly desensitized online population. The same rings true for app marketplaces like the App Store and Play Store (the latter is banned in China). It takes a lot of effort and budget to convince users to download a new app. An exciting new — and less crowded — marketplace could make things a little bit easier, at least in the early stages.

A business alliance consisting of Xiaomi, ZTE, Huawei, Gionee, Lenovo, Meizu, Nubia, OPPO, Vivo, OnePlus, and the China Academy of Information and Communications Technology under the Ministry of Industry and Information Technology hopes that a new standard will address just that.

The central value proposition of the platform is that it will offer “fast apps,” akin to WeChat’s mini-programs, all forced to follow the same standard. Users will be able to instantly launch the fast apps without downloading anything, hopefully lowering the barrier of entry for users hesitant to put their data cap or available storage toward a new app.

To developers, the primary benefit of the platform is that the jointly developed standard will avoid compatibility issues between different handsets, something that has previously forced developers to build different versions of apps to have them work properly across different hardware.

So, in other words, Chinese phone manufacturers have come together to offer a competing (and “open”) standard to WeChat’s proprietary mini-programs.

Unfortunately, however, the business alliance did not take the opportunity to launch a joint marketplace for fast apps. Instead, individual manufacturers will offer the fast apps through their own app stores. One of the manufacturers in the alliance, Xiaomi, has already launched support for fast apps on its application marketplace, offering “over 100” fast apps on day one. This means that, even with a common standard, the Chinese app landscape on Android will remain fragmented with no way of publishing an app (“fast” or otherwise) on a single app store to reach most, if not all, Android users in China.

Also important to note is that the new standard is currently exclusive to Chinese Android smartphone manufacturers, meaning that such apps would have zero market penetration with the, on average, more affluent Apple iPhone users in China.

It remains to be seen if users will be receptive to the new standard and whether marketers and developers think it’s worthy of consideration next to WeChat mini-programs, traditional apps, and mobile-friendly websites.

For marketers, the potential early-mover advantage could prove attractive. On the other hand, WeChat’s closed mini-program platform already addresses many of the potential problems with fast apps: it works across all platforms, including Apple devices, and has around a billion monthly active users.