Editor's Note:#

The existence of the Chinese daigou market has long been a headache for luxury brands who want to gain control over their profits. In recent years, the Chinese government has made significant efforts to crack down on the illicit daigou practice in order to boost domestic spending. While this makes the lives of daigou shoppers more difficult, the demand to purchase luxury goods overseas in order to exploit price differences is still high among domestic consumers. According to Jing Travel, our sister site, this trend has been evident in China's neighbor country South Korea, whose tourism industry, particularly the retail sector, is currently suffering from China's soft travel ban as a result of THAAD. The continued interest shown by daigou from China to purchase luxury items has helped South Korean duty-free stores sustain their business, however, it has also raised concerns among individual brands on the authenticity of products.

China’s “ban” on the sale of tour packages have hit South Korea hard in retaliation to the THAAD deployment in March. The South Korean duty-free industry has been particularly affected; South Korean duty-free shops have lost an estimated 528 million. Chinese representatives to the WTO have denied the existence of retaliatory measures, but the ban on South Korean was, in fact, initiated by the China National Tourism Administration(CTNA).

August saw Chinese arrivals fall by 56.1 percent year-on-year, a substantially smaller drop in arrivals compared to some months since the controversy began in earnest in March. Chinese spending was a key source of revenue for South Korea’s duty-free shops. Even with the considerable decline in Chinese arrivals, Chinese customers are still coming to South Korea to shop, but it’s not necessarily good news.

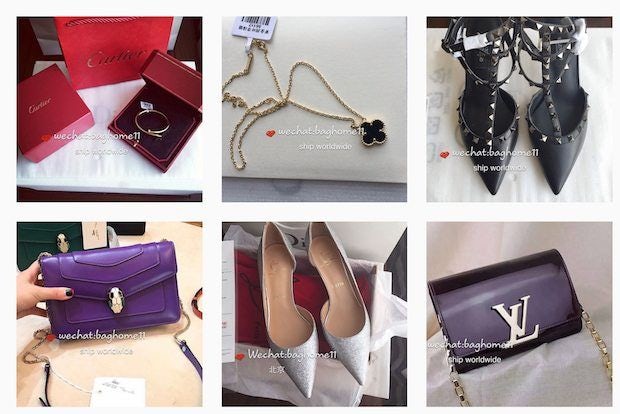

These shoppers are overwhelmingly “daigou” (代购) buyers, or “shuttle traders.” These customers travel abroad to circumvent Chinese taxes on imported luxury goods and then resell them to Chinese consumers either in shops, or more often on online retail sites. Not all of these daigou buyers are Chinese; some are South Korean citizens ferrying goods to and from China for profit. According to these daigou, demand is higher than ever.

This phenomenon is not limited to South Korea or luxury clothing, cosmetics, or handbags. These daigou buyers are present in many Western markets, including the U.S., and are also interested in reselling high-end American electronics, like Apple iPhones. They often buy these goods in small “bulk” purchases during sales, promotions, or at duty-free shops.

To combat the artificial restriction in supply caused by both domestic and foreign resellers, some companies, like Apple, have introduced limits on the number of units a single customer can buy.

For South Korean retailers, the ban on the sale of group tours from China to South Korea has meant a significant drop in revenue, so daigou buyers are to some extent good news. Sales are sales after all, and daigou purchases have helped buoy South Korean retailers. However, retailers often have to pay daigou tour operators commissions to attract them to their outlets. The volume of sales from these buyers is large, but profits are much, much lower.

This phenomenon is also very worrying for luxury brands. With one beauty company executive quoted by The Moodie Davitt Report as saying, “It taints both the purpose and image of duty-free… It is fatefully short-sighted.” At least one South Korean luxury brand, Amorepacific, has implemented limits on the number of units a single customer can buy.

Some luxury brands have argued that the practice hurts Chinese consumers. To some extent this statement is true. The popularity of buying relatively cheaper luxury goods through daigous, opposed to official retailers, has led to an abundance of fake and knock-off products on Chinese online retailers.

However, when the prices for already expensive luxury branded goods are made even more exorbitantly expensive by Chinese law, it’s hard to fault Chinese consumers for looking for lower prices domestically. Moreover, for South Korean duty-free shops daigou sales are one of the few remaining sources of “Chinese tourist” revenue.

What this phenomenon says about Chinese consumption of South Korean goods and services, including through tourism, is quite telling. The “travel ban” to South Korea only affects tour groups, Chinese citizens are still free to travel to South Korea as individuals. The drop in Chinese arrivals however still represents a major decline in Chinese interest in South Korean tourism for independent travelers.

Nonetheless, demand for South Korean luxury goods is reflective of how Chinese consumers are still very much interested in the consumption of South Korean goods and culture. In many ways, the current drop in arrivals but continued demand for South Korean goods, is similar to other drops in Chinese arrivals to nations following diplomatic rows. It seems that desire to travel to South Korea and/or consume South Korean goods and services is still high, but social pressure and potential embarrassment in supporting a “hostile nation” is keeping independent Chinese travelers away.