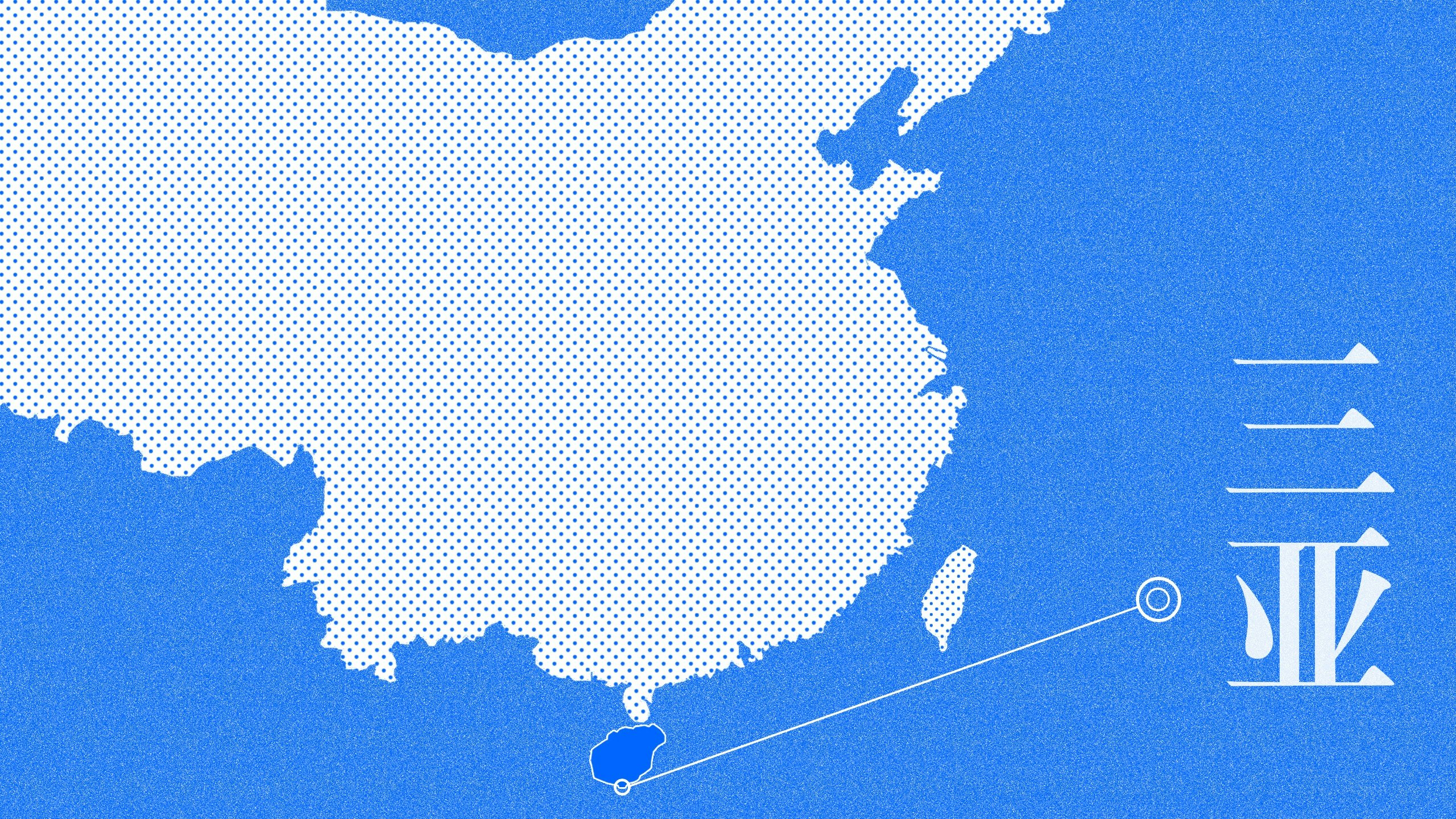

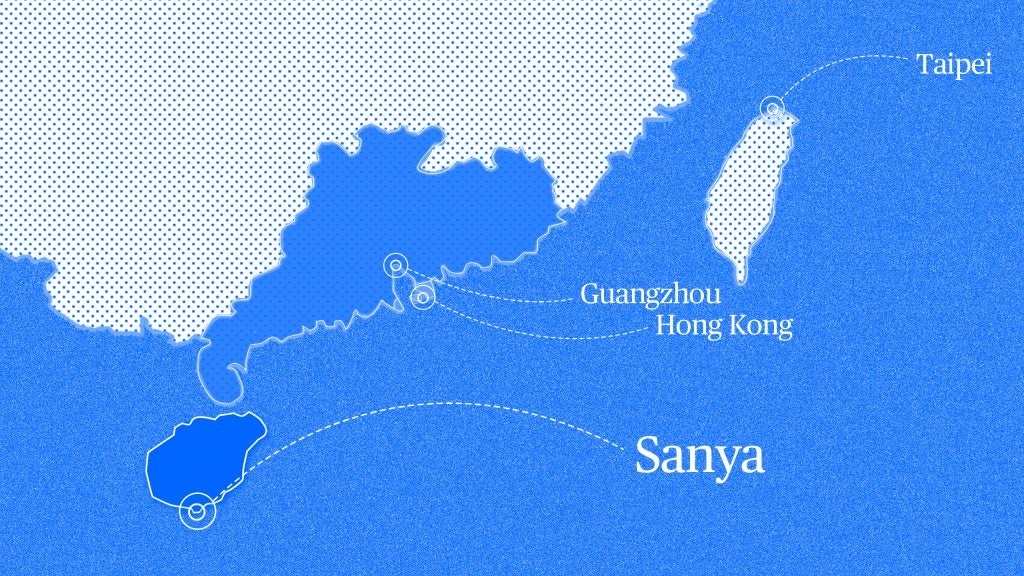

For our second Jing Daily City Guide, we look at Sanya: a well-known tourist destination on the southern coast of China’s Hainan island province that boasts a picturesque, Hawaii-like climate and the world’s largest stand-alone duty-free shop. Since 2011, the Chinese government has been creating tax refund policies for Hainan island while continuing to build out its local infrastructures, and their efforts to develop the local retail and travel scene over the past few years have intensified.

China’s most recent policy change happened this June when it announced new measures to raise annual offshore duty-free quotas for shoppers visiting Hainan island from $4,215 (30,000 yuan) to $14,050 (100,000 yuan). This new allowance is 20 times the amount the central government set in place in 2011 when Hainan first gained its duty-free status.

Hainan also opened two new offshore duty-free shops in the cities of Haikou and Qionghai in January this year. All of these measures show that the Chinese government is keen on turning Hainan into a strategic destination for travel retail, perhaps, as many in the local media have predicted, to substitute for troubled Hong Kong. "Morgan Stanley reckons that Hainan’s contribution to China's duty-free market would jump up from 24 percent in 2019 to around half in 2025. We think the growth and the 2025 share might be even stronger than that, especially as tourism infrastructure is built up in Hainan,” said Martin Moodie, the founder and chairman of The Moodie Davitt Report, to Jing Daily.

Also, in their latest webinar, the director-general of Hainan Provincial Bureau of Intentional Economic Development (IEDB), Shengjian Han, disclosed a greater plan for Hainan, saying, “Before the year of 2035, we are going to realize six things: free trade, free investment, free capital, free visas, free transportation, and free data. [And] by 2050, a high-level free trade port with strong global influence will be built.”

Now that Hainan has been dubbed the next “shopping heaven” after Hong Kong, the city is expected to disrupt China’s travel retail scene thanks to its beneficial policies and up-and-coming travel tourism. Below, we evaluate the luxury and fashion presence in Hainan while also highlighting opportunities for potential new contenders:

Sanya’s key statistics#

GDP#

$9.53 billion (67.79 billion yuan) (2019)

Tripled the GDP in 2010, which is $3.45 billion (23.87 billion yuan)

Population#

Around 634,369 (2019)

Yearly tourists#

23.96 million (2019)

67 percent of Hainan’s tourists are under 40, according to China’s largest online travel agency Ctrip in 2019

Its total tourism revenue for the year reached $8.93 billion (63.32 billion yuan), an increase of 15.6 percent over the previous year

Wealthy travelers and seasonal residents#

Sanya is ranked number one with independent travelers in terms of popularity, according to Ctrip

Tourists and seasonal residents swarm to the city during national holidays like Spring Festival, Labor Day (May 1-3), and Golden Week (Oct.1-7)

Sanya is also a popular venue for international events such as Miss World, PGA and LPGA golf tournaments, and the Clipper Round of the World Yacht Race

Average disposable income of locals#

$4,659 (33,130 RMB) in 2019, a 8.6-percent increase from 2018

Average traveler spending#

One of the top 10 cities for Chinese travel spending

Average spending from tourists reached $1,505 (10,421 yuan) during the Spring Festival in 2019

Luxury presence#

Luxury fashion, cosmetics, and jewelry brands under LVMH, Kering, Richemont, and L’Oreal are present at the China Duty Free (CDF) Mall (the complex is also home to four Michelin-starred restaurants)

Who is the Sanya luxury shopper?#

Family travelers#

In 2019, Sanya’s tourist destinations amped up their family attractions, which led to more families visiting. According to Trip.com, 59 percent of all travelers in Sanya came with families. Meanwhile, 29 percent of all tourists were born between 1980 and 1990, making up the greatest percentage of spending power in the area. The Chinese government’s official website even states that Sanya has transitioned from a sightseeing location to an interactive spot.

Therefore, this group will have diverse needs when shopping at Hainan’s duty-free malls. Estée Lauder is one brand that reportedly drew immense lines at its stores during China’s national golden week. And unlike at home, Gen Zers tend not to spend much on family vacations as compared to the older generations.

Luxury rational shoppers#

For the avid luxury shoppers who are calculated with their spending habits, Sanya’s duty-free malls are a good choice. Middle-class travelers purchase handbags and cosmetics from the CDF Mall because the items are cheaper than they are in other parts of the country. But high-end shoppers have noticed that Sanya’s malls tend to carry outdated and limited luxury items. Due to travel restrictions, it’s likely that these shoppers are limited to travel within China, and cannot go to the US for cheaper and more assorted goods.

Local residents with vocational houses versus out of city travelers#

Most of the shoppers in Haitong Bay are still tourists. Although long lines form outside luxury fashion stores like Gucci, Prada, Miu Miu, and Cartier, their selections aren’t as complete as they are in flagship stores, but the prices are quite reasonable. Yet locals don’t usually shop there.

Interestingly, according to Trip.com, Changchun travelers are the primary shoppers in Sanya, spending an average of around $600 (4,000 RMB) on shopping during their trips. Of the top-ten cities where residents spend the most when traveling to Sanya, four cities are in the northeast region of China. Travelers from the northeast seem to favor Sanya’s warm weather and are also big spenders at the duty-free malls.

Retail snapshot#

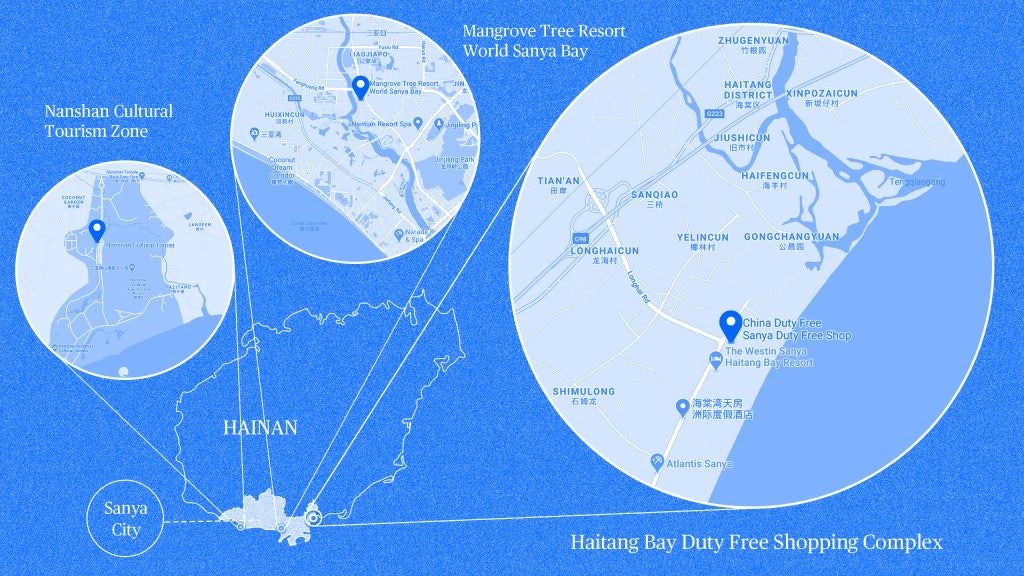

China Duty Free Mall#

The CDF Mall in Sanya operated by China Duty Free Group (CDFG), which opened in September of 2014 and is also known as the Haitang Bay Duty-Free Shopping Complex, is the only duty-free shopping center in the city. With a total build-out area of approximately 1.29 million square feet (120,000 square meters) and a carpet area of 775,000 square feet (72,000 square meters), the mall is currently the largest stand-alone duty-free shop in the world.

Since the offshore duty-free policy for Hainan Province was issued in 2010, luxury travel retail sales have taken off there. The mall originally launched in Dadonghai Bay in 2011 but relocated to Haitang Bay in 2014. In this new location, surrounded by high-end resorts and hotels like Rosewood, Edition, and Atlantis and fueled by developed infrastructures around Haitang Bay, the mall attracts millions of international tourists and shoppers on their vacations.

The reopening of the CDF Mall not only brings over 300 renowned brands together, but it’s also the first tax-free location in Mainland China for ten luxury houses, including Prada, Giorgio Armani, and Rolex. In addition to the usual boutiques and counters, the shopping center also hosts spectacular brand launches and campaigns.

Along with supplementary divisions such as Hainan local specialties, dining services, entertainment, and leisure areas, the mall has grown to become a comprehensive experiential shopping destination and one of the most popular tourist attractions in Sanya.

While the CDF Mall in Sanya has undoubtedly been impacted by gloomy travel retail amid COVID-19, its e-commerce business has surged since it reopened on February 20. The mall now exceeds $6.3 million (44.28 million RMB) daily in e-commerce sales, according to the Moodie Davitt Report. Though it has yet to restore its pre-COVID foot traffic, the mall’s growing digital business will help drive online-to-offline shopping experiences, as in-store traffic continues to return.

Two new offshore duty-free experience stores#

The parent company of China Duty Free Group, China International Travel Service Corporation (CTS), announced that two new offshore duty-free stores had opened at the Nanshan Cultural Tourism Zone and the Mangrove Tree Resort World Sanya Bay in April. Both spots have smaller areas and volumes than the Haitang Bay Duty Free Shopping Complex, but each features experiential travel retail stores that encourage customers to order products online. Located in two of the most popular tourist destinations in Sanya, the new stores make offshore, duty-free shopping convenient for travelers staying farther away from Haitang Bay.

According to the Sanya Tourism Bureau, the duty-free experience store in Mangrove Tree Resort World Sanya Bay covers an area of roughly 740 square meters. In addition to typical product displays, the shop is equipped with an e-commerce experience area and professional sales staff who help customers better understand Hainan’s offshore duty-free policies.

What Luxury Shoppers say about Sanya#

In general, most Chinese shoppers still identify Hainan as a family vacation destination, even though duty-free shops may have alluring discount offers and huge shopping spaces, it’s less exciting collections or activities to draw the younger crowd.

“I might purchase things that interest me, but because Sanya is more of a family travel destination instead of a shopping one, I don't typically prepare for big spending. I do enjoy the experience of going to a big mall though.” – Gen Z college graduate. Gen Zers find Sanya duty free shops less interesting.

“If I happen to be on a family vacation, I would go to the Haitang Bay Duty Free mall because it’s cheaper. I’m typically interested in handbags and cosmetics.” -- Middle class traveler, female, full-time mother, age 40+. Their income does not usually allow them to travel outside the country.

“Sanya duty free shopping malls carry outdated and limited items. I’d much rather go to the US or Europe to purchase cheaper luxury items with more variety.” – High-end shopper, female, age 40+.

“I went to Hainan during the May golden week to shop at the CDF Mall in Haitong Bay. The discounts are alluring, 25 percent off on three items and all duty free. Long lines are formed outside of luxury fashion stores like Gucci, Prada, Miu Miu and Cartier, those items are not as complete as flagships in the city, but pricing is quite attractive. Locals don’t usually shop there, mostly are still tourists. My family purchased housing about 6 to 7 years ago, but then the real estate market cooled down after then, now there is a significant trend of the government developing Sanya again.” – May Zhou, Fashion PR, family houses in Sanya and vacationed there frequently.

What experts say about Sanya#

In addition to local consumers who show stronger interest in Sanya due to its early recovery and newly launched duty-free policies, business insiders are on board with the promising outlook. Experts who have kept a keen eye on the development of the duty-free island say that the future looks even brighter. Jing Daily talked to three of them to gauge what travel retail would look like in the next few years:

"Indeed, Sanya is becoming increasingly popular as a shopping destination in China due to a large number of reasons. Since Hainan offshore duty-free policy launched in April 2011, visitors’ duty-free shopping allowance has been easing from 5,000 yuan then to 30,000 yuan now. Just a few weeks ago, the government announced a new annual limit of 100,000 yuan but no date is set for implementation yet. Moreover, after each adjustment of tax policy over those seven years (2011-2018), each year duty-free sales were increased by more than 20%.

I do believe that Sanya will see a growing influx of Chinese tourists and a shift to domestic spending for the coming years. Additionally, the 'Hainan free trade port' plan aims to facilitate investment and cross-border capital flows; so it can be assumed that imported goods will be exempted from tariffs on the whole island meaning golden terms for shopping allowing to set more attractive prices for luxury retailers." – Sofya Bakhta, Marketing Strategy Analyst at Daxue Consulting

“Due to COVID-19, Chinese consumers cannot travel overseas due to travel bans, but lots of them want to support their local economy by travelling closer. While some international cities heavily relying on Chinese tourists will suffer for the near future, this is creating an opportunity for touristic destinations in China such as the beautiful island of Hainan with its crystalline water and modern and comfortable hotels. Brands and especially luxury brands, should have more than ever an omni channel experience, bringing a seamless shopping experience to their clients rather than opening plenty of stores.” – Louis Houdart, founder & CEO of Creative Capital

“With most other markets severely restricted due to COVID-19, Hainan is currently the only game in town for beauty companies in travel retail. That is boosting the priority given by brands to offshore duty free and we see it becoming even more important in future.

Morgan Stanley reckons that China’s duty free market will more than double by 2025 to around US$16.5 billion, with the Hainan contribution shooting up from 24% in 2019 to around half in 2025. We think the growth and the 2025 share might be even stronger than that, especially as tourism infrastructure is built up in Hainan.” – Martin Moodie, Founder & Chairman, The Moodie Davitt Report

Key takeaways for brands#

Given Sanya’s complicated consumer demographic, brands must localize their travel-retail strategies. Therefore, we’ve concluded our Sanya city guide with seven key takeaways for brands that are looking to better resonate with travel shoppers during the COVID-19 pandemic.

Given the on-going international travel restrictions, “China’s Hawaii” is going to become more popular than ever. So brand marketers should seize every opportunity they can to connect with visiting families and couples.

While duty-free prices are the main driver for consumer shopping in Sanya, buyers will expect the same fresh, full inventory as flagship stores in the home cities have. In addition to ensuring a supply of best-selling products, limited Hainan-inspired drops and pop-up shops can fulfill consumer shopping experiences and motivate them to go back inside the stores.

The new scheme, which improves a visitor’s annual allowance for offshore duty-free shopping, presents huge opportunities for luxury brands. The improved quota encourages shoppers to purchase larger amounts of goods and leaves room for higher-priced luxury products.

But brands should be cautious of the new Hainan daigou in replacement of the established Hong Kong daigou, as the former are likely to take advantage of the raised allowance despite a recent regulation that punishes anyone who benefits financially from making duty-free purchases for others.

Considering the success of mixed-use buildings and Gen-Z’s increased interest in shopping experiences, Sanya malls and brands should focus on making an entertaining physical location by incorporating indoor activities, especially as they’re fighting beach and resort attractions for consumer attention. If brands in the duty-free mall can become a landmark that attracts families, sales could jump from unconscious spending.

The CDF Mall is competing against lower prices and a more up-to-date pool of luxury items in the Western hemisphere, so it will be challenging to win over high-end shoppers. However, residents in certain cities like Changchun are willing to spend more money than others, so brands can increase their revenue by collaborating with travel agencies and marketing their duty-free stores in specific regions to attract travelers.

According to Trip.com, 40 percent of all Sanya travelers are under the age of 40 — with the percentage of Gen-Zers rapidly rising — and they are attracted to a “youthful” atmosphere like Sanya’s. Therefore, brands and malls must target these specific demographics.

Reported by Yaling Jiang, Wenzhuo Wu, Jennifer Zhuang and Ruonan Zheng.