This post originally appeared on Walkthechat Blog, our content partner site.

Once upon a time, there were very few social networks in China. Renren was dying out, Weibo was getting kicked in the gut by WeChat which was growing double or triple digits.

Fast-forward to 2019, these days are long gone. There is now a plethora of social Apps to choose from. Is WeChat still growing in this new Chinese Internet?

The beginning of the end for WeChat?#

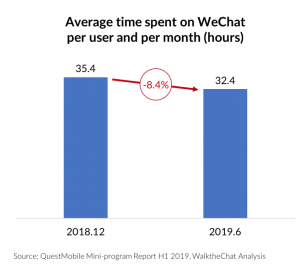

There are certainly some clouds in WeChat’s sky. A recent report by QuestMobile indicates that the time spent on the WeChat App dropped by 8.6% between December 2018 and June 2019.

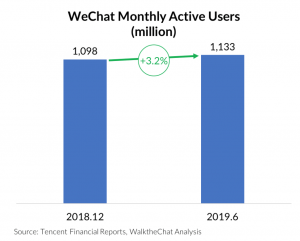

Although WeChat continued to grow its user base, the increase of 3.2% of Monthly Active Users (MAU’s) during the same period did not offset the loss of engagement.

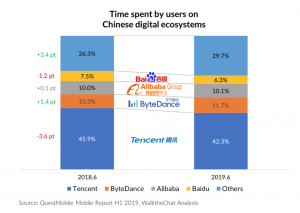

The decrease of engagement on WeChat is mostly due to competition from ByteDance (mostly via Douyin and Toutiao).

Other smaller Apps also have taken market share from the Chinese Internet giants, leading to a less concentrated market.

Deceleration of advertising growth#

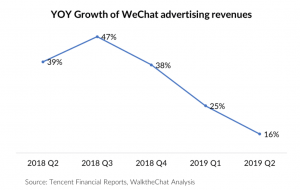

On the financial side, advertising revenues have disappointed analysts’ expectations.

YOY growth of Tencent advertising has reached a low of 16% for Q2 2019. The growth of Tencent’s ad revenues is following a steady downward trend for the last year.

This decrease was likely the result of a fiercer competitive environment (especially with competition from ByteDance) and challenging macroeconomic context.

James Mitchell, chief strategy officer at Tencent, stated in an earnings call: “Our assumption is that the macro environment will remain difficult for the rest of the year and that the situation of the heavy supply of advertising inventory will continue for the rest of the year and potentially into next year.”

The silver lining of WeChat Mini-programs#

The growth of WeChat advertising revenues is decelerating, and the increase in MAU’s has been sluggish. But WeChat has one thing going for it: Mini-programs.

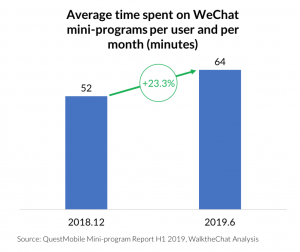

While time spent on WeChat decreased by more than 8% in 6 months, time spent on WeChat mini-programs actually increased by more than 23% during the same period.

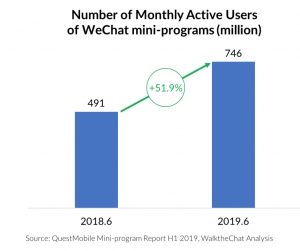

The number of MAU’s of WeChat mini-programs also boomed. It grew 52% YOY to 746 million MAU’s.

Conclusion#

With more than 1.1 billion monthly active users, WeChat remains the main social network in China.

But WeChat is also an App which became too slow to seize some major opportunities: it missed the switch toward video and is still lagging behind in terms of advertising compared to Western competitors such as Facebook.

WeChat Mini-programs also enabled the App to keep an edge over competitors by becoming more of an ecosystem, and are proving to be a winning bet for Tencent.

It is, however, undeniable that we now live in a much more fragmented digital ecosystem than we did two or three years ago. WeChat is still a must-have social channel. Brands are also looking beyond it at the right mix of other platforms to complement their digital marketing footprint.