Overseas fast fashion brands have been struggling in the Chinese market over the last two years, and with significant profit drop-offs, stores like H&M to Forever 21 are pulling back on planned expansions in the country.

According to its annual report, H&M’s net sales growth in mainland China slowed from 7 percent in 2016 to 3 percent in 2017. Also in that year, ZARA closed its Chengdu flagship store (its largest in mainland China), while H&M was forced to scale back its physical expansion and put its hopes into e-commerce instead. According to H&M’s latest six-month report, two more stores were closed in the first half of 2019. Meanwhile, British fashion retailer Topshop pulled all its products from Tmall, exiting the mainland market last November. Forever 21 has also completely backed out of the country, shuttering their online presence and closing all stores.

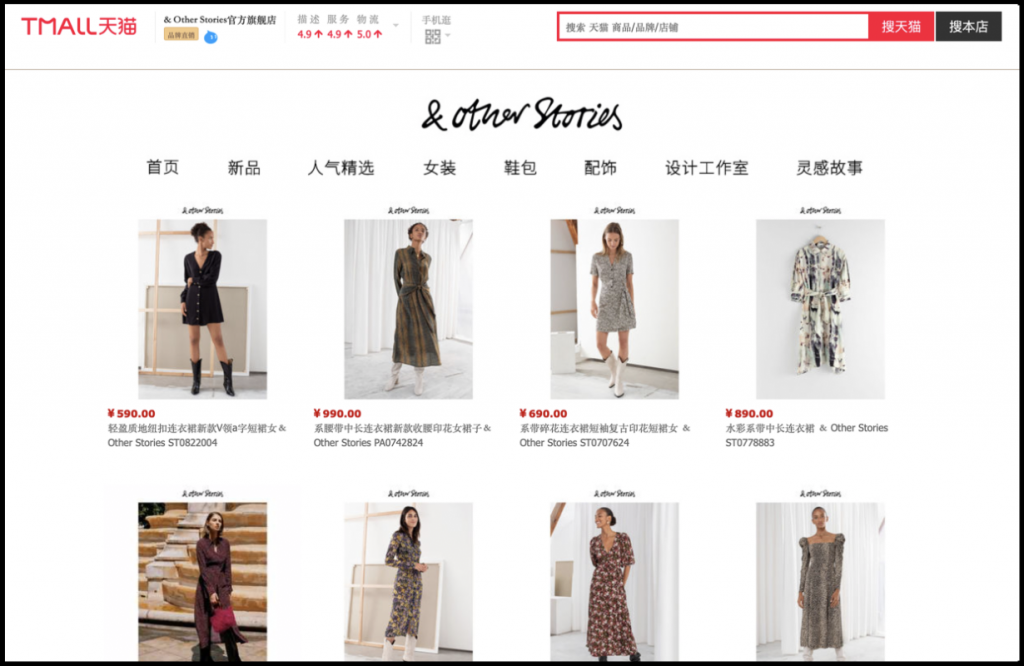

But COS, H&M Group’s high-end, fast fashion option, has been seeing consistent growth, having opened 37 stores across 19 cities in mainland China since it opened in 2012. Now, H&M Group is bringing & Other Stories, COS’ sister brand that offers women’s apparel and beauty products, to China, where it launched on Tmall, on August 29.

While overseas fast fashion brands were quick to enter the Chinese market, they’ve had a hard time competing with local online retailers on websites like Tmall and Taobao. Chinese tastes have also shifted toward more elevated options, which offers an opportunity to high-end, fast fashion brands but hurts entry-level fast fashion. McKinsey & Company’s research suggests that more than 75 percent of China’s urban consumers will enter the middle-class bracket by 2022. While this presents a huge opportunity to many brands, specifically fast fashion brands targeting the middle-end market, understanding segmentation within this demographic will be vital to ensuring success. The key question: Will this new consumer prefer COS or H&M?

This growing middle class is made up of seasoned shoppers who have a long-standing relationship with online retailers like Tmall and Taobao — e-commerce sites that already provide many affordable fast fashion options similar to Forever 21 or Topshop. “Chinese consumers have easy access to a variety of home-grown and affordable fashion brands online that pose a bigger challenge to brands like H&M and Zara,” says Ray Ju, the New York-based senior consultant of the global brand consultancy Labbrand. As this consumer steps into a new bracket, they are looking for new options that they can’t already find online: clothing with an affordable price point but with higher quality and design.

Local customers have shown waning interest in fast fashion in recent years, complaining about bad quality and uncompetitive prices compared to local brands on Taobao. “Zhang,” a 25-year-old white-collar female based in Shanghai, said that she hasn’t purchased fast fashion apparel like Zara and H&M since graduating from college. “Zara’s low price and trendy style were appealing to me when I was a student, but now I pay more attention to fabric, cutting, and design,” she states. “Many styles of COS are similar to high fashion brands like Lemaire and Jil Sander, but COS is much more affordable.”

As higher-end fast fashion brands like & Other Stories develop their strategies to enter the market, they’re faced with a decision between digital and brick-and-mortar options. Unlike its sister brand COS, & Other Stories has settled on Tmall as its first sales platform in China. Tmall presents one option (launching an online flagship store) for fast fashion or luxury brands looking to dip their toe into the China market. It’s a practical way of scrutinizing the landscape while also limiting company investments.

According to Tmall’s official website, Tmall asks for a deposit around $14,000 (100,000 RMB) for a flagship store, an annual service fee of $8,362 (60,000 RMB), and a commission of 3 to 5 percent (this quote is based on & Other Stories’ case, as fee schedules vary depending on the category, and there’s a higher entry fee on the Tmall Global platform.) Launching on a site like Tmall saves brands a considerable amount of money versus building and operating physical stores. However, a digital-only strategy requires an extremely strong product, since, again, overseas brands are competing with a wide range of offerings online. “You are going to see fast fashion brands that have a stronger brand ethos and curate their products based on that foundation become more successful,” says Ju about the success of COS and Uniqlo in China.

A variety of similar options suggested by Taobao, as well as product reviews from previous customers, are continuously shaping purchasing decisions in China’s online market, making it extremely difficult for newer players to enter. However, premium fast fashion brands tend to stand out from the competition thanks to higher quality and elevated product design, but those brands still need to find alternative channels where they can communicate their identities to Chinese consumers.

The popular Chinese fashion influencer Savi (@SavisLook) recently shared her visit to & Other Stories’ Stockholm-based studio on her daily vlog, where her post received over 202,000 views in 10 days, on Weibo. The video has been driving conversations on the platform about the debut of & Other Stories in China’s online market. Collaborating with a KOL who owns an already-engaged audience is undoubtedly an efficient way for a new player to infiltrate the market, and introducing a brand through a beloved blogger’s personal and intimate narratives is a convincing way to deepen customers’ understanding of the brand.

Once they’ve established themselves online, building a physical presence allows brands to interact with their consumers even further. COS’ pleasant fitting experience is a perfect example of how brick-and-mortar stores can present an advantage for brands. “COS Fitting Room” is a hot topic on the much-hyped social app and e-commerce platform Little Red Book, where customers post selfies inside COS’ fitting rooms, share their outfits, and hashtag the brand. The COS’ fitting room has been commended by Chinese customers for its minimal interior design, attractive lighting, and ample space, positioning the brand as more luxury than fast fashion. This invaluable in-store shopping experience reaffirms COS’ philosophy of timelessness while also impressing customers.

Having seen success in European and North American markets, & Other Stories’ infiltration of the Chinese market seems promising. As the “middle child” between H&M and COS, the price and positioning of & Other Stories match it nicely with China’s newest market gap. But challenges from home-grown fast fashion brands and the sophisticated demands of Chinese customers await this new player. Whether it can deliver advanced products and unique experiences is key to seizing this opportunity. That’s because both established and emerging middle-class Chinese consumers want a high-end experience — whether it’s luxury or fast fashion, digital or in-store.