Video-driven e-commerce has been around since 2016 when e-commerce platforms Mogujie and Taobao began hosting livestreaming sessions on their platforms.

But only recently has this trend taken off, with Taobao generating a whopping US15.1 billion (100 billion RMB) in livestreaming transactions in 2018.

Now, video platforms such as Douyin and Kuaishou are selling Taobao products, and other social media platforms such as WeChat, Weibo, and Little Red Book are getting into the mix by testing e-commerce functions as well.

We discuss what's going on and what brands should keep in mind going forward.

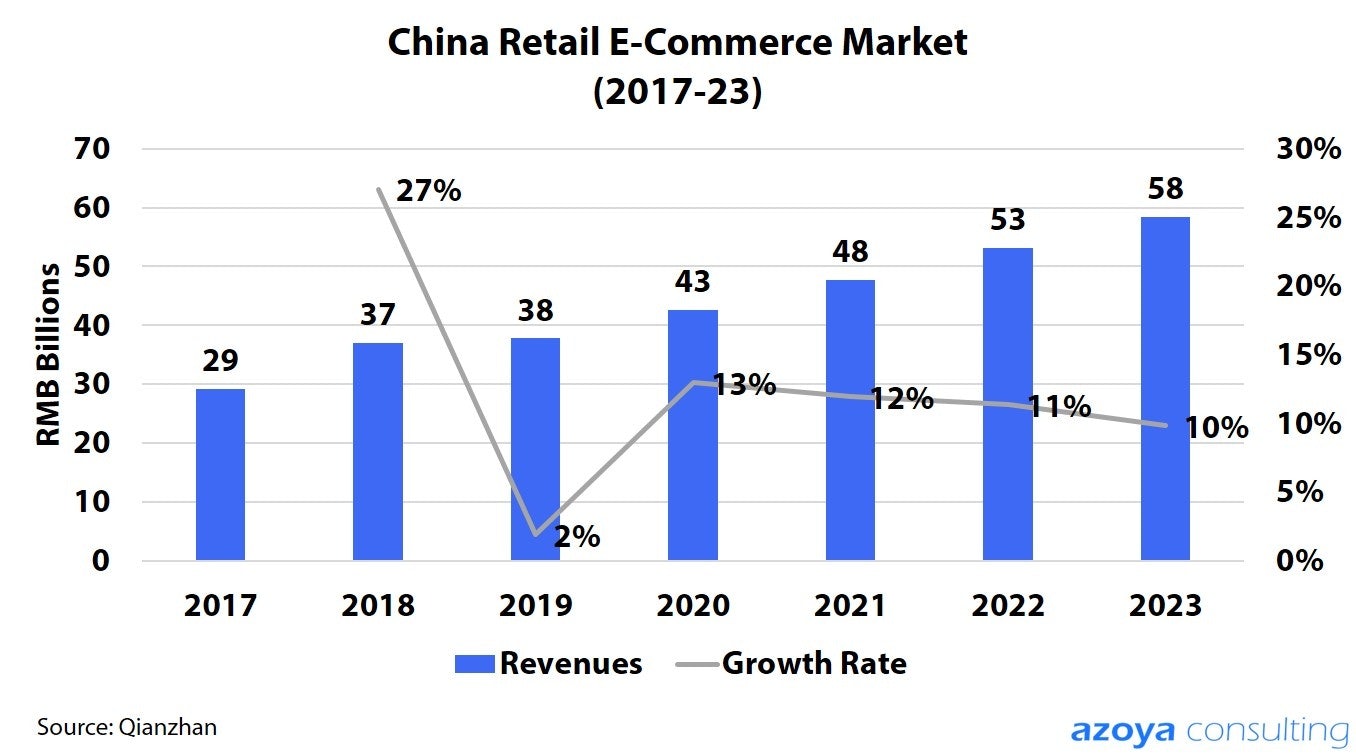

China's E-Commerce Market is Maturing, and Brands Need to Shift Their Focus

In the world of e-commerce, there are three types of customers to target:

- users who know what they’re looking for

- users who don’t know what they’re looking for but are browsing online

- users who don’t have plans to buy anything at all

E-commerce platforms have figured out how to serve the first two groups of customers. They possess massive amounts of customer search & purchasing data, and brands can leverage a combination of AI-powered recommendation technology and advertising tools to reach their target customers.

But now growth is slowing, the platforms in China are getting crowded, and bidding prices for search keywords and ads are getting more and more expensive as the number of brands multiply. There are already 20,000 international brands on Tmall Global alone, and the customer acquisition costs are rumored to be in the 200-300 RMB range.

The next stage of e-commerce will focus on the third group of customers - those who aren't active on the big platforms and have no immediate plans to make a purchase.#

To target this group, brands must work increasingly with third-party social platforms and create great content to grab their attention. This is where video comes in.

Not only is video content eye-catching, but it also provides a channel for customers to see how a product looks and feels in real life.

This shortens the customer journey, and customers are more likely to make impulse buys. According to Taobao Live, the conversion rate for livestreaming can reach as high as 32 percent, an astronomical figure in today's competitive e-commerce environment.

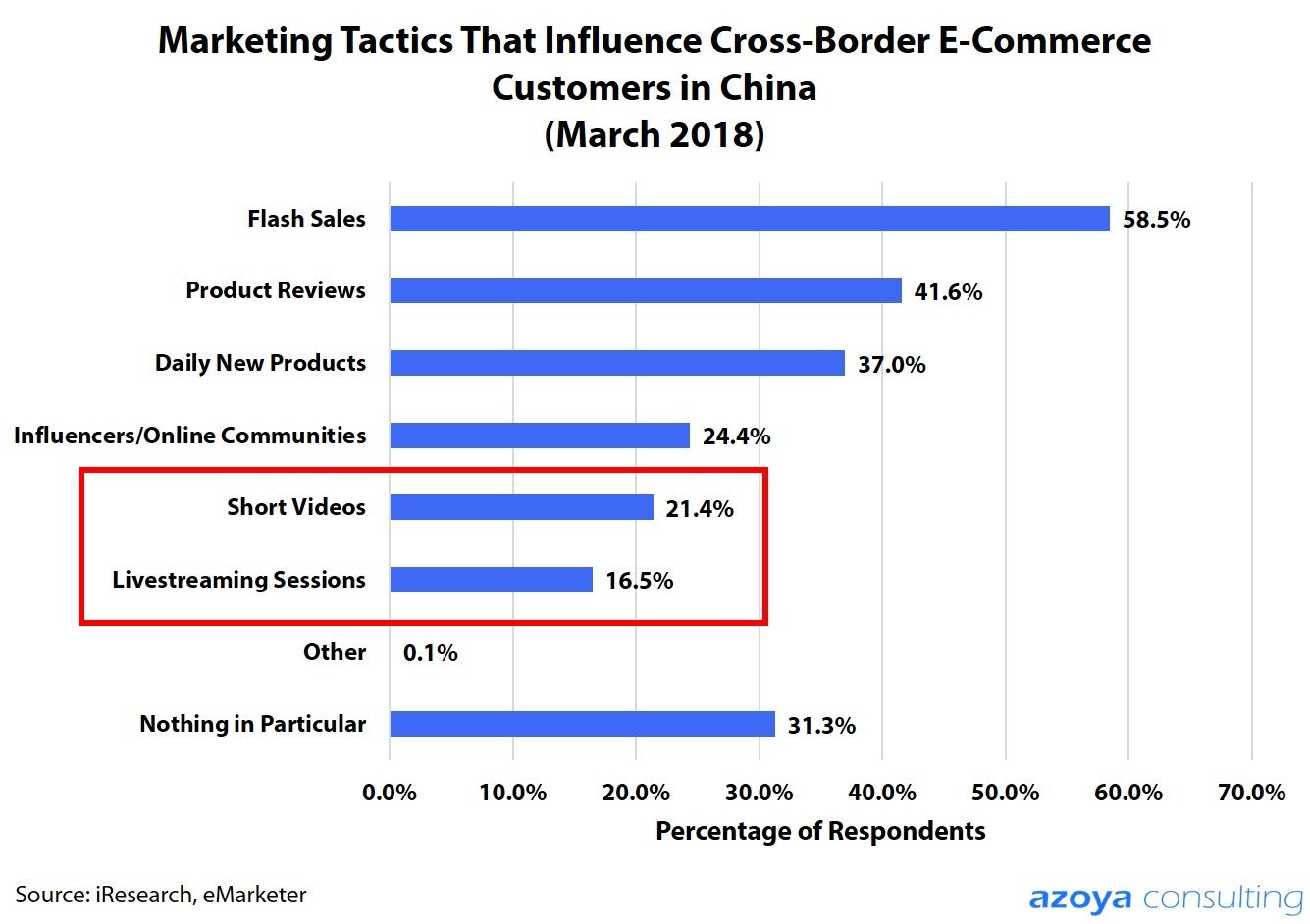

Short Video vs Livestreaming for China E-Commerce

Should brands use short videos or livestreaming sessions to market and sell their products?

The short answer is, it depends.

There are a few key differences between short videos (Douyin, Kuaishou) and livestreaming (Mogujie, Taobao, Shopshops) video sessions.

Short videos are 10-20 second videos. They are static pieces of content that can be quickly digested, and the user can quickly decide whether or not to dig deeper or move onto the new video. For example, the Douyin interface requires the user to slide the screen up and down to access different videos recommended by the platform.

Because of their short nature, these videos have to quickly capture the attention of the viewer. Common themes will involve people dancing, working out, or even walking on the street, etc. Some even stage videos in which the models walking in public behave as if they're being discovered by a street photographer for the first time.

In the Douyin snapshot below, KOL Zhang Dayi prances along a street in Japan with her friends while wearing a polka dotted yellow dress, which can be purchased through a Taobao link.

During last year’s Double 12 Festival (December 12), Douyin short videos drove over 200 Million RMB in sales for Taobao.

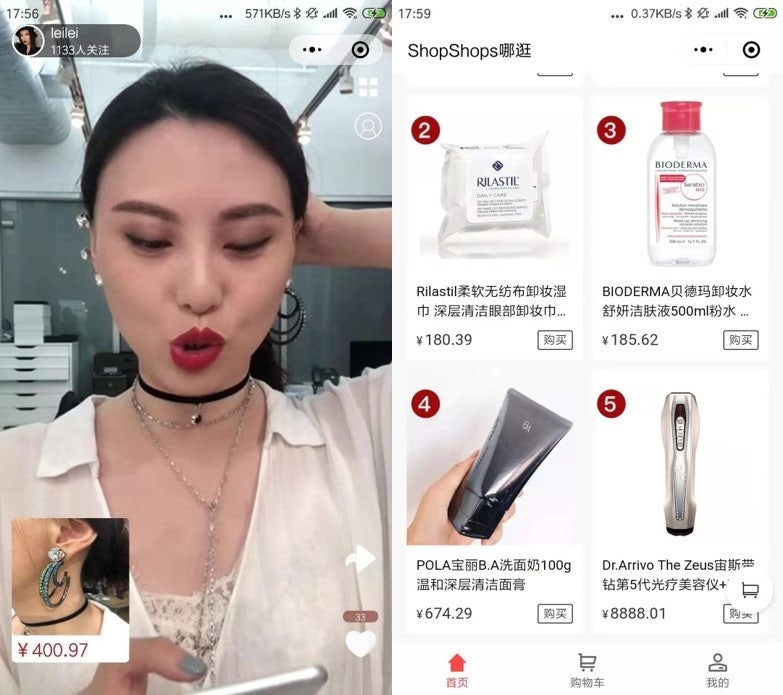

Livestreaming, on the other hand, is a much more involved and interactive phenomenon that is part of the shopping discovery experience. Livestreaming hosts will try on and discuss 4-5 products over a 40-60 minute period, and viewers can comment and ask questions in real time. They can ask questions about the fit, color, material, etc. and even ask the host to try items on with different outfits or in different colors.

Below, a host from cross-border livestreaming platform Shopshops shows off a pair of earrings. The right picture displays top-ranked products sold on the platform.

In a sense, livestreaming is like QVC on steroids. The interactive nature of livestreaming builds a much stronger sense of trust with viewers, which is important for new or complicated products where it takes longer to get the customer to make a purchase.

This could include apparel, where the items are non-standardized SKUs and could look and feel drastically different in real life, or it could include multi-step makeup routines where customers go through elaborate procedures to apply their products.

Skincare products that have special chemicals solve a functional need are also another example.

However, because of their length, livestreaming sessions require much more time and work to plan and execute. Fixing up hair and makeup, and coming up with topics and questions to talk about can take hours. Many livestreaming hosts work over 12 hours a day, and sometimes even go through plastic surgery to keep their youth appeal.

The Road Ahead#

Video will be a major driver of e-commerce in the coming years as e-commerce platforms, brands, and retailers alike look for more channels to reel in customers. Taobao executives say that livestreaming could potentially drive 500 million RMB in sales over the next three years.

What else is on the horizon? This year, WeChat, Weibo, and Xiaohongshu have each tested the incorporation of livestreaming- and short video-driven e-commerce on their respective platforms. Given their large user bases, this could open up many opportunities for brands and retailers.

The challenge for social media platforms is 1. - maintaining the quality of the content and the user experience, and 2. - ensuring that their e-commerce partners' supply chain and logistics operations are on par with the expectations of their users.

For brands and retailers, they have to consider whether each platform and their respective user base is a good fit for their products, as well as how effective the targeting technology is at driving ROI.

While video-driven e-commerce is still in the early stages, brands and retailers should keep these considerations in mind for the road ahead.