The same day it reported strong fiscal third-quarter earnings, the American premium beauty giant Estée Lauder Companies (ELC), which is the parent company of brands like Estée Lauder, La Mer, MAC, and Tom Ford Beauty, announced it would cut retail prices in mainland China — a move meant to sustain the company’s robust growth in the market.

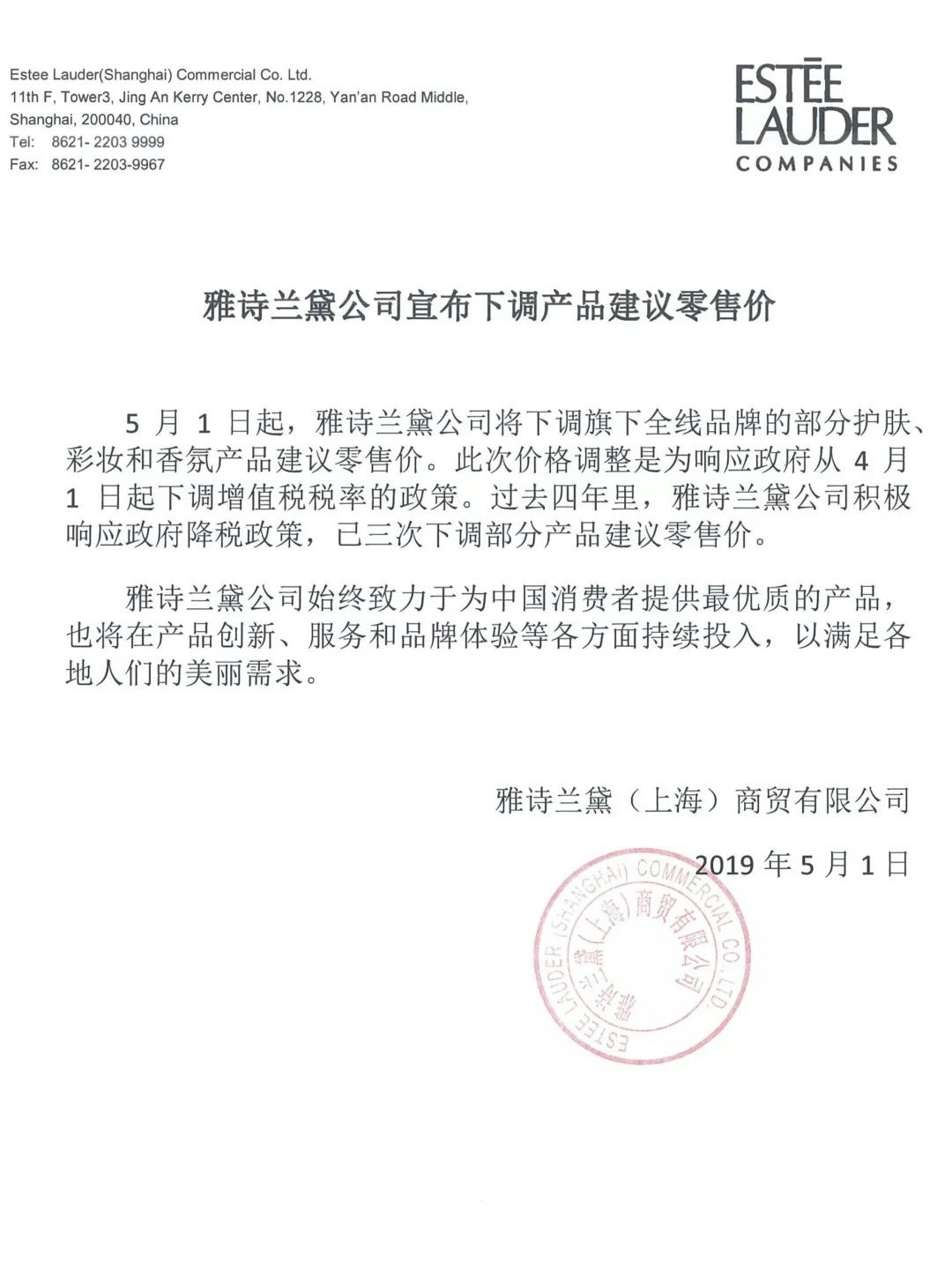

On May 1, ELC’s Chinese subsidiary released an official statement reporting that the company plans to cut the suggested retail prices of certain skincare, cosmetics, and fragrance products from all of its brands. The price drop is the fourth from ELC since 2015 and is also a direct response to the recent import tax cut by the Chinese government that went into effect on April 1.

Last week, ELC's major rival in China, LVMH’s beauty division, also lowered retail prices for its labels Christian Dior Perfumes and Givenchy Beauty by two to five percent.

The latest ELC price drop in China can possibly offer a strong boost to the company’s fastest-growing market. In the third quarter of the 2018 fiscal year, ELC saw the business of its key brands soar in the Chinese market despite concerns about an economic slowdown and trade tensions. Overall, the company experienced an 11 percent increase in net sales year-on-year, primarily due to the China market, pushing global earnings to 3.74 billion by March 31, 2019. ELC raised its full-year sales guidance to expect growth of 11 percent from 10 percent.

“We had anticipated gradual growth in China and travel retail starting in the quarter, which didn’t happen, and that contributed to our overachievement,” said Fabrizio Freda, President and Chief Executive Officer, during the conference call. "Nearly every one of our brands rose by strong double digits in China, as did all distribution channels.”

Aside from the continued strength of the company’s signature brand Estée Lauder, which has been producing solid retail sales and social media strategy in China, ELC’s other brands like La Mer, Tom Ford, and MAC all saw their businesses burgeon in China during that same period. Freda noted, for instance, that La Mer’s relaunch of “The Concentrate” line had a staggering 60 percent jump in sales during its first four weeks in China. MAC’s sales on Alibaba’s B2C marketplace Tmall was ranked number one in the category of “Prestige Makeup,” and Tom Ford also debuted successfully on the platform.

In spite of the strong earnings, stock investors are divided on the outlook of Estee Lauder Companies, primarily due to its sluggish business performance in the United States. Investment company Telsey Advisory Group raised its price target per share from 190 to 195, while others like RBC and D.A. Davidson from “outperform” to “perform.”