This post originally appeared on WalkTheChat.

Ocean Insights, a Bytedance subsidiary, released a Douyin Beauty Industry Report 2020. The report shows Douyin is increasingly becoming a good marketing channel for beauty and cosmetics brands.

Some highlights for the Douyin beauty industry includes:

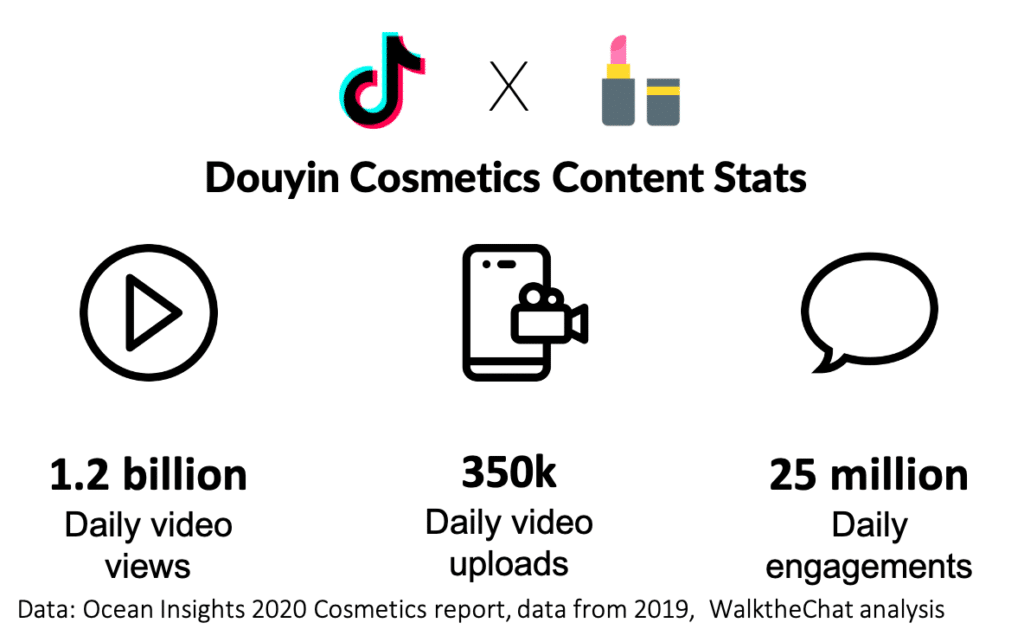

- Daily video view reached 1.2 billion

- Beauty video content has increased by 228% YoY in 2019, above the average Douyin YoY growth of 192%

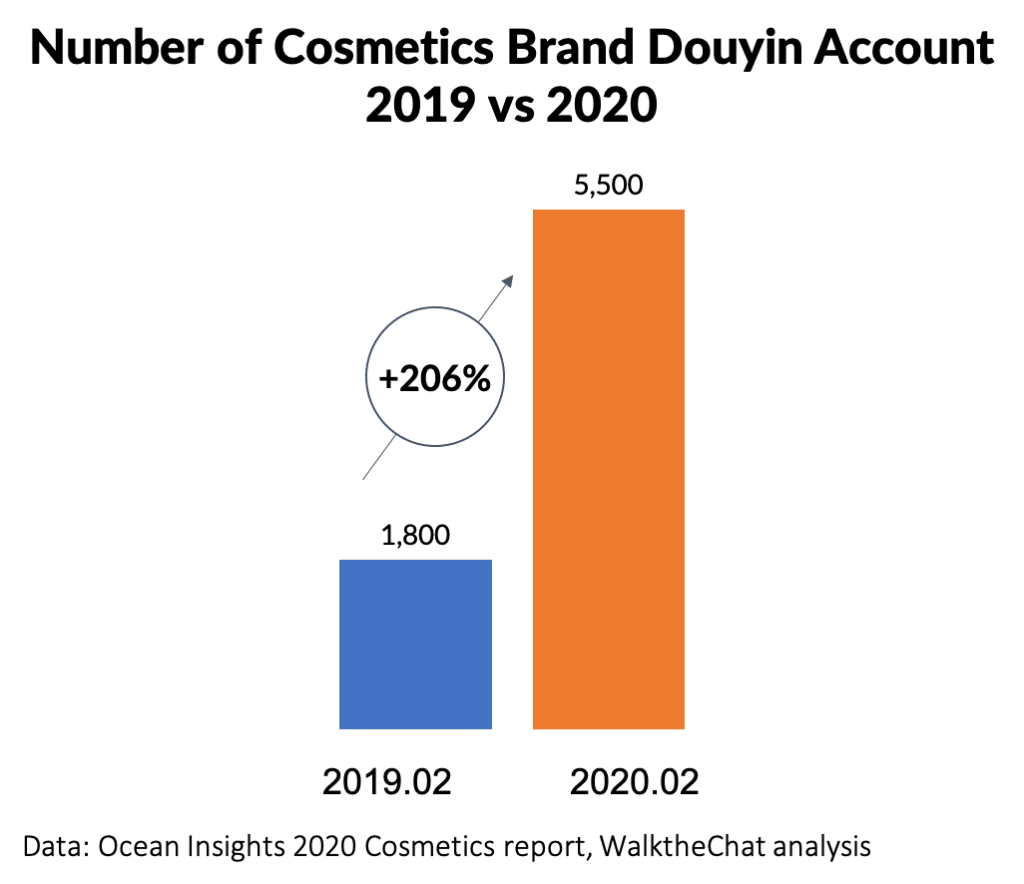

- The number of company Douyin account increased by 206% YoY to 5,500 in Feb 2020

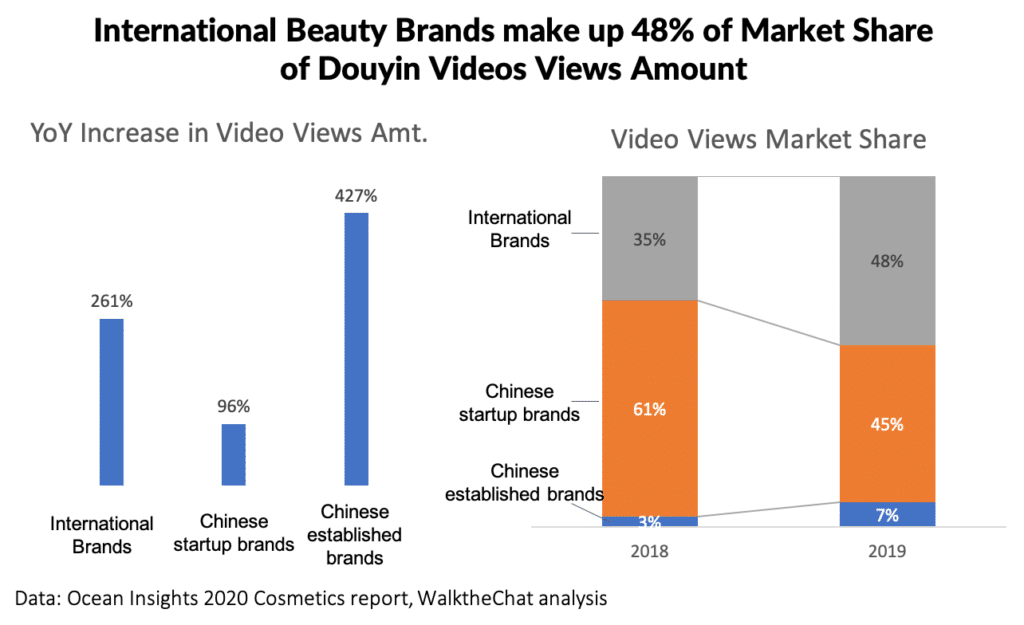

- International brands now make up 48% video view market share

- Luxury beauty brands content has 30% market share

- 32% of users who watched beauty videos have clicked on an e-commerce link at least once

Douyin Beauty & Cosmetics Industry Statistic#

Compared to the overall Douyin content, the beauty & cosmetics industry experienced faster growth in video amount, views, and likes. Video views in the cosmetics industry increased by 220% YoY. This growth is almost twice faster than platform-wide 138% YoY growth.

Demographic of beauty & cosmetics users on Douyin:

- 51% of female

- 46% of users are below 30 years old

- 44% of users are from tier 1 and tier 2 cities

Cosmetics Brands on Douyin#

The amount of brand’s official Douyin account increased from 1,800 in Feb 2019 to 5,500 in Feb 2020, a 206% YoY increase.

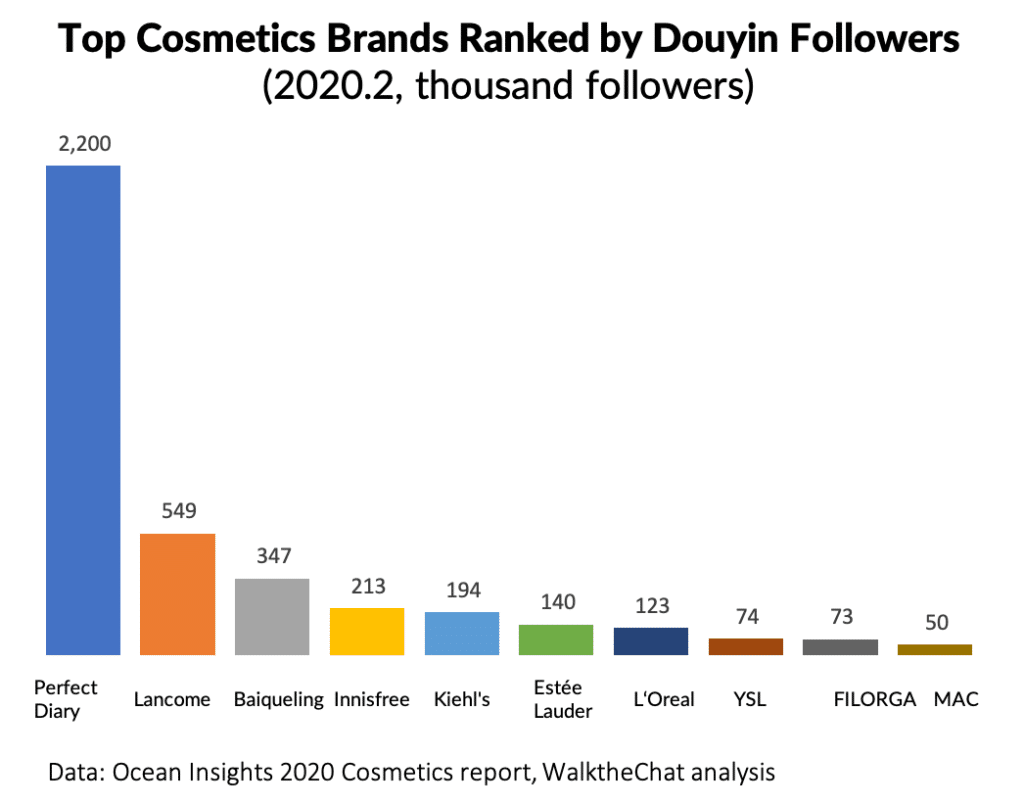

Among the top 10 cosmetics brands on Douyin, 70% are international brands. Perfect Diary is still by far the largest Douyin cosmetics account, the follower amount is larger than all the rest combined.

International brands now have half of the market share in video views. Their view amount grew 261% YoY in 2019.

Chinese established brands are also increasing at a fast 427% YoY speed.

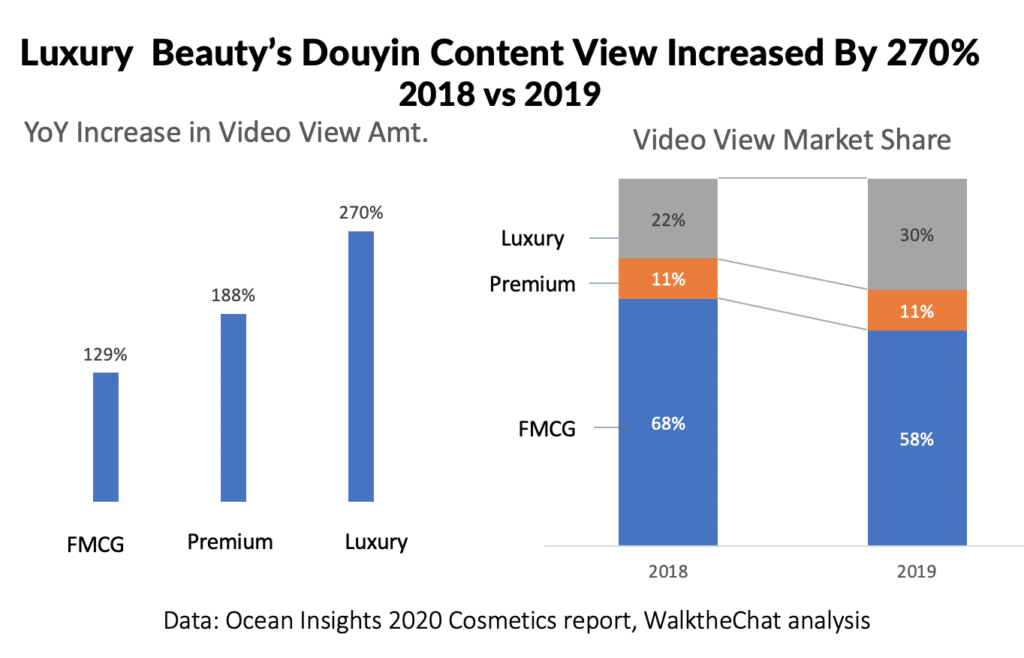

Video view from luxury brands is increasing at a rapid 270% YoY rate. Premium and luxury brands now take 41% market share in video view.

Comparatively, Chinese beauty brands have adapted well to the Douyin environment. The following are one of the fastest-growing Chinese startup brands in beauty and cosmetics. Even the top-ranking brand Perfect Diary has grown 20 times in 2019.

Douyin’s E-commerce Potential#

32% of users who watched beauty videos have clicked on an e-commerce link at least once.

Other than direct e-commerce conversion, Douyin is also used as a search platform before users make a purchase. For example, the Douyin search volume of beauty-related keywords peaks right before the Single’s Day and Double 12.

Each brand has a different marketing focus for shopping holidays. Based on the index, Women’s Day and Single’s Day are the most popular holidays to promote on Douyin. Brands might or might not decide to invest in the other shopping festivals. For example, Lancome focused on Chinese Valentine’s Day, while SK-II focused on the October Holiday.

Conclusion#

Douyin is already an essential marketing channel for beauty and cosmetic brands, on top of WeChat and Little Red Book.

More and more luxury and international brands are grasping the mechanics of Douyin marketing. Before you know it, it could be the next top-performing social e-commerce channel.