Labor Day, 520 Valentine’s Day, 618 Mid-year Shopping Festival – these successive marketing occasions have actively engaged brands, retailers, and e-commerce platforms over the past month alone. And, to encourage consumers to spend, China’s local governments and e-commerce giants have splashed out billions of virtual vouchers and digital coupons. Their respective initiatives aim to stimulate demand and accelerate local business dominance.

Unlike western countries, China’s savings culture holds up despite the rapid economic development of the country. As of the end of 2019, China had the highest national saving rate: 45 percent of gross domestic product. Thus, compared with handing out cash relief to citizens – which might further result in savings - vouchers can drive spend, helping the industries impacted by COVID-19 to resume their business.

To date, over 190 cities in China have issued vouchers to its citizens. Though the leverage ratios measuring worth of vouchers to the actual consumption stimulated vary from single-digit to double-digit, the cities that have achieved remarkable results from the voucher strategy are predominantly economically developed regions with relatively strong spending power.

On May 4, China’s primary commercial and financial hub, Shanghai, initiated “Double Five Shopping Festival” to boost local consumer spending. As reported by local media outlet The Paper, sales from online channels approached RMB100 billion (14.14 billion) while offline sales amounted to RMB144.36 billion (20.4 billion) in the city by the end of the month.

On the heels of Shanghai’s effective coupon leveraging, the Beijing Municipal Bureau of Commerce announced the kickoff of the capital’s “Shopping Season” on June 6 where it handed out vouchers worth RMB12.2 billion(1.73 billion).

As fashion and beauty sectors have both benefited from the voucher scheme, Jing Daily has analyzed online and offline channels in order to identify what the policy means for global brands, and how they can leverage it to help their own businesses in China.

Partnering with e-commerce partners is essential#

Given the popularity of mobile payments in China particularly, these Government vouchers and coupons are mostly distributed through e-payment tools such as Alipay and WeChat Pay, as well as online marketplaces, including Tmall, JD.com, and Pinduoduo. With digital transformation on each global companies’ agenda in order to survive in China post-COVID, having an online payment partner means your consumers can easily access these vouchers distributed by e-commerce platforms, shopping malls, and other partner vendors.

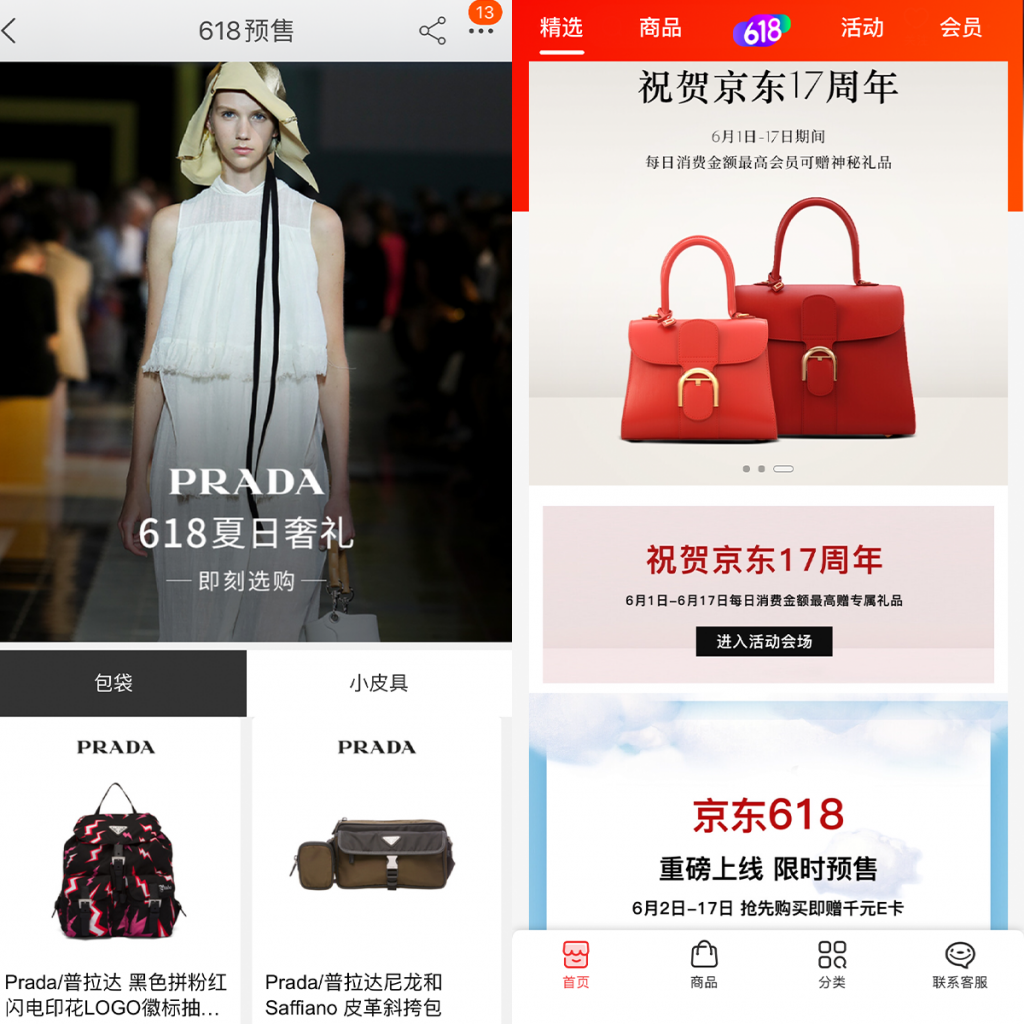

Equally notable, local e-commerce platforms are promoting their own site-specific bonuses and coupons to encourage brands to participate in these mid-year shopping seasons. Both Tmall and JD.com have committed to offer billions of dollars to fuel the shopping festival on June 18. To respond, global brands featured on the two platforms have launched either coupons or exclusive rewards to celebrate the event. According to the results of the first round of presale on Tmall and JD.com, both platforms have shown strong performance in fashion and beauty. Tmall’s beauty sales reached RMB100 million ((14.14 billion) within one minute while JD’s luxury sales increased 400 percent within one hour, exceeding the same period of last year.

In addition to driving sales, voucher programs provide a solution for brands to optimize their inventory amid the COVID-19 crisis. International players, from fast fashion, to sportswear, and luxury conglomerates, are all facing substantial challenges to their offline businesses. Given this, China is the region where they can redirect their products through seizing upon these digital incentives and marketing tools from e-commerce platforms.

More importantly, digital vouchers are being ingeniously offered to consumers; in addition to site-wide price break discounts, vouchers are developed to add value services. Flagship stores on Tmall, JD.com, and WeChat Mini Programs roll out exclusive drops, bonus points, and interest free payment plans as a way of rewarding customers. To support the Beijing shopping season in June, local luxury-focused e-commerce platform Secoo rolled out an intra-city express delivery service and handed out vouchers that can be used in high-end hotels in Beijing. These variations will not only eliminate markdowns and dilution of brand values, but also extend customers’ lifetime.

The voucher scheme goes beyond discounts#

Thanks to Chinese authorities and local media outlets publicizing the voucher scheme, social chatter has spread across the country. Now, this consumerist spectacle has been extended to offline resources too; local shopping malls, in conjunction with brands and retailers, are playing a vital role in fueling the recovery of offline channels.

As one of the most high-end shopping complexes in Shanghai featuring top tier brands such as Hermès, Louis Vuitton, and Chanel, Plaza 66 is a leading player to participate in the city’s Double Five shopping festival. In addition to gifting customers with cash vouchers, food, and beverage coupons, the mall curated a range of interactive programs. General Manager of Plaza 66 Ms. Janice Cheung said these included onsite installations, an Alipay augmented reality game, and a WeChat mobile game. Examples of ‘curatorial retail,’ these contributed to increasing the in-store footprints and the average time spent in the stores - all of which restore consumer confidence.

As distinguished from stand-alone flagship stores, brand boutiques depend on the shopping malls in which they are located. This ecosystem consisting of the mall and its tenants under various categories collectively drive the mall’s traffic. In Plaza 66’s case, purchases in any of the mall’s stores qualify for the promotion program; this means all tenants from fashion to food benefit, a tactic Plaza 66 has adopted to cultivate trust. Ms. Cheung noted: “We always value our relationship with tenants and partners, and have been engaged in collaborations with international brands to provide unique offerings and exclusive experiences for our shoppers, with the ultimate goal of a win-win situation.”

Plaza 66’s strategy also illustrates the sweet spot of the voucher scheme: reinforcing offline shopping experience and maintaining customer stickiness rather than relying on discounts. Indeed, the approach is resonating well with local luxury shoppers. Alice Chen, a Shanghai resident in her late twenties, shared her recent shopping experience with Jing Daily. “When I’m hanging around shops and malls I can feel that everything is coming back to life. Even if I came to the mall for dinner but not shopping, I love to stop by the boutiques to see if they have anything new.”

Moreover, what draws shoppers back to stores after lockdown is the congenial atmosphere – not necessarily how much discounts brands can offer. Therefore, the voucher scheme reaffirms local confidence and consumer sentiment. Chen who was unambiguous on her perception of the voucher scheme, stated: “I will continue to buy brands and products that I usually follow; discounts are only a slight driver.” Yet, brands can still optimize this opportunity to speed up their recovery in the China market; namely by approaching vouchers through new product launches, value-added services, and tailored collaborations with e-commerce platforms and shopping malls.