“Our sales are slowing down in Europe, even if we have a great media plan focused on premium media that have been long-time partners …” the senior executive of a famous fashion house said to me during a lunch meeting in Paris. My answer was quite simple: “I don’t think your final customers in Europe read French magazines. I believe that your typical client is probably a young woman glued to her smartphone, reading bag reviews on WeChat in Chinese.”

My name is Akim Mousterou, I’ve been a business consultant specializing in the fashion and luxury industries for more than 10 years.

The fast-evolving Chinese consumers have a strong impact on the luxury industry in both China and abroad. In their daily life, Chinese customers have already incorporated seamless shopping experiences into their lives – more than their European and American counterparts. With a thirst for knowledge, Chinese consumers are becoming more experienced about the topics of design and craftsmanship. When fashion houses are just barely starting to understand millennials on Instagram, most of them are completely “lost in translation” with Chinese millennials on Sina Weibo or WeChat.

For fashion brands, the key to growth is to attract the hyper-connected Chinese customers. The great unsolved mystery is how to be relevant on social media platforms composed of a billion monthly active Chinese users.

In a report from McKinsey & Company, titled “Chinese luxury consumers: More global, more demanding, still spending”, it was revealed that the Chinese market will grow steadily, reaching almost 44 percent of the total luxury market by 2025, with total wealthy households in China topping 7.5 million yuan (HK8.5 million) and spending more than 1 trillion yuan in luxury goods. In reality, for many fashion houses, more than half of their revenue is already coming from Chinese customers.

Unfortunately, with a “Western-centrism” mindset, marketing and communication directors of luxury houses lack cultural knowledge of China and its consumers. Doing business with Chinese customers is not limited to giving red envelopes for the Lunar New Year. In Paris, each business conference about fashion or luxury, you will have at least one panel focused on how to lure Chinese millennials. During these business conferences, it is not uncommon to hear sentences from guest speakers such as “Chinese Valentine’s Day is in the middle of August, because China is based on a lunar calendar” talking about Qi Xi Festival (七夕) or “We did a one-day event for Golden Week (黄金周)”. While PR and communication directors are acutely aware of most of the influential Hollywood stars from actresses and actors to musicians and TV personalities, sadly the only Chinese celebrity they know is Fan Bingbing.

During the last 10 years, as a contributor in various international magazines and newspapers, I’ve witnessed the fall of print media and the rise of the digital, as well as the ever-evolving change of influencers.

In China, the media landscape is growing extremely fast in both print and digital while the staff of European magazines is shrinking every month. At fashion shows, the seating structure remains conservative towards the old-continent. European media are still located right in the middle, leaving out the Chinese press on the sidelines, near the exit door. It’s not common to have a European journalist from an obscure magazine seating in the front row, while a Chinese journalist representing millions of potential buyers having is seated in the third row just because the PR department are allocating limited number of tickets by geographic region.

At the other end of the extreme, marketing and communication teams sometimes try too hard to please their Chinese customer. For example, many fashion brands are putting the most-liked type of dog for Lunar New Year on a red leather bag in an attempt to grab attention, compromising their brand identity in the process. In the jungle of endorsements, fashion houses rely on their local PR teams or sometimes external consulting companies to select their celebrity or key opinion leaders (KOLs), aiming at unrealistic sales results.

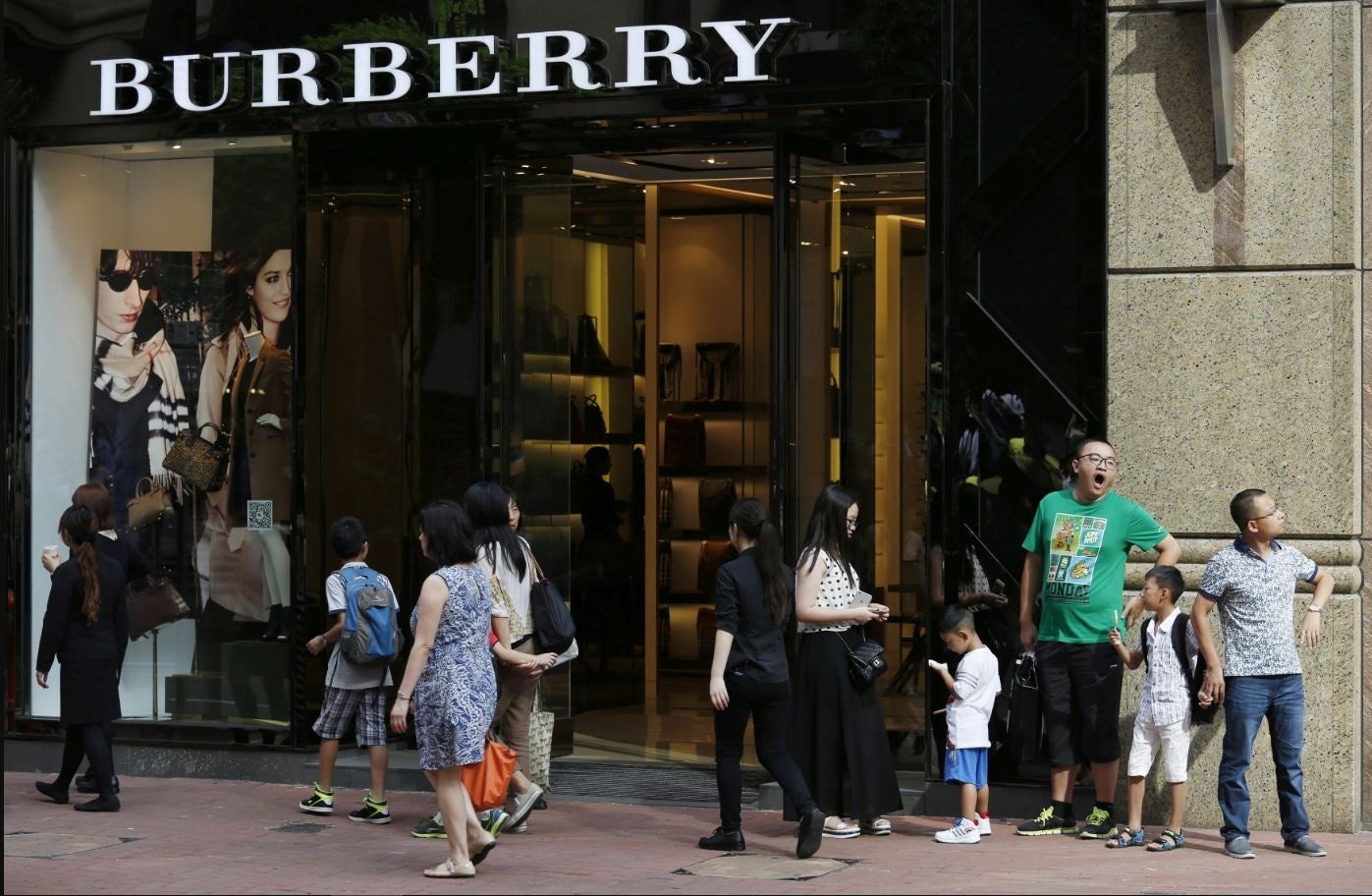

Over the last decade, CEOs of luxury brands have invested heavily in China to expand their boutique networks. Unfortunately, due to pricing strategies in mainland China, customers prefer shopping online or abroad.

Having worked in retail and wholesale worldwide, I have to admit that most retail staff are top-notch. In Europe, retail directors are doing an amazing job at recruiting and training Chinese-speaking sales associates. However, marketing teams have created a monster by waiting too long to adopt Chinese social media platforms such as Weibo or WeChat or refrained from working with an online platform such as T-Mall or JD.com. Nowadays in department stores, it’s common to spot sales staff on their smartphones taking pictures of items or responding to customers to push the sales via their own private profiles.

The clear winners of this technology phobia are “Daigou” (代购). Based in Europe, these Chinese shopping agents are always connected to their customers via social media and are controlling luxury sales, making it impossible for brands to understand who their real clients are. In French department stores, depending on the fashion brands, these digital private shoppers can create sometimes an astonishing 60 to 70 percent of the turnover of corners. Daigou is smartly optimizing its profit by buying many luxury items on the same day around 20,000 to 30,000 euros (HK180,000 to HK270,000), allowing them to access a better tax refund percentage from 12 to 16 percent. In addition, they will use their loyalty cards granting rights to vouchers.

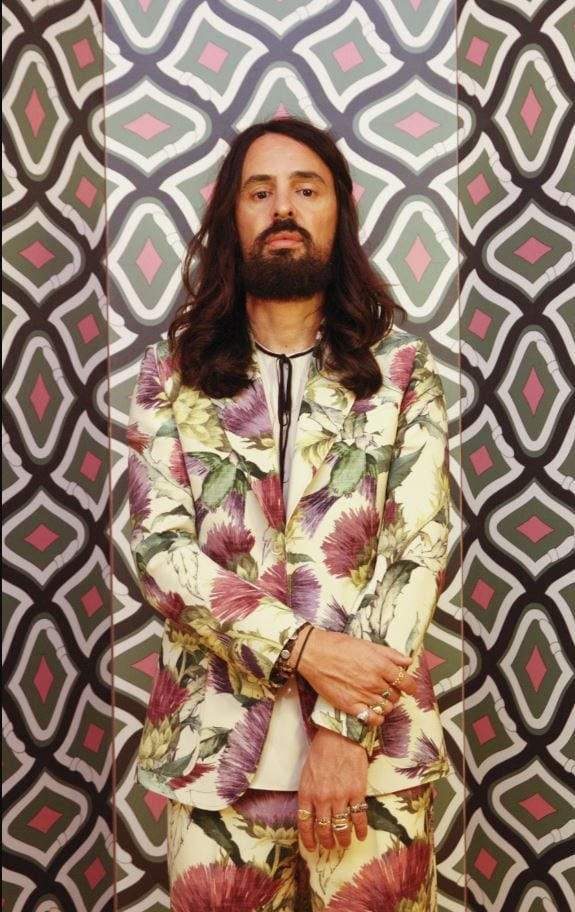

In the newest report of Deloitte “Global Powers of Luxury Goods – Shaping the future of the luxury industry”, the clear strategy winner is Gucci. The Italian house’s e-commerce sales rose by 86 percent in 2017, with millennials accounting for about 50 percent of revenue. Total Gucci brand sales increased by 42 percent, up to 6.2 billion euros.

Gucci is making a bold digital transformation. For example, in January 2018 it began leveraging the new feature on WeChat called “Brand Zone” to redirect users to its own e-commerce channels. Garnering both critical acclaim and commercial appeal, creative director Alessandro Michele invited consumers to “Guccify” themselves using a gamification app mixing fun, digital customization and e-commerce tools.

Also poking a bit of fun at themselves, Gucci has commissioned a number of internet memes from artists, photographers, meme-makers and writers to promote a new line of wristwatches on Instagram.

With unexpected collaborations, the Florentine fashion house is reinforcing its voice with various creative people or brands such as Ignasi Monreal, Isabella Cotier, the hip-hop tailor of Harlem Dapper Dan, internet sensation Adrian Kozakiewicz, Disney's Donald Duck, and the Major League Baseball.

By taking risks, Gucci is fully embracing digital innovation and make optimum use of social media to reach millennial customers, including Chinese customers, without compromising the brand values and identity.

Luxury giants such as Louis Vuitton, Cartier, Christian Dior, and Gucci have already fully incorporated digital tools to connect with Chinese consumers. Many fashion brands may need to take those opportunities if they want to survive in a rapidly changing consumer landscape that is now heavily influenced by Chinese tastes. Meanwhile, Google is investing US550 million into China’s JD.com, Tencent is launching its digital marketing system for advertising on WeChat and the biggest payments firm of China, Alipay, will be available in 20 countries across Europe at the end of this year.

This post originally appeared on South China Morning Post Style Magazine, our content partner.