Today, Swiss luxury goods group Richemont reported $15.3 billion (€14.2 billion) in earnings for the year ending March 31, 2020, which was a 2-percent rise from $15 billion (€13.9 billion) last year. Despite the ripple effect from the COVID-19 pandemic on the group’s fourth quarter and beyond, the group’s chairman is confident in both the value of “hard luxury” and China’s recovery.

Within the Asia-Pacific region, the group’s Greater China market reported $3.24 billion (€3 billion) in sales, a decrease of 6 percent from $3.7 billion (€3.4 billion) in 2019. The COVID-19 pandemic and the Hong Kong protests both took their toll on the region during the fourth quarter, and sales in the Asia-Pacific was down by 36 percent, as Hong Kong alone shed 67 percent. The Asia-Pacific region makes up more than one-third of shares for the parent company of Cartier, Piaget, and IWC and is the largest of all markets.

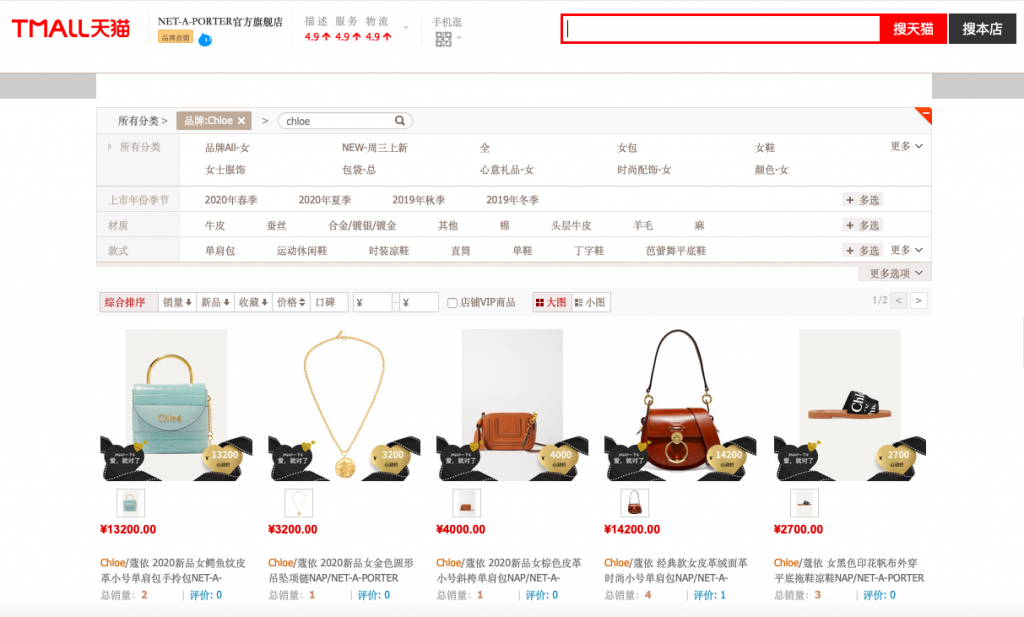

All of the group’s 462 boutiques in China have reopened, the group reported. It also noted that “hard luxury” products, which usually include jewelry and watches, “are not transient.” This suggests that this demand is expected to continue. The group’s Chairman, Johann Rupert, offered special notes on China and online retail, stating, “Our joint venture with Alibaba in China and our initial online ‘Pavilions’ are introducing Cartier and the other Maisons to a new generation of shoppers. In times when tourist traffic is impacted by concerns over the virus, internet shopping has proven to be a key avenue and will remain key to the growth of our business.” The group also owns luxury e-tailer Net-a-Porter, which is present on Alibaba's Tmall.

Jing Take:#

“We may be looking at 12, 24, or 36 months of grave economic consequences,” said Rupert, who chose not to give investors a definitive answer on when he thinks the different markets would bounce back. But one clear message from his comments is that the group, which is used to be known for jewelry and watches, has decided to put more trust in online channels and its partner in China, Alibaba.

When asked about how COVID-19 might change consumer habits, and, in turn, the group’s business model, Rupert again referred to Alibaba, using the term ‘new retail’ to describe selling online — a phrase Alibaba has been touting for years. “Any of the online businesses should be viewed as ‘new retail,’ and it should be viewed as plans wishing to have a seamless experience with the product of their choice,” he stated. “I think the company that’s resistant to change will find that it’s really difficult to catch up.”

Investors waited for a full year after Richemont’s announcement in October 2018 that it would go online in China before it happened last September. According to a source at UK-based Net-a-Porter, the team is still transitioning many operational tasks, including product translation, to the Alibaba team. But with COVID-19 currently worsening in Europe and America, will the group want to move things faster?

The Jing Take reports on a leading piece of news while presenting our editorial team’s analysis of its key implications for the luxury industry. In this recurring column, we analyze everything from product drops and mergers to heated debates that sprout up on Chinese social media.