Jing Daily’s insight report “The Drop: Understanding Successful Brand Collaborations” is available for purchase on our Reports page. Packed with 88 pages of market research, exclusive interviews, and on-the-ground consumer insights, the report is a must-read for anyone interested in tapping China’s most powerful new consumer base. Get your copy of the report here.#

Offering early or first access to upcoming co-branded products can drive up conversations surrounding their release, once such access is revealed. If a brand’s chosen partner is an artist, their fan base makes them the initial source for such hype; they can utilize the fame of their family and friends to drive engagement surrounding a collaboration months, or even years prior to its launch.

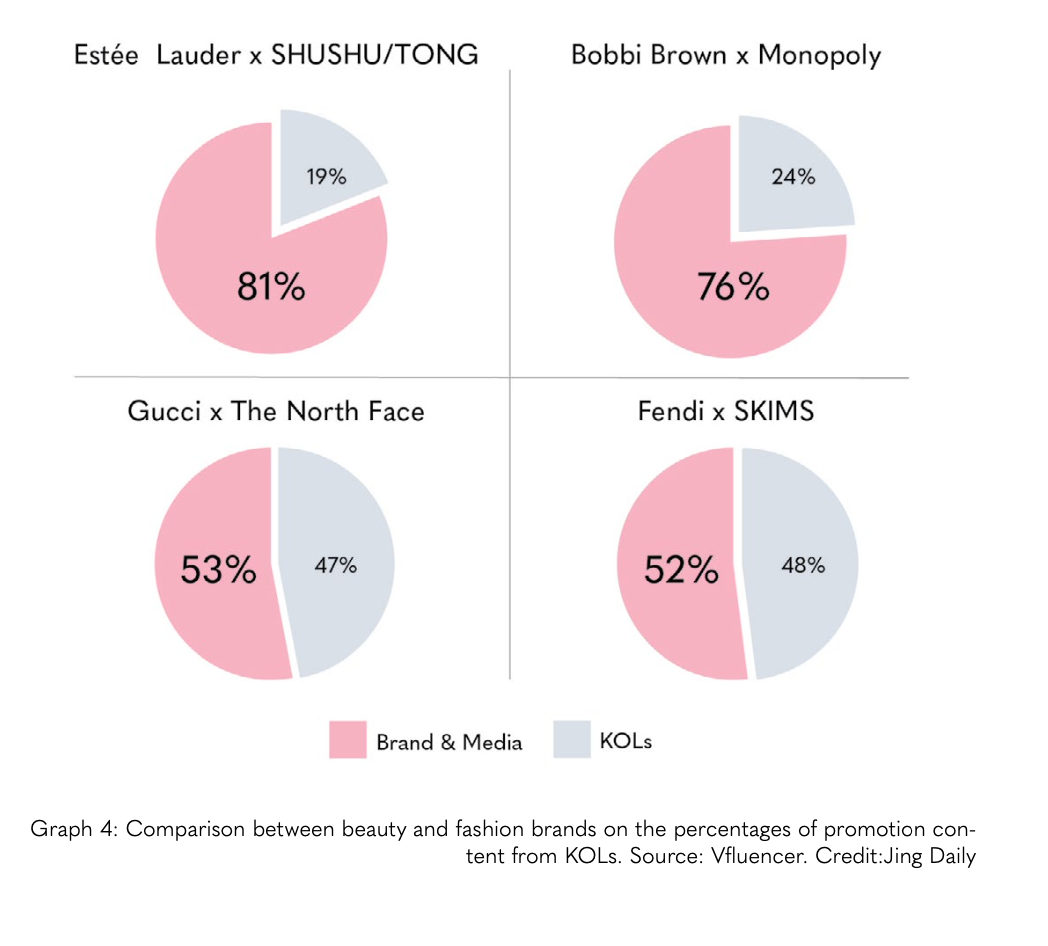

Labels adopt a variety of early access tactics. In China and the West, it is common for beauty brands to grant first access to key opinion leaders (KOLs), allowing them to review and demonstrate the product before it goes on sale. For instance, Estée Lauder gave several Chinese beauty KOLs early access to the Estée Lauder x SHUSHU/TONG limited beauty gift boxes for 2021’s Qixi Festival — China’s traditional Valentine’s Day. On local social media platforms such as Weibo, the KOLs posted pictures of themselves using the makeup and praised the collaboration for its quality and originality. One beauty influencer with almost 3.7 million followers even produced her own 90 second-long promotional video to promote the collaboration, receiving more than 25,000 likes.

The same strategy was adopted by the Bobbi Brown x Monopoly collaboration released in fall 2021, in which KOLs created over 75 percent of the original promotional content on Weibo, as shown in the following graph.

Source: Vfluencer. Credit: Jing Daily

Graph 4 also indicates that top luxury brands rely far less heavily on private influencers to generate consumer anticipation in China. Instead, they typically grant early access to brand partners or celebrities. For their collaboration, Gucci and The North Face released photos of various Chinese celebrities (many of whom were the former’s brand partners), wearing outfits several days before the collaboration was launched in China (on December 29, 2020, the earliest worldwide).

Another Louis Vuitton tie-up, this time with Supreme, was boosted by Chinese idol Lu Han, who acquired a highly sought-after collaboration hoodie before its official drop in China on June 30, 2017. One day before, Lu posted pictures of himself wearing the hoodie on Weibo, which received more than 1.8 million likes.

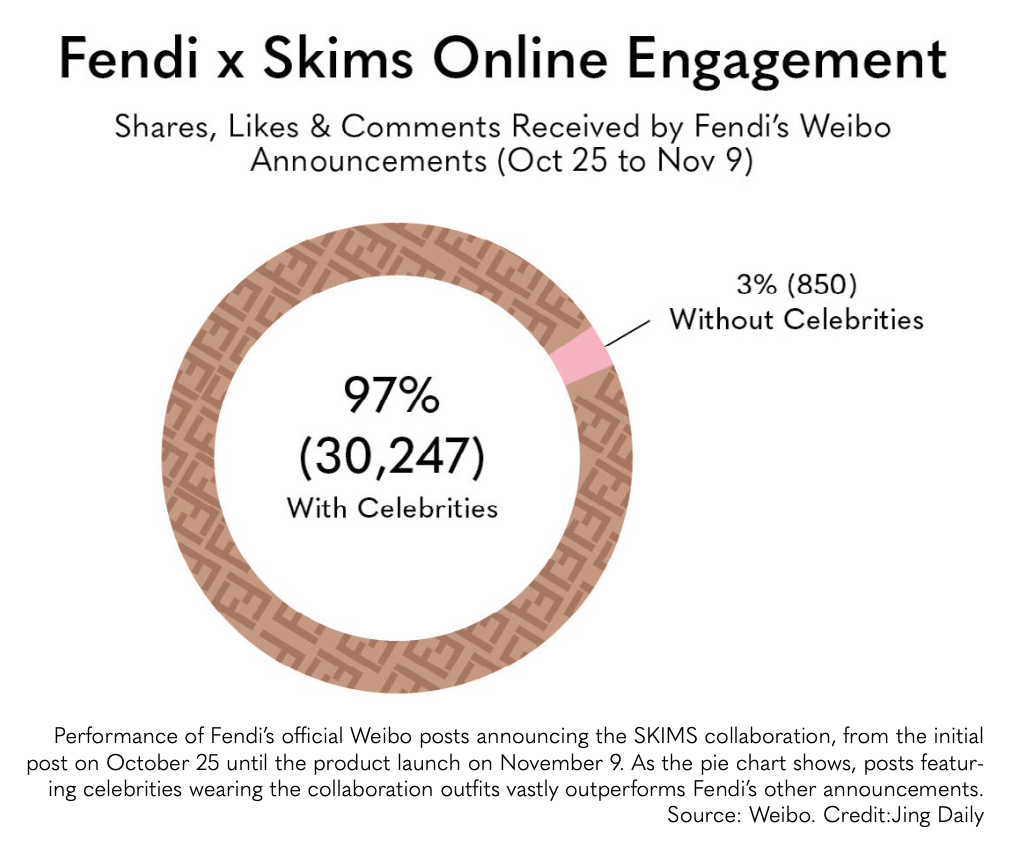

Most recently, the Fendi x Skims collaboration that was launched on November 9, 2021 saw several celebrities acquire items early, prompting public recognition of the cooperation that eventually yielded $1 million in profit within the first minute of launching. Gwyneth Paltrow posted her unboxing gifted pieces on Instagram on October 28, while Kylie Jenner was spotted wearing the outfit during Halloween. In China, several female idols posted pictures for Fendi x Skims in late October, and noticeably, Fendi’s Weibo posts featuring these idols received increased likes, comments, and shares compared to other posts announcing the collaboration. The following highlights the reliance of Fendi on the country’s KOLs in its online strategy — despite being a world-famous, highly-recognizable brand.

Source: Weibo. Credit: Jing Daily

Beauty and luxury brands use a wide range of first-access strategies as a result of commanding different levels of cultural capital. Beauty brands are relatively prolific in introducing new offerings and conducting cross-brand collaborations, and thus make more of an effort to distinguish their products. The beauty market in China in particular sees fiercer competition than the country’s luxury market, given the simultaneous presence of Chinese, Korean, Japanese, and Western beauty companies. Therefore, beauty influencers play a critical role in explaining and demonstrating the uniqueness of products in detail.