Key Takeaways:#

- The fear that a young generation of consumers would have limited interest for personal luxury goods has been buried by evidence of the opposite. Luxury items remain the best vehicle to fit into society

- Digital natives imply that casualization and digitalization are not fads and COVID-19 has been an accelerator of both

- The issue with youth is they ask tough questions and expect you to have values: time to step up!

In my book, Future Luxe, I have a resolutely bullish stance on the next decade of growth in the luxury sector post COVID-19 and have identified three cohorts of consumers that will move the needle for luxury brands: first, women. Second, the continuous recruitment of Chinese consumers and third, the next generation.

A few years ago, investors and the media were nervous about the new generation of consumers, arguing that they would have limited interest in luxury products. Quite clearly, it has been the opposite. Imagine you are a young female employee in South Korea, you just graduated from university, and you are about to start your first day at your first full-time job. You have been successful in your studies, but now, you want to prove to the world (your friends, peers, parents, and coworkers) that you are worthy of doing business with, possibly worthy of a promotion. Projecting an image of success will inevitably put you in a better position to indeed be successful. If you arrive at the office wearing a Cartier Ballon Bleu watch (or the latest Pasha they just relaunched), a Louis Vuitton Pochette Métis small bag, and some Christian Louboutin heels, it sends a strong message to your employers and coworkers: you are ready, you belong, and you will be going places.

When you are young and your list of accomplishments short, there’s no better way to say “I’ve made it in life” than to look good. The “1998 generation” or the “selfie generation” is spending hours on social media and posting pictures of themselves, trying to influence the perception of others. Brands are paramount and betting against luxury demand with the young generation is almost like betting against human nature, you can’t win. So as much as you might think it is horrendous for a young lady to spend her first paycheck on luxury goods, get used to the idea, it isn’t going to stop tomorrow.

This next generation will imply that casual wear will continue to spread and social media will only gain in importance, even as consumers expect authenticity from brands. Digital natives accounted for around 9 percent of the world’s population in 2016, and this is set to rise to 30 percent by 2030. Looking at the two global consumer powerhouses, China and the US, the modal age of their respective population (i.e., the age that holds the greatest number of citizens), is thirty-one for China— with a large cohort of people around that same age—and twenty-six in the US. Importantly, that number changes dramatically if you break it down by race and ethnicity: for Hispanics in the US, the most common age is eleven; for blacks, it’s twenty-seven; for Asians, twenty-nine; and for whites, fifty-eight. In most emerging markets, the modal age is usually lower than it is in developed countries, with India for instance being at twelve only and the country having half of its population aged twenty-seven or younger.

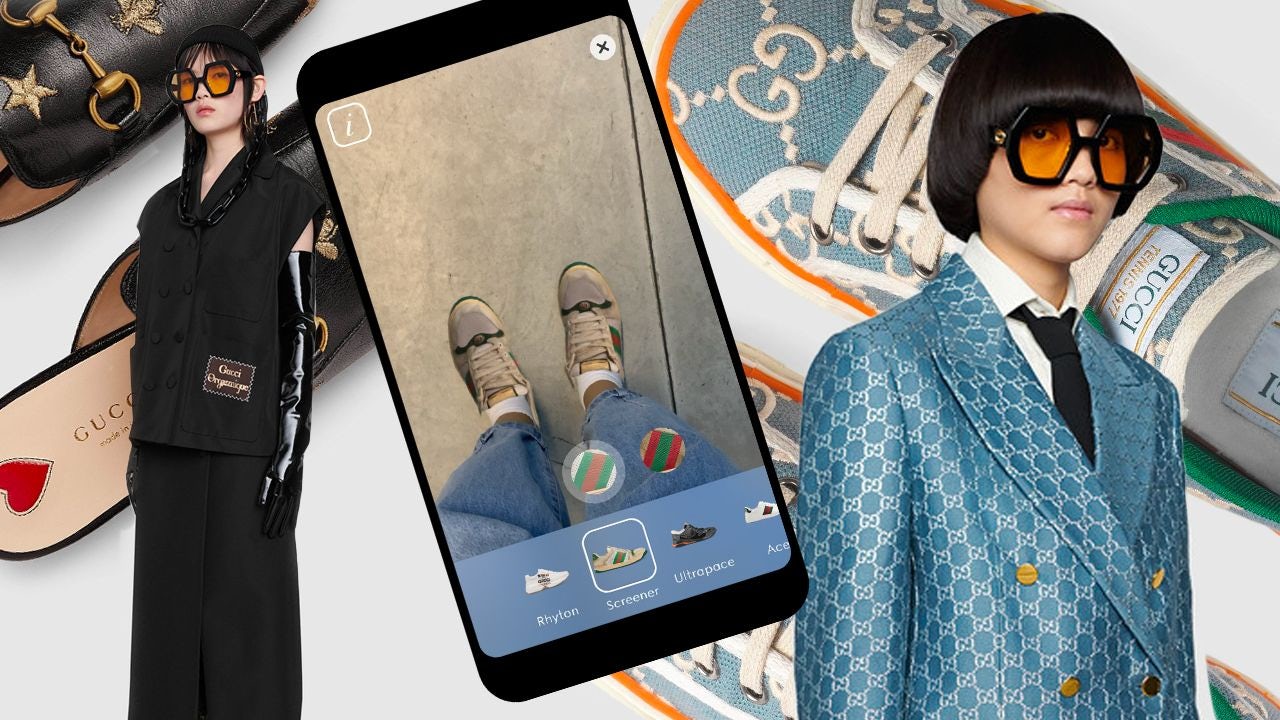

So when contacts ask me “how long will the super-cycle of growth of sporting goods companies like Nike, adidas or Puma will last” and “will Gucci and Moncler still produce sneakers in two years from now,” I tend to answer that we are not looking at a fad — fads don’t last decades — we are simply looking at a generational shift. The fact that we are all spending time on Zoom, Microsoft Teams, BlueJeans and whatever else you favor doesn’t exactly help in dressing more formally in the short term either.

On social media, as I made the case a few weeks ago, there seems to be emerging a rule of 80/20. In other words, consumers might be spending eventually only 20 percent online for luxury but in terms of information gathering, storytelling, “education,” 80 percent of the knowledge about a brand and its products is likely already happening online. Here again, COVID-19 has worked as a phenomenal accelerator.

None of this is too threatening for a brand. What can be, however, is the reality that younger consumers are looking for values, purpose within the brands, and not just products. They have cultural, political, ethical, racial sensitivities and social media will amplify any misstep — and there have been many — a luxury brand might make. Constant exposure to social media has made youth savvier and wary of mass communication. And they are asking tough questions on how you produce, who you employ, whether you are giving back to the community they are a part of, essentially if you are trustworthy. The potential to sell to the young up and coming generation is huge. The potential for them to make or break brands as well. Not every young luxury consumer has the voice or the mission of a Greta Thunberg but brands better listen as that consumer asks questions that are getting tougher to answer.

Erwan Rambourg has been a top-ranked analyst covering the luxury and sporting goods sectors. After eight years as a Marketing Manager in the luxury industry, notably for LVMH and Richemont, he is now a Managing Director and Global Head of Consumer & Retail equity research. He is also the author of Future Luxe: What’s Ahead for the Business of Luxury (2020) and The Bling Dynasty: Why the Reign of Chinese Luxury Shoppers Has Only Just Begun (2014).