Key Takeaways:#

China’s rental field only started in 2014 when Ms. Paris entered the market, and twelve other startups followed in the coming year. From 2014 to 2017, the sector boomed, during which time it received over 130 million from venture capital firms.

Lockdowns acted as a natural selection process for sharing models. The subscription platforms that quickly revamped their business structures made it through COVID-19 and earned a dominant market position. Now, YCloset, LeTote, Ms. Paris are seeing user subscriptions return to pre-pandemic levels.

China’s national statistics state the domestic sharing economy market size surpassed three trillion in 2019 and is set to grow by 30 percent in the upcoming three years. Environmentally-conscious Gen Zers are the main drivers behind luxury growth, yet their debt-income ratio has climbed 1,850 percent as per 2018 data.

Not everyone can afford Gucci or Dior. So what’s the next best option for owning a designer brand coat or handbag? Rent one, of course. And now, some young fashion fans looking for luxury are turning to China’s affordable rental market, which offers guilt-free, space-saving options to style-conscious consumers.

Over the last few years, rental platforms have been gaining traction in the local market. From cars to phone-charging power banks and fashion sharing, local investors have been tapping into the rental trend by throwing billions in venture capital at the sector.

Until last October, the possibility of renting clothes and accessories was relatively niche in China. Then, an article that came out on WeChat, titled, "I lurked in the Shanghai Socialite Group & Observed Them For Half a Month,” unveiled the glamorous world of luxury flexing in China. The post caused a stir on social media and gained over three million views. But, more importantly, it uncovered the fashion rental platforms that these socialites used to display their wealth.

Additionally, with limited spending power, young generations are eying alternative solutions to keep up with the latest trends. Mckinsey & Co. reported that China’s affluent consumer households earn above 3,900 per month, accounting for 30 percent of the urbanized population.

Yet, while the US rental market is valued at 1.9 billion and is expected to double by 2026, China views renting as radical, as its societal mindset is firmly rooted in the worship of ownership. As this mentality changes, Jing Daily looks at what has worked in China, what hasn’t, and what rental opportunities will present themselves in the future.

China’s relationship with renting so far#

China’s national statistics state that the domestic sharing economy's size surpassed three trillion in 2019 and is set to grow by 30 percent in the upcoming three years. But it is hampered with issues from slow user uptake to operations costs.

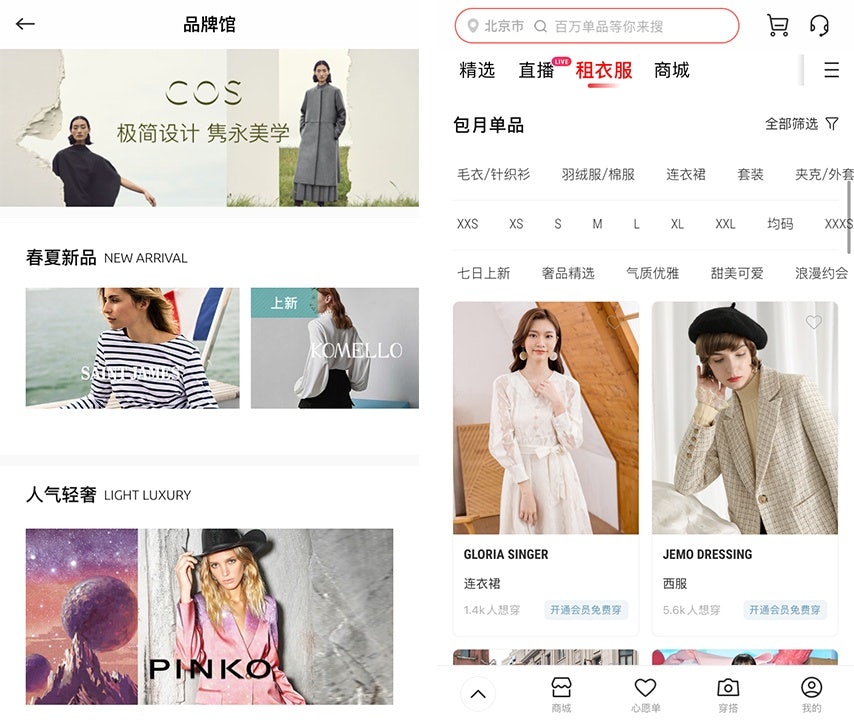

It took off in 2014 with the creation of the local company Ms. Paris, which was founded by the female entrepreneur Xu BaiZi. Others then followed into the sector: YCloset received a 50-million investment from Alibaba in 2017 and became the industry’s unicorn. Meanwhile, the company DoraYmen, which obtained 12 million in funding, quickly folded. In total, at least 14 different companies have held a market share at one time.

Fashion subscription platforms face competition from affordable luxury, second-hand luxury, and even counterfeit goods. And the average 60-a-month rental fee is still considered high for many users. YanYan Froud, the regional VP of APAC at the marketing agency Forwardpmx, agrees that the sector is flooded with difficulties.

“Consumer acquisition journeys can be immensely long [on rental platforms] and don’t see immediate conversion,” she explained. “The business model itself [poses challenges.] In China, renting a luxury brand is only 3 a day.” But the outbreak of COVID-19 accelerated the model, resulting in a rental market revitalization. And, in 2021, despite the challenges, three big players have survived.

China’s three main rental players#

American rental platform LeTote charges 77 per month, which is the highest fee, and offers affordable contemporary pieces for office women, including some local niche names. It has increased user trust by livestreaming its sanitizing and disinfecting process for the clothing in its warehouse centers, credibly convincing users.

Domestic company YCloset targets young consumers by offering a 60 monthly fee for contemporary American and European designer brands. When people were stuck indoors during the lockdown and decided to make money from unused wardrobe items, it quickly saw an uptick and diversified. Soon it had positioned itself as a platform where users could sell or purchase second-hand products, as well.

In a fiercely competitive field, building trust and brand recognition can be a long and arduous journey for luxury rental platforms. As the oldest rental company in China, local luxury pioneer Ms. Paris, which has the most reasonable fee at 50, has built up fans over time.

Does renting have a future in China?#

Rental platforms work on long-term, return-on-investment cycles, and as an early flood of investing has died down, the industry's future survival is now in jeopardy. Price competition among various platforms threatens business liquidity, and none of these companies have yet to turn a profit.

DoraYmen’s failure was most likely due to its high shipping and cleaning costs, which often surpassed garment values. But other companies have failed, as well, such as Magic Wardrobe, You Clothes, and Mocha Box. And LeTote’s monthly charge is the highest among its competitors, making it harder for the platform to be the first choice for new users.

While the pandemic did accelerate positive changes for the industry, it also brought challenges. To meet them, some have changed their models to guarantee cash flow. LeTote reduced its number of shipments to twice per month, and YCloset now requires clothes to be returned within 24 hours, leaving frustrated users with "gap days." Yet, China’s customers are spoiled for choice, so these companies must meet their demands.

If they don’t, social media will be awash with complaints, and that can severely damage their reputations. Online comments reveal that LeTote lacks luxury designers while Ms. Paris stocks outdated collections. Until companies can address issues ranging from unsatisfactory selections and subscription models to shipping and packaging, the entire division will suffer.

How can luxury tap China’s rental frontier?#

International rental players looking to tap the Chinese market will need intimate knowledge of the industry. Ralph Lauren's new rental venture may work in the US, but he knows his audience there. Froud suggests that potential newcomers need to understand expectations and the competition, saying, “[Companies must ask themselves]: if local competitors are offering low prices, can they compete with them? If they don’t compete by adding value, what can they provide so consumers will subscribe?”

Rental platforms can help brands raise awareness with younger luxury buyers and capture consumer trend shifts or accumulate relevant data on their profiles, which should help labels learn about emerging trends. Other gaps rental luxury could fill include offering subculture fashion trends, such as Preppy style or Dark Academia, two styles that are gaining traction with younger Chinese consumers. While the luxury opportunities in China’s rental are debatable, brands can no longer simply bet on debt-ridden Gen Zers to drive market growth until the bubble bursts. But by aligning with a sustainable expansion model and the circular economy, luxury will improve its stickiness with this generation.