The first quarterly report by British fashion house Burberry was better than expected, a result perfectly timed with the arrival of the new CEO, Marco Gobbetti. The lift comes from the rebound in demand in China and its good performance in the UK.

The results, released on July 12, were boosted by strength in mainland China, which delivered mid-teens percentage growth and is the major driver of mid-single-digit percentage growth in the Asia Pacific region, according to Burberry. Chief Financial Officer Julie Brown said Chinese consumers' confidence had rebounded, resulting in stronger growth in mainland China and Hong Kong.

The China growth is driven by the digital innovations Burberry has undergone, namely on e-commerce and WeChat. The revenue from China's e-commerce has more than doubled compared with the prior year, and WeChat's reach has tripled through the key-influencer campaigns for its DK88 bag.

Burberry has invested a lot of resources in the DK88 collection to bid on the interest of millennial Chinese. For one campaign, the brand co-created a video series with Vogue Film that featured A-list stars—model Liu Wen, singer Kris Wu, and actress Fan Bing Bing—carrying the DK88 bag.

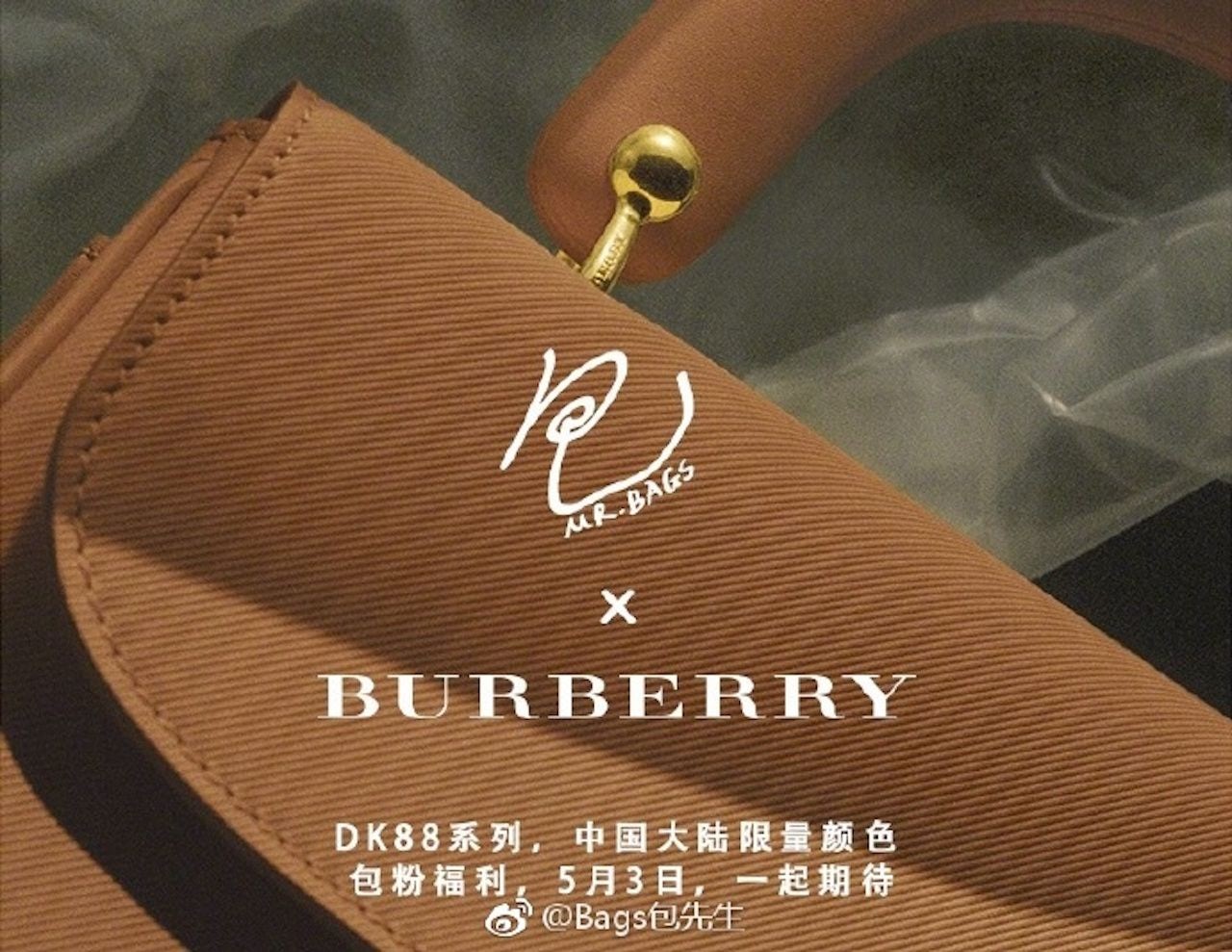

The brand also launched exclusive limited edition bag with Chinese top KOL Mr. Bags, who created a sensation when a bag he designed for Givenchy sold out in 12 minutes.

The company said that WeChat advertising was only part of its overall sales strategy, which included new physical stores to meet the growing demand of Chinese consumers who are returning to physical stores to spend.

Despite the good news about first quarter performance, the new CEO faces a tough challenge in continuing to sustain the brand image of the maker of the iconic trench coat in this ever-changing market.

“Gobbetti will take greater control around brand distribution with the further cleaning of the wholesale channel,” wrote John Guy, an analyst at MainFirst Bank AG. “This is a similar strategy when he ran LVMH brands, such as Celine. He would sacrifice short-term sales in order to protect/elevate the brand and drive improved productivity over the long-term.” The influence of this decision was reflected in the first quarter results, where US sales performance experienced single-digit percentage decline because of the reduction of discounted products—a strategy that was aimed it improving the brand value in the long run.

Others posed concerns for the future of the brand. “You are in the market where consumers are demanding newness," said Luca Solca, the head of luxury goods research at Exane BNP Paribas, in an interview with CNBC. "One of the problems Burberry has been having is sticking too much to their icons.”