Last year, Chanel launched its first-ever Christmas advent calendar. It’s fair to say it did not go down well at all in China. Stocked with 31 different products, each of the 1,000 editions was priced at 946 (6,000 RMB), yet it only contained five actual Chanel products. The remaining items were a paltry mix of stickers, bookmarks, and crystal balls. On Weibo, the hashtag #Chanel blind box# earned over 46 million views.

So what went wrong, exactly? And how can brands avoid making the same mistake? To find out, Jing Daily looks at various offerings — from Charlotte Tilbury to Penhaligon’s — for this Advent season.

Surprise factor#

For those unfamiliar with the concept, Beijing-based Jacob Cooke, co-founder and CEO of e-commerce consultancy WPIC Marketing + Technologies, compares the advent calendar to China’s booming blind box trend. As with these, “customers don’t know exactly what products they’re getting. This is a popular retail format in China with part of the value coming from the surprise and exposure to new products,” he says. Indeed the blind box sector here is in fine health, forecast by the Mob Research Institute to be worth 4.6 billion (30 billion RMB) by 2024.

Even so, the advent calendar itself is still new to most Chinese consumers according to Yishu Wang, CEO of China marketing agency Half A World. But she agrees that it’s the idea of a “limited/special edition” which sells. “I've noticed many people on social media mentioning a “Christmas blind box” when they talk about labels' advent calendars. Given how popular blind boxes have been in China, it's a great way to promote the idea and the products of branded advent calendars,” Wang argues.

Shopping holidays are a top-line growth driver, and the winter festivities in particular offer the advantages of bonus season and consumers’ willingness to spend. Wang affirms that “no matter how they celebrate Christmas (if at all), consumers will buy into the joy of unwrapping a nice gift every day. Such a feeling is universal.”

Value for money#

But brands should be mindful to ensure that what they are offering is fair value for money. “Chanel had its PR crisis last year simply for that reason, selling advent calendars that were perceived as too expensive given the products,” Cooke explains. While Chanel has declined to release one this year — for reasons not disclosed — and it’s difficult to calculate total sales volume (many houses use different names when presenting their advent calendar), the gifting market and “she economy” in China are growing sectors not to be missed.

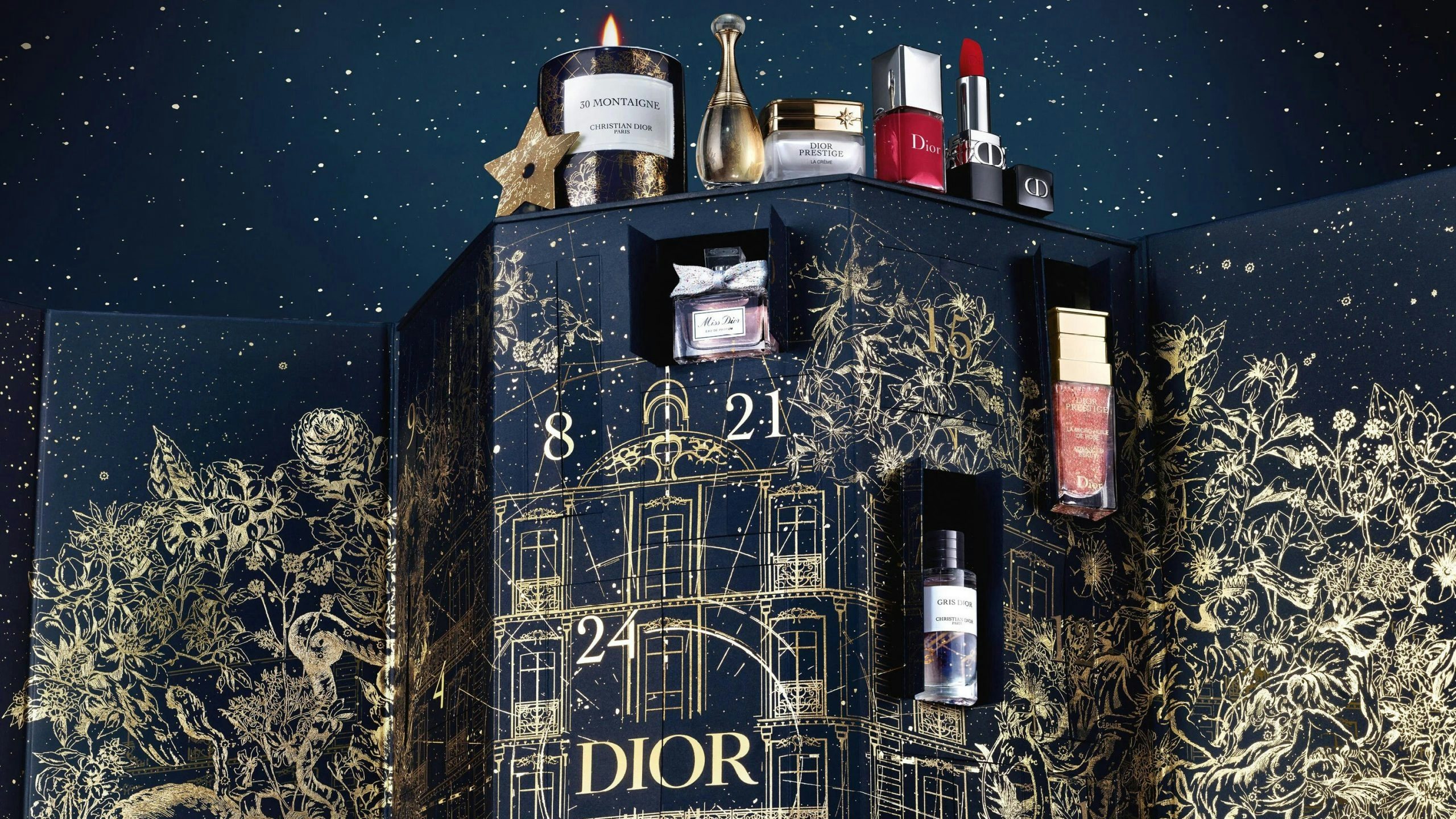

As Cooke maintains, it’s all about the value of products versus price paid. “There has to be value. Diptyque and the like, these are all around 500 (3,500 RMB),” says Torsten Stocker, COO at Thakral Corporation, a Greater China beauty brand distributor and retailer. “So, it's not a pure impulse purchase. Even though it’s affordable, it's still a considerable amount of money.” Stocker thinks the value comes from having products that “feel real” and are not merely “a collection of the smallest samples or slow sellers that you are trying to clear.” It has to contain objects that consumers need, want, and value.

Iconographic variety#

What makes Christmas particularly exciting for brands is the rich iconography related to the holiday. For local Valentine’s festivals, companies veer towards limited variations on the theme of hearts and roses. But Christmas offers a wide range of symbols and colors to play with. “This gives brands a lot of creative freedom in mixing in their own brand point-of-view with festive design to stand out,” explains Gregory Cole, managing partner at boutique marketing consultancy éCLAIR Asia.

Cole suggests that “Penhaligon’s Doors of Wonder advent calendar is a good example as it references both Christmas with the North Pole (especially its fetching Santa sack carrier bag) and a more general feeling of discovery and diversity with the theme of nostalgic wonder.” One of the pricier calendars (458 or 3,200 RMB), it features a lavish range of scents, soaps, candles, and a decorative charm.

Creating extra value#

One of the easiest ways to add value is through strong design and packaging. Compared with a decade ago, when offerings looked “a bit shoddy,” Stocker thinks brands are now over their discovery period. “Certainly the ones I see now in China and globally look quite good. Charlotte Tilbury looks great as it has a makeup-boudoir feeling and good packing. If you charge someone this price you have to offer more than an expensive cardboard box. It has to be something people enjoy looking at and a keepsake — so even after you’ve used it up, you can use it for something else,” he observes.

Charlotte Tilbury’s announcement (now with 300 million Weibo views) in May of Chinese actor Gong Jun as its global ambassador has helped it find relevance with today’s younger generation and bolster its premium positioning locally. On the design of its Diamond Chest of Beauty Stars advent calendar surprise box, Xiaohongshu user @grace posted: “The pink box is perfect for a jewelry box.” This underlines the fact that these products don’t necessarily need to be localized for the market. As Stocker notes, “The design is very important, but it doesn't have to incorporate Chinese elements as ultimately it is a Christmas item. My view is that it can be more subtle. Don't change too much in terms of the basic concept you have.”

Will it go local?#

The domestic market is, for now, dominated by low-level chocolate company offerings (such as Whale Talk), much like in the west. But given the mainland’s retail gamification and propensity for blind boxes, it won’t be long before C-beauty and lifestyle lines jump on the craze. Cooke confirms that it's a smart strategy for local players looking to “build their credibility as global luxury brands.”

Another broader trend in China retail is the emphasis on customer loyalty. Cooke notes that as the country’s market has matured and become more competitive, brands have shifted their focus to “long-term customer value.” This is often achieved through membership programs that offer exclusive benefits. Special seasonal offers are no different.

He ends on the fact that even as the “guochao” trend continues to take hold, there’s still a “strong association between western labels and luxury — so it can pay dividends for Chinese names to put their own local spin on the advent calendar.” If so, the 2023 season will open a new window of opportunity for those homegrown brands willing to take the chance.