For an afternoon of discussion on new technologies and opportunities for luxury brands, the Luxury Society Keynote in Shanghai recently gathered executives from Baidu, Baume & Mercier, Bulgari, Dior, LVMH, Mei.com, Michael Kors, Nars, Sephora, Swarovski, Shiseido, Qeelin, UCO Cosmetics, Yixia Tech, and many more speakers, panelists, and delegates from the luxury and digital industries. Below are six key questions that were asked and answered throughout the day.

1. How are Chinese brands and retailers bridging the gap between offline and online commerce?#

In the words of Arthur Chang, UCO Cosmetic’s Co-Founder and Chairman, “e-commerce is dead.” Not because nobody buys online anymore, but the opposite. E-commerce is becoming so ingrained in the every day that it shouldn’t stand apart from any other way to shop. Furthermore, simply selling products online doesn’t work anymore as a business strategy. Luxury brands in particular need to utilize technologies and offer different experiences to customers so that they can stand out from the crowd of other online sellers.

China’s biggest e-retailers have in recent months displayed their understanding of this need. One such e-retailer, Mei.com, has become China’s leading luxury e-commerce fashion platform. As shared by Thibault Villet, the Co-Founder & CEO, not only does Mei.com seek to inspire its shoppers with a weekly magazine designed in-house by its team of 20 editors, but it’s also explored ways to speak with new and different customers.

2. Live streaming seems to be all the rage. Are there really luxury and prestige brand success stories?#

The best place to start when speaking about live streaming, is by looking at live streaming’s core audience, which is largely made up of China’s always-connected millennials, of which there are over 300 million. Today’s Chinese millennials, like other millennials around the world, are looking for meaningful yet ephemeral experiences. As shared by Pablo Mauron of Digital Luxury Group, “The millennial generation will be the opportunity for the future. Their way of thinking is more complicated and they want to be inspired; they seek experiences and emotional connection, they’re not just a bystander. As a result, live streaming has become a medium for them to express themselves and follow others.” They appreciate the realness of something live rather than the airbrushed and edited version of something that’s been staged well in advance.

Some brands have really taken this understanding to heart. L’Oréal-owned beauty brand, Maybelline, decided to live stream the announcement that Angelababy was it’s newest ambassadress. With support from broadcasting platform Meipai, and with a direct link to its TMall store, Maybelline sold over 100,000 lipsticks in under two hours.

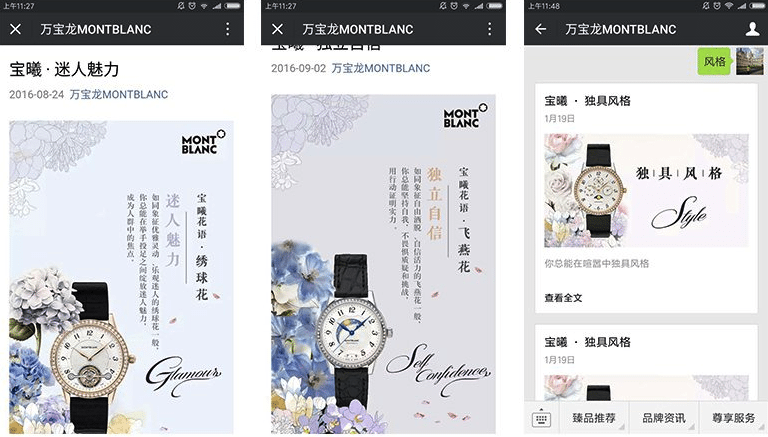

Montblanc hosted an event in honor of its new Boheme collection. Uncle Alex, an astrological guru and Chinese key opinion leader (KOL), live streamed the event on his Yizhibo account, which the brand further amplified by sharing across Weibo and WeChat. The result was over 1.9 million clicks to view, 3.9 million likes, and 195K simultaneous users during the broadcast.

In collaboration with Tmall, one of the most well-known online shopping players in China, Mei.com live streamed a major fashion show, receiving over 5 million interactions from their online audience and selling through more than 65 percent of the products featured.

Though live streaming is still at its infancy in regards to adoption by luxury brands, the first case studies are showing significant opportunity.

3. Are augmented reality (AR) and virtual reality (VR) really relevant for a luxury audience?#

A figure to consider: Taobao has been selling over 300,000 virtual reality (VR) sets every month in China.

With so much interest in VR these days, it’s no surprise that brands and retailers have been looking to jump on board.

Chinese tech giant, Alibaba, has been reinventing retail with its 11.11 Single’s Day Global Shopping Festival, which takes place every year on November 11. This past year, augmented reality (AR) was used to drive traffic to offline stores in China prior to 11.11. Over 30,000 stores participated in the “Catch the Tmall Cat” AR game and more than 70 million people played the game via the mobile Taobao app, generating more than 1.7 billion interactions.

Similarly, virtual reality (VR) allowed consumers to sample and purchase items from around the world. As reported in Vice, nearly 8 million users experienced VR shopping on Buy+, a VR shopping channel created by Alibaba, with seven international stores (including Target, Costco, and Macy’s).

In the luxury space, all kinds of examples are popping up. Dior and Tommy Hilfiger have been equipping their stores with VR headsets in order to transport shoppers to front row at the latest fashion show or event, Mei.com unveiled a VR experience in their last pop-up shop, and numerous other brands are taking their first steps into this new arena.

While VR is booming, it’s important to remember that it’s still very much in its infancy, especially for luxury brands. For the moment, VR experiences are mostly focused on transporting people to a venue—making it especially relevant for the travel or automotive industries. When luxury brands are considering offering an experience through VR it has to be considered not just as the hot new “toy” but as a way for a brand to tell a story that makes sense for its audience.

4. How can I use WeChat to develop a social CRM strategy and better deliver personalized content to my audience?#

This was a question that John Hamilton, Four Seasons Hotels & Resorts’ Director of Marketing Communications for the APAC region, asked himself. Tasked with defining the online experience for an Asian audience, Hamilton knew that WeChat would need to activated to best connect and engage with existing and prospective clients in China.

Unique to the hospitality industry is the fact that Four Seasons does not have a loyalty program, the system by which most hotel groups learn about their customers. Working with Digital Luxury Group as their social media agency of record in China, Four Seasons began testing and optimizing the hotel group’s WeChat experience in order to better understand consumer demands.

There were a few key challenges that Four Seasons had to work through when getting started. Limited follower data was available on WeChat, activities had been limited to broadcasting messages without a lot of feedback from the audience, and it was hard to drive bookings from WeChat.

With those challenges in mind, a CRM approach was built. First, advanced analytics were put in place to better understand follow behaviors and actions. Next, audience segmentation and targeted content was unveiled with a goal to personalize the message. And finally, the audience was given a call-to-action when appropriate, and their intent to book was better tracked.

One important insight in this case was that Four Seasons learned to not underestimate the power of small communities. By segmenting according to interests, they were able to push out customized messages and generate better results. The four key segments that were initially defined were: food and beverage audiences, inbound travelers, outbound travelers, and those most interested in promotions.

While more insights were shared, the basic takeaway for brands and companies looking to start their WeChat CRM was that by analyzing who your audience is and what they’re most interested in, you can easily start to push targeted messages to targeted groups at the most opportune time, resulting in better call-to-action results.

5. Do celebrity and key opinion leader (KOL) partnerships really work to drive sales?#

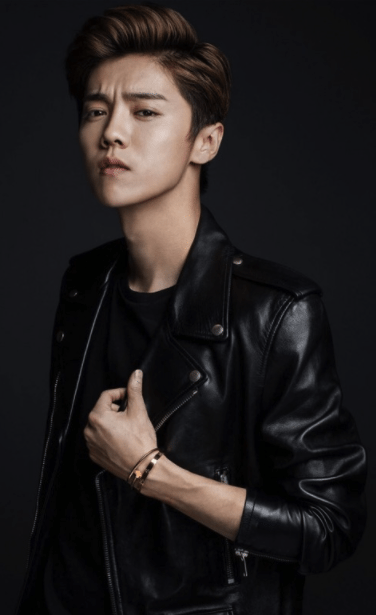

Easy Entertainment is a leading celebrity agency in China that works with famous celebrities on their partnerships with luxury brands. One of the most recent success stories for Easy Entertainment has been the collaboration between Lu Han and Cartier, easily one of the most talked about personalities this year. Qing Dai, commercial director at Easy Entertainment, shared her insights about whether celebrity and KOL partnerships really work.

First, when a brand decides which celebrity to work with, one the key factors that must be taken into consideration is the celebrity’s social data. Those with large, qualitative audiences (on Weibo, for example) have a better chance of maximizing the reach of the brand’s messages.

Also taken into consideration is whether the celebrity’s personal image and follower base pairs well with the brand’s targeted audiences. If there is not a strong affinity between the two then the authenticity of the KOL’s endorsement will be questioned and the partnership won’t have as strong of an impact.

It’s believed that there will be more and more celebrity endorsements in China because when done right the results are there. Last month Forbes reported that Chinese e-commerce giant Alibaba has been heavily investing in entertainment and social media platforms including Weibo, Momo, and Youku Tudou to bring top bloggers and performers onto its Taobao Marketplace. And this strategy has been paying off; in its December quarter, the e-commerce company increased the number of active mobile buyers by 25 percent to 493 million and defied the country's economic slowdown by continuing to deliver strong revenue growth.

As previously reported in Luxury Society, Chinese netizens continue to show a stronger interest in and resonance to local celebrities. Brand ambassadors and friends of brands like Montblanc’s celebrity brand ambassador, Gui Lunmei 桂纶镁, showcased their experience at recent luxury exhibition SIHH with Lunmei becoming the second most buzzed about celebrity in China during the event.

6. Which luxury watch brands are resonating most with Chinese digital natives?#

Chinese digital natives (those born after 1990) represent the customer base of the future for expensive luxury brands in China. Even at price points far above their reach for the moment, China’s young adults are showing great interest in the brands they respect.

According to Baidu, the leading search engine of China, the luxury watch brands that are capturing the most interest from this important audience are as follows:

Cartier

Vacheron Constantin

Piaget

Patek Philippe

Jaeger-LeCoultre

Baidu's Grace Zhang also shared exclusive numbers on the Chinese Digital Native (aka Post-90's) generation, including their points of interest, behaviors, and data specifically related to luxury goods. Watch the full video presentation.

Cartier’s lead is heavily linked to their chosen spokesperson, Lu Han, mentioned above, the well known singer and actor that is loved among China’s millennials who Cartier China considers one of the most popular representations of China's new generation.

The campaign saw Lu Han, who was featured on Business of Fashion's "BOF 100" rankings 2016, the only Chinese celebrity to make it onto the ranking, starring in a series of portraits and a 45-second short film for the Juste un Clou campaign.

Cartier’s first position on this short list shows the power that KOL and celebrity partnerships can have on gaining awareness and interest.