For the past decade, countless companies

—#

from startups to conglomerates

—#

have entered China. That’s because the potential rewards are big. Huge in fact. As a CEO that’s been in the KOL industry for over a decade, I have first-hand experience with how vast the local market is. It totals 5 trillion today and just keeps on growing. Our consumer pool, currently the highest spending globally for luxury goods, is expected to grow at a rate of 13 percent in 2022.

Despite the opportunity, both companies and marketers face challenges when it comes to understanding today’s shopper in China. Besides preconceptions about the market, the pandemic had an even deeper impact on luxury expenditure, posing another obstacle to expansion. Additionally, the digital ecosystem evolves by the day as do the ways people live and interact in it.

Here, I highlight the top five preconceptions that every marketer wishes their senior executives understood in order to make their lives easier.

China is a highly competitive and expensive market#

The country has grown beyond the time where small marketing strategies were enough for brands to enter the market successfully and reap huge rewards. Customer acquisition for brands are now more costly than in any other developed market – especially when it comes to influencers and social advertising. Xiaohongshu’s KOLs cost 50 percent more this year than they did at the same time in 2021. Additionally, Weibo KOL costs are up 20 percent compared to last year. Livestreaming costs on Douyin and Xiaohongshu are up from 20 to 30 percent. Thus, the long-term marketing strategies necessary to target locals are vastly expensive.

China is unpredictable#

The region offers many opportunities but most of these come with unpredictability for brands that can interfere with their plan in the long term. Here are two examples that have shaken the fashion, luxury, and beauty industries in China recently: firstly, in August 2021, the Cyberspace Administration of China unveiled new regulations that look to restrict a large variety of companies in how they use algorithms to recommend content to their consumers and tailor prices. This could affect how many companies market on social media and e-commerce platforms.

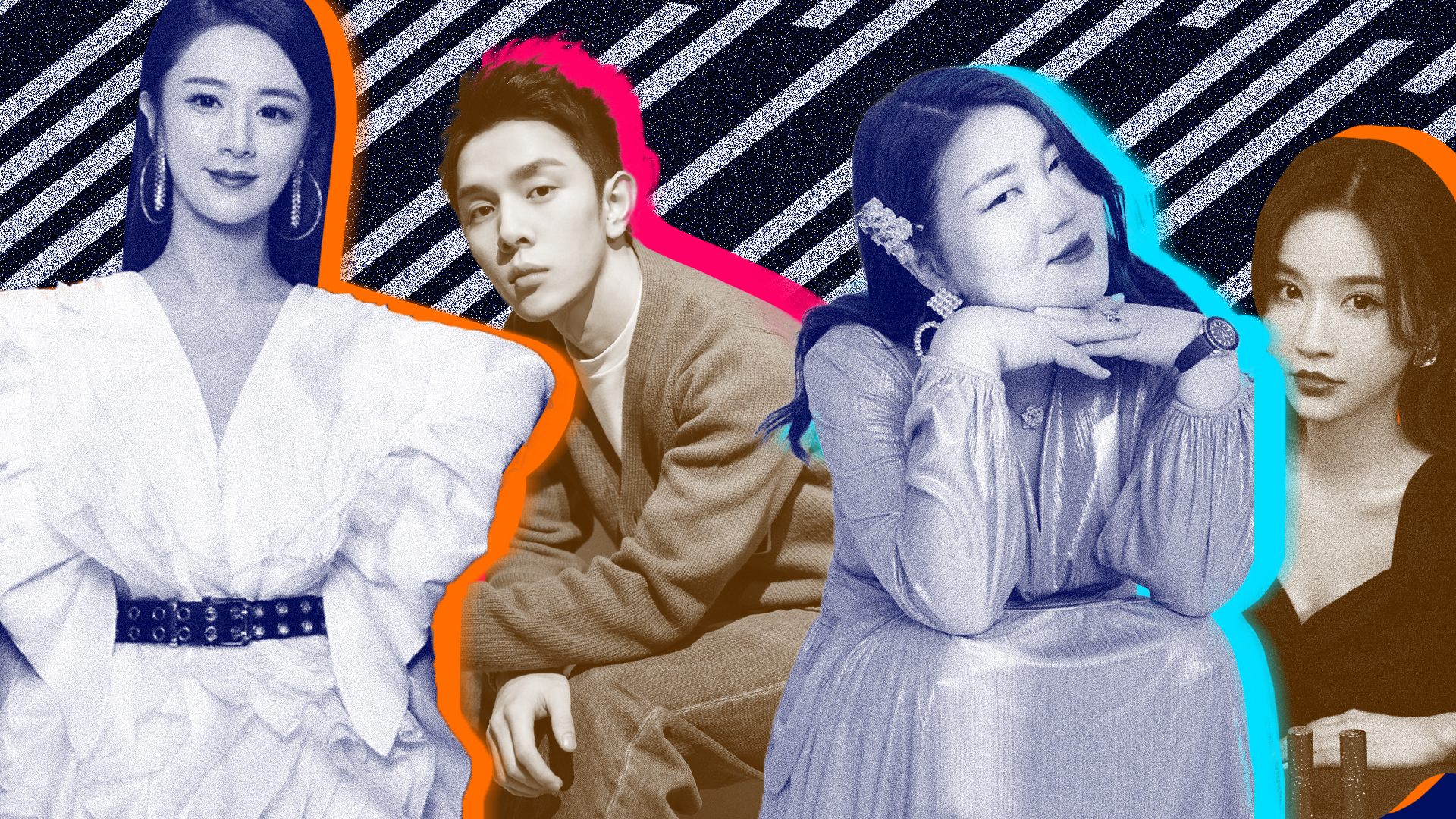

Secondly, in December 2021, the “live-streaming queen” commonly known as Viya was taken off social media for tax evasion. The mega KOL, who amassed an impressive 18 million followers on Weibo and 80 million on Taobao, had been working with brands like Gucci, I Do, and Shu Uemura. However, as Chinese authorities continue to crack down on public figures for bad behavior, picking brand partners has become trickier.

It’s all about glocalisation#

Despite being one of the biggest markets worldwide, China still operates (mainly) locally. Consequently, brands and marketers need to strike a balance between distributing their product globally and accommodating their consumer’s needs in a local market. The cultural context plays a large role in being successful. With the Chinese consumer evolving rapidly and constantly, it is key to have a stakeholder in China who is hyper-aware of the local market and can influence the decision making of the brand.

Working in China means being one step ahead permanently#

WeChat resonates with the Chinese speaker#

Finally, I come to WeChat. Once a messaging app, it is now a vast social network with 1.2 billion monthly active users. If a brand’s goal is to become global, it’s important to understand that the platform is not a China-specific platform. However, as a payment method, the platform only allows Chinese phone numbers which can present a challenge to luxury. WeChat is a great tool but it requires investing accordingly and strategically to what your brand wants to convey through the app.

Marketers in China are constantly confronted with new challenges to target the consumer of tomorrow. One thing is for certain: brands should continue to leverage KOLs in China. But in order to be impactful, they should think of strategies that will resonate with a global and local consumer simultaneously.

This is an op-ed article that reflects the views of the author and does not necessarily represent the views of Jing Daily.

Kim Leitzes is MD of APAC at Launchmetrics