China’s fast-developing tech and e-commerce ecosystem is arguably a boon for luxury brands that can successfully navigate the market’s digital landscape. From JD.com’s ever-evolving shopping integration with WeChat to Alibaba’s progress in New Retail, brands have access to a more integrated landscape from which to reach and cater to an increasingly discerning Chinese consumer.

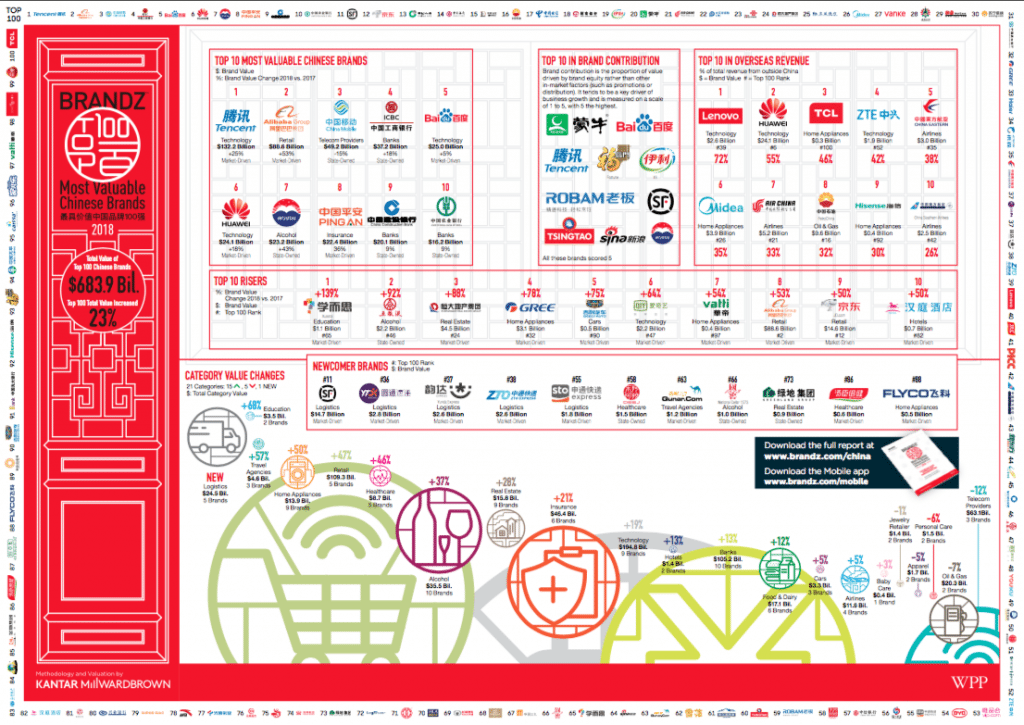

The growing potential for brands in China is apparent in WPP and Kantar Millward Brown's latest BrandZ rankings report, which illustrates how China’s tech and retail giants are driving the growth in the overall value of the nation’s top brands as they break down borders between social media, e-commerce, travel, and other categories to become all-encompassing platforms.

(The only brand that can be described as luxury among the top performers is baijiu label Moutai, which placed seventh.)

BrandZ China 2018, which draws from both financial data and interviews with more than 400,000 Chinese consumers, has Tencent at the top of the list for the fourth consecutive year with a value of 132.2 billion. Meanwhile, Alibaba has achieved 53 percent year-on-year growth and JD.com witnessed 50 percent growth, catapulting the e-commerce giants to second place at 86.6 billion and 12th place at 14.5 billion respectively. Overall, China’s top 100 brands grew in value by a record-setting 23 percent to 683.9 billion, with Tencent’s value alone resting at 132.2 billion.

BrandZ’s latest findings establish China as one of the fastest growing markets in terms of brand value, noting that China’s top 100 brands have grown by 80 percent over the past five years, almost triple the 27 percent growth of BrandZ’s top 100 global brands. In that period, market-driven brands, not state-owned enterprises, have been leading the value growth. In 2014, when BrandZ released its first report on China, SOEs made up nearly three-quarters of the total brand value.

WPP and Kantar Millward Brown's latest BrandZ rankings report. Click to view the full Pdf.

This “power shift,” according to the report's authors, has major implications for brands competing in China as it “corresponds to the transition of China’s economic engine from production to consumption. It illustrates that brand strength has become the main determinant for building brand value.”

David Roth, CEO of The Store WPP, said in a statement that “the game is changing for brands that want to compete successfully in China,” adding that the trend among Chinese consumers towards trading up for more premium goods and services is rapidly expanding into lower-tier cities and across categories. According to the report, about 94 percent of consumers in third-tier cities consider the concept of a ‘brand’ to be important to them, compared to 88 percent in 2014.

This means that in order to stand out, brands need not only innovate and differentiate themselves but broaden their reach to lower-tier cities where consumers with more purchasing power are increasingly willing to overlook price in exchange for value or uniqueness. Doing this also involves navigating the marketing and media landscape in ways that cut through the noise—successful Chinese brands, according to the report, are reaching consumers through customized ads and communicating brand value in ways that make their more discerning audience care, by exhibiting unique characteristics or even a brand’s social responsibility.

Brands are also not limiting themselves to one channel for reaching consumers. The report author writes, “As brand choice increases, loyalty weakens, and it becomes important to reach consumers at every important moment. Being present on multiple screens pays off. Brand value increased twice as fast for BrandZ China Top 100 brands that continuously invested in multiple screens.”

Yet, it’s the idea of a single, integrated mobile platform that’s behind the strategies of some of the top companies on the BrandZ list, including Baidu, Alibaba, Tencent, and JD.com. At number one, Tencent has already made significant progress in becoming a platform that’s entrenched in consumers’ everyday lives by offering services across a variety of categories, including retail, travel, and food and drink, and Fintech through its WeChat app alone. The relationship also goes both ways—for example, JD.com’s integration with Tencent’s WeChat means that it can leverage data of its shoppers to connect with consumers through an app that gets used for day-to-day life.

Seng Yee Lau, Senior Executive Vice President, Chairman of Tencent Advertising and Chairman of Group Marketing and Global Branding said in a statement, “Technology has become an integral part of our everyday lives, now the final piece of the jigsaw is ready to be put into place, and a completely Digital China will emerge.

“In the future, Tencent will continue to hold fast to its 'connecting everything' strategy,” he said. “This means that we will fully leverage the Internet and new technological connectivity and innovation to empower every connected individual and organization, enable more Chinese brands to be known and embraced by consumers locally and internationally, and become the new torchbearers of global innovation.”

BrandZ attributes the success of tech and e-commerce companies to two main strategies: investment in other online companies in order to broaden consumer reach, like Tencent and JD.com’s investment in e-tailer Vipshop last year, and the investment in online integration with brick and mortar retail, logistics, and data demonstrated by Alibaba’s numerous advancements in its New Retail model. While the report notably illustrated the impact of New Retail on the FCMG segment, luxury has the potential to see benefits from these strategies, too.

Also reflecting the efforts of China’s e-commerce giants to grow at a significant scale is the appearance of logistics brands in the BrandZ report for the first time. Five were included altogether, the largest being SF Express, coming in at number 11. E-commerce companies themselves have capitalized on the evolution of logistics to create opportunities to expand their services further from more urbanized centers into harder to reach areas and to get products to consumers faster leveraging data from shoppers.