Chinese e-commerce platform JD.com will collaborate with Meili on a new fashion e-tail venture, which will reportedly be run as a WeChat mini-program. The venture is set to make its debut after Chinese New Year.

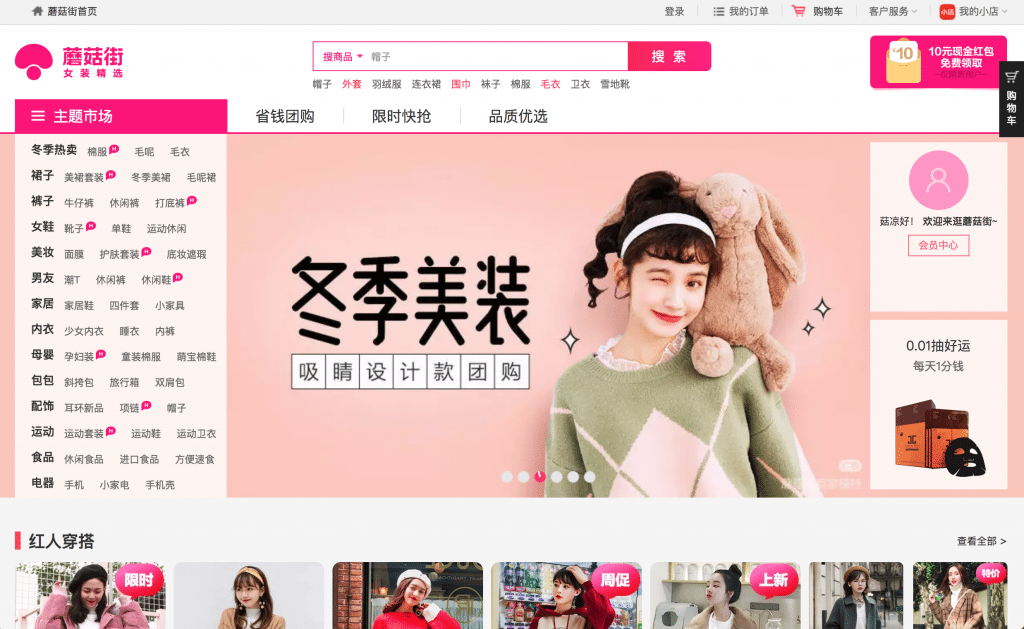

Meili (美丽联合集团) is a company that formed when social e-commerce site Mogujie (蘑菇街) bought out rival Meilishuo (美丽说) in 2016. Meili continues to run both sites, which are something like a cross between Pinterest and a fashion catalogue. Mogujie and Meilishuo are platforms to share visuals and discuss trends before making purchases on the sites.

The decision to establish the venture not as an independent site but a WeChat mini-program shows not only how important WeChat has become, but also how close all three companies have grown.

WeChat’s owner, Tencent, is a major investor in Meili, having increased the stake it already had in Mogujie when it bought out Meilishuo. It is also JD.com’s largest shareholder, with a 20 percent stake in the company. Tencent still relies on JD.com for a significant chunk of the transactions made through its payment service, WeChat pay, and is no doubt taken with JD.com's powerful delivery and logistics system. The two companies also share data to better target consumers.

The relationship between JD.com and Tencent grew even closer after the two companies invested in luxury e-commerce platform Vipshop together last month.

The strategy seems clear: to join forces to compete against Alibaba’s Taobao and TMall for a larger share of China’s lucrative e-commerce market. It's like the Avengers, all teaming up to take on Alibaba CEO Jack Ma. (Note: JD.com also has partnerships with Walmart and Baidu)

While JD.com has its own platform for selling to consumers, it seems determined not to miss out on a big shift to purchasing directly on WeChat, an app that aspires to be nothing short of the whole Chinese internet.

Selling on WeChat is becoming increasingly popular among luxury brands, and the joint venture between JD.com and Meili promises to help convert excited discussion on Mogujie and Meilishuo over the latest items into sales.

Unlike Alibaba’s Luxury Pavilion, WeChat mini-programs aren’t exclusive to members, meaning WeChat user can stay in the app and complete the entire purchase more seamlessly, if with somewhat less social cachet.

Pinterest With Interest#

But will connecting users on WeChat with an image-sharing and online sales site (aka Chinese Pinterest with Interest) be a success in China’s dynamic luxury e-tail space?

The JD-Meili joint venture will certainly benefit from the relationship with WeChat, which is an increasingly important sales channel for brands, and which possesses an in-built payment system that Chinese consumers are familiar with. The customer base is absolutely huge on WeChat, with nearly 900 million active users all around the world.

At the same time, the JD-Meili joint venture faces some fierce competition, which may even come from WeChat itself.

In December last year, WeChat launched a new feature called “brand zone,” which includes an “Official Boutique” (官方精品店) for each brand. Within just two weeks, 12 high-end brands (including Louis Vuitton and Swarovski) had already registered their official boutiques, and many more will follow. The “brand zone” enables any WeChat user to search a brand and find its WeChat store, regardless of whether the user has already subscribed to the official account (微信公众号).

Will users really want to purchase via the new venture’s mini-program instead of going to a brand’s WeChat boutique directly?

Perhaps. But it will require the new venture to foster and sustain a thriving, close-knit community inside WeChat, and to immediately convert some of that excitement into sales.

With its investments in JD.com and Meili, Tencent will win either way.