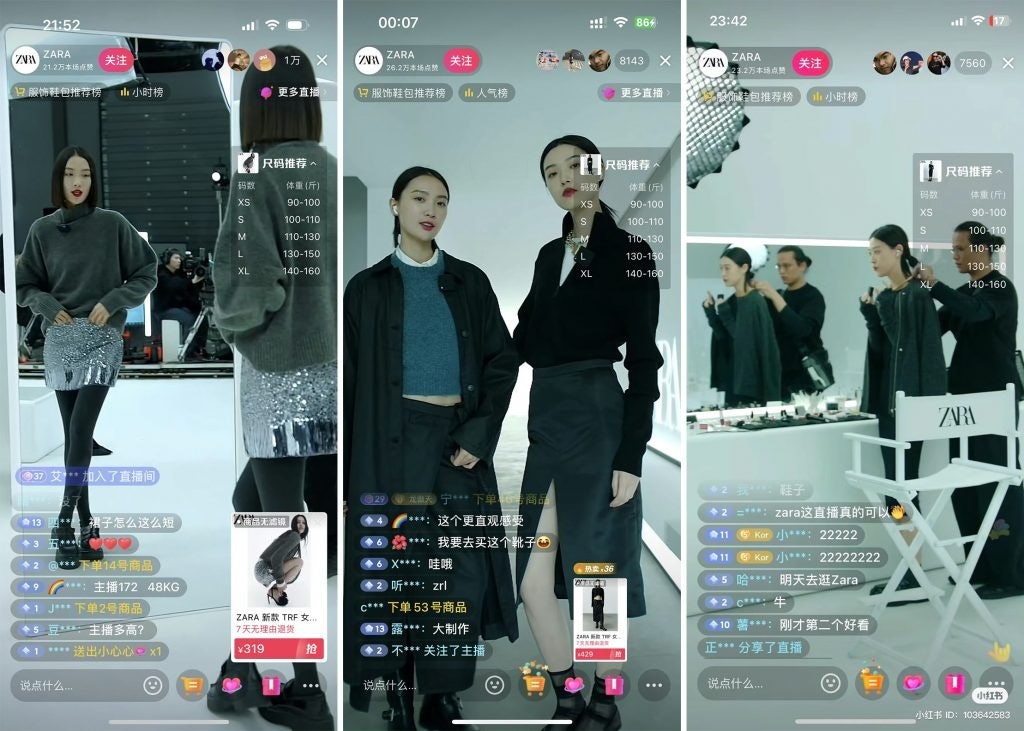

When it comes to live commerce in China, Zara is setting the bar. With 12 cameras, 50 professionals, and a 9,000-square-meter set, the brand’s latest broadcast could easily be mistaken for a movie or music video backdrop at first glance.

On November 17, the Spanish fashion brand debuted a new livestream concept on Douyin, hosted by supermodel You Tianyi. Running for five hours, the livestream included catwalks, walkthroughs of the fitting room and makeup area, and “behind-the-scenes” views of the camera equipment and staff.

Rather than the typical, fast-paced Chinese livestream, Zara’s was far more calm and choreographed. The host took her time modeling products, showcasing the brand as stylish and sophisticated.

“The ‘show-style’ livestreaming reflects our constant efforts to level up our image and seek the best customer experience,” a spokesperson from Zara China’s communications team tells Jing Daily. “And this is the approach we have had with our first Douyin livestreams. With the experience of our first shows and our permanent aim of pushing ourselves to do everything with the highest levels of quality, we have launched our new Douyin livestream style.”

Although Zara did not release figures for the November 17 broadcast, e-commerce data from analysis platform Douchacha shows that the total number of viewers surpassed 1.2 million, a jump from the average 200,000 viewers. How is the Inditex label benefiting from its new livestreaming format, and what can luxury brands learn?

China’s changing livestream preferences#

“The livestream itself, more than a showcase of fashion, was a tailored experience designed to resonate with the sophisticated tastes and growing luxury preferences of Chinese consumers,” says Sophie Coulon, managing director of digital consultancy VO2 Asia Pacific.

Indeed, consumer expectations have changed. Some Chinese shoppers have grown accustomed to, even weary of, loud anchors peddling cheap products. For example, the rise of quiet selling — a very slow, storytelling-focused style of livestreaming — and quiet luxury both signal a shift to more subtle forms of consumption.

“After watching Zara’s live broadcast, I feel like the livestreaming industry is about to change,” writes Xiaohongshu user UFOxijingyichuangkongjian (@UFO西境艺创空间), a photography studio in China. “The anchors were talking about products, matching [outfits], and fashion in a relaxed manner ... The whole atmosphere was like an online meeting for brand fans, without the noise and discounts of other live broadcast rooms. The brand’s reputation is at its peak.”

Many netizens across Weibo were also impressed with the livestream, describing it as “high-end” and praising the lack of “3, 2, 1, click the link!” (“321, 上链接”), a phrase used to instill an urgency to buy. “In this broadcast room, Zara could sell a 500 RMB item for 1,000 RMB,” posts one Weibo user.

Despite the positive reactions, the gross merchandise value (GMV) for the livestream was reportedly lackluster. Douchacha data shows that sales ranged between 250,000 RMB ($35,054) and 500,000 yuan ($70,100), a lower conversion rate than previous livestreams.

Using livestreams to improve brand image#

But Zara’s new format isn’t about immediate sales; it’s an investment in brand positioning. And elevating brand perception is crucial in a fast fashion landscape where domestic brands account for 70 percent of market share, according to Daxue Consulting, and where several global players have been forced to pull out due to profitability concerns.

Beyond fast fashion, Zara’s new concept could be appealing to luxury and premium brands that find the typical KOL-led livestreams not in alignment with their brand image.

“Luxury brands have the opportunity to use this platform to create compelling narratives that showcase their heritage, craftsmanship, and values,” says Coulon. “This approach elevates a livestream from a simple sales channel to an immersive storytelling medium, fostering a deeper connection with the audience.”

Taking this a step further, luxury brands could integrate interactive elements into their broadcasts, like live Q&A sessions with designers or virtual tours of ateliers, for a more holistic brand experience. “Such elements can enrich the viewer's experience, making the livestream not just informative but also engaging and memorable,” she says.

But is it replicable?#

However, not every brand will be able to replicate this behind-the-scenes livestream format given the high operating costs, a point brought up by several netizens.

“The reason why Zara is criticized is the high costs and unknown returns. In the context of a turbulent overall economic environment, where small brands seek development and large brands strive to survive, who dares spend such money on brand image?” writes Xiaohongshu user Lili (@立里).

But GMV isn’t the only metric that defines a successful livestream, notes Coulon. Engagement rate, brand sentiment post-event, the quality of customer interactions, and the long-term impact on brand perception are all things to consider.

“The goal should be to create a memorable brand experience that resonates with the audience, fostering loyalty and elevating the brand's status in the consumer's mind,” she says.

While Zara is keeping mum on its exact GMV numbers, the brand is pleased with its progress and intends to move forward in this direction.

“We are very happy to see that our unique and innovative livestream style is very welcomed by our customers,” a Zara China spokesperson tells Jing Daily. “In the near term, we are going to keep this Zara show-style livestreaming on a weekly basis and try to offer the best image and the best fashion offer. Moving forward, we will constantly evolve based on our customer feedback.”