In today’s new normal, luxury houses face a dilemma: Should they make cost-saving, short-term business decisions by discounting goods or defend their brand images for long-term sustainability? The answer is complicated.

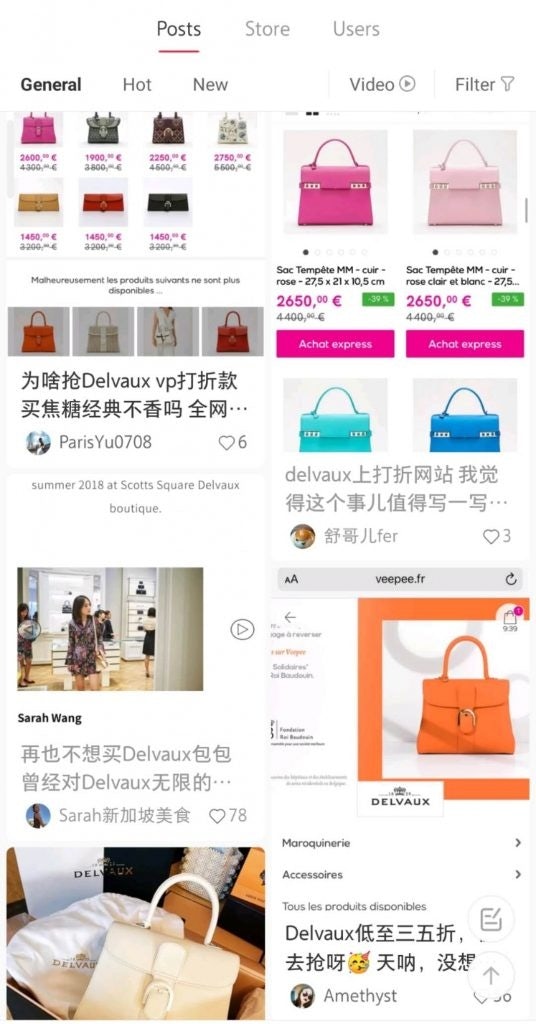

When screenshots of offerings from the Belgian luxury brand Delvaux priced at 60-percent off — as seen on the French flash sales site Veepee — began circulating on Chinese fashion accounts in late July, an avalanche of complaints flooded comment sections like “Isn’t this the Belgium version of Hermès?” and “Do they know this flash sale is going to hurt all their clients here?”

Over the years, Delvaux stood for exclusivity and prestige in wealthy Chinese circles, with many believing that the brand was the discreet luxury choice of European royalty. It wasn’t uncommon to hear stories about people spending tens of thousands of dollars on leather accessories just to earn the right to acquire the brand’s IT bag: the Brilliant.

But then, Delvaux held a heavily-discounted flash sale on Veepee, with its logo placed right next to a mass-market beauty brand known as NYX. Although the event was only available on that one French site, it has had a ripple effect among China’s luxury buyer community. This incident begs the question: Will the luxury market face a post-COVID markdown crisis?

Thus far in 2020, a series of radical moves from established luxury houses meant to entice China’s mass-market audience has raised eyebrows amongst the country’s high-end spenders. In April, Louis Vuitton became the first Western luxury brand to hold a livestreaming sale on Little Red Book, but most who viewed it said the show looked “cheap.” In June, Dior surprised many by opening an official account on the Chinese Gen-Z site Bilibili after opening one on Douyin (the Chinese version of TikTok). Over just a few months, almost all of luxury’s big names from Chloé to Coach have attempted to cash in from China’s livestreaming opportunities — although most found a lackluster response from their core audiences.

Are luxury brands risking their names by dipping too far into the mass market, which allows them to make immediate sales but forfeits their long-term brand appeal? Now, let’s take a look at some of the most pressing issues to emerge during this luxury identity crisis via China’s online fashion voices.

First of all, context matters. To an industry that sells dreams — not just products — aspirational image-making and narratives are what inspire top-end shoppers in the first place. So when Louis Vuitton’s livestream was broadcasted in front of a bland, tradeshow-style background, it was an instant blow to the brand’s true admirers. The ensuing problem for Louis Vuitton is twofold. Not only did its set look inexpensive, but it also reminded Chinese shoppers that the legacy brand’s livestreaming sales did not differ much from livestreams that sell cheap, non-branded products.

“For a long time, we were used to aspirational brands that invested heavily in communication channels and used the world's top resources to make us say ‘wow.,’” wrote influential fashion blogger @Gigi的时尚现场 in a WeChat post. “Whether it’s through TV, magazines, or online, fashion never fails to deliver aspirational beauty. But now, one bad livestreaming session could drag [Louis Vuitton’s] image off the cliff.”

Next, an inconsistent pricing strategy in the digital age is bound to provoke consumer complaints. When Chinese shoppers spotted Delvaux’s discounts one Veepee, they also found that the brand was selling those same items at their full listed prices on its Chinese flagship store on JD.com.

Deal-savvy Chinese shoppers diligently conduct price comparisons across sites and even countries. So if one brand puts an item on sale on one site, this community knows to ask daigous to find them the best bargain. But to seasoned luxury consumers who buy for the sake of exclusivity, any discount is an act of betrayal.

One explanation for luxury brands’ increase in discounts can be attributed to their excess inventories. According to a June report from the consulting firm BCG, total sales in the jewelry, watch, and ready-to-wear categories are expected to drop between 35-50 percent this year and likely won’t reach pre-crisis levels until 2023. This grim sales forecast means that excess inventory, which has led to reckless discounts as a way to salvage margins and survive this moment, is causing long-term brand damage.

Denis Morisset, professor of luxury marketing at Essec Business school, told Jing Daily that “in the case of Delvaux [employing big discounts], we are talking about two different online channels. One is a full-price channel, while the other one is a flash-sales channel. Luxury brands shouldn’t make flash sales regularly, but in times of crisis, brands and retailers need to face the excess inventory problem.” To the majority of brands that don’t have the image power to hike up prices the way that Chanel and Gucci do during a pandemic, discounting is a more-than-understandable business strategy. “At this very moment, many brands have excess inventory in the West and clients in China,” Morisset said. Similar issues, he added, were also prevalent after the 2008-9 market crisis.

But lastly, it is a loss of prestige that could ultimately kill a brand’s future. When it comes to ultimate luxury, the public perception and mainstream narrative of the brand’s status still rule in China.

In the now-trending TV series “Nothing But Thirty,” the episode where the protagonist, Gu Jia, was cropped out of a group photo because she was carrying a Chanel bag instead of an Hermès became an online sensation because this scenario resonates with many fashion fans. In the series, Gu Jia’s Chanel bag, despite its status as a limited-edition piece, doesn’t conform to the norm of a wealthy wives’ club, which is a Hermès bag. The protagonist is excluded until she eventually gets a limited-edition Hermès bag. Although this is a fictional account, the episode realistically reflects that, when it comes to top luxury, public perception trumps personal preference.

The same psychology applies to crisis discounting. “I was enraged when I saw the same Delvaux bright pink mini bag I bought in the store with a 40-percent off sign on Veepee,” said Jilin Zhang, a Hong Kong-based finance analyst and luxury aficionado. “I will not buy that brand again. From now on, it is Hermès or nothing.”

“Exclusivity will be even more paramount than before,” said Kering’s CFO, Jean-Marc Duplaix, to analysts in April. As pre-crisis level consumer confidence and in-boutique interaction still feel unlikely for the duration of 2020, brands must again consider how to approach a digital format, so they can balance their short-term business needs with their long-term image concerns.

Morisset had a few bits of advice on what these brands could do differently. First, refocus on existing clients. “The real, existing clients are looking for exclusive, one-to-one relationships,” he said. “To them, these digital moves focused on sales are not relevant.” But on the other hand, brands should use digital formats like livestreaming to engage with the occasional client or newcomers to the brand.

Next, they should avoid obvious and superficial sales practices. On Moriset’s Bilibili luxury business channel, he mentioned that luxury livestreaming sales events have yet to find a way to differentiate from the mass-market sales in China because they’re too sales-oriented. Maintaining a certain quality of engagement is the key. “Turning the brand’s best staff, who have the most knowledge and skills, into internal KOLs rather than using third-party KOLs, could be a way to create inspiring livestreaming sessions,” he added.