Beijing office worker Cheryl Chen works with at least five different daigou on her WeChat. Some are brand-specific (like one who hunts for unique Chanel collections or niche brands like By Far), and others are country-specific, meaning they specialize in combing the US or Italy for better prices. They are all referrals from her friends in New York City, where she studied for four years to get her undergraduate degree.

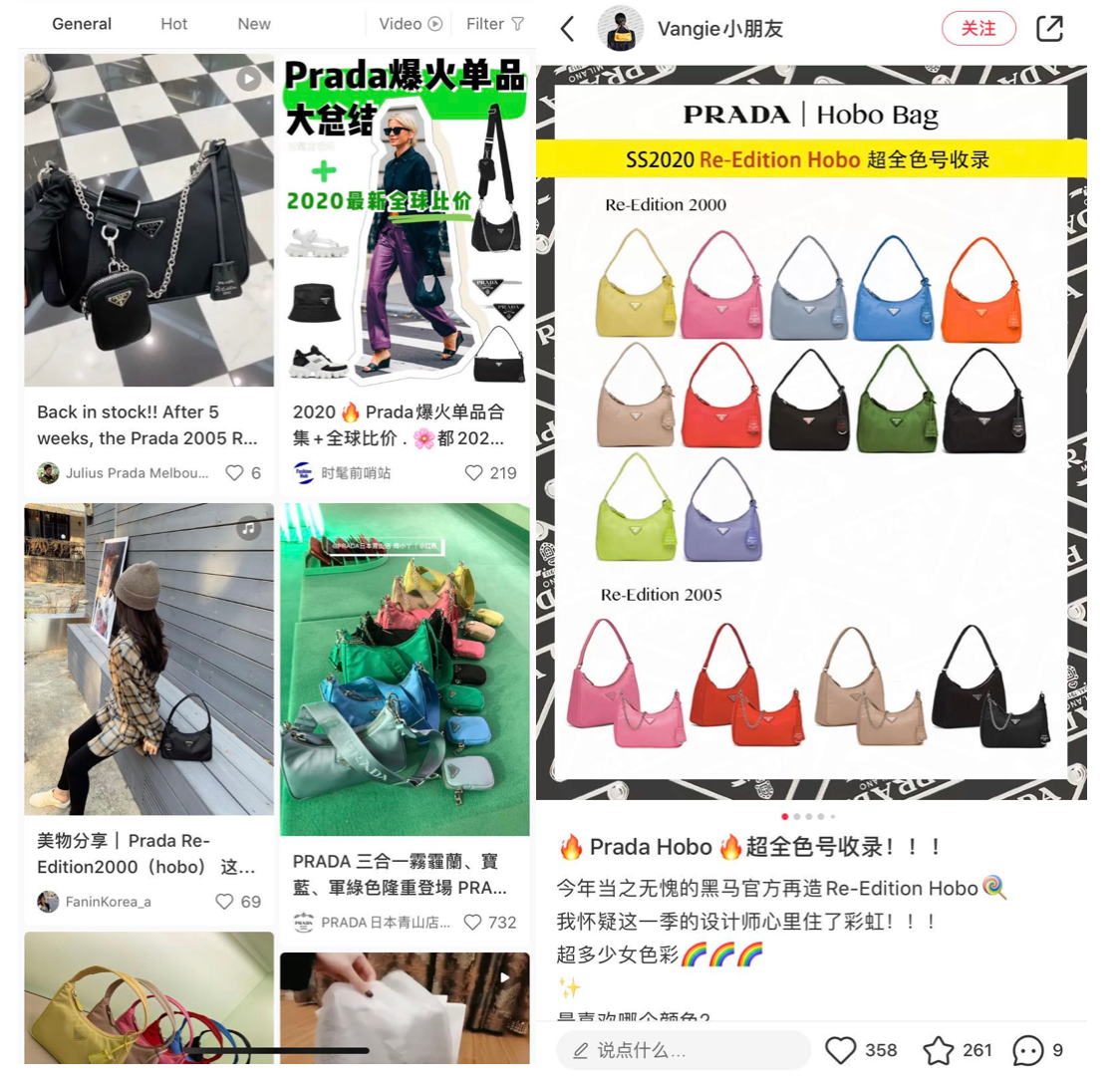

Lately, she’s been eyeing Prada’s Re-edition 2005 Nylon shoulder bag as a reward for surviving the COVID-19 lockdown, but it’s been so well-received and consequently hard to get in Beijing, so she turned to her daigou for help.

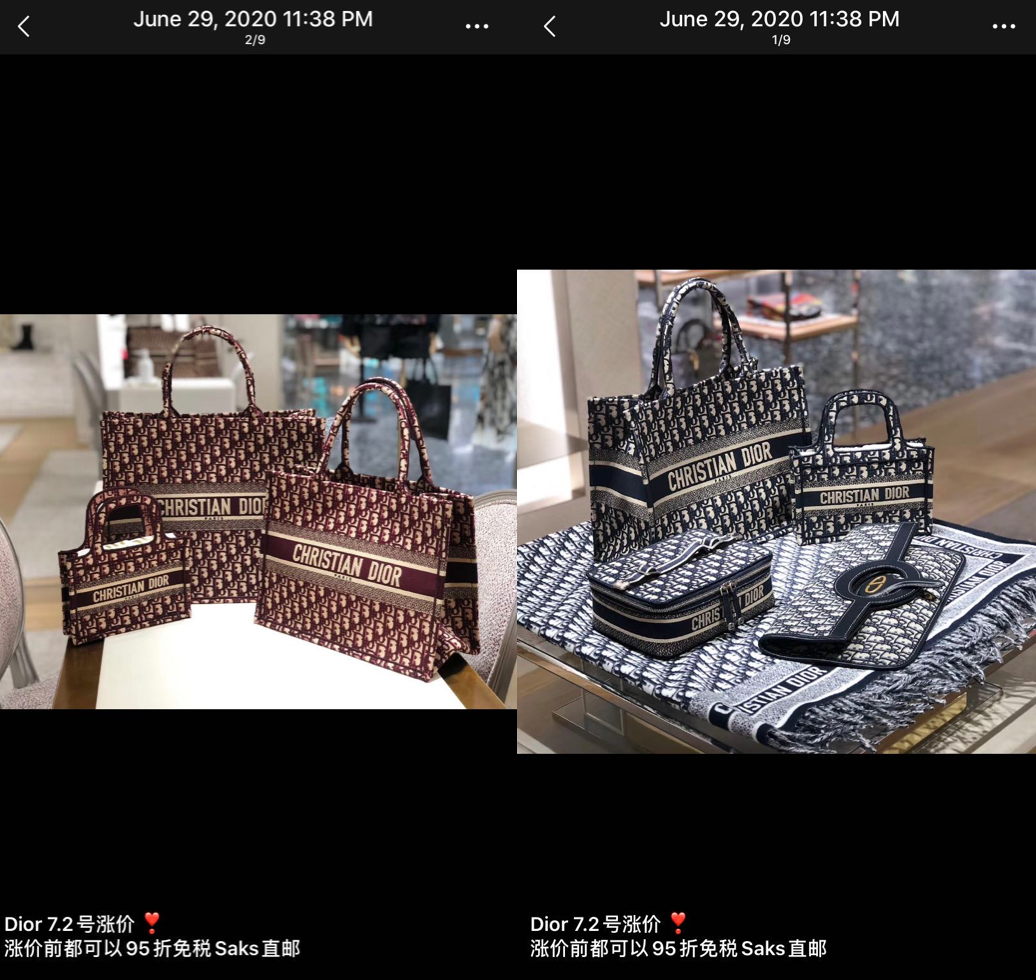

But Chen isn’t the only customer relying on daigou to shop post-COVID-19. “[Demand] in the market is still strong,” said one of Chen’s US-based daigou anonymously. The pandemic has made logistics more difficult, but it still only takes between two and three weeks to ship products to China. Even with added tax and insurance, certain brands’ prices are still lower than can be found domestically. For example, Tiffany is one of her most popular brands in China at the moment, and with luxury brands increasing their prices globally, business has been particularly strong for the daigou.

Chen’s American daigou has been working from the US for over ten years now. She started her business as a way to supplement her living expenses, but it quickly became a full-time job. By connecting with friends who worked at luxury stores, she was able to build a network of suppliers who allowed her to access goods with employee discounts. Daigou excel at bringing in customer volume and sales associates make the purchases worthwhile because of their exclusive discounts. It’s a win-win situation, and these relationships have become essential for both stores and daigou as they try to weather the ongoing COVID-19 storm.

However, not all brands appreciate this kind of rapport. Brands’ headquarters have avoided working directly with daigou for a long time because of legitimate long-term concerns. One is sales accountability, as daigou tend to take sales from staff or local third parties, making it harder for a brand to track sales and formulate regional strategies. Another is the brand image since the pictures and videos Daigou send to their clients aren’t as professional and could hurt a brand’s optics over the long-term.

But with mounting pressure to perform due to COVID-19, brands have slowly warmed up to working side by side with daigou. Tom Griffiths, the commercial director of Verb Brands, which is a digital agency that helps luxury brands launch in China, said that more of his clients have recently become interested in developing daigou strategies. According to Griffiths, daigou can be an effective way for smaller brands to test the market. While it would take at least six months to see results after launching on Tmall, daigou know more precisely where they can place products.

“Daigou are very good at finding what products work for what region or market, even demographics,” Griffiths said. Therefore, brands that are already in the market can use daigou to test products that haven’t received Chinese licensing yet, such as perfume or skincare product lines that refuse animal testing.

Daigou can also act as consultants, as they often have valuable information about popular products and price sensitivities. Like Chen’s daigou, they can usually spot which products sell well and why, and they tailor each sale to suit the client’s needs. Brands could surely use this information to prioritize sought-after, limited-edition products, or consider strategic offers that fall in line with daigou requests.

In some cases, if daigou scale up enough, they can become a brand’s wholesale partner, which allows them to receive 30-percent off the retail price. But regardless, brands should always expect to offer some type of discount to daigou. Several experts we spoke with suggested that brands should treat daigou like VIPs, offering them exclusive discounts. And for brands, building a global customer relationship management (CRM) system would be helpful in tracking and engaging with this powerful, global consumer group.

Griffiths suggested that a brand should work with daigou that will maintain the brand’s integrity as much as possible. That is particularly important for new brands, as their first impressions on consumers could come from daigou. But employing too many daigou or only relying on them can be a slippery slope because brands can quickly lose pricing control and cannibalize their high-end branding. The key is to balance the right amount of diagou with other sales channels.

The Chinese government has been cracking down on daigou since 2018 by enforcing them to obtain licenses and register as businesses. Though it didn’t end daigou activities, it did signal that the Chinese government is trying to regulate the practice.

While brands may still be deciding whether or not to work with daigou, this group will remain a vital part of the cross-border luxury business. "As long as a price gap remains in and outside of China, a portion of Chinese consumers will continue to seek daigou, many of whom are still not declaring, despite the e-commerce law," said Greg Cole, director of the digital agency CDGL Strategic Communications. And most brands seem to be alright with that — thus far. “The legality aspect is not exactly a black and white scenario,” added Renee Hartmann, a co-founder of China Luxury Advisors. “For a lot of brands, once you ship your product, it’s out of your hands, especially with shipping and customs.”